GPs on China's New Third Board: Public market oddity

A dozen Chinese private equity firms have been listed on the New Third Board in recent years, but the model is far removed from that seen in other markets and regulators are concerned

JD Capital's listing on the National Equities Exchange and Quotations (NEEQ), an over-the-counter (OTC) platform also known as the New Third Board, in mid-2014 drew relatively little attention. Over the next 12 months, however, the Chinese GP was regarded with growing incredulity as its valuation climbed to RMB100 billion ($15 billion), on a par with The Blackstone Group. JD has about $4.5 billion in assets under management (AUM) to Blackstone's $334 billion.

The 10-fold increase in JD's market capitalization unfolded across three share sales following the listing, worth a combined RMB15.7 billion. The proceeds became dry powder in the firm's quest to establish itself as a broad-based "mega asset manager." On top of that, last year the GP completed a backdoor listing of its PE business and now trades on the A-share market in Shanghai.

Driven on by JD's success, more than a dozen domestic GPs have since followed suit and achieved New Third Board listings. Towards the end of last year, even some PE firms that established themselves as offshore fund managers before entering the renminbi space - such as CITIC Capital, Innovation Works and Legend Capital - announced listing plans.

It remains to be seen whether their dreams will come to fruition. In late December, the China Securities Regulatory Commission (CSRC) suddenly shut down capital raising by PE firms on the New Third Board, leaving about 30 new applicants in the queue.

"The regulator is concerned about the overheated market and potential risks caused by the excessive valuations of PE firms listed on the board. It might also be concerned about suspected illegal fundraising," says Zhiran Sheng, a partner at law firm Anli Partners. "The CSRC also questioned if the funds raised by the PE firms have been channeled back to the real economy. If not, where is the money going?"

Many private equity firms value permanent capital and a number of global players have successfully tapped the capital markets for this additional funding. But the Chinese model differs markedly from the global norm, largely due to insufficient oversight of listing structures and the OTC market itself. It appears the regulators are now convinced that the system must be fixed.

The JD approach

JD Capital, formerly Jiuding Capital, was founded in 2007. It rose to prominence as a renminbi fund manager that made a lot of small bets on domestic companies, essentially relying on IPOs at valuation multiples several times those at which it invested. The initial motivation for the listing was to ease pressure from LPs that wanted to cash out, the GP repeatedly told local media.

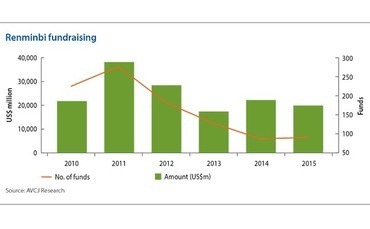

JD has raised a handful of renminbi funds over the past few years, which usually have a three-year life. This narrow timeframe became a problem as China's IPO market slowed to a standstill. Even when the 14-month embargo on new share offerings ended at the beginning of 2014, there were still more than 600 companies on the waiting list.

With JD's underlying portfolio companies unable to list due to the gridlock, the firm devised an alternative exit strategy - listing itself and swapping LP interests in the funds for shares in the public entity. Investors who were clamoring for liquidity would now have it because they could sell their shares in JD on the secondary market.

Beijing Tongchuang Jiuding Investment Management - a holding company, because a GP to a limited partnership cannot list - issued RMB3.5 billion worth of shares to 138 investors, over 100 of whom were LPs in JD funds. Four months after, it issued a further RMB2.2 billion, with selected LPs once again exchanging their positions in funds for shares in the listed entity.

JD's revenue structure also changed. Traditionally, a GP receives an annual fee of 2% of assets under management, plus 20% in carried interests based on realized investments. Following JD's share swap, the GP interest in each fund increased substantially. As such, it became less dependent on management fees, with its fortunes resting solely on the performance of the underlying portfolio companies. Ahead of the listing, JD had 185 unrealized investments across three renminbi funds.

The firm could also tap the capital markets directly for financing - a much faster fundraising process than raising private vehicles. As of October 2013, JD had RMB26.4 billion in AUM sourced from LPs in the traditional fashion; by May 2015, the total had reached RMB33.2 billion, an increase of RMB6.8 billion. However, the firm was able to raise RMB10 billion in a single move last November by selling more shares in the New Third Board entity to third-party investors.

"After securing the financing, JD used the proceeds to restructure its business, operating in banking, securities, insurance and other financial businesses," notes Shoushuang Li, a partner at Dacheng Law Firm, who advised JD and other PE firms for listings on the third board.

The firm's ambitions extend well beyond private equity. It envisages becoming a financial conglomerate in the style of Fosun Group or Warren Buffett's Berkshire Hathaway, and independent capital markets fundraising streams makes it easier to seed new ventures. JD has launched a brokerage, a mutual fund arm, online peer-to-peer lending and payments platforms, and a student loan fund. It also bought Ageas' Hong Kong life insurance business and is applying for a banking license.

In May, JD acquired domestic property developer Jiangxi Zhong Jiang Holding and the PE business was duly injected into a Shanghai-listed shell company owned by the developer. A few weeks ago, the shell was rebranded as JD Capital, while the holding company now trades on the New Third Board as JD Group.

"JD has done it all seamlessly, sometimes avoiding many regulatory loopholes. The key to the firm's success is the high valuation, which means it can raise a large amount of capital. You can either pledge shares to borrow money from banks, or raise capital directly from investors. After that, operations become more flexible and you can pursue various investment strategies instead of relying on LP commitments which usually come with restrictive requirements," says a domestic PE fund manager, whose firm is waiting for regulatory approval to list on NEEQ.

Follow the leader

The first batch of firms that followed JD onto the board, including CSC Group, Heaven-Sent Capital, Shenzhen Cowin Capital, and Tiantu Capital, have copied the strategy of swapping LP interests in funds for listed shares. They also want to become investment holding companies for a range of businesses, although none have undergone a similar restructuring to JD.

The second batch have different motivations. Kai-Fu Lee, founder of Innovation Works, said he hope the listing would allow his firm to get more funding to support start-ups with the potential to achieve billion-dollar valuations. Meanwhile, CITIC Capital's listing entity has set up a renminbi fund-of-funds that will invest in the firm's offshore funds - which cannot form part of the onshore listing - as well as selected funds raised by third-party managers.

"Many firms pursue management company or GP listings to seek additional sources of funding to expand their business operations because they have found that management fees are an unstable source of revenue. And, sometimes they have to cut management fees to attract more LPs," says John Gu, a partner at KPMG. "Through a public listing on the New Third Board, GPs could improve their financial position to invest, co-invest, or to hire more professionals and open up new business lines, while raising their profiles in the market place."

The board started in 2011 as a pilot program in Shenzhen enabling private small and medium-sized enterprises (SMEs) in the high-tech space to raise capital. It expanded into additional cities and then the CSRC united all the OTC markets and established NEEQ. Listing requirements are less stringent than for other bourses: companies must simply have a clear shareholding structure and two years of financial statements.

Last year the board saw more than 3,500 new listings - a threefold gain on 2014 - mostly by PE-backed companies. Fundraising came to RMB123 billion, up from RMB13 billion in 2014. PE firms accounted for 13 listings and over RMB37 billion, nearly 30% of the total capital raised on the board. CSC and JD between them raised RMB20 billion. The bullish environment was in stark contrast to the gloom on China's mainstream boards, and this made regulators worried.

"PE firms' fundraising activities have been fairly frequent since the start of this year. The size and investment of the raised funds is of concern and being questioned," Xinghai Fang, vice chairman of the CSRC, said in statement last month. "Therefore, we will enhance regulation on this kind of PE firm, by halting listing and fundraising activities in the national equities exchange system. We then plan to investigate their use of the proceeds."

CSC said in its prospectus that it wanted to raise RMB9 billion to broaden the scope of its business. Following the listing, the firm raised another RMB30 billion and this has reportedly been invested in A-share listed stocks rather than to support private companies. This strategy clearly runs contrary to the government's desire for the New Third Board to fill the financing gap for Chinese SMEs that often struggle to obtain loans from large commercial banks.

Structural concerns

In addition to concerns about the use of listing proceeds, questions have been as to what exactly is being listed. This comes back to the share swap strategy pioneered by JD and the use of a listed entity to monetize interests in funds that hold illiquid positions in private companies. "There is no clear regulatory framework to govern the fund or the investment company's public listing in the PRC," KPMG's Gu says of the business model some PE sponsors seeking listings.

The listing structure of global investment firms, such as Blackstone, KKR and The Carlyle Group, are comparatively clear. Publicly traded entities generate revenue primarily from fund management fees, with additional but less predictable contributions coming from distributed capital, or carried interest. Valuation assessments are largely based on AUM and the resultant management fees. The problem with certain Chinese GPs is that the share swap greatly reduces the relevance of fees, which means price-to-earning (P/E) ratios are harder to calculate.

For example, in this respect Tiantu is no different from JD. The GP issued RMB2.67 billion worth of shares to 100 investors soon after going public, and 98 of these were investors in Tiantu funds. Almost all of the LP interests in four funds have now been transferred to the listed entity.

Share swaps are fully legal, however. "Secondary market transactions on the New Third Board are all based on a market-driven mechanism - they are completed only if buyer and seller agree on a price," says Dacheng's Li. "All investors on the board are high-net-worth individuals (HNWIs) and institutions. They know what they are investing in, unlike regular retail investors in the A-share market, such as housewives and senior citizens, who might have little knowledge of stocks."

Participation on the New Third Board is restricted to institutional investors or HNWIs with assets of RMB50 million. At first, the board was tiny in terms of trading volume and quantum of financing, while transactions involved direct negotiation between individual sellers and investors. The regulator then introduced a market maker system, allowing brokerage firms to represent listed companies and market stocks.

Some listed companies try to take advantage of this system and push up their valuations. There are suspicions that offerings are being priced at ultra-high P/E ratios and friendly investors then come in and help drive the price even higher. In the case of PE firms, HNWI LPs could perform this function. Illegal fundraising is another, related concern. For example, an unqualified investor could pool capital from several associates in order to meet the RMB50 million threshold.

"In China's capital markets, every time a bubble emerges, a group of people always becomes smarter and richer. Imagine the New Third Board is a flea market selling antiques, you can quote any price for your products," says Dayi Sun, managing director at fund-of-funds Jade Invest. "Due to the loose listing requirements, investors see an opportunity to create a bubble. That's why many firms want to follow JD and list. By working with OTC-focused funds, they can make the bubble even bigger. Early movers take advantage before the bubble bursts."

Regulators have also stoked investors' expectations of the New Third Board, suggesting it could become a formal route to the main stock exchanges for companies that build scale - essentially a shortcut to the front of the long and slow-moving IPO queue. However, the door has now been shut and regulators are emphasizing that the board should be seen as a stepping stone to the A-share market.

"The regulator has suspended new listings by GPs, probably because some industry participants were too aggressive in raising capital," one manager observes. "It is hard to calculate a PE firm's valuation because a lot of the net income is unrealized. Those listed GPs just told a simple story to investors about how they could build a company worth tens of billions, but that is misleading."

Long-term view

The general view is that listings will not resume any time soon as the CSRC looks into how the proceeds of previous fundraising activity have been used. Some expect new rules to be introduced that govern how private equity firms raise capital and what they can do with it next, as part of efforts to ensure valuations do not spiral out of control.

While a disappointment to some GPs, the ban is unlikely to hurt candidates such as CITIC Capital and Legend Capital. They are well established names in the market, have other sources of capital, and importantly, they are not relying on New Third Board listings to facilitate exits for LPs in their existing funds. However, offshore LPs might be wary of portfolio GPs pursuing domestic listings, even though they have no direct exposure to the onshore business.

"US dollar fund investors will be concerned about potential breaches of confidentiality post-listing - for example, to what extent fund performance or LP names will be disclosed to the public investors or regulators. Some LPs will only get comfortable once GPs explain that the usual operations will not be affected," says Lorna Chen, a partner at Shearman & Sterling.

There are also likely to be concerns about GPs expanding into multiple categories of asset management simply because the public markets provide capital to support these endeavors. The risk is that Chinese private equity firms will spread themselves too thin, fail to develop the skill sets required to operate in different asset classes, and lose focus on their core business. As a result, returns may suffer.

"If their investment capability hasn't kept up with their fundraising ability, a lot of money will fund companies that aren't deserving. This will lead to poor performance," says Jade Invest's Sun. "There are already a lot of unrealized investments in China, so that would really shake investors' long-term confidence in the PE market."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.