Portfolio: AIG

Advance Intelligence Group has developed a relatively narrow enterprise fintech business into one of the region’s leading digital lending operations with the help of several VC investors

Singapore-headquartered and Indonesia-focused Advance Intelligence Group (AIG) was founded as a credit scoring and fraud prevention platform Advance.AI in 2016. Seven years and at least 12 VC firms later, it has diversified across lending, buy now-pay later (BNPL), and e-commerce merchant services. The company is generally considered ripe for IPO, although no plans have been confirmed.

Jefferson Chen, AIG's co-founder, group chairman, and CEO, regards Northstar Group as the cornerstone investor. Partners of Northstar invested in a personal capacity as early as 2017. When the company achieved sufficient scale to be backed by Northstar's flagship fund, the private equity firm backed a USD 80m Series C round in 2019.

This is similar to the approach Northstar took with regional super app GoTo, which it backed as a fledgling ride-hailing service, Gojek, in 2014 via its then VC unit NSI Ventures. Northstar declined to comment as to why NSI – which became independent in 2018 as Openspace Ventures – did not join the 2017 investment in Advance.AI.

"When I was first working on the business, I thought if there was one regional-focused fund that I wanted support from, it was Northstar," Chen said.

"It's become an almost unspoken rule among Chinese and international entrepreneurs in Indonesia that having Northstar's support and endorsement is a great signal to the market and network for business. Their track record and reputation among the entrepreneurial community is very evident here."

Chen sees much of this value in a private equity-style – as opposed to venture capital – positioning. Northstar typically takes significant stakes in companies, which gives it greater influence in facilitating portfolio synergies than many pure VC players.

The most essential support to date has included introductions to potential clients and strategic guidance in terms of building out the business model. A key moment came in 2017, when Patrick Walujo, a co-founder and managing partner at Northstar, helped organise a China research trip to meet-and-greet financial services professionals at the cutting edge of fintech expansion areas of interest.

At this time, Advance.AI had already established a micro-lending subsidiary in China – ND Finance – but the country was viewed more as a fintech indicator for Southeast Asia than a growth market in and of itself.

"To do lending, you don't only need the technological tools, you need to convince the bank to fund the lending. It was an eye-opening trip for the Indonesians to see how these things get done in China," Walujo said.

Early movers

There are a lot of other fingers in the AIG pie, however. Some of the earliest investors include Alpha Startups, ZhenFund, Provident Capital Partners, and Vision Plus Capital Partners, as well as Farallon Capital Asia and GSR Ventures. The latter two were previous employers of Chen. He facilitated introductions but noted their investment decisions were independent.

This group provided a USD 50m round in 2018. A year later, GSR, Vision Plus, Pavilion Capital International, eGarven Ventures, Unicorn Ventures, and Gaorong Capital took part in a USD 80m round. In 2021, SoftBank Vision Fund 2 and Warburg Pincus led a USD 400m Series D at a valuation of USD 2bn. It also featured Northstar, Vision Plus, Gaorong, GSR, Tencent Holdings, and EDBI.

This phase was largely about diversification of the business model, from an initial focus on know-your-customer functions around credit and risk management (Advance.AI) to consumer lending and BNPL (Atome), and e-commerce enablement (Ginee). But Yiran Liu, a partner at Vision Plus and a long-time acquaintance of Chen, remembers that the seeds of the expansion were planted early.

"I basically told [Chen], ‘This is what I think. I like your team, and if you do this business, we can invest.' It took him a while to think it over, and when he came back, he was determined that this was the right way to go. When the idea is there, it's only the expansion capital he needs, and we were able to get into the investment discussion really fast," Liu said.

"Years later, he told me he always had the thought that he should go into B2C, but he was hesitating, and he needed a push. Whether it was the advice or the capital support, when we were there, he was in a much better space to do that."

When Chen flew in from Singapore to oversee his China team in the early days of the business, he used to stay at a hotel close to Liu's home in Beijing, which resulted in several strategic conversations. As travel slowed and videoconferencing took off, Liu observed that the rapport actually strengthened. During the pandemic, they spoke at least every quarter.

Vision Plus' post-investment unit provided some systematic support in the form of facilitating some mid to senior-level hires. The VC firm, which was established by Alibaba Group co-founder Eddie Wu, also introduced AIG to Lazada, an Alibaba-owned Southeast Asia e-commerce platform, in 2020.

Still, as with Northstar, it was arguably the informal nudging and brainstorming that ultimately proved most pivotal. In terms of regional expansion, for example, Liu saw value in early conversations about how certain business lines and expansion methodologies would be more replicable in new markets than others.

"When he started doing the BNPL business, he really started seeing network effects. There are more network synergies both on the merchant side and the consumer side," he said, describing Chen as one of the entrepreneurs with whom he's worked the most closely in recent years. "I think discussions like this helped him tweak the business model."

Market mapping

Other early-stage investors were instrumental in terms of zero-to-one essentials like identifying product-market fit and building a core team. Silicon Valley-headquartered GSR, for example, was important in establishing global coverage, while Farallon helped source the talent necessary for the initial China entry. Indeed, AIG acquired ND Finance from Farallon.

Meanwhile, Gaorong helped explore forays into social e-commerce, business cards, and e-commerce software-as-a-service, while jointly evaluating potential expansion markets, outlining growth targets, acquiring licences, and setting the pace of financing.

In 2020, Gaorong prefaced the move into BNPL by conducting an in-depth study on the segment, which demonstrated the feasibility of positive unit economics thanks to a low marketing expense-to-revenue ratio. A deeper dive revealed that the low ratio is due to the fact that the majority of gross merchandise value (GMV) is contributed by user repurchases and redirected to partner merchants.

"The BNPL model mainly connects with online rather than offline merchants and provides a better consumer experience, hence the high repurchase rate," Sam Hu, a managing director at Gaorong, explained.

"It was through this study that AIG focused more closely on user repurchase rates in actual BNPL operations. Furthermore, they increased the proportion of online merchants which promoted the healthy growth of BNPL."

Gaorong has also supported interview evaluations in recruitment and ongoing skills enhancement. Through RongHui, an innovation community led by the GP, it has hosted seminars on themes such as global growth trends and branding that have convened senior executives at AIG – including co-founders and the chief marketing officer – with their counterparts at companies such as ByteDance and LinkedIn.

Xinhua Liu, a venture partner at Gaorong, has held executive roles at ByteDance, app maker Cheetah Mobile, and short video platform Kuaishou. He has facilitated various Chinese collaborations in artificial intelligence (AI) and metaverse, including with the likes of Parametrix. AI, XVserse, and Wiz.AI.

"The development of the Chinese counterpart is a mirror that can be empirically helpful to AIG," Matthew Ma, a managing director at Gaorong, added.

"Additionally, Gaorong conducts regular research on the latest business models in Europe and America as well as changes in the upstream and downstream of Southeast Asian industries. Among these activities are case studies of successful enterprises to distil the winning pattern."

Achieving scale

AIG's roots as a fraud detection and credit scoring company have helped the broader group manage risk as it has diversified. According to Chen, this has translated into scaling speed. He described annual revenue as currently in the hundreds of millions of US dollars but declined to offer more detail on the growth rate.

As of 2019, the lending and BNPL business, has become the main revenue driver, followed by Advance.AI, and by some distance, Ginee.

Atome, which is often described as Asia's largest BNPL player, partners with more than 5,000 online and offline retailers across nine markets, with key partners including Zalora, Sephora, Agoda, Shein, and Zara. Meanwhile, Kredit Pintar, the Indonesia digital lending app, has received more than 20m downloads and disbursed more than USD 1.5bm in loans.

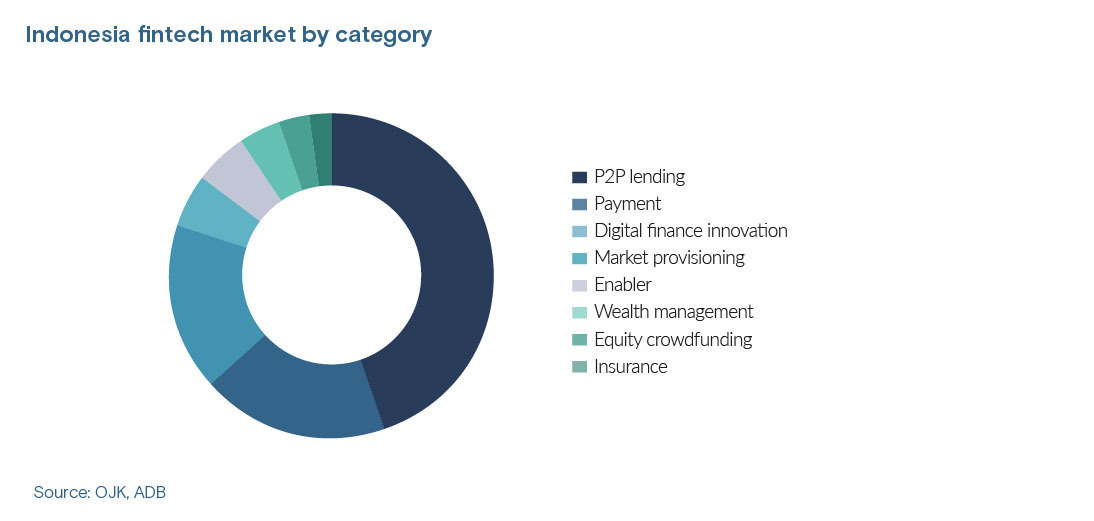

This jives with research by Indonesian financial services regulator OJK in partnership with Asian Development Bank that found 43% of Indonesia's fintech market – at least in terms of number of start-ups – was in the lending space. The closest follower is payments on 18%.

Traditional banks, needing to put capital to work, have been supportive of a model that effectively sees AIG acting as a middleman matching lenders and borrowers, although it is assuming the risk. Culturally, the key achievement in this area was in redirecting a skills base in risk assessment toward the practicalities of lending, portfolio management, collection, and recovery.

AIG's internal research further illustrates the competition factor in the segment, finding that 112 digital lending companies were established in Indonesia between 2014 and 2020. This perhaps underpins a sense that the original B2B lines are set to rebound: "Don't be surprised if the enterprise business, in terms of relative contribution to overall revenue, starts climbing again," Chen said.

Advance.AI processes more than 3m daily application programming interface (API) queries, and its identity verification technology and facial recognition is said to have a higher than 99% accuracy rate. Ginee has processed more than 130m orders for small to medium-sized businesses and has an annualised GMV of approximately USD 2bn.

As of the Series D, AIG employed around 1,500 staff and operated in 12 markets across South and Southeast Asia, Greater China, and Latin America. Its enterprise and consumer business serve more than 800 enterprise clients, 100,000 merchants and 20m consumers.

Greg Moon, a managing partner at SoftBank Investment Advisers, has touted the company's AI-first approach to building a diverse suite of financial products and services to consumers and enterprises alike. Saurabh Agarwal, a managing director of Warburg Pincus, has described the go-to-market strategy as differentiated and the product offering as "best-in-class."

Additional clients across the consumer and enterprise businesses include Standard Chartered Bank, KEB Hana Bank, Shopee, GoTo, HBL Bank, JD.ID, Bukalapak, BFI Finance, Bank Jago, and Bank BTPN. Many of these were the result of networking support from investors, but Northstar's Walujo observes that there's more to ecosystem building than handshakes.

"We can encourage, make introductions, and be a catalyst, but all these partnerships are made possible because Jefferson can execute and find win-win solutions," Walujo said. "Historically, people have asked for our support and thought that just by getting an introduction, things would happen. That's not the case. At the end of the day, you need to be able to deliver."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.