DCP sells MFS Technology to Chinese strategic for $460m

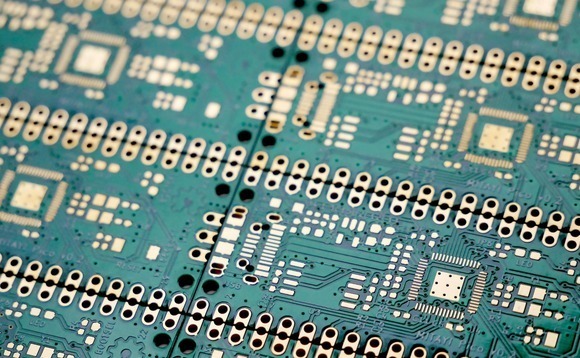

DCP Capital Partners has agreed to sell MFS Technology, a manufacturer of customised printed circuit boards (PCB) that has a presence across Asia, to Shenzhen-listed Victory Giant Technology for USD 460m.

Victory Giant, which claims to be China's fourth-largest PCB manufacturer and the 21st largest globally, will acquire a 100% equity position in MFS for USD 365m and assume USD 95m in debt, according to a filing. Various regulatory approvals are required for the transaction to proceed.

China-focused DCP bought the Singapore-headquartered business from Navis Capital Partners and Novo Tellus Capital Partners in 2018 for an undisclosed sum. Navis secured a 90% interest in MFS four years earlier as part of a USD 95.7m buyout alongside Novo Tellus. It exited with a 3x money multiple and an IRR of more than 40%.

MFS was founded in 1988 and produces a range of flexible and rigid PCBs and semiconductor substrates and value-added services around design, engineering, and assembly. Its manufacturing footprint spans Singapore, Malaysia, and China.

Value creation efforts during the Navis-Novo Tellus ownership period included scaling down operations in high-volume, low-margin sectors such as mobile telephony, and doubling down on longer-cycle markets related to automotive, healthcare technology, and data storage. The goal was to maximise exposure to gradually evolving trends around the internet of things, clean cars, and medical wearables.

Revenue came to USD 261.3m in 2022, down from USD 280.5m a year earlier. Over the same period net profit rose from USD 16.9m to USD 18.9m. At the time of DCP's acquisition, China was responsible for less than 40% of revenue.

Victory Giant was established in 2003 and generated CNY 7.9bn (USD 1.1bn) in revenue in 2022. It serves a similar set of industry segments to MFS.

Before 2000, the Americas, Europe, and Japan accounted for more than 70% of global PCB production value, Victory Giant said in its latest annual report, citing specialist electronics researcher Prismark Partners. Asia then emerged as the dominant force and China became the number one market. Asia was responsible for more than 90% of the global market, with China alone contributing 54%.

DCP is currently raising its second fund, which has a target of USD 3bn. Recent investment activity includes a carve-out of Cargill's China poultry business and a USD 175m commitment to Canadian health and wellness products player Jamieson Wellness, partly to support China expansion.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.