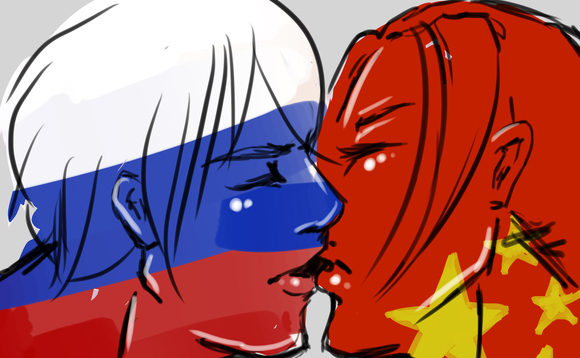

Russia builds PE ties with China

Russia and China’s sovereign wealth funds have joined forces to boost cross-border trade. For Moscow, it is a much-needed opportunity to diversify the economy and attract more foreign investment

Depending on whom you ask, Russia is either a nascent private equity market of unbounded horizons or a blighted desert with very few prospects for the foreseeable future. Either way, the creation of the a $4 billion joint fund by China Investment Corp. (CIC) and the Russian Direct Investment Fund (RDIF), has drawn attention to potential opportunities. If all goes to plan, it could see a huge amount of capital travel from China to Russia.

"While there are a number of risks around investing in Russia, the rewards can be significant if you understand the rules, follow them and forge a local network to work through the bureaucracy," says James Cook, founder of private equity firm Aurora Russia. "Russia has enormous potential and you can still achieve high returns for your investments."

Nevertheless, concerns about these risk factors - a combination of generic investor fear and skepticism about rule of law and a reputation for corruption - means PE activity is muted. The industry is worth about $4-6 billion in Russia, with fundraising reaching just $1.4 billion between 2008 and 2011. This is poor compared to the country's BRIC cohorts: China generated $28.6 billion over the same period, with India and Brazil on $15 billion and $5 billion, respectively.

Patricia Cloherty, chairperson and CEO of Delta Private Equity Partners, argues that these numbers don't illustrate the country's strong growth potential. She notes that there were 73,000 cell phones in use in 1995; a decade later it was 180 million. Similarly, in 1995, Moscow had only two shopping malls; by 2005 there were 44 mega-malls and many others of more modest size under construction.

"For a country that had no consumer choice for over 80 years, the growth prospects - and I'm only referring to the non-tech sectors - are extraordinary," she says. Delta's IRR from 1995 through to the first quarter of 2012 amounts to a whopping 207.9%, net of fees.

Mixed opportunities

A tech deal is perhaps the most spectacular illustration of the private equity's potential in Russia, however. Baring Vostok Capital Partners acquired 35.7% of internet search services provider Yandex in 2000, paying an estimated $5 million. By the time it went public last year, the company had a 60.9% share of the Russia search market and net profits in excess of $600 million. The IPO generated $1.3 billion, giving Baring an 800x return on its investment.

One stellar transaction shouldn't be allowed to distort perceptions of the whole market. The Carlyle Group's David Rubenstein is among those with little positive to say about it. "The perception is the best deals go to the oligarchs, and because these oligarchs have a fair amount of money there isn't so much need for Western private equity capital. So there haven't been that many great investment success stories," he told a conference in 2010.

Mega-deals aside, Russia's private equity industry might be approaching some kind of inflection point. In the short term, there are concerns about economic growth - the stock market is down 20% since March, while industrial output and fixed-asset investment are also in decline - and the impact a slowdown would have growth capital available to companies. Longer term worries persist regarding capital flight, the impact of the euro-zone crisis and Russia's stubborn dependence on energy and natural resource exports, which account for an estimated 17% of GDP. Clearly diversification is a priority and this is where private equity - and, ultimately, China - comes in.

RDIF was designed to facilitate investment in Russia, with each capital commitment it makes supposed to be matched by an equal contribution from a co-investor. The target is to attract $50 billion from foreign buyout firms, sovereign wealth funds and companies seeking to expand in the country. The fund will receive $10 billion from Moscow over the next five years, of which $2 billion was in place by the end of 2011. Two investments have been made so far.

According to Sergio Men, managing partner of Hong Kong-based Eurasia Capital Partners, RDIF amounts to the best guarantee that foreign investors will find in terms of matching funding and minimizing concerns over corruption. "The government needs to create some success stories if it seriously hopes to attract massive volumes of FDI down the road," he says.

Another source was more cynical, suggesting that RDIF's primary function is to generate good publicity. At time of writing, RDIF CEO Kirill Dmitriev is barnstorming in the US, hoping to do just that.

Ties to China

Half of the $4 billion corpus for the joint fund with China will come from CIC and RDIF, with Chinese institutional investors likely to contribute the remainder. Apparently 70% of the capital will be spread over projects in Russia and the CIS group of countries, with the remaining 30% earmarked for investment in Chinese businesses with some sort of Russian involvement. Targeted sectors include engineering, agriculture, forest and timber industries, transportation and logistics, with a special focus on energy efficiency and energy-saving opportunities.

This fund should be seen as one part of an expanding bilateral trade picture. According to Chinese data, trade between the two countries reached around $80 billion in 2011 and growth rates are said to be staggering. Heilongjiang province, which borders Russia, saw trade spike 154% to $19.3 billion. China's demand for electricity and oil from Russia shows no sign of dwindling.

What all this means for PE activity, however, is unclear. Resource sectors are traditionally peripheral plays for private equity players, but Aurora's Cook says that proximity makes the two countries natural partners.

"I think deals will be done in the general infrastructure or infrastructure services, plus forestry and in the hot spots of the big bilateral trade picture," adds Delta's Cloherty. "Also, this emerging partnership is also likely to be a help in terms of the balance of power - it keeps Russia from becoming too dependent on the West."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.