New Zealand deep-tech VC Pacific Channel seeks co-investors

Pacific Channel, which claims to be the largest deep-tech specialist in New Zealand’s venture capital industry, is seeking co-investors to support maturing portfolio companies that require additional capital.

The firm is especially keen to secure co-investors in Australia, a natural first expansion market for New Zealand companies, and the US, a significant deep-tech market and logical port of call for businesses from Australasia that want to scale globally, Stephane Janson, a San Diego-based partner, told Mergermarket, AVCJ's sister publication.

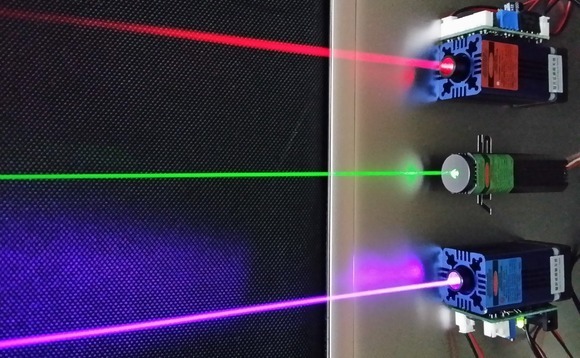

Pacific Channel, which operates out of offices in New Zealand and the US, is currently investing its second fund, a NZD 55m (USD 34.5m) vehicle that closed in 2020. Half the corpus has been deployed in companies such as photonics testing player Quantifi Photonics, ‘green' mineral mining specialist Geo40, and diagnostics business Orbis.

In March, Orbis told Mergermarket that it wanted to raise USD 10m in Series A funding from strategic investors that can support distribution efforts. The US, Australia, and Southeast Asia are its priority expansion markets.

The Pacific Channel fund received NZD 20m from the New Zealand government's Elevate NZ Venture Fund, a fund-of-funds run by NZ Growth Capital Partners (NZGCP) that backs managers able to fill the Series A and B gap for high-growth local companies. Other LPs come from the US, New Zealand, Australia, and Europe.

Jason was recruited in November 2021 from Los Angeles-based Orchard Capital Venture Partners with a brief to "to build global relationships for portfolio companies, secure co-investors and bring investment banking in-house to drive exits," he said.

Pacific Channel was founded in 2006 by Brent Ogilvie, who previously served as New Zealand's trade commissioner to New York. The goal was to bring investors into New Zealand's deep-tech space, with a focus on biotech opportunities, and establish relationships in the US to support global expansion.

The firm formed a partnership with a seed co-investment fund under NZGCP – then known as New Zealand Venture Investment Fund (NZVIF) – in 2008. The co-investment fund matched commitments to start-ups made by VC firms. A total of NZD 15m was invested in approximately 30 companies, of which seven have been exited, said Janson.

Fund II focuses on four themes within deep-tech: quality and length of life, the future of food, sustainability, and industry 4.0. Pacific Channel ensures domain expertise by hiring investment professionals with doctorates and from engineering backgrounds.

"Many investors haven't yet clued into the fact that there are niches where Australasia-based companies are at the bleeding edge of these extremely advanced industries," Janson said. "This ‘technical literacy' allows us to prospect for opportunities in emerging industries before they are well understood by other investors."

Pacific Channel has yet to finalise its future fundraising plans. However, it is possible that a third New Zealand deep-tech fund will be accompanied by a more internationally focused photonics fund. The firm is also interested in launching a climate vehicle that would use a combination of debt and equity to purchase and monetise land via New Zealand's carbon trading scheme.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.