SummitView leads $99m round for China's Enflame

Enflame Technology, a Chinese artificial intelligence (AI) technology developer that provides deep learning solutions for data centers, has raised RMB700 million ($99 million) in Series B funding led by Summitview Capital.

Other investors include Tencent Holdings, SHIVC - a venture capital platform established by the Shanghai government - Oceanpine Capital, Redpoint Ventures China, and Delta Capital. The proceeds will go towards increasing production capacity and business scale, as well as recruitment and R&D.

AI training is intended to deliver high computing power at low cost. Established in March 2018, Enflame focuses on accelerating communication within integrated circuits in order to make neural networks more efficient and reduce data center power consumption. It manufactures AI training accelerator cards that can be used to support scenarios involving images, data streaming, and speech. The cards feature specialized high-end deep learning chips.

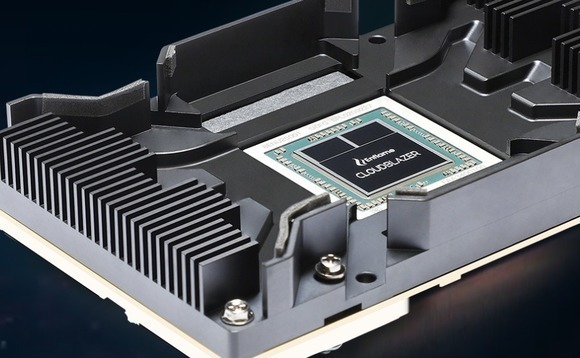

Last year, the company collaborated with chipmaker Global Foundries to develop a deep thinking unit for its CloudBlazer T10 accelerator. It is said to combine high bandwidth memory with an on-chip configuration algorithm that delivers fast, power-efficient data processing.

Wu Ping, a founding partner of Summitview Capital, said: "In the field of AI, China has not fallen behind in terms of algorithms and data. But in terms of computing power, there has not been a breakthrough in high-performance cloud training chips for a long time. Enflame's contribution in this area is of far-reaching significance for the development of the AI industry."

Enflame received an RMB340 million Pre-A round funding led by Tencent in June 2018. This was followed by an RMB300 million series A led by Redpoint last June.

AI as an investment theme is becoming ever more integrated with big data processing and the provision of cloud-based IT services. Customers can leverage the machine-learning capabilities of third-party platforms to apply algorithms to different aspects of their business. It underpins a shift towards platform-as-a-service (PaaS) solutions, with software-as-a-service (SaaS) and infrastructure-as-a-service (IaaS) providers as the main actors.

DataCanvas is a leading start-up in this space. It recently raised RMB120 million ($17 million) in Series C, with Delta and Redpoint among the participants. Other major players include MiningLamp Technology and 4Paradigm. Tencent co-led the former's $300 million Series E round last month. Meanwhile, 4Paradigm closed an $80 million extended Series C, bringing its valuation to more than $2 billion.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.