China to Singapore: A VC invasion

Chinese venture capital firms are establishing and expanding operations in Singapore in response to challenges at home and to address the Southeast Asian market. Do they have staying power?

"I'm afraid that I am the last US-dollar GP still here," observed the founder of a Beijing-based VC firm. He was speaking to AVCJ shortly after cancelling a trip to the US in response to heightened pandemic-related restrictions on those returning to China from overseas.

Last-minute itinerary changes and quarantine notices – often communicated to users through a pop-up on an app – have become part of the routine for residents of Beijing, regarded by many as one of the world's least accessible cities. Indeed, China's commitment to "dynamic zero COVID" and the strictures that come with it, have precipitated a mass exodus among start-up founders and investors.

One well-known China investor recently estimated in a WeChat post that 70% of the investors and entrepreneurs in his circle are now located in Singapore. The likes of Yong Zhang and Xiting Li, founders of hotpot chain Haidilao and medical equipment manufacturer Mindray, have already found their way onto the local Forbes rich list.

The trend has become so pronounced that many industry participants are reluctant to discuss it openly, aware that Chinese regulators may frown on this kind of industrial outflow. Singapore's venture capital assets under management (AUM) reached SGD 24bn (USD 17.1bn) in 2021, up 50% year-on-year, but the managers accompanying this capital are contributing to vertiginous rises in property rental prices.

Sean Murphy, a fund formation partner in the Singapore office at law firm Cooley, has also noted rising demand for the structures and licences that codify a manager's ability to operate locally.

"In the last 12 months, we've seen an increasing number of sponsors apply for venture capital fund management (VCFM) licenses – a license tailored specifically for VC managers – or set up variable capital company (VCC) structures that facilitate the deployment of capital from Singapore," he said.

Dozens of Chinese venture capital firms are expanding their Singapore footprints, which could mean opening a new office, adding more people to an existing one, or securing alliances with local partners.

Qiming Venture Partners, Shunwei Capital, Source Code Capital, Vision Plus Capital, Sky9 Capital, Lyfe Capital, Hillhouse Capital, MSA Capital, Loyal Valley Capital, Meridian Capital, and XVC Capital are all engaged in these activities, according to multiples sources familiar with the situation.

"Chinese funds have found it difficult to maintain fundraising and fund management efforts due to the COVID restrictions and expanding into Singapore is a way for LP-facing partners to support fundraising momentum with less friction," said Thomas Chou, co-head of Asia private equity group at law firm Morrison & Foerster in Hong Kong.

"Some managers are actually Singaporeans returning home after long stints in China, which means a much-shortened learning curve compared to others."

Among the GPs named above, Loyal Valley Capital relocated the head of its investor relations team to Singapore to facilitate fundraising, according to two sources familiar with the situation. The firm did not reply to requests for comment.

Stick or twist?

In terms of personal mobility, the impact might be relatively short-lived. One Singapore-based lawyer observed that he is already seeing people returning to Hong Kong following moves by the territory to ease restrictions on inbound travellers. However, there is no such quick fix to the investment-related reasons that have prompted China VCs to target Singapore.

For many GPs, China has become a challenging market as geopolitical tensions create a perceived divide between US dollar and renminbi-denominated funds. The hard-tech and deep-tech start-ups currently in vogue are expected to list domestically and founders are sometimes reluctant to accept offshore capital for fear that regulations out of China or the US could cause problems down the line.

This has prompted some managers with US dollar pools of capital to reinvent themselves as pan-Asian players and pursue the same business models – and perhaps some of the same founders and portfolio companies – they worked with in China, just in overseas markets.

"Every China fund you talk to now is called a China-plus fund – China plus India, China plus Southeast Asia, China plus US, China plus anything but China," said one Hong Kong-based placement agent.

"A GP called me up and said, ‘I heard you are about to close a China fund, could you help with ours?' I explained that we weren't taking on any new China funds, and he said, ‘We're not a China fund, we're a US fund.' But the track record and the team are all about China."

Southeast Asia appeals because themes that GPs have already monetised in China are still playing out. Southeast Asia-focused Asia Partners expects 20 unicorns to emerge in the region over the next decade across the four categories responsible for China's tech IPOs: telecom infrastructure; ads, gaming, travel and horizontal e-commerce; speciality e-commerce, video, social networking; and mobile and offline hybrids.

Qiming was in the first wave of Chinese managers that looked at Southeast Asia several years ago. One of its early investments, hotel management and booking platform RedDoorz echoed the development of budget hotels in China.

Getting recognised

The rewards for those who crack this nascent market are considerable. An annual study released by Google, Temasek Holdings, and Bain & Company estimates that Southeast Asia's digital economy will be worth USD 330bn by 2025, a nearly 3x increase on the 2020 total.

Moreover, the likes of Singapore's Economic Development Board (EDB) are offering incentives to start-ups that relocate to the city-state. Under the Tech@SG programme, companies that have received at least USD 10m in funding over the past three years from a recognised investor will receive 10 work permits so they can hire foreign staff in addition to Singaporean talent.

More than 100 managers are on the recognised investor list, including China players like of Sequoia Capital China, 5Y Capital, Hillhouse Capital, and Shunwei.

The founder of another Beijing-based GP told AVCJ that he set up a Singapore office in the summer and is now close to recruiting two local employees, one to focus on research and the other to handle risk controls and administration. The manager has made overseas investments since inception but now expects them to account for 40% of his latest fund corpus, double the level in the previous vintage.

He added that inclusion in the list is a useful value-creation tool when working with portfolio companies. The firm is currently helping one business to relocate from China to Singapore, with a view to selling products into the US and European markets.

"Amid US-China tensions, establishing a headquarters in Singapore mitigates some operational risk. It also helps the company create an international brand image. Factories could be set up in Singapore or other Southeast Asian countries," the GP founder said. He added that it only took a few weeks to apply for inclusion in the list, although the length of the process can depend on a GP's track record and scale.

Redomiciling a company in a neutral jurisdiction outside China can also facilitate a US IPO. For example, Chris Xu, founder of Shein, China's largest online fashion platform, is now a Singapore permanent resident. The company states on its LinkedIn page that it is recruiting for 40 positions in Singapore. Reuters reported that Shein is shifting assets to the city-state in preparation for a US listing.

It is a relatively well-trodden path. Perfect Corp, a VC-backed start-up that uses artificial intelligence (AI) technology to enable virtual product try-ons of makeup and jewellery, recently began trading in New York following a USD 1bn merger with a special purpose acquisition company. The company claims to be Taiwan-based, but it originated in mainland China.

Asia Innovations Group, best known for operating a streaming service that has gained a widespread following in emerging markets, has a similar heritage. However, prior to agreeing to merge with a US-listed SPAC at a valuation of USD 2.5bn, it redomiciled to Singapore.

"Chinese companies that want to go public in the US face obstacles because China won't allow US regulators to investigate audits carried out locally. That's why it makes sense to move to another jurisdiction, and Singapore is often used for that purpose," said the Singapore-based lawyer.

Money and motivation

Inevitably, a relocation of founders and entrepreneurs to Singapore is accompanied by a significant movement of wealth. The number of single-family offices in the city-state reached 400 in 2020, twice the previous year's total, and climbed again to 700 in 2021, according to the EDB. Industry participants estimate there are now approximately 1,200.

A higher bar to qualify for tax exemptions appears to be no deterrent. The government has imposed a minimum capital requirement of SGD 10m on application, rising to SGD 20m within two years. Family offices must also deploy at least 10% of their AUM or SGD 10m – whichever is lower – in local investments. These could take the form of commitments to PE funds or direct stakes in start-ups.

However, one Singapore-based placement agent was keen to downplay the significance of this for the private equity and venture capital community. Most of the family offices he has encountered have little to no interest in or knowledge of private equity. Most just want to buy real estate.

Not all China GPs see a long-term future for themselves in Singapore. Two managers told AVCJ that it amounts to little more than a temporary haven. If and when China reopens, they will go back.

Ying Zhang, founder of Matrix Partners China, published an open letter last month in which he questioned why investors "choose to lie down easily" and focus on Singapore when the China market is so diverse and rich, and the entrepreneur community is so large and innovative.

"Do they really believe that in Southeast Asia, in a different field, they can regain or even surpass their previous achievements at home?" Zhang asked. "I believe in focusing on China, focusing on my main business, and being diligent and patient. There will be good results beyond all expectations."

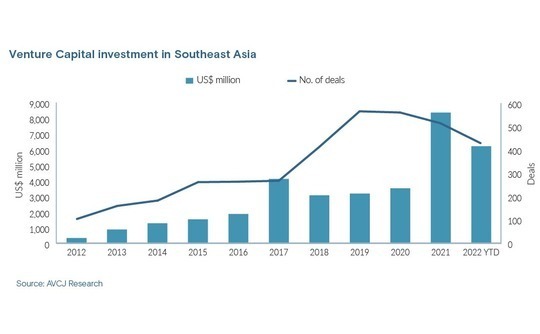

VC investment in Southeast Asia reached a record USD 8.4bn in 2021, more than the previous two years combined, according to AVCJ Research. Prior to 2017, it had never surpassed USD 2bn. Bullishness underpinned by liquidity events for the region's largest unicorns – ride-hailing platforms turned super apps Grab and GoTo both went public – has only been partially dampened by this year's corrections.

The growth is undeniable, yet the market – a conceptual amalgamation of 10 very different economies – is still a fraction of China's size, and it lacks China's geographic, cultural, and linguistic cohesion.

"It is more difficult to expand from one country to another and this presents its own risks to it, so you won't see as many regional companies in Southeast Asia reaching scale and strength found in China," said Michael Lints, a partner at Southeast Asia-focused Golden Gate Ventures. "However, those that can build a regional platform or dominate two or three countries will create a very high moat."

In some areas, comparisons with China are moot. Southeast Asia has become a hub for web3 and crypto-related investment in part because China banned trading in such assets. Nearly all China managers with Singapore offices that spoke to AVCJ identified crypto as a priority area. One went as far as to claim that up to 15% of family office assets in Singapore will be allocated to crypto.

"In the last 12-24 months, we have witnessed an uptick in interest and comfort in investing in web3 and blockchain companies, as well as digital assets," said Cooley's Murphy.

Hong Kong appears to be trying to close the gap with a recently announced digital assets consultation and proposals to allow retail investors to trade crypto assets. This follows years of regulatory ambiguity, but it remains to be seen what impact the move might have on the competitive landscape.

Cross-border considerations

There is also some scepticism around the notion of backing Chinese entrepreneurs to replicate their China-centric business models in Southeast Asia. Some degree of localisation is required, which presents execution challenges. In addition, it may take longer to generate positive unit economics than in China and the competitive threats will be different.

Alibaba Group and Tencent Holdings didn't pursue greenfield expansion; the former acquired Lazada, and the latter invested in SEA Group, which essentially means they backed local teams and networks.

New approaches could emerge following the latest tweak in the prevailing China cross-border investment thesis, known as "China go global." It involves hardware-based exports like smart devices, where China leverages its AI capabilities and its most comprehensive hardware supply chain.

"Chinese companies with highly technical business models that local founders would have difficulty replicating may unlock synergies through knowledge sharing," said Chou of Morrison & Foerster. "While there are challenges for Chinese founders coming to Southeast Asia, those who adopt aggressive localisation plans or have technically driven business models may find more traction in the market."

VC investors might champion the globe-trotting Chinese entrepreneur out of necessity, but there is some truth behind the spin. Nurtured in brutally competitive domestic conditions, founders are known for their fortitude and flexibility. Eric Xin, a managing partner at Trustar Capital, told a recent AVCJ webinar that he believes Chinese founders can build successful businesses no matter where they are.

From small start-ups to technology giants, Chinese interest in Southeast Asia has already altered the market. Investors native to the region argue that in these dynamic conditions – and with capital generally becoming scarcer – their local knowledge and networks have never been more important.

"While we expect more direct early-stage activity from Chinese GPs, the majority will likely still operate through collaborations with players based in the region," said Yinglan Tan, Singapore-based founding managing partner at Insignia Venture Partners. "Chinese GPs are also likely to be tightening their belts amidst the global headwinds in tech markets and their country's evolving political environment."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.