Japan procurement marketplace secures $89m Series C

Six Japanese venture capital firms have led a Series C round of USD 89m for Caddi, operator of a B2B procurement marketplace that services the manufacturing sector.

Globis Capital Partners, DCM Ventures, Global Brain, World Innovation Lab (WiL), Jafco Group, and Minerva Growth Partners led the round, with participation from four unnamed new investors. The company has now raised USD 164m to date. The Series C valuation is higher than that of the Series B round, which Techcrunch put at USD 450m.

Caddi received JPY 1bn (USD 9m) in Series A funding from DCM, Global Brain, Globis, and WiL in 2018, according to AVCJ Research. All four re-upped for a JPY 8bn Series B in 2021, for which they were joined by DST Global, Jafco, Minerva Growth, SBI Investment, and Tybourne Capital Management.

Caddi was founded in 2017 by Yushiro Kato, who previously led the procurement and internet-of-things practice for manufacturing at McKinsey & Company, and Aki Kobashi, an engineer who worked on NASA projects for Lockheed Martin and helped develop iterations of the iPhone and Airpods for Apple. They now serve as CEO and CTO, respectively.

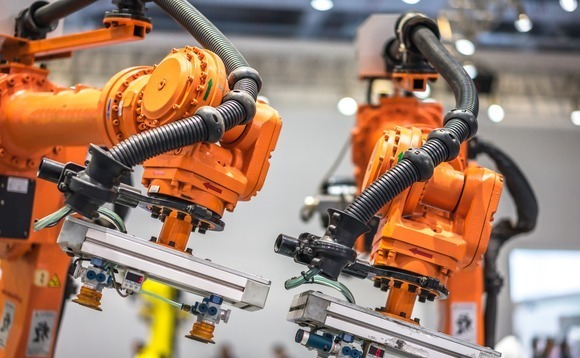

There are two offerings: a parts procurement platform that aggregates the capacity of more than 600 manufacturing partners around the world; and an artificial intelligence-enabled engine that analyses design drawings and helps identify suppliers, reducing search time and procurement costs.

The company has 590 employees – up from 230 when it closed the Series B – and offices in Japan, the US, Vietnam, and Thailand. International expansion is a key priority, as evidenced by the recent establishment of a US division and a Mexico-based supply chain to serve American manufacturers. There are plans to add 100 staff in the US this year.

The new capital will be used to expand both aspects of the business, according to a statement. Caddi wants to generate USD 10bn in revenue by 2030, with Caddi Drawer – the drawing analysis engine – expected to contribute USD 100m in annual recurring revenue (ARR) within a few years and USD 1bn by 2030. Caddi Drawer has posted 10x growth since the Series B.

Japanese start-ups are increasingly targeting global markets as they pursue greater scale, following in the footsteps of early unicorns such as flea market app Mercari and news aggregation platform SmartNews. Globis recently opened an office in San Francisco to support these efforts.

"More and more entrepreneurs in Japan are becoming very ambitious about doing business outside of Japan, and they increasingly realise that if you over-rely on the domestic market, it's much harder to expand overseas later on," Emre Yuasa, a general partner at Globis, told AVCJ last month. "As a result, we need to develop new capabilities as a fund to help them grow into new international markets."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.