Medical devices: Proceed with caution

Medical devices has become a difficult place to invest but potentially all the more rewarding for those willing to take the plunge. Asia is in a prime position globally

It's not easy to piece together how myriad market variables have transformed the global medical devices space during the past decade, but much of the story traces back to Obamacare.

Most essentially, the Patient Protection and Affordable Care Act of 2010 triggered an influx of new healthcare system beneficiaries in the US and imposed a 2.3% tax on products sold by device manufacturers. Under pressure to reduce their risk exposure, insurers and manufacturers responded by imposing stiffer requirements around demonstrating clinical benefits in new devices.

This set the tone for a long-unfolding overhaul of global regulatory practices that turned medical devices from a biotech-style ecosystem characterized by a kinetic abundance of investors and independent talent into a seemingly impenetrable oligarchy of corporate giants.

Consolidation – driven by more difficult and unpredictable approvals processes – has been the biggest and most consistent trend during this period, with the 10 largest players said to control almost 40% of the market as of 2019. In some niches, such as orthopedics, the top five companies are believed to enjoy a global market share of more than 60%.

This environment has proven less palatable to PE and VC investors, whose interest in the sector revolves around the development of novel products requiring more fluid paths to market. According to EY, investment in medical devices fell 15% during 2019 to about $31 billion; the average for the previous five years was $37.5 billion. Capital raised by companies with less than $500 million in sales fell 13%, to $19 billion.

In light of this retreat, IPOs have become even rarer versus strategic acquisitions. But buyers want to see proof of market penetration and revenue growth before partnering with innovative companies. Again, this process has been stymied by changes in the regulatory landscape, especially within the US Food & Drug Administration (FDA).

Compared to other health tech categories, medical devices benefit from low technical risk and a cheaper route through human trials to proof-of-concept, but the endgame for investors has become harder. "Not only do you need to demonstrate that it's safe, efficacious, and lowers the cost of healthcare, you also need to do that in a way that fills the pockets of doctors," says one industry participant. "Either the doctors get more cash or it doesn't get adopted."

The politics of industry reimbursement is nothing new in medical devices, but it has become increasingly obstructive given the diminishing returns caused by the higher costs associated with protracted commercialization timelines. Chris Nave, a founding partner at Australian health tech investor Brandon Capital, sees this as creating a challenging environment in terms of company valuations, even as competition has generally thinned out.

"There are a lot of medical devices companies out there that have raised $100-150 million with really good products but have just taken longer to get what they needed to get done," Nave says. "So they've had to go through a total recap back at a valuation of $10 million to raise another $50-100 million. That's been a pretty regular occurrence over the last 5-8 years for devices companies because it's just taking so long and costing so much."

Growth story

All this paints a pretty bleak picture for medical devices as a target for the private equity and venture capital industry at large. However, it doesn't preclude careful, contrarian entries with significant upside.

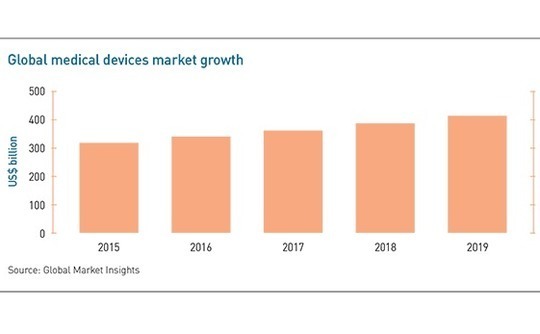

Investors able to survive the regulatory and reimbursement trenches of medical devices will benefit from a massive and steadily advancing expansion story. According to Global Market Insights (GMI), the global devices market grew 6.8% a year on average for the five years to 2019 and will continue expanding at 5.3% a year through 2026, when it will be worth $595 billion.

Asia could well be among the biggest beneficiaries of this trajectory, especially in terms of M&A. Sumant Ugalmugle, a senior research manager at GMI, says major global medical devices players are looking to invest and expand their sales in the region. These companies – including the likes of Medtronic, Boston Scientific, and Johnson & Johnson – are seen as having significant appetite for later-stage plays in the private innovation space.

"Lately, despite growing inflation, recession, and the economic downturn, Asia is growing at a very rapid rate compared to other regions," Ugalmugle explains. "That depicts Asian countries as having the necessary resources to invest rigorously in healthcare. The diabetes, cardiovascular, infectious disease, and orthopedic sectors are some of the major healthcare areas that are expected to experience high growth in Asia's medical devices market."

MedTech Actuator, one of the few medical devices incubators in Asia Pacific, is tracking rising interest among the global giants for early-stage companies. Part of this trend is attributed to better understanding that much of the technology development in Asia now rivals the traditionally dominant US and European markets. "They're also seeing that local tech can be very useful for local markets when it's purpose-built for those environments," says Vishaal Kishore, CEO of MedTech Actuator.

MedTech Actuator invests via a fund set up in partnership with regional VC firm Artesian and is currently finalizing agreements around an expansion into Singapore. Core operations involve helping a portfolio of around 50 seed-level companies de-risk their models through exposure to regulatory, legal, and scientific experts, including potential acquirers. The idea is that medical device start-ups require significantly more handholding than their biotech cousins.

"The commercialization journey in med-tech is often imagined to be a linear and progressive process. We are not of that view," says Kishore, who previously served as deputy secretary of Victoria's Department of Health. "Most importantly, the ability to iterate and reiterate needs to go beyond technology and into key dimensions of the team and capital capability. How willing are you to test, try, throw out and iterate again in every aspect of what you're doing?"

Domestic champions

Capacity for self-reinvention is an important factor at the larger end of the market as well. GTJA Investment Group, a healthcare-focused GP, demonstrated this last year when it realized an IRR of 44% on an IPO exit from Mindray Medical, China's leading devices maker. The company is currently worth about RMB364 billion ($51.4 billion).

"High R&D investment results in efficient and rapid product iteration," says Gracie Huang, CEO of GTJA. "Over the years, Mindray has invested 10% of its sales revenue into R&D, and independent innovation has never stopped. Global development brings global brand power. Overseas distribution began in 2000, and by 2017, the overseas and domestic parts of the income were half and half."

In this case, a backdrop of growing demand was also certainly an important factor. Huang estimates that China's medical devices market grew from RMB228 billion in 2011 to RMB489 billion in 2016. This was punctuated in 2014 by new rules from the National Medical Products Administration facilitating approvals procedures for novel device makers. Mindray's focus areas include life information and support, medical imaging, and in-vitro diagnostics.

The Mindray story also illustrates hope for homegrown champions at a time of global consolidation, at least in the most innovation-conducive jurisdictions. In China, R&D and company building support has been further reinforced by incentives to take commercialization risk such as a government initiative that aims for 95% of the devices used in local hospitals to be domestically produced.

"The high-end Chinese market is dominated by international players, but that's changing," says Tina Deng, a senior medical devices analyst for UK-based Global Data. "Growth won't be as high as before and revenue will decline for multinational players in China. A lot of them are worried about that and looking at ways to make up that lost potential."

As in other health tech domains, approaches to the devices space usually start with an assessment of the addressable market in terms of disease type. Prosthetics, including spinal and bone replacements, are a key development area, especially in challenging subsets such as nontoxic materials that can be accepted by the immune system. Other important categories involve various cardiovascular valves and heart pacemaker tools.

Few markets are more attractive than kidney dialysis, however, which represents 7% of total healthcare spend in the US, the country's largest single treatment expenditure. The World Health Organization estimates that chronic kidney disease increased worldwide by 50% between 1990 and 2010. That year, some 2.6 million people received dialysis, a number that is expected to hit 5.4 million by 2030. The global market is currently worth $80 billion.

Singapore's Vickers Venture Partners approached this opportunity set last year by co-leading a $40 million round for Awak Technologies alongside an unnamed medical technology company. Awak makes a wearable purse-sized dialysis treatment device that provides users with more freedom of movement and lifestyle. The deal was said to be the largest investment ever in the Singapore medical technology space.

Awak is also useful in illustrating the factors around device type, including those used by a technician or by the end-consumer. In the case of the latter, they are often selected by the consumer and subject to traditional retail challenges around marketing. Although Awak touches the consumer directly and has positioned itself commercially in terms of consumer-facing design, it remains a prescription product in the hands of doctors.

"We tend to avoid the ones where the consumer makes the decision," says Jeffrey Chi, a managing partner at Vickers. "The consumer generally decides on things based on price, feel, and perception, and that's just a game we have decided not to play. There are very successful companies in that space. However, the chances of success are getting lower because customer acquisition costs are rising while the value you're expected to extract out of the customer remains constant."

Deal targeting otherwise balances a number of familiar hardware investment considerations around product-market fit and ensuring that there is a significant digital overlay to avoid competitors reverse-engineering the product. Intellectual property (IP) protection can also be achieved through a complex mix of materials. Awak, for example, claims a proprietary and patented system of electrolyte and glucose solutions in its blood purification unit as well as an ammonia detector, and protein and bacterial filters.

Patient players

Unlike many hardware categories, manufacturing-related difficulties are not considered a meaningful roadblock in medical devices. The vast majority of companies that receive investment have no plans to ramp up to mass production until they have partnered or been acquired by one of the leading strategics. In this way, investment is less of a build-and-distribute play than a design, prototyping, and testing play on par with biotech.

Brandon Capital has four device companies in its portfolio subscribing to these tenets, including EBR Systems, a cardiac resynchronization specialist that is still in clinical trials but has already secured a reimbursement arrangement. The main value proposition is a large target market with no alternative; 30% of patients receiving surgery for an asynchronous heart go uncured.

The VC firm's user-facing investments include Global Kinetics, which makes a device resembling a smart watch that tracks the symptoms of Parkinson's disease with a strong digital component. Doctors order the device like they would a blood test. It is then delivered to the patient's home where it is worn. The data is sent to a cloud and a report is provided back to the doctor. Finally, the patient mails the device back to Global Kinetics by standard post.

Most importantly, the appeal is that the device, known as a KinetiGraph, provides information that changes treatment decisions. Brandon is not interested in consumer-use products such as step-counting wearables. The logic is that users lose interest when there are no measurable outcomes, and measurable outcomes are not possible if the data being gathered are not used by a doctor to adjust treatment.

"A lot of people – and Google is a good example – spend hundreds of millions of dollars to get into digital health from a consumer technology point of view and have struggled to come up with really impactful devices because they've taken an app-type of approach to the problem rather than coming at it from the clinical side as well," says Brandon's Nave.

The philosophy that devices represent a deep tech opportunity rather than the capital-intensive production and marketing space associated with popular wearables may ultimately be the sector's saving grace for PE and VC investors. Not only are traditional consumer-style user adoption strategies an ill-advised approach from a clinical impact perspective, they would also be prohibitively difficult to execute in competition with the incumbent device giants.

The consolidation of medical devices can therefore be seen as a double-edged sword. While it squeezes exit options and sucks up talent from the entrepreneurial sector, it also redefines the potential for a home run in terms biotech investors can easily digest. The most promising companies are not just those with great business models but also those tinkering in the opaquest, bleeding-edge technologies.

Next big thing

Augmented reality, 3D printing, and internet-of-things are expected to create big waves in the devices space in the near term, as are concepts around wireless connectivity for bodily implants. The Medtronics and Boston Scientifics of the world will most likely guide these products into best-practice usage at hospitals, but they are not expected to hatch the IP at laboratory level.

Deloitte estimates that the internet-of-medical-things market alone will be worth $158 billion by 2022, encompassing everything from pregnancy testing kits and surgical instruments to artificial joints and radiological scanners. Within Asia Pacific, this will include fivefold growth during the coming two years to $51 billion.

Meanwhile, MarketsAndMarkets expects annual expansion of 17.5% in the global 3D printed medical devices market through 2022, when revenues will hit $1 billion, and ResearchAndMarkets believes the augmented reality healthcare market will hit $3.5 billion by 2024 spurred by a yearly growth rate of 33.4%.

"I wouldn't say that the horizon has narrowed or that the playing field is smaller. All these big companies in the medical devices space may have hegemony in multiple areas, but that doesn't mean that there aren't enough areas to innovate," says Luc Loja, an analyst at Vickers with a background in biomedical engineering.

"The PD [peritoneal dialysis] space, for example, is effectively a duopoly in the US and internationally, but despite that strong hold on it, Awak has been able to come up with a new technology that completely blows away what's been available on the market."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.