Indonesia private equity: Green shoots?

While Indonesia’s VC industry is taking off, private equity firms have found the last few years challenging due to economic headwinds. GPs are now feeling most positive, thanks in part to government policy

Twelve months ago, Eri Reksoprodjo was preparing to close an oil and gas deal. The seller had made the assets available at a reasonable price and Reksoprodjo and his partner were applying the final touches to the financing package. Having departed Saratoga Capital a few months earlier, this investment was the first step in a new direction.

Then oil prices slipped below $50 per barrel and the financial rationale of the transaction was called into question. If the slide continued, they would have difficulty servicing the banking facilities. Reksoprodjo and his partner agreed to hold off and see how the market developed. With oil still trading at less than $40, it is as well they did.

Reksoprodjo, meanwhile, has ended up in a place he never expected: venture capital. Earlier this year he joined Kejora Group as a partner and is working on the Indonesian firm's first institutional fundraise. "They wanted someone who knew how a fund works, had been exposed to fundraising and portfolio monitoring, and who understood the working relationship with the LPs," Reksoprodjo says.

Kejora closed its debut fund in 2013 with $12 million in committed capital; it is now looking to raise as much as $100 million. The firm is a poster child for the rise of venture capital in Indonesia, with investors of all stripes looking to leverage increasing smart phone penetration. Private equity, by contrast, has lost some of its allure in recent years, as the commodities-dependent country continues to struggle with falling prices and slowing growth.

"The appetite for emerging markets is low, in with the trend of commodity prices going south. They have stabilized a bit - and from an Indonesia perspective the currency and capital markets have also strengthened a bit - but it is nowhere near the good old days when coal was trading at $100 a ton," says Kay Mock, founding partner at Saratoga. "I don't think we will see those days again. Indonesia needs to restructure its economy to move away from natural resources towards services and manufacturing."

Transition time

It is a transition that will take time, and from a PE perspective, Indonesia has suffered due to investors nurturing expectations that were unrealistic. In the space of about 18 months from mid-2011, Northstar Group closed its third fund at $820 million and Saratoga raised $600 million for Fund III, both substantially oversubscribed. Meanwhile, more than half a dozen fledgling GPs launched first-time funds and global and regional players were scouring the country for deals.

"Then the commodities boom ended, tapering was announced in 2013, and all of a sudden global emerging markets became unpopular. Indonesia went from being the darling of private equity to its poor stepchild, and that lingering sentiment continues today," one local GP observes. "It takes much longer to change perceptions to the upside in emerging markets."

Towards the end of last year, Northstar closed its fourth fund on $810 million, completing a near 18-month process complicated by LPs' concerns about a volatile rupiah and a stuttering economy. Saratoga is still in business, as are a couple of other GPs that predate the 2011 revival. However, all but two of those fledging firms - Capsquare Asia Partners and Falcon House Partners - never got started.

As for the large pan-regional firms, there have been a handful of stand-out investments, but transactions of $75 million and above have proved relatively difficult to source. While local GPs stress the importance of having people on the ground to source and execute deals, there has to be sufficient deal flow to justify the cost of keeping them there.

"The volume of investments and exits is probably on the lower side of what people would have expected from such a large consumer market. That is where the disappointment lies," says Brian Lim, a partner at Pantheon. "On top of that, returns have been impacted by the currency getting completely slammed. You've lost about 35-45% of your value just in currency in the last 3-5 years. That is a big hurdle to surmount."

The challenge for country-focused funds is convincing LPs that they are a valuable part of a private equity portfolio in spite of the macroeconomic headwinds. Where once Indonesia was seen as a potential strategic counterpoint to China and India, now it is regarded with more wariness. As such, the local GP ecosystem remains shallow and relatively few industry participants have experience dealing with institutional capital.

Furthermore, the newer managers have yet to prove their thesis, with Capsquare and Falcon House only in the early stages of raising their second funds. "It's a thin market and not enough managers are able to show decent track records," adds Wen Tan, a partner at Aberdeen Asset Management. "Those with decent track records have in certain cases scaled up their fund size, and it can be difficult to work with too large a country-focused fund."

The lumpiness of Indonesia private equity deal flow means it is difficult to read too much into headline investment numbers. Last year was the country's biggest since since 2008 with nearly $2.2 billion deployed - more than four times the 2014 total, although from roughly the same number of deals.

Two investments are responsible for about 80% of the total. First, a consortium led by resources investor EMR Capital agreed to buy the Martabe Mine in North Sumatra from Hong Kong-listed G-Resources for $775 million. This was followed by Northstar Group - in conjunction with TPG Capital and Gateway Management - providing $1 billion in structured financing to local conglomerate Salim Group. The financing is secured against several assets, including convenience store operator Indomaret.

A similar transaction took place earlier this year as GIC Private agreed to invest IDR5.2 trillion ($387.4 million) in Trans Retail, a hypermarket operator controlled by CT Corp. Both deals have been linked to less aggressive lending policies from the country's banks and weak public markets, which have restricted companies' capital-raising options and therefore made private equity a more palatable option.

While on a general level this tallies with the views of several industry participants - loan growth dropped sharply in 2015 from the previous year and Saratoga's Mock observes that PE is "relatively more attractive or more available than other sources of capital" - those involved in the Salim deal are reluctant to link the two situations. According to Patrick Walujo, founding managing partner at Northstar, Salim has not shortage of funding options and the investment, which is primarily driven by growth expectations for the Indomaret business, took several years to construct.

Rather, he views policy as a more compelling trend for private equity. "It has been tough for Indonesian corporates, but these conditions also deliver opportunities," Walujo says. "When commodity prices are high then policies tend to be less business friendly and more protective, but when commodity prices are low the government is more open and business friendly. Right now we see the government pushing for more liberalization."

Expectations game

Much like private equity, President Joko "Jokowi" Widodo has been burdened by the weight of unrealistic expectation. His election was accompanied by a wave of optimism that Indonesia would see much-needed reforms, but unwinding old policies and implementing new ones is a time-consuming and highly political process. While the removal of energy subsidies that accounted for up to 20% of the state budget is credited with freeing up capital that can be put to more productive use, in other areas progress has been muted.

In June of last year, Jokowi inaugurated the Cikampek-Palimanan toll road, which was in part financed by Saratoga and Singapore's OCBC. At 116.75 kilometers, it is the longest toll road ever built in Indonesia and construction was completed in 13 months, shorter than the projected timeframe of 18 months. However, it took the consortium of investors seven years to acquire the land, and the president acknowledged this kind of delay was unacceptable.

"The country needs infrastructure; the president understands this and is pushing hard. Unfortunately there are many different constituencies to satisfy," says Saratoga's Mock. "His party doesn't control parliament and his proposal to expand the budget for state-owned enterprises, so they can become the driver of infrastructure development, has not been approved by parliament as yet. There is likely to be another cabinet reshuffle before that can be passed."

The Jokowi administration has introduced no fewer than 11 stimulus plans in the last six months - a 12th is expected next week - in an attempt to revitalize an economy that grew 4.74% in 2015, missing the 5.7% target set in the state budget. Initiatives range from administrative measures such as speeding up licensing procedures to tax cuts for small business to the removal of foreign ownership caps in 35 industries.

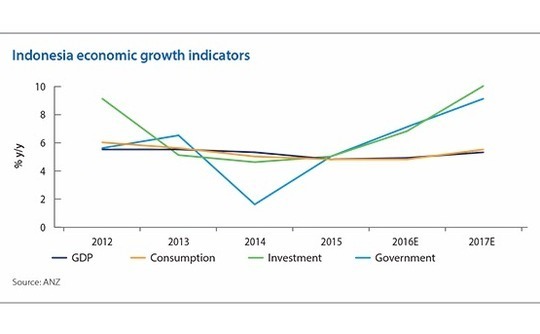

There have also been a string of interest rate cuts and measures intended to lower banks' cost of funding and encourage lending. The ultimate goal is to deliver an improvement in private investment. Few economists expect an immediate turnaround. ANZ, for example, is slightly below consensus in projecting GDP growth of 4.8% in 2016 and 5.5% in 2017, still well below the 2008-2012 average of 5.9%. An investment turnaround is expected late in the year but it will be government-driven.

In a recent research note, Glenn Maguire, ANZ's chief economist for South Asia, ASEAN and the Pacific, describes the stimulus measures as micro rather than macro-focused and therefore lacking the "big bang" effect the country needs. He claims the measures have failed to address the lack of private and public investment that is the root cause of Indonesia's economic troubles, and concludes that a revival in public investment may even crowd out private sector activity.

This view is not shared by all. Benedict Bingham, senior resident representative for Indonesia at the International Monetary Fund (IMF), agrees that the much-needed pick-up in private investor confidence has yet to come to fruition, but he is more bullish about the long-term strategic impact of the stimulus packages.

"They are having a positive impact by pushing the strategy away from a defensive orientation, focused on protecting the domestic market, toward a more outward orientation focused on being internationally competitive," says Bingham. "The packages are helping shift the policy orientation via policies that target investment, trade, skilled labor, deregulation and infrastructure."

Much appears to rest on whether Jokowi can turn words into concrete action, and how quickly investors expect this to happen. Several PE investors say they are convinced by the government's will to bring about change, and based on current progress, they expect to see an improvement. Indeed, Northstar's Walujo believes the most important aspect is that the government is thinking in the right way. He adds that Jokowi is the first president he can recall talking about Indonesia competing on a global stage.

Consumers count

For all the uncertainty surrounding Indonesia's economy, the most successful private equity investments in the country have hinged on consumer demand. Private consumption accounts for about 55% of GDP, and while purchasing power has been eroded by rising commodity prices and currency volatility, disposable incomes continue to rise.

According to Brian O'Connor, founding partner at Falcon House, Indonesia is in a transformational phase previously experienced by other countries as per capita GDP moves from $3,000 to $4,000. This is where consumers shift from wet markets to modern markets, from vegetable proteins to animal proteins, and from public to private healthcare. The likes of Falcon House and Capsquare exist in this space, identifying consumer-oriented companies that can achieve scale.

The fundamentals - a youthful population, a growing middle class, and a need for consolidation in developing services industries - are largely unchanged from five years ago. It is possible that investors must pay more of a premium to access them, which is why some groups are going earlier, taking on more risk but potentially greater upside by working with less mature companies.

One aspect that has changed is technology. It is not only creating a wealth of venture capital opportunities, but also forcing private equity firms to reconsider their approach to investments.

Northstar is a case in point. In 2008, the firm acquired Bank Tabungan Pensiunan Nasional (BTPN) with TPG and proceeded to refocus the bank on lending to small businesses. The PE firms exited most of their stake last year. If that investment was made today, it would look very different, given the impact of smart phone proliferation and mobile payment systems on access to financial services. Northstar now has a VC arm, NSI Ventures, which offers insights into these trends.

"The opportunity is quite obvious with rising internet penetration and technology adoption, but we have to find the right balance in terms of risk," Walujo says. "Through NSI Ventures we get to see how these companies are doing, and at the appropriate time our main fund may make an investment."

When NSI provided Series A funding for Go-Jek in 2014 the motorcycle tax firm was preparing to re-launch its call center-based service as a mobile app. Had this happened any earlier, the market wouldn't have been ready. Go-Jek has since established itself as part of urban life in Indonesia, adding food delivery and online-to-offline local services to its core service of transporting people and packages.

With Go-Jek's army of riders numbering more than 100,000 - suggesting the business has staying power - the Northstar private equity fund joined the Series B and C rounds.

SIDEBAR: The fiscal black hole

Indonesia has ambitious plans for infrastructure development, with around $480 billion - or about 50% of GDP - earmarked for investment in the space between 2015 and 2019. The capital is expected to come from public and private sources, but private sector investment remains weak and there are question marks over the state of public finances.

"This government has important aspirations to reverse the underinvestment in economic and social infrastructure, so expenditure will have to rise over the next 4-5 years," says Benedict Bingham, senior resident representative for Indonesia at the International Monetary Fund (IMF). "But they need a medium-term revenue strategy to fund that rise in expenditure, especially as the revenue trajectory is currently heading in the wrong direction."

The fiscal deficit is arguably the most significant challenge the government faces as it provides the foundations required to strengthen the services and manufacturing contribution to a resources-dependent economy. Revenue was down 11% year-on-year in February while spending rose 21%. In order to comply with a constitutional requirement that the deficit must not exceed 3% of GDP, action needs to be taken.

"There is a funding gap and that is why Indonesia continues to need foreign investor involvement in local currency bonds. The sustainability of it really depends on the mood of global investors, and things don't always hold for Indonesia," says Trinh Nguyen, senior economist for emerging Asia at Natixis.

The country relies on taxes for 80% of government revenue and most of that comes from VAT and import duties. Nguyen's concern is that insufficient attention is being paid to how this base can be expanded. The policy focus is on driving GDP growth, but this could come at the expense of maintaining financial and fiscal stability.

Eliminating fuel subsidies has taken a huge bite out of the budget, essentially freeing up capital to be used for other purposes such as infrastructure. The government is also placing a lot of faith in the Tax Amnesty Bill, likely to be passed later this year, which allows Indonesians can to bring undeclared earnings onshore and pay a reduced tax rate. Natixis doesn't expect this one-time boost - the effective tax rate in subsequent years will be lower - to make significant inroads into the fiscal gap.

There are other measures under consideration. Excise taxes could be raised on goods such as tobacco and luxury vehicles; steps can be taken to modernize tax administration as part of efforts to improve public investment management and strengthen governance in state-owned enterprises and at the local government level; and structural reforms to the business environment would also help.

Bingham believes it is possible to increase revenue by 2.5 percentage points by 2020, noting that between 2002 and 2007 Indonesia engineered a two percentage point increase without taking substantive action on tax. Nevertheless, he questions what comes after the investment in hard and soft infrastructure and the achievement of medium-term economic stability.

"The first 10 years of this strategy involves moving unskilled workers from low productivity jobs in the informal sector to higher paying, higher productivity jobs in the formal sector," he says. "You can get a lot of mileage out of that but to sustain growth beyond that you need some serious investment in education. Given the long lag times, you have to start thinking now about generation 2025."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.