India's Unacademy moves to form edtech group

Indian online education platform Unacademy has acquired a majority stake in industry peer Mastree. It is the company's second acquisition in recent weeks, suggesting a consolidation strategy within the space.

Unacademy paid $5 million for a majority stake in the company, according to a blog post. This facilitates an exit for Blume Ventures, which is also an investor in Unacademy.

Founded last year by a team that includes Shrey Goyal, a former Blume employee, Mastree offers a digital subscription product aimed at primary school students. It provides online classes, quizzes, personalized coaching, and on-demand assistance.

The deal follows several investments by Unacademy in other education platforms. It has secured majority control of Wifistudy, Kreatryx, CodeChef and PrepLadder, all of which are examination preparation businesses. PrepLadder - a specialist in postgraduate medical examinations - was acquired last week for $50 million in cash and stock.

Earlier in the year, Unacademy raised $110 million in a round led by Facebook and General Atlantic. Indian media reports indicate the education technology start-up is looking to raise further capital to take advantage of an increase in organic traffic attributed to the curtailing of outdoor activity due to the COVID-19 pandemic.

In addition to Blume, Unacademy's investors include Sequoia Capital India, Nexus Venture Partners, and Steadview Capital.

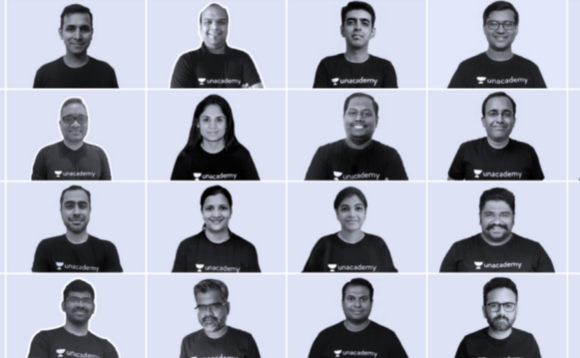

Founded in 2015, the company previously targeted students taking competitive exams and employed tutors with prior experience. In April, it began offering online classes for pre-university students. Unacademy says it helps students taking more than 35 different types of examinations in the country. More than 800 tutors conduct sessions on a daily basis.

Other education technology platforms in the country have also received substantial VC backing in the year. These include Vedantu, a live tutoring provider, and Byju's, an educational video platform.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.