Wavemaker hits first close on SE Asia climate fund

Singapore’s Wavemaker Partners has hit a first close of USD 13m on its debut impact fund, which focuses on climate themes in Southeast Asia. The target is USD 25m.

LPs include Singapore's Economic Development Board (EDB), Temasek Holdings-owned Pavilion Capital, JG Digital Equity Ventures, Grantham Foundation, and a VC arm of Japanese construction company Kajima. EDB New Ventures, the venture-building arm of EDB, will provide support as a new strategic partner.

The fund, billed as a first-of-its-kind venture builder, was launched in October last year as part of a programme called Wavemaker Impact. The plan is to reduce global carbon emissions by 10% by 2035 through investments in clean-tech start-ups.

Wavemaker Impact prefers to work with entrepreneurs to build businesses from the ground up rather than invest in existing start-ups. Central to the investment thesis is the idea that successful clean-tech companies must focus on value creation for their customers, not just emissions reduction.

Four companies have been launched to date across Singapore, Indonesia, and Vietnam. There are plans for another eight to 12 companies over the next two years; they will be supported from launch through Series A, or in some cases, Series B.

"Delivering on sustainability goals has never been more pressing and presents an opportunity for collaboration across the ecosystem to build and scale climate tech ventures," Choo Heng Tong, executive vice president for new ventures and innovation at EDB, said in a statement.

"This partnership combines Wavemaker Impact's strong venture-building expertise and extensive founder networks with EDB's access to sustainability-focused corporates and insights on climate needs."

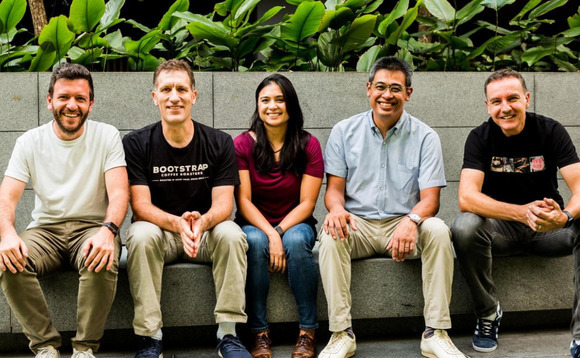

Wavemaker Impact is led by Paul Santos, a managing partner at Wavemaker Partners (pictured, fourth from left), alongside Steve Melhuish, founder of real estate portal PropertyGuru (right), and Doug Parker, ex-COO of Nutonomy (second from left).

They are joined by Quentin Vaquette (pictured, left) and Marie Cheong (third from left), who built more than 10 climate tech start-ups during their time at Engie Factory, the Asia-based venture arm of a global low-carbon utility.

Last month, the team confirmed partnerships with Temasek and its decarbonisation platform GenZero, as well as with Bill Gates' Breakthrough Energy Ventures. Existing partners include Enterprise Singapore, which is supporting the venture-building programme in Singapore, and the United Nations Development Programme, which is supporting impact measurement.

Wavemaker was founded as a US-based firm in 2003 and began investing in Southeast Asia in 2012. Philippines-based technology company Xurpas acquired Wavemaker's US operations in 2019, leaving the Southeast Asia business as an independent entity.

Both firms continue to operate under the name Wavemaker Partners, although the Southeast Asia-focused firm is sometimes referred to as Wavemaker SEA and Wavemaker Pacific Partners.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.