Portfolio: Advantage Partners and Elise Fashion

Advantage Partners acquired Vietnamese women’s apparel retailer Elise Fashion with a view to integrating manufacturing, design, and distribution into a leaner operation with a more international profile

A new factory has been constructed and come online. Enterprise resource planning optimisations have been implemented. A specialist consultant has advised on state-of-the-art manufacturing equipment. As a result, production is down.

This is all part of the plan for Elise Fashion, a Vietnamese womenswear retailer acquired by Japan's Advantage Partners in December 2018 for an undisclosed sum. The core concept is to establish a more integrated, in-house production and distribution paradigm that allows the company to transition into a lower-volume, more upmarket operator.

The feasibility of such a reinvention was first confirmed by signs of the company's youth and energy. During due diligence of the warehouse, Advantage found a lack of proper tracking, racking, and barcoding, with inventory scattered everywhere. The private equity firm mentioned the lapses and potential fixes. Within two weeks – before investment – Elise independently resolved the issues.

"There's a saying at the company that they shoot first and aim later. We move quickly to solve problems rather than just waiting and planning," said Yotaro Tokuo, a Singapore-based principal at Advantage who headed the investment. "Culturally, it's more like a start-up."

Advantage acquired a majority stake in the business via its USD 380m Asia fund, which typically writes cheques in a range of USD 20m to USD 70m for companies outside of Japan that have some kind of Japan angle. In this case, Vietnam will remain the sole operating environment, with Japan serving as an important supplier of superior machines, materials, and industry knowhow.

At the time, the company was already building an international profile, with participation in fashion events in Paris and New York among other industry hubs. Branding, marketing, name recognition, and design were considered strengths. Weaknesses included outdated techniques in pattern making, cutting, and sewing.

Quality control was another significant issue. Too many zippers and buttons fell off, for example, to justify the price tag. To this end, a former executive at Japanese casualwear giant Uniqlo was brought in for a one-year consultation in Hanoi. Product quality is still not on par with Uniqlo, but it's getting there.

Integrated approach

Part of the solution was also about achieving business integration. Prior to investment, production came from two company-owned factories, but this required significant outsourcing. It can be difficult to react to changing fashion trends while overly reliant on third parties in the production process, and relatively small-quantity orders are not always welcome.

A third factory was constructed in 2019 – financed using internal resources – and dependency on outsourcing is said to have dropped significantly. This effect has been offset to some extent by the shift toward ever more sophisticated designs, which can require specialised outside production support.

There were also external pressures to go in this direction after a string of global brands, including Zara, H&M, and Uniqlo, established retail footprints in Vietnam. Many local players have suffered, with the likes of Foci, Blue Exchange, and Nino Max having reportedly scaled back in recent years.

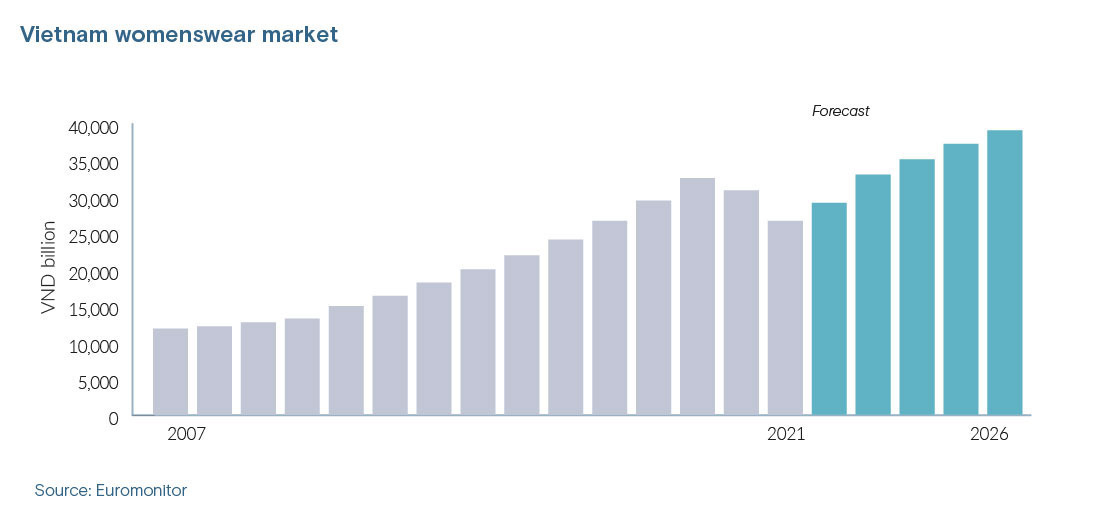

The retail value of the local womenswear market was growing at around 12% a year until a 14% drop in 2021 to VND 26.2trn (USD 1.1bn) in 2021, according to Euromonitor. The dramatic swing is attributed to a shift in manufacturing capacity from China to Vietnam in the preceding years and the effects of local lockdowns on inventory. A swift rebound is expected, reaching nearly VND 40trn within five years.

"It's a very blue ocean right now, but you need to keep improving in quality to survive and grow in this market. We believe that as we become more international in quality, the customers will come to us," Tokuo said.

This requires a fair amount of legwork. Advantage has allocated four professionals to manage Elise; they spend 40-50% of their time in Hanoi supporting management. The GP has also introduced a dedicated visual merchandising design team of four, with two in the country's north and two in the south.

Additional resources were deployed with the engagement of Singapore-based retail interiors designer Kingsmen in 2020. Kingsmen, which specialises in sleek, mall-ready facades, created a new store format similar to those of established global brands.

Maintaining an international profile has also meant a sharper focus on environmental, social, and governance (ESG) issues. Global brands want local counterparties to be squeaky clean in areas such as tax, licensing, and labour regulation. But such is the tendency toward corner-cutting bribes and false documentation, 70% compliance is sometimes the best they can achieve.

"We are the first and only local brand that is 100% compliant in everything, which makes us a prestigious brand for our customers," said Jude Suresh Manuel, Elise's CFO. "Unfortunately, many Vietnamese consumers still don't see this as an attractive feature for purchase decisions, but they will in the future. We think it differentiates us in the mid to long term."

The brick-and-mortar footprint has grown from 95 locations at the time of acquisition to 119, covering every province in the country. The expansion was primarily planned as part of the brand enhancement, but it has also broadened the options for a burgeoning O2O strategy in terms of offline experience showrooms and online order pick-up points.

E-commerce has gone from zero in 2018 to 15% of sales currently, and it is expected to hit 20% in the years to come. The e-commerce team includes 50 full-time staff. Backend systems integration, including sales, inventory, and order management software, is an ongoing project.

Most sales come from the website, Facebook, livestreaming, and other social commerce outlets, with a negligible contribution from marketplaces the likes of Shopee and Lazada. This is in direct contrast to many competitors which favour the more outsourced approach.

"The main challenge with e-commerce was that Vietnam was still not quite ready at that time. You need a lot of manual contacts with consumers to close an order and deliver," Tokuo said.

"You need to build up that process of human contacts into an e-commerce model, and that's still the case today. That's not a major cost, but it requires a proper standard operating procedure and systems to control the quality of the human touch."

Meanwhile, the push toward a more controlled supply chain and an optimised offering has meant reduced overall output; production currently stands at around 800,000 pieces a year. Likewise, the number of stockkeeping units has fallen from about 2,000 to 1,600.

Follower of fashion

Differentiating the product suite from the influx of global competitors is largely a matter of local knowledge. Due to its cooling effect in the hot climate, satin is increasing in popularity despite being pricier. There's more silk, lace, slimmer, shorter cuts, and a sense that chic is routine.

"We cater to cultural differences in design. Clothing that would only be worn to a party in the US might be worn at the office in Vietnam," Manuel said. "Our customers are also about 30 on average, not too young, so they can afford a higher price for something with glamour. That's one of our competitive advantages."

Advantage has longstanding experience in fashion, with three prior Japan-based investments in the sector: Credge, Ray Cassin, and online-focused Nissin. Part of the plan with Elise is to copy a complementary accessories strategy at Credge and Ray Nissan – without losing focus on the company's core.

"It's about mixing and matching. The important thing to remember is that we are not a bag or shoe store, and nobody comes in just for that. But accessories are part of fashion, and they are a good opportunity to cross-sell and upsell," Tokuo said.

One of the key metrics in the fashion space is the average annual discount rate, which reflects the subtraction of net sales received from the combined tag prices off all merchandise sold. This is essentially the effect of season-end sales and arguably just as important as a sign of brand dilution as lost revenue.

The benchmark in Vietnam is 20-40%: Elise was tracking more than 50% discount rates prior to acquisition. That number has been cut in half, which implies a doubling of gross margin. Advantage and Elise declined to comment on financial metrics for this story but confirmed profitability was improving.

"You cannot just increase product quality and get a smaller discount. Everything has to be integrated – the product, the store, the service, design, marketing," Tokuo said. "It's the combination of those aspects that leads to a smaller discount rate later on."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.