Japan VC: Global appetites

The relatively recent advent of sizeable VC funds and high-profile start-ups in Japan has exposed long-simmering ambitions to be more international. This could be a breakout moment

Japan's Global Brain is finally living up to its name. The VC firm, founded in 1998, has dabbled in overseas investment since its early days but didn't have much success until recent years, with most of that activity targeting other developed markets. That had clearly changed as of last month when it backed Nigeria-based automotive aftersales platform Mecho Autotech.

Global Brain is unique among Japan VC firms in that it invests via several separate accounts for local corporates, but it's not unusual for corporate strategic agendas to drive managers overseas. The GP is also deploying what is likely its largest blind pool fund to date. The vehicle launched in 2021 with a target of JPY 40bn (USD 353m), double its predecessor, and an expanded international remit.

The overall portfolio is 64% Japan, 19% Europe, 8% US, 8% Asia ex-Japan, and 1% Africa. The Mecho deal is typical of the strategy in that it combines interest in a specific growth geography with interest in a specific industrial segment. It is atypical in that it's purely a financial play with no particular LP impetus or co-development plan.

Global Brain's cross-border motivations are easy to understand. Japan represents only 3% of the global VC market, so staying at home is unpalatably limiting. Japan is not growing, and by some measures, the local market is shrinking. And the country has been a latecomer to the digital age, which has prompted the government and domestic tech sector to explore options overseas.

"We want to make early bets on specific sectors where we couldn't find the right start-up in Japan," said Ken Kajii, a general partner at Global Brain, flagging life sciences, climate tech, and crypto as potential areas of interest for overseas investment.

"We want to be at the forefront of those trends by tapping into those more advanced markets. And honestly, in three to five years, those ecosystems will develop in Japan, so we want to make sure we've seen them before and already know how they work."

Starting points

There is a sense that initiatives in this vein are multiplying in Japan VC, an historically insular industry where even firms with overseas bases have tended to face homeward in deal-making and lack international diversity in staff.

The earliest movers are notable exceptions. They include East Ventures, founded in 2009, and Spiral Ventures, founded in 2012 as IMJ Investment Partners; both were set up to bridge Japan and Southeast Asia and quickly set up headquarters in Singapore rather than Tokyo.

Indeed, the country's first proper VC firm, Jafco, established in 1973 as Japan Associated Finance, has invested overseas since at least 1984 with the creation of Icon Ventures, its US division. Jafco Asia put down roots in Singapore in 1990 and operates via bases in Taipei, Seoul, Beijing, Shanghai, and Bangalore.

Global Brain, for its part, opened its first overseas office in Singapore in 2013 and has since added eight more countries. The US, UK, Indonesia, and Israel have been the primary ex-Japan markets, with the latter targeted from London. Overseas could represent up to 40% of overall investment going forward.

However, even the most entrenched cross-border players have lacked the scale to be meaningfully global actors until recently. Like Global Brain, East Ventures and US-Japan specialist World Innovation Lab (WiL) both raised their largest-ever funds last year with USD 400m and USD 1bn, respectively.

Headline Asia, formerly Infinity Ventures, is taking a more inorganic approach. The Japan-based firm is the regional arm of Headline, a result of a 2021 tie-up between Infinity and its long-time collaborators, US and Europe-based E.ventures and its Brazilian affiliate Redpoint Eventures. Fund IV closed on USD 100m under the Infinity name in 2019. Fund V is currently targeting USD 200m.

Headline Asia's story is demonstrative of Japan VC's accelerating internationalisation. China was the initial overseas target in the early 2000s until shifting regulations, a slowing growth rate, and political risk factors redirected much of that capital to Southeast Asia.

Less characteristically, English is the main language at the firm's Tokyo office. About 40% of the portfolio is non-Japanese, and the preference is for companies that can exploit the platform's resources in the US, Europe, and Brazil. Japan's penchant for premature IPOs – often regarded as the ecosystem's core weakness – is leveraged as a strength in the context of a global operation.

"Having Japan as a core element of our investment thesis gives us high DPI [distributions to paid-in] because we create liquidity events early on, but at the same time, we are not stuck with Japan-only exits, which might limit our upside," said Akio Tanaka, co-founder of Headline Asia. "We try to blend the growth we see outside of Japan with the very solid foundation Japan has created for venture."

Going Globis

Even firms that are not comfortable with the risk of making direct investments overseas are obliged to start considering cross-border expansion as their funds enlarge.

The essential thinking here is that pumping more money into a domestic-only Japan start-up market will not yield the unicorns required to provide a big fund with commensurate returns. As Japan VC funds begin to reach JPY 20bn-JPY 30bn with more frequency, the only viable way to achieve the necessary exit valuations is to create companies with international revenue streams.

Globis Capital Partners raised JPY 72.7bn for its seventh flagship fund this month, its largest yet, with just such a plan. The fund – which is mostly backed by local institutional investors – will invest from early to late stages, sticking to domestic start-ups but with an understanding that exiting via Tokyo IPOs will no longer move the needle.

"More and more entrepreneurs in Japan are becoming very ambitious about doing business outside of Japan, and they increasingly realise that if you over-rely on the domestic market, it's much harder to expand overseas later on," said Emre Yuasa, a general partner at Globis. "As a result, we need to develop new capabilities as a fund to help them grow into new international markets."

Globis opened a San Francisco office to help make this happen and will continue to leverage the staffing resources of its corporate training parent company, Globis Corporation, in China and Singapore. The GP also operates an executive hiring platform for portfolio companies headed by Takehiko Ono, formerly a partner at global recruiter Egon Zehnder.

These are considerable strengths considering talent sourcing will likely be the primary challenge for Japanese VC firms attempting to take portfolio companies overseas.

The ecosystem's breakout success story in this area is Mercari. The flea market app raised almost JPY 18bn in private funding from Globis, Global Brain, East, and WiL among many others before achieving Japan's first major technology IPO in 2018.

Mercari is credited with stoking unicorn ambitions in Japan, but investors see danger in a false sense that its story can be easily replicated by companies with limited language skills and poor familiarity with their target market.

Mercari scored a major coup in its US expansion, engaging John Lagerling as its US CEO. Lagerling is a former executive at Google and Facebook, who happened to have lived extensively in Japan, worked for local tech giant NTT Docomo, and speaks Japanese.

"The biggest mistake you can make is trying to hire someone who understands Japanese language and culture because you're narrowing down the talent pool too much. That's the mindset you have to change when you go overseas – you're not a Japanese start-up anymore."

The skills challenge in cross-border expansions has myriad cultural and economic dimensions, which are arguably exaggerated in the US, a significantly less relationship-driven market. Japanese start-ups that prioritise trust building by working with brand-name companies back home might be surprised to find those connections carry less weight stateside.

More importantly, tech sector salaries in the US can appear astronomical from headquarters in Japan, especially given recent yen weakness. Even when salaries are accommodated, the discrepancy in compensation between teams can cause internal tensions. The perception is that newly hired Silicon Valley elites are drawing the same or greater wages than their superiors in Japan.

Gen Isayama, co-founder of WiL, specialises in coaching start-ups on navigating these points but has seen little progress in the past 10 years in terms of Japanese start-ups entering the US in a meaningful way. He estimates offhandedly that he gets to see around 97% of the notable start-ups in Japan but that practically none of them have what it takes to follow in Mercari's footsteps.

"If the founder-CEO is not willing to commit and take leadership, it's very hard to win. We ask questions like, ‘Why do you want to go to the US? How much are you willing to spend? Are you going to move to the US?'" Isayama said.

"If you keep probing like that, half of the companies disappear, and of the half that are left, maybe 10% have a shot. I haven't seen a lot of companies in Mercari's situation, generating a lot of profit at home and therefore willing to spend, hire the right people, and give them the right compensation."

Local knowledge

Globis' flagship gambit in this cross-border corridor is news aggregation app SmartNews, which is number one in its category in Japan and has claimed annual growth of 2x-3x in the US since it entered the country in 2014. The VC firm's new San Francisco office space is leased from SmartNews, which is hoped to help with networking for other portfolio companies.

SmartNews raised a JPY 25.1bn Series F in 2021 but has yet to turn a profit and is generally not considered to have the necessary economics for a straightforward US hiring spree. Nevertheless, around one-sixth its staff is now US-based, according to LinkedIn data, and the app is now beating CNN in terms of usage minutes per subscriber.

The approach was to tap the investor base. Social Starts, a US-based VC firm with a Japan presence and one of SmartNews' early investors, sought out one of its LPs, recruiting industry veteran Dennis Moss, to be the company's head of executive hiring.

Moss was hired at the outset of the US push and quickly rallied his network. This involved bringing in one professional from fellow SmartNews backer Atomico Venture and Rich Jaroslovsky, founder of Online News Association, a digital journalism network founded in 1999.

"That's how you have to start. If you don't have the money to pay these outrageous recruitment fees, you basically have to lean on your VC's network. Then the first hire or two should be people who have been working in the US for 20-plus years because our networks are golden," Moss said.

"It was really through word of mouth and networks that Rich and I were able to recruit the first 10 people into the company. If they had just put a Japanese national in, it would not have worked."

Moss added that while compensation packages in the US were significantly higher than those in Japan and most of the world, start-ups seeking top talent must pay the market rate. Sometimes it is possible to trade generous equity in place of cash, but this is a case-by-case negotiation.

The further opening of other cross-border corridors appears to be less driven by the increase in fund sizes. For example, Japan-India has emerged as a growing theme for smaller funds, many of them with corporate-influenced mandates. They include Strive Ventures, Beyond Next Ventures, and Dream Incubator.

Jafco Asia is also pushing into the subcontinent. Its latest South-Southeast Asia fund closed on USD 130m in 2021, smaller than some previous vintages. But this came with a renewed focus on India, including the hiring of its first in-country investment talent. For the past decade, the firm has targeted India only opportunistically; there have been six deals in the past 18 months.

Incubate Fund is another example of a GP casting a wider net without increasing fund size. While its flagship funds have ticked up to USD 250m in the latest vintage, these invest exclusively in Japan. Overseas programs are ambitious in spirit, but fund sizes are usually less than USD 10m.

Incubate's LP base has gradually shifted from corporates to financial institutions since it was founded in 2010. By 2015, the firm made its first international foray in Southeast Asia, where it has raised three funds to date. It entered India a year later and has since raised three funds. Two funds have been deployed in the US since 2019, and the first Brazil vehicle closed in 2021.

Each geography has a dedicated local investment team; there are 15 overseas staff – versus 45 in Japan – and seven overseas partners. There is also exposure to Africa via an LP investment in Samurai Incubate, an otherwise unrelated Japan-Africa specialist.

"Our approach of incubating start-ups with a founder from day one is unique in most markets," said Masahiko Homma, a co-founder of Incubate. "Even in India and Southeast Asia, there are good seed and early-stage start-ups, but not many players are helping build start-ups from scratch. That's our motivation for going international – we think our style is unique in our target markets."

Plenty of upside

Incubate's approach helps clarify the fact that although Japan has only recently emerged as a globally visible VC player, a fair amount of relatively uncelebrated legwork has been underway for several years.

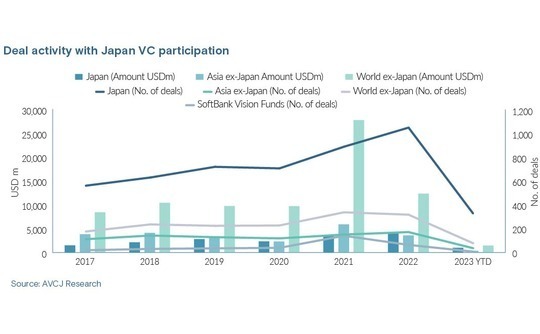

The quantum of investment where Japan-based VC firms back non-Japan companies has consistently tripled or quadrupled the amount invested by Japan-based VC firms in domestic companies in the past five years, according to AVCJ Research.

However, results are exaggerated by the classification of SoftBank Investment Advisers, the manager of the SoftBank Vision Funds, as a Japanese investor. The Vision Funds contributed especially to the industry-wide spike in 2021 when they joined 137 deals, only two of which were in Japan. This accounted for about one-third of the transactions that year featuring a Japanese VC firm.

This inconspicuous pervasiveness sets the stage for the growth of Japan VC to outpace other ecosystems that are more disrupted by the current macro environment. But much will depend on the industry's ability to reconcile its conservative tendencies and embrace the opportunity.

In India, Japan VC plays are expected to benefit from warming bilateral ties and momentum in economic cooperation. In Southeast Asia, an influx of traditional Japanese financial institutions will see de-risked investment options in VC-backed companies. And in the US, the tech rout punctuated by Silicon Valley Bank's implosion could represent the most promising opening in recent memory.

"The US market is going to be cold for a while, but Japan should stand on its own and not follow that US sentiment. This is a time for Japan to be aggressive for once. A lot of money from the BRICS [Brazil, Russia, India, China, South Africa] is shut out of the US for geopolitical reasons., so Japan is in a pretty good space," WiL's Isayama said.

"There's also less competition domestically, with the Googles and Facebooks laying off a lot of talent. If Japanese start-ups have the resources and the guts, this is a once-in-a-decade opportunity to hire these people at a decent cost."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.