Chinese GPU chip designer raises $186m

Iluvatar CoreX, a Shanghai-based computing chip designer has raised RMB1.2 billion ($186 million) in Series C funding led by Cedarlake Capital and Centurium Capital.

Guangzhou-based Gortune Investment and China Unicom Capital also participated in the round. The company secured Series B funding - described as hundreds of millions of renminbi - in 2019 with Centurium and US-based Princeville Capital taking the lead, according to AVCJ Research.

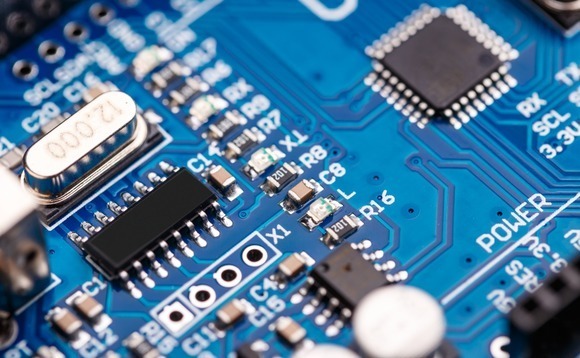

Founded in 2015, Iluvatar focuses on graphics processing units (GPGPU) for general-purpose computing. GPU is the mainstream solution for powering artificial intelligence computation in areas like autonomous driving, finance, education, and healthcare. GPU chips, which can satisfy general graphics and high-performance computing, are deemed to represent the height of chip technology.

Iluvatar claims to be the only company in China that has chip products under the GPU architecture. The new funding will accelerate product commercialization. Iluvatar initiated a 7-nanometre cloud computing GPGPU chip in 2018. It was taped out in May 2020 and its usability was proved last December.

The company claims its product provides more flexible programming ability and stronger performance at a lower cost than competing mainstream offerings.

Iluvatar's round comes a matter of days after Moore Threads, a Chinese GPU chip desinger established as recently as last October by a team from Nvidia, closed two funding rounds amounting to several billion renminbi. Participants included Sequoia Capital China, GGV Capital, and ByteDance.

Chip design is arguably the most popular area among PE and VC investors targeting China's semiconductor industry, largely because it has the highest technology content and is the least capital intensive. GPU chips - often referred to as AI chips in China - are said to have the largest market ceiling, given the exponential growth of AI-related applications.

AI chip designers that have received private funding in recent months include Biren Technology, Enflame Technology, and Horizon Robotics. Meanwhile, last July, VC-backed Cambricon Technology became the first Chinese AI chip manufacturer to list on Shanghai's Star Market.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.