Square Peg backs US, Malaysia-based LottieFiles

Square Peg Capital has led a USD 37m Series B round for US and Malaysia-based motion graphics platform LottieFiles.

XYZ Venture Capital, GreatPoint Ventures, and existing investors 500 Startups and Microsoft's M12 also participated. M12 led a USD 9m Series A in early 2021. The company claims to have grown its net new registered user base by 160% between the two rounds.

"LottieFiles plays into the theme that the future of design is in motion as digital engagement increasingly revolves around interactivity," Piruze Sabuncu, a partner at Square Peg, said in a statement. "We have been impressed with the fast-growing LottieFiles community all over the world from the biggest tech companies to individual designers."

Popular apps and websites typically use the open-source vector-based file format, Lottie, which enables designers to set up animations on any platform. Lotties are also small files that work on any device and can scale up or down without pixelation. This allows designers to create various in-app features.

LottieFiles.com is said to be the most-visited destination for Lottie motion globally, servicing a new animation every nine seconds. The website currently has users from more than 135,000 companies globally, including animation designers and motion designers from Google, TikTok, Disney, Uber, Airbnb, and Netflix.

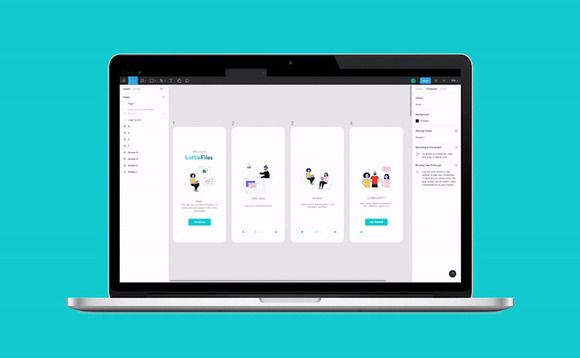

LottieFiles also claims the world's largest library of animations with more than 50,000 free and premium Lottie animations. The platform is integrated with design tools such as Adobe XD, Adobe After Effects, Figma, Webflow, and Wordpress.

The fresh capital will be used to build out the product suite and expand operations to cater to the larger user base. This includes plans to launch a new design workflow and collaboration service. The aim is to help designers save more than 15 hours per asset, which would give them 80% more time to focus on creativity.

"Our mission is to democratise motion design and graphics animation and make it accessible to all," LottieFiles' CEO and co-founder Kshitij Minglani added. "LottieFiles completely transforms the creation and design workflow process, which empowers every designer and their teams to leverage the power of motion to create delightful user experiences."

Square Peg was an early investor in Australian design platform Canva, which raised a USD 200m round last year at a valuation of USD 40bn, up from USD 15bn five months earlier. The VC firm backed a USD 3.6m round for company in mid-2014.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.