Southeast Asia tech: Resilient with an asterisk

Southeast Asia’s booming tech space no longer lends itself to an easy narrative. As start-up fever cools globally, the region charges forward. Cracks are beginning to show but so are counterintuitive bright spots

Rising interest rates coinciding with rising inflation while geopolitical tensions and pandemic aftershocks imperil supply chains for talent, capital, and essential commodities has proven too much for venture capitalists. Globally, start-up funding is estimated to have fallen 19% quarter-on-quarter and 39% year-on-year during the three months June. This isn't happening in Southeast Asia.

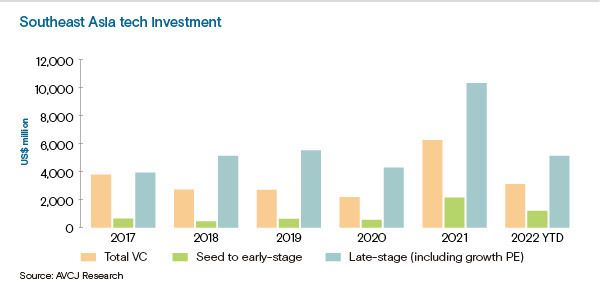

The tech investment explosion that characterised 2021 remains on track to repeat itself in 2022. Having jumped 187% to about USD 6.3bn last year, total VC deployment in Southeast Asia had reached USD 3.1bn by the midpoint of 2022. This holds true across early-stage and late-stage markets, according to AVCJ Research, with the latter representing a mix of VC and growth-oriented private equity.

The idea that Southeast Asia is merely lagging the global trend overshadows this phenomenon. But continued bullishness for companies entering the listed markets – typically canaries in the uncertainty coalmine – suggests otherwise. Deloitte Singapore recently noted that proceeds from IPOs on the Singapore Exchange (SGX) reached SGD 572m (USD 406m) in the first half of 2022, up 70% year-on-year.

During the same period, the local tech board, known as Catalyst, tripled its number of IPOs to six while doubling proceeds to an admittedly still paltry SGD 44m. Action on the mainboard included three listings via private equity-backed special purpose acquisition companies (SPACs) that raised a combined USD 528m. These vehicles have yet to find merger targets, but they are looking in the technology sector.

"Tech start-ups in Southeast Asia have been growing remarkably, and we see a wave of Southeast Asia unicorns going to the US for listings in search of better liquidity and valuation," said Darren Ng, disruptive events advisory deputy leader at Deloitte Singapore.

"This phenomenon may help SGX's secondary listing market breathe new life, with Southeast Asia companies listed in the US looking to move closer to home to tap investors familiar with their brands and benefit from extended trading hours by trading on more than one exchange with different time zones."

The great withdrawal

Nevertheless, global investors coping with deflated portfolios in their core markets are said to be scaling back. They are expected to continue their retreat in the second half of the year.

The pull-out of brand-name late-stage investors is mostly anecdotal at this stage, but the anecdotes are vivid. One investor told AVCJ that Tiger Global Management recently pulled out of several Indonesian deals that were on the brink of closing. Tiger Global – a hedge fund that routinely dips into late-stage private rounds – has reportedly seen 52% of its value wiped out this year amid tech stock selloffs.

Further evidence of a growing late-stage vacuum can be inferred from regional tech giants slimming down to make ends meet.

Singapore-headquartered super app Grab, which listed on NASDAQ in December last year at an enterprise valuation of USD 30.4bn, confirmed last month it would slash 5% of its team. It coincided with financial technology provider StashAway cutting staff by 31% and Sea-owned e-commerce platform Shopee laying off parts of its food delivery and payments teams in Southeast Asia.

The risk here is that if a longstanding growth-stage funding gap in Southeast Asia is exacerbated in the medium term by a drought of fly-in capital, it could effectively decapitate the ecosystem, prompting many global LPs to return to their home markets. The number of Fund IIIs and Fund IVs that have attracted institutional support is growing, but it is unclear if it has hit critical mass.

"It's still too early to say whether green shoots in Southeast Asia will wilt. We take time to build conviction and have a long-term outlook, so once we start investing in a region, circumstances have to be dire to make us decide to exit," said Sunil Mishra, a partner at Adams Street Partners, which has fewer than 10 GP relationships in Southeast Asia.

"We started building in Southeast Asia venture capital because we thought the market had reached a certain scale with supply of talent, capital, management teams, and exit avenues. Those things have to be continuous and sustainable because venture is like a relay race and needs a thriving ecosystem. If you drop the baton, you can't realise projected returns."

From this perspective, the key lesson of the global tech rout for Southeast Asia could be that indigenous, on-the-ground growth-stage capital is an indispensable part of the proverbial relay team.

When Asia Partners, one of the only dedicated growth-stage VC investors in Southeast Asia, was set up in 2019, the firm estimated it was 100 times harder for a company to raise a Series C or D round in the region than in the US, and five times harder than in China. It closed its debut fund last year at USD 384m, targeting a USD 1.1bn growth-stage gap.

Last month, the firm led an USD 80 Series F for ShopBack, an e-commerce rewards start-up with exposure to a looming recession in the form of discretionary spending categories, deferred payments, and point-of-sale consumer credit. The company claims down-market protections in services that help consumers budget for groceries and avoid predatory lending.

"Notwithstanding macro headwinds, fundamental socio-demographic drivers – including an emerging middle class, skyrocketing mobile and broadband internet penetration, and the emergence of a digitally native generation into the workforce – will be the driving force behind the sector in the medium to long term," said Nick Nash, co-founder of Asia Partners.

Sub-regional pain points

Early-stage investors are moving into this space, with the likes of Jungle Ventures, Openspace Ventures, and East Ventures raising growth funds in the past several months. Questions remain, however, to what extent these efforts could counterbalance an extended absence of global players, whether more regional middle-market or buyout investors are able to participate in pre-IPO deals, and how many more early-stage players can join the party.

Golden Gate Ventures aimed to raise a USD 200m growth fund for Southeast Asia in 2019 alongside Korea's Hanwha Asset Management. It ended up with less than USD 80m and eventually reclassified the project as an "opportunities fund." The vehicle is now fully deployed, and Golden Gate is squarely focused on early stage, citing more reliable upside amid growing pressure on tech valuations.

"When we invest at seed or Series A, the valuation is well below USD 40m. Whether we end up exiting at USD 1bn or USD 2bn, it's still an amazing outcome for us as a fund. So, we're less affected by these fluctuations," said Michael Lints, a partner at Golden Gate. "We know those [later-stage] valuations are going to be compressed this year, but if we invest early enough, we can have a good outcome."

Like many early-stage players, Golden Gate has not decelerated its pace of deployment this year, but that is in the cards. The foreboding is largely connected to an industrywide sense of déjà vu around the implosion of WeWork in 2019. The episode saw the US co-working start-up retract USD 47bn in valuation in a matter of weeks due to governance problems around a high cash burn consumer-driven model.

Due diligence around defensible competitive advantage, unit economics, and the path to profitability became more strict, fair-weather investors pressed pause, and valuations retracted. If the current weeding out period follows pattern, these outcomes will creep into the early stages.

"A lot of investors are seeing things they've not seen in 15 years seen like high inflation and high interest rates together. Down-rounds only happened in textbooks in this venture world. They will clearly happen more. Down is the new flat. Flat is the new up," said one investor. "If your business model is not designed to sustain a focus on profit, it will be very challenging to maintain."

Pan-Southeast Asian early-stage investor Monk's Hill Ventures is juggling these ideas, tracking confidence in the region even as it slows down its pace of deployment.

The GP is currently finalising fundraising for its third fund – Fund II closed on USD 100m in 2020 – with more than 80% of the capital coming from long-term institutions in North America. Family offices and high net worth individuals proved to be more reactive, short term-driven and content to hold cash as the macro situation shakes itself out. It's worth noting that the fund was largely raised last year.

Prepared for the worst

At the same time, Monk's Hill is taking a cautious approach, maintaining a portfolio where 80% to 90% of companies have both growing revenue and positive contribution margins. Flat rounds are starting to come into view, but an economic bounce related to post-COVID tourism and pent-up spending is dominating sentiment.

"We're sensing that investment rounds are taking longer to develop, though there's still a lingering expectation for high valuations in some instances. Some founders are deciding to wait out the storm. But, directionally, founders are becoming a lot more flexible on valuations as macro issues hit home," Kuo-Yi Lim, co-founder of Monk's Hill said.

"There's a real sense of uncertainty at this point. People are expecting things to change and more likely worse than better."

A shift in valuations and increased scrutiny around financial metrics would not be the only changes in a downturned Southeast Asia. There is a general consensus that the ratio of consumer to enterprise models would tilt toward the latter – and that this is already happening. It will translate into more cross-border transactions by small businesses and investment in the relevant supporting infrastructure.

A new mix of players is also possible. Family offices, while often regarded as more reticent in times of increased uncertainty, are tipped to ramp up their exposure to technology for strategic reasons. Indeed, Singapore's Jungle Ventures closed its fourth early-stage fund last month at USD 600m with about half the corpus coming from family offices, a massive increase on Fund III.

Sector funds and corporate venture capital are also seen as growing parts of the tech scene in this environment. The standout example is arguably France-based Eurazeo, which set up a USD 200m insurance technology fund for Southeast Asia last month with a lone European insurer as the LP.

Meanwhile, high interest rates will limit businesses' ability to take loans from banks, prompting both parties to explore financial technology options. And supply chain disruption, including a migration of industrial capacity to Southeast Asia, could accelerate the down-streaming of entrepreneurship from broad consumer concepts to regionally specific B2B services.

"This is the best time to be thematic. The key is to be as strategic as possible to both your LPs and your investees. LPs that are strategic will be interested in what you're investing in, and founders want VCs that can be partners and active supporters," said Victor Chua, a managing partner at Malaysia's Vynn Capital, which focuses on logistics, tourism, mobility, and fast-moving consumer goods.

"I'm seeing a lot more CVCs [corporate venture capital firms] being set up. There is a bearish feeling and it could be risky. But corporations are not looking at it from a purely financial angle. They're looking at it as a learning process. Rather than put tens of millions into a factory, they might as well experiment."

Corporates, however, are not often flagged as a likely near-term driver of exits, another crucial ingredient in the fate of the Southeast Asian tech scene that remains in question.

An uptick in direct secondary activity – Golden Gate's Lints calls it more alive than ever – could be stoked by increased pressure on valuations. But the key buyers will be specialist funds and family offices, especially in fintech and software-as-a-service (SaaS).

The liquidity debate

The bigger question is the region's fledgling tech IPO market. Whether companies list overseas or locally, pulling off an IPO has become more challenging, especially in light of weaker valuations for mature tech companies. Furthermore, the market for the SPAC listings that have generated some of Southeast Asia's biggest stories is seen as especially choppy.

Cause for optimism can be seen in Indonesia-based super app GoTo, which raised IDR 15.8trn (USD 1bn) on the Indonesia Stock Exchange in April. But it is tempered by e-commerce platform Bukalapak and Grab. The former completed an Indonesian IPO, the latter merged with a US-listed SPAC – both are trading at more than 75% discounts to their offering prices.

"I think for a number of years, you can live on a promise, but you need to deliver on that promise after a while. That is the next phase for the VC end of the market in Southeast Asia. Monetisation, if anything, will determine the future success of fundraising," said Brian Lim, a partner at fund-of-funds Pantheon.

"Now will be the time when GPs are truly tested. In many ways, this is when investors will find out who's been able to navigate Southeast Asia in the right way, and who's picked the right horses."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.