Mitsui Sumitomo VC unit backs Israel fusion start-up

Japan’s Mitsui Sumitomo Insurance Venture Capital (MSIVC) has joined a Series A round for Israel-based nuclear fusion start-up NT-Tao that had raised USD 22m as of February.

This is MSIVC's third deep-tech investment in the past week. It confirmed investments in virtual reality-enabled medical scanning company HoloEyes and space robotics developer Gitai on August 29. Both are Japanese companies. Overseas investments are rare.

In July, MSIVC backed a JPY 1.8bn (USD 12.3m) Series A for Japan's EX-Fusion, which is developing commercial-use reactors that leverage a unique system of high-pulse lasers to generate fusion reactions. EX-Fusion's business model, which involves selling reactor parts to other fusion companies, is considered a de-risking factor.

The NT-Tao deal marks a confluence of two trends, including a groundswell in Japanese investor interest in fusion start-ups and the increasingly outbound focus on Japan's historically insular VC scene. Kyoto Fusioneering, another Japanese fusion start-up, raised JPY 10.5bn in May to advance expansion plans in the US and UK.

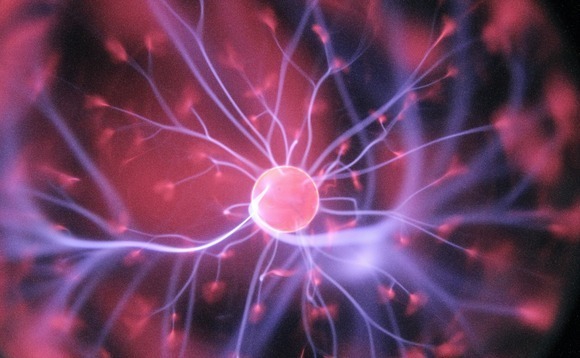

NT-Tao hopes that by leveraging two competing approaches to fusion – tokamak and stellarator technologies – it can develop a reactor the size of a shipping container that can be scaled to various settings and power requirements. The project is currently in its third iteration of prototypes.

MSIVC is the company's second Japanese investor after Honda. Other participants in the Series A include Next Gear Ventures, East Innovate, OurCrowd, Delek US, Grantham Foundation, J-Impact, and Grantham Foundation.

"Fusion energy is the future of clean energy, and as a company that is dedicated to sustainable growth and addressing climate change, it is our responsibility to help enable that future," Ryosuke Ide, an investor at MSIVC, said in a statement.

"We are impressed with what NT-Tao has achieved in such a short amount of time and the scientific approach they are taking and are excited to be a part of their journey to bring the cleanest form of energy to humanity."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.