New Zealand Venture Investment Fund

New Zealand deep-tech VC Pacific Channel seeks co-investors

Pacific Channel, which claims to be the largest deep-tech specialist in New Zealand’s venture capital industry, is seeking co-investors to support maturing portfolio companies that require additional capital.

Australia's Blackbird launches New Zealand fund

Australia’s Blackbird Ventures has launched a NZ$60 million ($40 million) New Zealand-dedicated fund with a cornerstone investment of NZ$21.5 million from the government.

New Zealand opens $200m VC scheme to private managers

New Zealand has opened a NZ$300 million ($199 million) government-backed venture capital scheme to applications from domestic and international private fund managers.

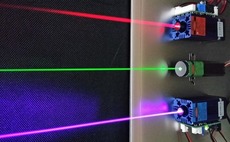

VCs back New Zealand supercomputing company

A group of VCs including Tokyo-headquartered East Ventures has completed an $8.5 million Series A round for New Zealand big data computing company Nyriad.

NZVIF expands seed-stage mandate

The New Zealand Venture Investment Fund (NZVIF), a government-sponsored fund-of-funds, has doubled the investment cap of its seed-stage vehicle to NZ$1.5 million ($1.1 million) per company.

New Zealand's VC-backed Phitek Systems sold to US tech player

New Zealand-based audio equipment and technology developer Phitek Systems has been sold to a US strategic buyer, providing an exit for a number of domestic VC investors.

New Zealand's Movac reaches $74.5m first close on tech fund

New Zealand venture capital firm Movac has achieved a first close on its fourth technology-focused fund with NZ$105 million ($74.5 million) in commitments.

NZVIF, Enterprise Angels to invest $14m in NZ start-ups

The New Zealand Venture Investment Fund (NZVIF), a government-sponsored fund-of-funds, and domestic investor Enterprise Angels plan to commit about NZ$20 million ($14.3 million) to local start-ups over the next four years.

New Zealand's Spotlight Reporting gets $3.6m Series A

New Zealand’s Spotlight Reporting, a cloud-based accounting services provider, has received NZ$5 million ($3.6 million) in Series A funding from investors including the Global from Day One (GD1) Fund II.

New Zealand VC: Apprehensive eruption

After a dormant 2015 during which no funds were raised, New Zealand has seen a flurry of activity in the first half of this year. It is piquing enthusiasm – albeit cautiously – for a fledgling VC space

NZVIF appoints new CEO

New Zealand Venture Investment Fund (NZVIF), a government-sponsored VC fund-of-funds, has appointed Richard Dellabarca as its new CEO. He replaces Franceska Banga, who has led the fund since its inception in 2002.

NZVIF commits $13.5m to Movac's fourth fund

New Zealand Venture Investment Fund (NZVIF) has committed NZ$20 million ($13.5 million) to the fourth fund of domestic early-stage investor Movac Partners.

NZVIF, Taiwan NDF reach $75m first close on VC fund

The first VC fund to be supported by a co-investment partnership between New Zealand Venture Investment Fund (NZVIF) and Taiwan's National Development Fund (NDF) has reached a $75 million first close.

NZVIF receives $49m underwrite for new fund investments

New Zealand Venture Investment Fund (NZVIF), a venture capital fund-of-funds, will receive a NZ$60 million ($49 million) underwrite facility from the New Zealand government.

New Zealand, Taiwan ink $200m co-investment pact

New Zealand Venture Investment Fund (NZVIF) and Taiwan’s National Development Fund (NDF) have formed a co-investment partnership which aims to commit up to $200 million into venture capital funds in the two nations.

Valar Ventures unveils $32m NZ fund

Valar Ventures, the venture capital firm run by PayPal co-founder Peter Thiel, has raised NZ$40 million ($32 million) for a vehicle launched in partnership with the New Zealand Venture Investment Fund (NZVIF).

NZVIF to invest $6m in start-ups

The New Zealand Venture Investment Fund (NZVIF) is making plans to invest up to NZ$8 million ($6 million) in New Zealand-based start-up firms.

Dutchess Capital injects $16.3m in Motopia in Australia

The US-based Dutchess Capital Management, a fund manager specializing on short-term and growth-stage public companies that fall under the ‘special situation’ category, will invest up to A$15 million ($16.3 million) in Motopia Limited, taking a 19.99%...

NZ government boosts VC fund commitment

The New Zealand government has pledged an additional NZ$40 million ($28.3 million) to the New Zealand Venture Investment Fund, strengthening its commitment to the vehicle in which it has already invested NZ$160 million ($113.13 million).