Indonesia public markets: Technical exits

The Jakarta Stock Exchange has never been a popular location for private equity exits due to various structural problems. The government wants to address these issues, but there is no quick fix

CVC Capital Partners' investment in Matahari Department Store is arguably the most successful private equity deal ever seen in Indonesia, based on the size of the transaction and the magnitude of the exit. It is also a classic example of a secondary offering on the Jakarta Stock Exchange.

The private equity firm acquired the bulk of Lippo Group's 98%-plus stake in Matahari six years ago at an enterprise valuation of $892 million; the remaining 1.8% was a public free float. The two investors restructured the business as an 80-20 joint venture and then sold 46% of it in 2013 through a placement to a group of institutional investors. The so-called re-IPO raised $1.3 billion at a valuation of $3.3 billion.

CVC took advantage of its liquid position to complete several more partial exits during 2014 and 2015, reducing its stake to the single digits. The private equity firm has since repeated the trick with Link Net, an Indonesian broadband and cable TV provider also controlled by Lippo. It acquired a 49% interest in the business in 2011 and then completed a technical IPO in June 2014. A few months later, a larger offering saw a 30% stake sold for in excess of $600 million.

While hardly a go-to IPO location for private equity investors, CVC's windfalls suggest that public market exits are possible for high-quality businesses in Indonesia. Not many investors are keen to follow suit, however. The difficulties that come with identifying a window to complete a series of technical trades in a volatile market are too great - although the government has promised to improve conditions.

"It can be very challenging to exit a substantial investment via the public market in Indonesia. Many listed shares are illiquid because one family or business group dominates the shareholding," says Ashish Shastry, managing partner at Northstar Group. "Even if we're invested in a listed company, we still prefer to exit by selling our shares to a strategic. To date, we have never exited through an IPO process or an institutional book building."

Small showing

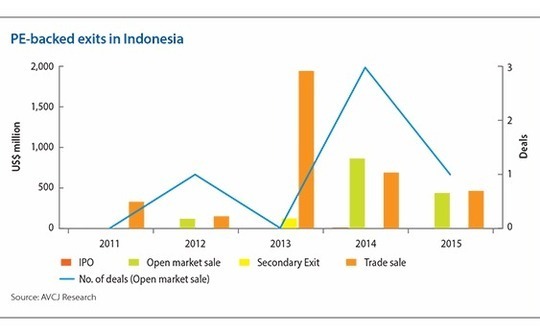

Only one PE-backed company - Intan Baruprana Finance (IBF), an investee of Singapore-based Phillip Asia Capital - has completed a full IPO in Indonesia in recent years, according to AVCJ Research. Trade sales remain the dominant exit route, but the market is still lumpy. After two transactions generated $2 billion in 2013, there were four worth a collective $691 million in 2014, and then one for $462 million last year. Open market sales attracted the most interest in 2014 and 2015, but Matahari and Link Net dominated the deal flow.

The success of Matahari is difficult to replicate because it picked the right time and it is an impressive company - the largest department store operator in a country that is seeing rising domestic consumption. When the 2013 offering took place, the Jakarta Composite Index (JCI) had just broken through 5,000 points for the first time. Matahari continues to trade at a sizeable premium to the offering price even as volatility has buffeted the Indonesian economy.

The JCI, meanwhile, hemorrhaged 1,000 points within six months of that transaction due to a combination of concerns about monetary easing in the US, sluggish exports and falling commodity prices. A year later it reclaimed these losses and in March 2015 peaked at 5,500 points. However, volatility - this time driven by a sell-off in China - kicked in once again and by August the index was hovering above 4,100 points.

Uncertainty in the market during this period resulted in numerous IPOs being suspended and CVC had to reduce the size and pricing of the Link Net offering in 2014 as investors hesitated. "The Link Net sale was not as successful as Matahari. It would not be the same result if it was sold prior to 2013," one industry participant says.

As of early April, the JCI stood at 4,800 points, having gained 12% over the past six months and nearly 6% since the beginning of 2016. Nevertheless, the market has some fundamental shortcomings that would make private equity investors think twice before launching a formal IPO or re-IPO, not least the low public trading volumes.

Of the 521 companies listed in Jakarta last year, only 9% had market capitalizations of more than $1 billion. More than half were valued below $100 million and 27% were in the $100-$500 million range. Many have less than 5% of their total equity in a public float, while the investor base is tiny. The proportion of Indonesia's population that is registered to invest in public markets is below 1%, compared to 20% in Malaysia.

Foreign investors therefore play an influential role in the market and they primarily focus on companies with market capitalizations of more than $1 billion and certain sectors such as consumer and financial services. "Deeper participation from domestic investors would reduce the volatility. For example, in 2013, a lot of jittery foreign investors pulled out and the index took a beating," says Jasmin Maranan, capital markets partner at PwC. "By educating the domestic market, you can create more stability and withstand downturns and capital outflows."

Regardless of these obstacles, a public market exit can be a logical option for private equity players as a way to deal with foreign ownership restrictions. Deals can be structured as debt with a view to converting to equity on listing because these restrictions do not apply to public companies. Similarly, some investors have purposefully targeting companies that are already listed with a view to taking the re-IPO approach.

"In terms of the IPO process, it's not always easy to launch a major offering with international book building, so you find companies trying to get a strategic listing first and then do a major secondary issuance when market conditions are optimal. It's a two-stage exit approach. The IPO itself isn't necessarily the exit for private equity - it is to comply with the listing rules and get the shares trading," says Joel Hogarth, a partner at law firm Ashurst.

However, not every sector is suitable for secondary offering, especially when public markets are challenging. Northstar and TPG Capital invested in Bank Tabungan Pensiunan Nasional (BTPN) shortly after the company went public in 2008. Rather than follow the CVC route of exiting via a large secondary placement and subsequent block trades, they opted for a strategic trade sale to Japan's Sumitomo Corp, completed over the course of 2013 and 2014.

"When the global market is doing well, the market in Indonesia can support an exit via the public market, especially if the company has a consumer growth story. But right now the market is tough and it's quite difficult to do an IPO. We cannot rely on the public markets because those windows open and close over the cycle - the most reliable way to exit a position in an Indonesian company is via a strategic sale," says Northstar's Shastry.

Hope springs

There is hope in the GP community that Indonesia's public markets can play a meaningful role in private equity exits over the next three years. The cause of this optimism is government reform, specifically the proposal earlier this year to permit 100% foreign ownership in 35 industries, including warehousing, tourism, toll roads, and e-commerce, and increased foreign participation in a host of others.

Meanwhile, on the public markets side, regulators have introduced a requirement that all existing listed companies must have a minimum float of 7.5%. Those wishing to go public must have a public float of 10-20%. The intention is to boost the market liquidity, explains PwC's Marana.

If and when these initiatives are properly executed, they are expected to contribute to a deeper and more active public market, with greater foreign and domestic participation. At this point, it might become a more viable exit route for private equity, agrees Cyril Noerhadi, senior managing director at Creador. The Southeast Asia and India-focused GP plans to list two Indonesia-based portfolio companies on the domestic market between 2017 and 2020.

"We need to prepare companies mentally, operationally and structurally to a point that, when the market window is open, they can list at any time," he says. "As markets are dynamic, it will not always be possible to predict when the market will be good for listings, but by being better prepared, we would be flexible enough to match these windows."

SIDEBAR: VC exits - New board?

VC investors are pouring money into Indonesian techn start-ups in order to capitalize on emerging trends in e-commerce and online-to-offline (O2O) services. Online marketplaces Tokopedia and Bhinneka and ride-hailing service Go-Jek have all raised significant rounds from international investors such as SoftBank, Sequoia Capital as well as up-and-coming local players like NSI Ventures and Ideosource.

Bhinneka, which sells consumer electronics, is unusual in that it has already achieved profitability. As such, it has a realistic shot at a domestic IPO in 2017; the main board is not open to unprofitable companies. However, earlier this year the government proposed launching a technology board that would enable all start-ups to access the capital markets. The board, which is still in an early stage of planning, would be an extension of the Development Board, a secondary board for commodity-related firms. Within the VC industry, views on the initiative are mixed.

Going public on regional exchanges is a rare occurrence for Indonesia start-ups. Of 14 tech IPOs in Southeast Asia between 2001 and 2015, none were from Indonesia, according to a report by Singapore-based Golden Gate Ventures. Instead, 26 Indonesian companies were exited through M&A between 2005 and 2015.

"More exit opportunities is a good thing for our Indonesian portfolio companies. The public markets have not always been the most receptive places for exits; typically, most companies that do well here expect to be acquired, not list. Having the Indonesian government step up to provide more opportunities for start-ups to list on the local bourse would certainly help," says Vinnie Lauria, managing partner at Golden Gate.

A listing could reduce a company founder's tax burden as they only have to pay 0.1-0.51% per transaction in capital gains tax when disposing of shares in the public market, compared to a 30% levy on making a trade sale exit. However, the low public market trading volume in Indonesia could be problematic, particularly as investors may not fully understand a company's technology and therefore its value. VC investors are also wary of start-ups disclosing details of their business operations to rivals because they are obliged to make financial statements available to the public.

"If a company is still growing and can get substantial venture capital funding, does it need to go public?" asks Donald Wihardja, co-founder of Convergence Ventures. "There are substantial costs associated with going public. Start-ups have to pay fees to accountants and legal advisors, and they also come under the purview of the public market regulators, which have stringent reporting standards."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.