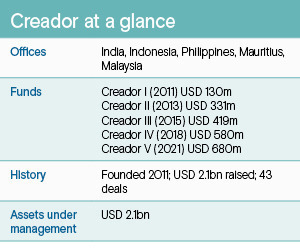

GP profile: Creador

Creador claims to be Southeast Asia’s only middle-market GP with on-the-ground capacities across the region. But in-house post-deal support and nimble deal sourcing are its key differentiators

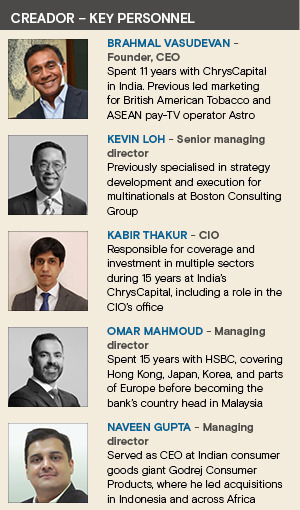

Brahmal Vasudevan had seen significant success with India's ChrysCapital Partners, helping the GP generate 43%-per-year returns for its investors on average between 2000 and 2011. When he set out on his own to set up a Southeast Asia-focused outfit under the name Creador in 2011, he thought it would be relatively straightforward to repeat the formula. That didn't quite happen.

The challenges of Creador's early days are easily assessed in hindsight. Well reputed professionals were brought in as partners, such as such as Cyril Noerhadi, the firm's Indonesia chairman, who was previously CFO of Medco Energi International and CEO of the Jakarta Stock Exchange. But Vasudevan was the only member of the team with significant investment experience.

Furthermore, Southeast Asia remained a tough sell with international investors; Navis Capital Partners was the only substantive player in the region at the time. And Creador was determined to set up shop in Kuala Lumpur rather than Singapore, a decision that left many LPs nonplussed.

"The most successful investor in the world lives in Omaha, Nebraska, and he seems to do very well. Sometimes you have to go to places where others haven't been, and sometimes being outside the noise helps you think more clearly and not be swayed by what the other firms are doing," Vasudevan said.

Vasudevan made a personal commitment of USD 35m to Creador's debut fund, while two Malaysian family offices provided an additional USD 20m. With support from some individual investors in Europe, a first close of USD 72m was quickly achieved. This enabled the firm to start investing and prove out its thesis, which attracted further support.

The key investment at this stage was OldTown White Coffee; Creador acquired a 10% stake for USD 15m in 2012 and generated a 2x return and IRR of 101% upon exit the following year. Nevertheless, Fund I closed in 2013 at USD 130m, well below the USD 380m initially contemplated.

Undeterred, the firm launched a successor vehicle within months and global players began to trickle in, including a large US endowment, Hamilton Lane, Macquarie Bank, and Siguler Guff. Meanwhile, Creador preferred to extend tentacles in Indonesia and India rather than Singapore. An Indian base was set up in Chennai instead of the more intuitive Mumbai. Fund II closed on USD 331m in 2014.

"Results among most Southeast Asian funds are below what US investors consider acceptable," Vasudevan said, adding that Funds I and II have both been fully exited at a profit, with the latter generating a 1.5x return on the original capital. "We're one of the very few firms that have been able to raise money with this mandate."

Under the hood

The firm's key differentiator at this time was a concerted focus on post-deal value creation through a formal operations division called Creador+. Kevin Loh, who has known Vasudevan since 1997, was hired in 2014 to lead this effort. He has grown an initial team of four to 26, still the largest private equity unit of its kind in Southeast Asia.

"A consulting background has a lot of positives in big picture strategy and structural thinking in terms of analysis," Loh said of his approach to team development. "If someone can blend that with operational experience, especially P&L, we get the strategic mindset but also the ability to just make it happen. When it comes to value creation at Creador, 20-25% is thinking about strategy, and the balance is down to execution."

Typically, Creador+ will run 3–6-month pilot projects to help portfolio companies build out internal capacity in new business lines before stepping back and moving on to another project. Up to four operational professionals are deployed per investment, especially in more buyout-friendly markets such as Malaysia.

Creador+ gets involved with founders as early as the deal sourcing process; this is usually a significant factor in positioning the PE firm competitively versus other investors. The deal team takes the lead on inorganic expansion support. Most other company building initiatives are handled by post-deal professionals. There is no difference in compensation between the two teams.

"Ultimately, we believe there is no deal if there is no value creation, and likewise, there is no value creation if you don't find a company to begin with," Loh said. "Both sides are dependent on one another to deliver what the firm needs. That's always been our principle."

Indian opportunities

Funds III and IV closed at USD 419m and USD 580m in 2016 and 2019, respectively, as Creador and its strategy continued to expand. Much of this growth has been in India, where the in-country team now numbers about 25, including group CIO Kabir Thakur.

Thakur worked at ChrysCapital for 15 years until 2020, when he came across to Creador. He observes that the two firms share a significant amount of DNA, although Creador benefits from an enhanced pitch to entrepreneurs in the form of international expansion networks.

India currently accounts for about 35% of the portfolio versus 35% in Malaysia, and the balance across the rest of ASEAN. Thakur's team is experiencing the most aggressive built-out, however, and is expected to add 2-3 professional this year, including one mid to senior level hire. He projects India will represent 40-45% of the portfolio in the foreseeable future.

"I'm seeing a lot of our competitors vacate the space they're in and move one notch up to do buyouts. So, I see a lot of white space for us in the USD 30-75m [cheque size] range, where we can dominate," Thakur said. "Competitively, we're in a sweet spot and we have a three to four-year runway to exploit. After that, we'll want to do larger things in buyouts."

The core strategy here is to target small to medium-sized enterprises with around USD 100m in revenue, potential for growth, and a view to IPO or in 3-4 years. Valuations in this market have crept up from 12x to 15x EBITDA in recent years, although Thakur notes that growth rates have kept pace at around 20-25%.

Creador will not underwrite growth faster than this based on outlier scenarios, but it doesn't ignore the possibility. This was part of the opportunity set discussed regarding an investment last November in Sapphire Foods India, an Indian franchisee operator of US fast food giant Yum Brands, best known for KFC, Pizza Hut, and Taco Bell.

The idea was that organised, brand-name food outlets would outpace mom-and-pop competitors amid COVID-19-driven anxiety about food and restaurant hygiene. KFC and Pizza Hut, in particular, were underpenetrated in India, and potential was spotted for Sapphire to outperform market expectations post-pandemic.

Creador put in USD 85m last August with a plan to list the company within two years; NewQuest Capital Partners and TR Capital fleshed out the remainder of an approximately USD 115m deal. Within three months, Sapphire raised about USD 277m through a domestic IPO, doubling expectations for an exit valuation.

Exit stories

Outside of India, the firm's fastest growing market is the Philippines, where an office was set up in 2020 and six team members have made fives investments to date. Omar Mahmoud, a 15-year veteran of HSBC, was hired to head up expansions in the Philippines, Thailand, and Singapore. He spends about 50-60% of his time in the Philippines.

Mahmoud befriended Vasudevan while serving as country head of global banking at HSBC Malaysia. At the time, he was impressed by deals such as Mr DIY, a Malaysian home improvement retailer with about 200 outlets at the time of investment and ambitions to go regional.

Mr DIY was considered under the radar of regionally active investors but primed for growth with family ownership ready to hand over the reins. Creador made its largest yet investment, committing USD 140m across Funds II and III in 2016. Mr DIY completed a MYR 1.51bn (USD 358m) domestic IPO last year. The private equity firm, which made partial exits through the IPO and a subsequent secondary trade, is sitting on a 7x return.

Malaysian credit bureau CTOS Digital has delivered a performance of similar magnitude, following a USD 287m domestic IPO last year. This was one of Creador's earliest investments; the GP acquired 80% at a valuation of USD 100m and proceeded to help triple revenue and profit.

"Over the next few years, they were finding companies I never knew existed, and after they bought in, you'd see the stores everywhere. And it wasn't just entries – there were exits," Mahmoud said. "I had a team that headed up equity capital markets, so I could see the IPOs getting done. I was like, ‘Wow, these guys are good.'"

Deal targeting is veering into VC territory in this jurisdiction, with Series A rounds already on the menu. The sixth investment in the country, currently being finalised, appears to be in this ballpark: a ride-hailing and food delivery player. Creador approached the company directly and structured a deal without an advisor, while competing investors were in wait-and-see mode.

"I knew the global private equity firms at HSBC because we would lend to them. But I wouldn't have joined any other PE firm other than Creador," Mahmoud said. "We're the only one that's really taking things to the next level for local private equity in the region as a true regional player. Our approach is intense and tiring, but it's usually rewarding."

Setting the pace

Speed is a hallmark of the Creador style. The process for Sapphire, for example, was six months in total, but Creador completed its due diligence and was ready to go months before NewQuest and TR had finalised their commitments. The firm took a 30% stake in Malaysian tea shop operator Tealive in June 2021 on the back of 2-3 meetings with management. Tealive's first Philippine locations will open this week.

Swiftness of thought and deed should not be mistaken for recklessness. Pre-deal communication and analysis usually involves investment committee (IC) meetings at the country team level every Monday, followed by region-wide ICs with the core nine senior IC members later that same day.

Furthermore, Mahmoud hosts a Friday catch-up for the Philippines, Thailand, and Singapore teams. "There is no competition between managing directors. If I'm working on a deal, I can take Kabir, for example, through a dry run to get high-level feedback in addition to taking it to IC," he said.

Country-level ICs have proven an important processing tool for grooming junior talent. Perhaps the best example of this is Livia Chan, who joined the firm as an analyst in 2015 directly out of the University of Cambridge and is now head of Malaysia investments. She also leads the Vietnam strategy, where publicly listed Mobile World is the sole deal to date.

Chan has executed eight investments in Malaysia, including Tealive. She sees upside in Creador's historically successful consumer-focused sectors but is keen to explore the opportunity set further upstream. Areas such as semiconductors, healthcare, and food ingredients are on the agenda.

"Retail has good metrics, but we want to move up the value chain," Chan said. "Malaysia is a manufacturing hub, but we're not going after the low-margin commoditised products. We're going after high value-added, high-margin areas that are sticky with customers."

As new geographies and sectors come to the fore, the strategy is being tweaked. Ticket sizes have scaled from USD 15-40m on average to around USD 40-60m, and they can exceed USD 100m with co-investment.

Among the latest developments is the closing of Fund V this year at the hard cap of USD 680m. This included support from several existing LPs, as well as more global organisations such as pension funds, development banks, and asset managers. In marketing the fund, Creador was able to claim 19%-per-year net returns for its investors since its inception.

"Raising money is the easy part. Investing and returning money with very high returns is not. So, we've chosen to hold ourselves back in size so that we're not forced to write big cheques," Vasudevan said. "We can keep doing the smaller deals that we think will generate high returns and are still quite substantive by any standard."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.