JIP supports Japan cancer diagnostics joint venture

Japanese private equity firm Japan Industrial Partners (JIP) is participating in a local joint venture with BostonGene, a US-based provider of artificial intelligence-enabled (AI) profiling solutions used to treat cancer patients.

NEC Corporation is the third partner in the joint venture – for which no details of equity ownership were given. JIP is a familiar counterparty of NEC, having carved out multiple assets from the Japanese conglomerate. According to the GP's website, of eight deals completed in the past nine years, four came from NEC, most recently Nippon Avionics via a tender offer.

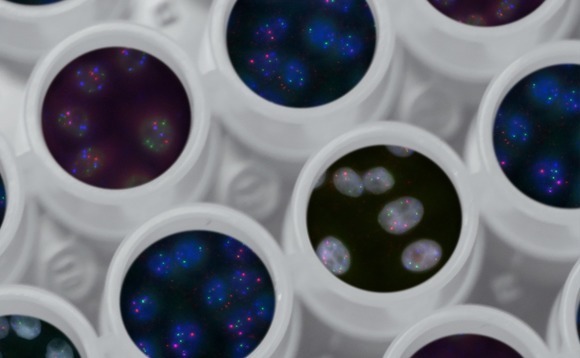

The joint venture is intended to advance personalised medicine and improve patient outcomes. BostonGene will contribute technology and advanced biocomputational algorithms that form the basis of its molecular and immune profiling services.

These profiling capabilities – used in conjunction with AI-powered cloud-based solutions, bioinformatics resources, and analytical tools – provide a comprehensive view of a cancer patient at a molecular level and identify targets to make evidence-based treatment decisions. For example, the Tumor Portrait test predicts responses to immunotherapy and stratifies patients into responders and non-responders.

BostonGene also offers supporting services such as biomarker discovery, clinical trial testing, assay design and development, and companion diagnostics.

"NEC is actively promoting the growth of its healthcare and life science business, centred on its hospital DX [digital transformation] business, which has a strong customer base," said Takayuki Morita, president and CEO of NEC, in a statement.

"By collaborating with NEC's healthcare solutions, which utilize powerful AI and digital technologies, we expect BostonGene's solutions to transform cancer care in Japan and aid Japanese pharmaceutical companies in developing the most effective therapies."

JIP closed its fifth fund on JPY 148.5bn (USD 1bn) – including a JPY 46.2bn co-investment vehicle – in 2018 and is currently in the market with Fund VI. The private equity firm is leading a consortium working towards a JPY 2trn privatisation of Toshiba Corporation.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.