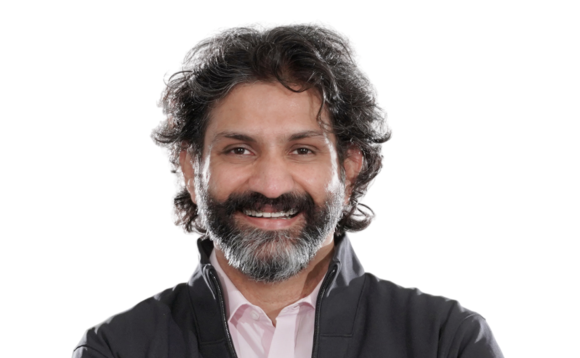

Q&A: Jungle Ventures' Amit Anand

Singapore’s Jungle Ventures has closed its fourth early-stage tech fund on USD 600m, shattering an initial target of USD 350m. Amit Anand, a founding partner at the firm, unpacks the achievement

Q: How do you explain the jump in fund size?

A: This surprised us. There was significantly more capital and interested LPs we had to say no to. Even today, we keep getting pinged about it. There's something to be said for the maturity of the ecosystem and Jungle as an institution, having been around for 10 years. I would like to say that a rising tide lifts all boats, but it's really the boat that is built the largest and strongest and sturdiest that benefits the most.

Q: What gives you confidence it's not oversized?

A: I think we are at the right size. Jungle was the first fund to pitch to both founders and LPs the idea of Southeast Asia and India as one market. In some ways, we were vindicated when Sequoia, Accel, GGV, Lightspeed, and other global franchises started doing the same thing. Our peer group has less to do with local funds and more to do with funds investing across Southeast Asia and India. And in that context, our number puts us in the top three funds for that combined opportunity.

Q: What was it like getting the LP advisory committee (LPAC) to sign off on such a large increase?

A: We believe in radical transparency. We display a portfolio scorecard to our LPAC every quarter and have a deep conversation on it. This is an LPAC that has been with us for the last two vintages and built comfort on our approach to portfolio construction and conflict management. We had one-on-one conversations around the first close [USD 225m in September 2021] when we could see the interest was large. We leaned on our core LPs – Temasek, IFC [International Finance Corporation], and others – and got feedback from them. They invest in 50-100 GPs globally, so this is not the first time they've seen this problem. We just went for one LPAC expansion, and it had unanimous approval.

Q: What's behind the greater interest from LPs?

A: It's been a pivotal year. There are a significant number of new LPs, both financial institutions and family offices, that invested in the region for the first time – not just in Jungle but across the board. The appreciation of the large opportunity was always there. The key difference is how large and meaningful the ecosystem has become. From Jungle's perspective, about 50% of the capital came from new LPs, a fairly diversified mix of large global financial institutions, family offices, and sovereign wealth funds. Europe and the Middle East are probably the two big geographies in terms of growth of capital.

Q: How has the LP mix changed?

A: From day one, Jungle has been very keen on global, regional, and local family offices, but this time around, they constitute almost 50% of our LP base. It's a huge jump and a significant portion of them are coming from Asia. We think family office money can be more than just capital. The promoters have a lot of experience and networks that can benefit our portfolio companies. They can be potential acquirers as well. We do well with family offices because we have this built-to-last philosophy. They appreciate that because they themselves are business builders.

Q: By Fund IV, many VC firms want to graduate beyond Asian family offices toward more global financial institutions. Is that a flawed aspiration?

A: I don't know if it's flawed. From our perspective, it's more relevant to our markets. Asian family offices' wealth has been created in this region, their success, their fame, and networks are here. In many ways, they see technology start-ups as a way to continue to bet on markets that they know so well. From a mindset perspective, family offices were initially harder to get, but I certainly think that our fortunes are tied in that we're all operating in these regions. They can see the disruption or the enablement that the start-up ecosystem is doing better than the global financial institutions.

Q: Was there any consideration of splitting the fund into early-stage and growth vehicles?

A: We've never done that, and I don't think we ever will. Our belief is always that you must be best at something if you want to be the number one player in any market. Founders come to us when they want their first cheque, and there's a reason for that. The early stages are business building times, when the founder is still thinking, ‘Who can help me?' They know that in our concentrated portfolio, they have literally 3-4 times more capital than their peers. That value proposition is what has made us among the top 2-3 early-stage venture firms in the region.

Q: What's the secret to picking winners?

A: We have a team of about 30 people across Southeast Asia and India with close to 250 years of experience in a diverse set of industries. Look at the teams across other funds and you'll see they've either hired these people very recently or they just don't add up in terms of operating experience. I have come to a realisation over hundreds of instances that this is not a market where ideas win – this is a market where execution wins. So, given Jungle's background and the unique processes we've built, we underwrite execution risk much better than our peers.

Q: What about exits?

A: It starts with portfolio construction. It's not obvious how you're going to exit 7-10 years down the road, but it's very important to have frank conversations with the founders and at the board level so they're all aligned. You don't want to be part of a journey where somebody thinks you're going to IPO in 15 years and somebody else thinks we should do a trade sale in 3-5 years. Jungle has done very well becoming an enabler of that conversation, and as a result, we've had literally one exit every year since inception.

Q: Have there been any exits to incoming growth investors?

A: All of our exits have been trade sales. We haven't done secondaries, but I think it will happen. There's always been a very high level of interest in secondaries, especially for companies that are planning to IPO, where we've seen a lot of growth investors wanting to pick up more equity.

Q: What's your outlook for IPO exits given the volatility in public markets lately?

A: With every big wave that comes, everyone is affected whether you're a big or a small boat. But if you look at the latest quarterly reports – and we're seeing signs already in India – you can start to see the difference between a company that is built to last versus a company that is just riding the wave. You'll see in the next few months that solid tech companies' numbers will look up again compared to the others. I'm very confident we still have a vibrant IPO channel. The guys who had decided to go public and paused will go back to the market because IPOs are still one of the best opportunities for people to get access to capital at large scale in these markets.

Q: How do macro pressures around inflation, geopolitics, and rising interest rates influence your outlook?

A: The journeys of early-stage companies are 10 to 20-year journeys. At the point we're investing these global movements have very little impact on companies. They have to get to 2%, 5%, or 10% of the overall market for these kinds of movements to have an impact. At Jungle, we bring together our LPs and founders quite often to talk about these topics. We're putting experts in front of them and enabling conversations. But for our companies, these ups and downs don't mean much in real-time. Maybe they need to be factored in longer term.

Q: But a weaker economy could hurt start-ups that depend on consumer spending power…

A: Yes, but the good news is if you look at the latest reports by any consumer benchmark in the region, there's no slowing down. The demand side is just relentless in terms of its growth and the appetite for the new things that they can do online or moving some of the offline companies online. It's also important to realise we are looking at a very different time for humanity compared to the last financial crisis. COVID has shown us, in emerging markets in particular, the demand is so strong. I think we are maybe better insulated from some of the shocks we're seeing than developed markets.

Q: What are you seeing in terms of market opportunity more broadly?

A: A lot of the talent at the companies that went public or raised significant amounts of growth capital in 2021 is leaving and launching new businesses because this is the best time to start. So, I think it is more vibrant in terms of quality of start-up talent, the kinds of ideas they're going after, and the insights they're bringing to the table. It seems like the headiness of 2021 are finally settling down, where fly-by-night operators are no longer competing in the market on the same deals and throwing money at crazy valuations. It's a much better opportunity for firms like us to invest.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.