Indonesia VC: Institutional upgrade?

Having won early support from as assortment of local conglomerates, Indonesian venture capital firms must now demonstrate their independence when pitching international LPs

Intudo Ventures was intended to capture three characteristics, each represented by the first two letters of its name: Indonesia, the firm's sole geographic focus; involved, signifying a willingness to support portfolio company growth; and independent, because there is no loyalty to any of the family business groups that dominate the economy.

"This was a common thread in our investor and founder interviews prior to launching the firm in 2017. If done correctly, partnering with corporate VC or a state-owned enterprise can be great, but sometimes it limits your ability to scale with other partners," said Eddy Chan, a founding partner at Intudo.

"VC firms are overwhelmingly not independent in Indonesia – and for the most part, they are loud and clear about it – so we made a point of being independent."

Intudo decreed that no individual investor may account for more than 10% of its funds and the team would be the largest investor. This has held firm even as fund size has grown from USD 20m to USD 50m to USD 144m. At the same time, the LP base has diversified. The corporates that backed Fund I were gradually joined by insurance companies, fund-of-funds, and endowments and foundations.

Interest from a broader swath of international investors has risen in tandem with the blossoming of Indonesia at the heart of Southeast Asia's digital economy, which is set to be worth USD 1trn by 2030. In the past 10 years, the number of unicorns has swelled from one to more than a dozen; VC investment has risen from negligible to USD 2.3bn in 2022; and growth-stage tech has seen boom and bust.

"The challenges the industry is experiencing right now are healthy, an educational process. And the next 10 years will be a great time to invest because the foundations have been laid, the ecosystem is more mature, and the quality of founders has improved," said John Riady, a managing partner at Venturra.

"The question for us is how we can do what we do well for the next fund: being entrepreneurial but combining that with an institutionalisation that will allow us to grow over alongside the ecosystem."

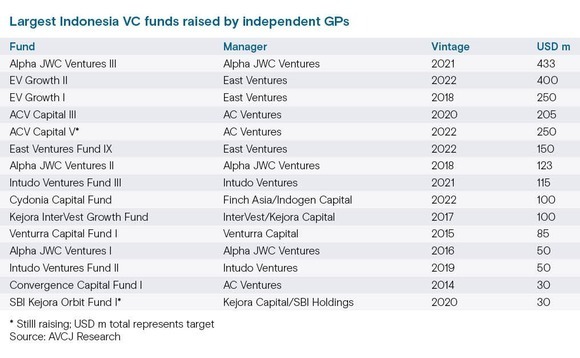

Venturra is one of a clutch of Indonesian venture capital firms established pre-2015 – alongside the likes of AC Ventures, Alpha JWC Ventures, East Ventures, and Kejora Ventures – that are on a similar journey. Institutionalisation is a catch-all term for upgrading processes and management to appeal to a different kind of LP, augmenting investor bases traditionally dominated by corporates and family offices.

It isn't a straightforward exercise. VC fundraising globally is stuck in a rut and establishing new LP relationships is challenging at the best of times. Above it all looms the independence factor. Being institutional means demonstrating an ability to work with – not for – the family conglomerates.

Sponsors of necessity

The origin story of the first wave of local VC firms is rooted in corporate and family money. "All of us raised our first funds because we knew someone who knew someone," said Donald Wihardja, CEO of MDI Ventures, which is controlled by state-owned Telkom Indonesia.

"There were no track records when we started, so convincing 200 people to invest wasn't going to happen. You stumble across someone who aspires to be a GP but doesn't have time for it and maybe just wants a title. You stand on those shoulders, make some investments, and then convince others to join."

MDI represents the second chapter in Wihardja's investing career. He previously launched Convergence Ventures with Adrian Li in 2013 and spent the next seven years there. The firm's angel backer was Anindya Bakrie, scion of local conglomerate Bakrie & Brothers, which backed a debut fund of USD 30m.

For Kejora, it was Prajogo Pangestu, founder of petrochemicals giant Barito Pacific Group, the most significant of three family-owned groups that together put in USD 7m for Fund I in 2013. Others started out as captive units. Venturra was built on the foundations of Lippo Group-owned Lippo Digital Ventures (LDV). An equivalent business under Sinar Mas Group, SMDV, formed EV Growth with East and Yahoo Japan.

Li describes these early moves as a function of necessity. When Convergence was founded, only two constituencies saw the benefits of backing Indonesia's nascent start-up ecosystem: entrepreneurs from more developed markets who had watched the story play out before; and local corporates who recognised their traditional businesses would somehow be disrupted by technology-enabled models.

"They were naturally motivated to learn more about the ecosystem. If there were some breakout investments, they could partner with those businesses or even acquire them," said Li, now a managing partner at AC, formed through the merger of Convergence and Agaeti Ventures in 2020.

"Some wanted to invest on their own, others were open to having multiple family offices. It was more corporate than family office – more about strategic interest than financial returns. The lines are blurred because a lot of corporates are family-owned, but we saw it as capital coming from a corporate pocket."

A cheque from Temasek was conditional on the recipient securing a local fund management license. In 2018, the Monetary Authority of Singapore introduced a lighter-touch regime aimed at VC managers, creating an underlying infrastructure that was accessible yet robust from a regulatory perspective.

"Early-stage private investment firms could relatively easily set up a properly-structured Singapore-based fund manager – this partly explains why more international capital started coming in," said Chris Flosi, general counsel and head of compliance at Southeast Asia-focused private equity firm Northstar Group and chair of the advocacy committee the Singapore Venture & Private Capital Association (SVCA).

"You never see US or European institutional investors investing directly into a PT [Perseroan Terbatas] company in Indonesia that is a pooling vehicle for fund management. If you move the pooling vehicle offshore and set up a fund manager in a regulatory environment that offers some comfort to investors, international capital is more accessible."

Independent's day?

Several LPs entered Southeast Asia venture capital through Singapore, citing those institutional credentials. Adams Street Partners was not one of them. The fund-of-funds decided to target Indonesia directly – China and India had already validated a preference for large homogenous markets – but a first commitment came as recently as 2018 after six years of searching.

Ensuring that managers are not beholden to family business groups was a key consideration, although Sunil Mishra, a partner at Adams Street observed that having ties to corporates is neither unique to Indonesia nor a dealbreaker.

"Indonesia's ecosystem is still relatively small, young and still developing, so we are seeing a higher percentage of opportunities in this category. We want to remain open-minded to all opportunities, but we must do our diligence and get comfortable with their investment style and positioning," he said. "If there is a high concentration in terms of sources of capital or deals, you naturally wonder whether they could do it as well outside of that ecosystem."

Adams Street ended up backing East's sixth early-stage fund, which closed on USD 75m in 2019. It subsequently went into the firm's second growth vehicle of USD 400m. By this point, the co-GP structure of EV Growth had been dissolved, with East assuming full control and absorbing much of the staff.

Wihardja of MDI contends that few investment teams want to remain captive, largely because of bureaucracy and less favourable economics. He compares SMDV's journey from investment arm to co-GP to independent manager to that of MDI: underpinned by an agreement with the parent that scale is best achieved through external fundraising rather than tapping the parent for more capital.

"When doing that, we have to use market standard GP-LP structures, but they recognise the return that agility provides, and that's how we break free," Wihardja said. "Even if you are the crown prince of a family, you don't want to be seen as getting something just because of your parents – you want to build your own enterprise. If that's VC, you want to be like the guys in Silicon Valley and fundraise externally."

MDI has not completed the journey. It is still under Telkom and the parent accounts for the bulk of the firm's USD 800m in assets under management. However, Telkom's share of the GP-LP funds is no more than 40%. MDI is increasingly raising capital from other corporates – the mandate is corporate-specific – though there is a desire to target development finance institutions (DFIs) and sovereign wealth as well.

For Riady, whose family controls Lippo Group, the first step came in 2013 when Venturra replaced LDV. A debut fund closed on USD 85m in 2015, with Lippo Group serving as anchor investor. Most of the other LPs were family offices and high net worth individuals.

Another step came more recently as part of the preparations for Fund II. Venturra has teamed up with Netherlands-based Dasym, which completed the transition from family office to independent institutional manager two decades ago. The goal is to institutionalise operations still further; not only fundraising and a diversification of the LP base, but also internal processes and management.

"[When we started] I was deliberate in not wanting to call the fund something that related to Lippo. I wanted more independence. That was the right approach and our partnership with Dasym takes it further in the same direction," Riady said. "At Venturra, we can benefit from whatever Lippo has to offer but go beyond that and focus on being a VC firm for the future."

Persons of interest

Inevitably, due diligence work on Venturra will address Riady personally. He remains a figure of influence within Lippo Group, serving as CEO of Indonesia operations, and so LPs will look for evidence of an unhealthy relationship between corporate and fund manager. Classic potential red flags include repeated co-investments with the corporate or exits driven by the constellation of the corporate.

"I would want to understand to what extent the benevolent backer at the start took an interest in the GP, whether the partners in some way feel they owe something to the guys that helped them get into business and whether that impacts their investment decisions and management in the long term," said Eric Marchand, co-founder of Southeast Asia-focused fund-of-funds Collyer Capital.

These issues are top-of-mind for DFIs that must balance their role as enablers in emerging markets – often participating in funds as the first institutional cheque – with stringent governance requirements. The International Finance Corporation (IFC), which made its Indonesia VC debut in 2017, relies on its country office when assessing the network of personalities behind different firms.

"Indonesia's family offices and HNWIs [high net worth individuals] are a big part of the economy, we need to work with them but also be conscious of them. We scrutinise LPs that come into a fund before us and after us, and there are some we won't work with," said Huai Fong Chew, regional lead for private equity funds in East Asia and the Pacific at IFC.

These priorities crystallise into a combination of situation-specific gut feelings, such as when a family's share of the overall fund corpus is too large for comfort, and hardline demands. IFC, for example, insists on representation on LP advisory committees (LPACs) as a means of overseeing governance.

Adams Street has a similar requirement. This is on a list of stipulations highlighted by Mishra, including visibility not only into the composition of the investment committee and how decisions are made, but also into who signs off on issues such as recruitment and economics at the GP level.

"We need to be convinced that what we are hearing is what we're going to get. Many family office setups have evolved into independent firms globally – there is a path. We want to be there, giving the right advice, sharing lessons learnt and offering reference points on best practices," he said.

Asked how he would explain the relationship between Venturra and Lippo Group, Charles Coker, a managing director at Dasym, emphasised transparency: demonstrating that, while one of the principals is a family member, the manager is independent and the family itself is just an LP.

Feedback on how effectively Indonesian VC firms have achieved this is mixed. AC's Li also highlights checks and balances when fielding questions about Pandu Sjahrir, another of the firm's founders whose energy sector background has prompted some LPs to consider him a politically exposed person. Li added that no investor has backed out after completing due diligence.

One LP recalls getting comfortable with East because questions raised about the roles of Sinar Mas and Yahoo Japan – no longer co-GPs but still significant investors – were fully answered. Concerns over potential conflicts of interest driven by the incentivisation of individuals abated.

Other managers, however, came up short. "We never got enough information, so we couldn't form a clear picture as to who they are and how everything works," the LP said. "There were so many structures, sidecars here and there. I don't know how any institutional investor would accept it."

Performance matters

To the extent investor bases have institutionalised, DFIs and financial institutions are leading the way, followed by sovereign wealth funds, according to multiple industry sources. Few members of the fund-of-fund or endowment and foundation constituencies have made commitments to Indonesian VCs. That said, managers continue to evolve in tandem with the ecosystem in which they operate.

The reorganisations of LDV and SMDV were partly driven by the need to institutionalise. AC's Li noted that Convergence and Agaeti realised they could achieve greater scale together than working alone. "It has paid off in many ways. We can source and win deals more effectively, we can help a larger number of portfolio companies, and we have been able to attract more institutional LPs," he added.

Several firms have recruited external talent. Helen Wong, who previously worked for GGV Capital and Qiming Venture Partners in China, is now a managing partner at AC. In addition to representatives from Dasym, Venturra hired Todd Meister of US-based deep-tech investor First Spark Ventures as a partner.

Kejora, meanwhile, lost one of its founders. Eri Reksoprodjo, a managing partner at the firm, declined to comment on the departure of Sebastian Togelang – which triggered a key person event – beyond saying that Kejora continues to raise capital. He also observed that early support from a family business group doesn't necessarily lead to re-ups in each subsequent vintage.

"Their priorities change over time. In 2016, everyone was looking at technology, including Indonesian family offices. Now, with what's going on in the global market, that interest has slowed. For example, Barito Pacific isn't in our latest fund [which closed on USD 34m last year," Reksoprodjo said.

This underscores that institutionalisation is just one benchmark. Commitments to Indonesian venture capital firms will ultimately be based largely on performance.

The three local IPOs – Bukalapak, GoTo, and Blibli – and a handful of trade sales are natural focal points, but most exits have come via later-stage funding rounds. These dried up with the withdrawal of growth-stage investors. Portfolios are still amplified by valuation markups rather than distributions, and with each passing year, it becomes harder to cite the industry's relative youth by way of explanation.

Managers talk of a maturity exit market and more paths to liquidity, but LPs will not remain patient indefinitely. Marchand of Collyer observed that unrealised AUM in Southeast Asia venture capital portfolios is close to China levels. He is not optimistic about the prospects for more large-cap IPOs.

"When we were evaluating, the hype was there, the valuations were high, and the funds were smaller. Then funds became larger, managers had more capital to deploy, and if they invested a lot in the first year, NAV will have suffered," added Chew of IFC.

"We need another two years to assess performance. The first wave of VC funds in China did very well. It could be the same in Indonesia, but there weren't many exits during COVID."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.