2023 preview: Southeast Asia VC

Southeast Asia VC is in fair position to hobble through a global downturn and cooling appetite for all things tech despite controversial politics in the region’s largest market and a dicey IPO outlook

Venture capital investment in Southeast Asia was relatively resilient in light of the global chill on the asset class. Most investors are talking about a plateauing phase rather than a bounce-back for the year to come.

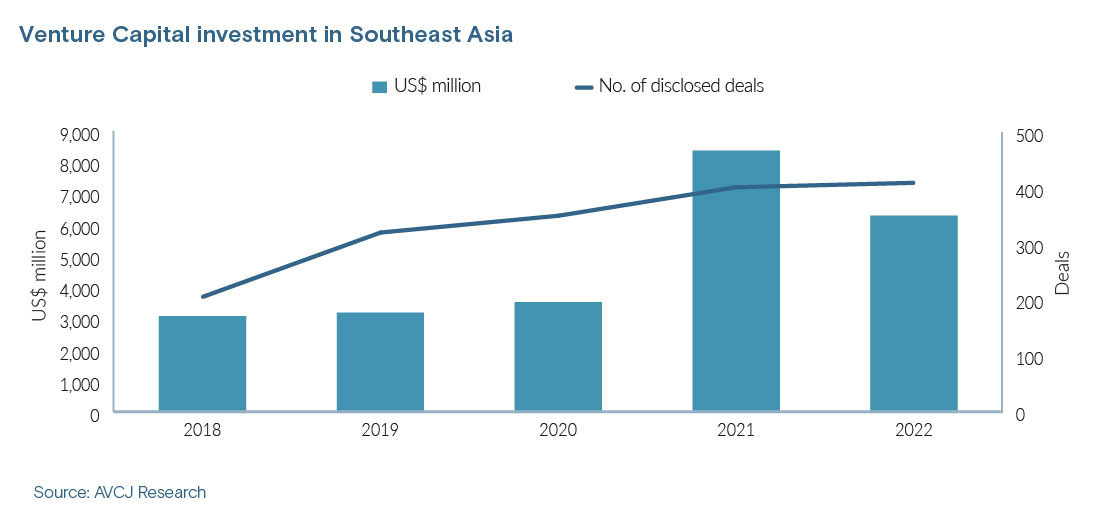

This is not a disaster. VC investment in the region averaged about USD 3.3bn a year between 2018 and 2020 before popping to USD 8.4bn in 2021, according to AVCJ Research. The year-to-date total for 2022 is a USD 6.3bn. Not a bad place to plateau, if that indeed plays out.

The coming year is expected to reflect a flight to quality in exits and up-rounds. Companies built on less-than-stellar foundations will do flat or down-rounds. They may have to restructure or delay coming to market at all. It will be a natural shakeout as capital becomes relatively scarcer.

Investment will be reserved for start-ups bracing for slower growth and demonstrating they learned survival lessons during COVID-19. More time for due diligence and improved international mobility will allow investors to pursue opportunities outside of the capital cities. In the meantime, valuations will continue to correct.

"I have been in situations where existing investors expect a 3x markup in the valuation of their portfolio companies from rounds that closed less than a year ago and that were high to begin with. This is clearly unrealistic," said Kuo-Yi Lim, co-founder of Monk's Hill Ventures said.

"I can understand where they're coming from because they raised funds on the back of rapid mark-ups in a previous fund. The disconnect is beginning to play out, and it may take time to unwind."

Points of uncertainty

It remains to be seen how a late-stage funding gap will develop. A withdrawal of global investors in 2022 encouraged some regional GPs to fill the hole with growth funds of their own. They include Indonesia's East Ventures, which closed a growth vehicle on USD 400m in May.

"Our investment in Southeasts Asia will continue despite the storm we are facing," Roderick Purwana, a managing partner at East said, describing the region as "moving towards its golden era," and flagging direct-to-consumer, agriculture, and climate solutions as emerging sectoral hotspots.

Products that are good-to-have but not must-haves, will fall by the wayside in enterprise-facing models. Consumer models around online spending will continue to expand a still-small wallet share regionally. Livestreaming commerce is a growth area.

There are a couple of potential spoilers on the immediate horizon, including waning sentiment for Indonesia in light of new legislation that limits several civil rights and raises concerns about a drift toward fundamentalism. Several new rules criminalise immorality and blasphemy; the most talked-about is a ban on extramarital sex.

The US State Department predicted the law would reduce investment in the country. According to The New York Times, Muhamad Isnur, chairman of the Indonesian Legal Aid Foundation, said the laws run "contrary to international human rights norms. We are in a new paradigm."

It is clearly rattling regional investors. East Ventures, whose vast majority of investment focuses on Indonesia, has made a feature of its environmental, social, and governance (ESG) credentials, becoming the first VC firm in Indonesia to sign the UN's Principles of Responsible Investment in March. Purwana declined to comment on the laws.

"I do fear it will stand out as a factor that deters people and makes them think twice about where the market is headed directionally," said one Singapore-based investor with exposure to the country.

"I can imagine a situation where you want to bring in a senior executive to a company in Jakarta, someone who is not Indonesian, not married and lives with his or her partner. Would that put off foreign talent from joining Indonesian start-ups? Maybe, but it will be more anecdotal than pervasive."

Bourse battles

The other possible spoiler is exits. After rising to USD 8.6bn in 2021, private equity and venture capital exits fell to USD 5.3bn, the lowest level since 2012 notwithstanding an anomalous pandemic-dented total of USD 3.1bn in 2020. There is some expectation that 2023 could be slower still.

Part of the trouble is that the most energetic efforts yet to bring digital companies to regional exchanges have coincided with a global retraction in capital markets. Exacerbating the issue is a dramatic sell-off of shares in GoTo, the unicorn super app and VC darling that listed in Jakarta last April as a loss-making concern.

GoTo's shares are trading at one-fourth their price in June and half their price in mid-November. The details of the slide revolve around a fizzled secondary offering by pre-IPO investors that had agreed to an eight-month lockup that expired on November 30. Now, it's left to the rest of the ecosystem to pick up the pieces.

"There will be good, thorough reviews at Southeast Asian listing venues. Indonesia will take some time to recover and fly the flag, but Thailand is gearing up nicely and can handle tech IPOs. We have a couple companies on the way there," said Shane Chesson, a co-founder of Openspace Ventures, one of GoTo's earliest backers.

"There is the US and Australia, and Singapore is working on initiatives to increase its relevance. There are a lot of ways the exit market can recover. VC firms don't have to worry about the next 12 months – it's really about the next five years."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.