Singapore cancer treatment start-up gets $126m Series A

Singapore’s Tessa Therapeutics, a biotech developer with a Hodgkin's lymphoma treatment in phase-two trials, has raised a USD 126m Series A round led by US healthcare specialist Polaris Partners.

Temasek Holdings, EDBI, Heliconia Capital, and Heritas Capital also participated. All four of these investors were part of a USD 80m seed round in 2017 that also included Hong Kong and Sydney-based healthcare investor Karst Peak Capital.

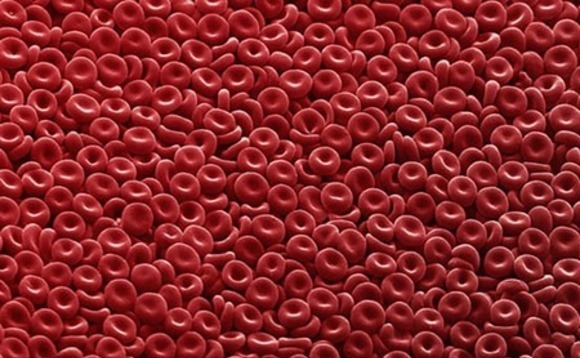

Tessa will use the Series A proceeds to advance the clinical development of its Hodgkin's program. This involves collecting blood cells using an automated separation process and reengineering them as cancer-fighting agents that can be reintroduced into the bloodstream.

Treatments based on a related approach – where patients use cells from a healthy person's blood rather than their own – are also in development. Testing for Tessa's leading product using this technique demonstrated a favourable safety profile and signs of efficacy with clinical responses observed in seven out of nine patients. Four patients saw their tumours disappear completely.

"Tessa is at an exciting point with two differentiated clinical-stage programs pursuing novel approaches for the treatment of CD30-positive lymphomas," said Amy Schulman, a managing partner at Polaris, referring to a protein in lymphomas that can be targeted by the modified blood cells.

Schulman and Darren Carroll, another managing partner at Polaris, will join the Tessa board. Schulman previously served as president of Pfizer Nutrition and was instrumental in its sale to Nestle for USD 11.8bn in 2012. Carroll founded biotech-focused Lilly Ventures in 2002 and Lilly Asia Ventures in 2008.

EDBI is the investment arm of the Singapore Economic Development Board. Heliconia is a subsidiary of Temasek that co-invests alongside other private equity investors and runs fund-of-funds. Heritas is a private equity firm sponsored by Singapore-based industrial conglomerate IMC Group.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.