Myanmar: Asia's anguish

Myanmar has proven unique among Asia’s frontier markets in terms of volatility and risk. As its ongoing humanitarian and political catastrophe deepens, a sense of helplessness has taken root

Yangon-based All Myanmar Advisors introduced a work-from-home policy at the onset of COVID-19. In recent months, Rudolf Gildemeister, co-founder of the boutique consultancy, has physically convened his team once a week in an attempt to regain a sense of normalcy amid a floundering business environment. As he was driving to last week's meeting, a bomb exploded on the road to the office.

The episode is a vivid analogue for the broader situation in Myanmar. Confidence in the country's long-term prospects has inspired grit in the face of drooping sentiment and morale, but when the knockout punch finally came, determination hit a brick wall.

Gildemeister is unharmed and still working from home, but since the military coup last February turned life in Myanmar upside down, his corporate finance practice has been increasingly weighted toward business life support and damage control services.

Meanwhile, violence is ripping the country apart, and it has become common for investors to discuss the possibility of a civil war without hyperbole. Indeed, Christine Schraner Burgener, the UN's special envoy for Myanmar, recently used just such terminology to describe near-term risks, adding "a bloodbath is imminent." The deadliest day to date came last week, when security forces opened fire on protestors, killing more than 90.

Some of the latest developments have struck directly at the finance sector, including a run on domestic banks. A range of limitations on the expatriation of cash and withdrawals have consequently been put in place, including a convoluted system of plastic tokens that aims to manage the crowds in front of banks. For its part, All Myanmar Advisors has even deployed staff to stand in line for corporate clients.

"Street traffic is the heaviest I've seen it in over a year. Most shops are open, and restaurants are filling up. You'd be tempted to say a new normal is emerging but then you see the very long queues at the banks and ATMs," says Gildemeister, who is also a board member of London-listed Myanmar Investments.

"Mostly we've been working with existing clients, helping them deal with security for their staff and due diligence around ownership structures of their suppliers and partners at the tertiary levels. But at the moment, our core focus – for us and for our clients – is just accessing cash to do payroll."

Fragile renaissance

The most acute social and economic pain in Myanmar has occurred since the military takeover of the government in February following the election victory of Aung San Suu Kyi's National League for Democracy Party. This includes more than 700 deaths as a result of protest violence to date, partial and total shutdowns of internet services, severe declines in foreign investment activity, and a record low for the local currency against the US dollar.

Cracks in the Myanmar growth story began showing well before the coup, however, in the form of a poor response to the pandemic and an internationally decried crackdown on the Rohingya people, a stateless minority group near the Bangladesh and India borders. The backdrop for all this was a fragile renaissance starting in 2011 after five decades of international isolation under a military junta.

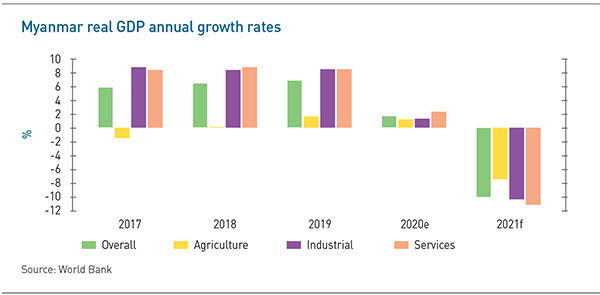

Now the situation is so uncertain that forward plans are virtually impossible to make, and economic outlooks have never been bleaker. The World Bank estimates that the economy slowed from a growth rate of 6.8% in 2019 to 1.7% last year due largely to the impacts of the pandemic. The development finance institution (DFI) expects the economy to contract 10% in 2021, and it's worth noting that this period will include four pre-coup months.

A significant and speedily developed private equity presence is now facing this challenge head-on. In the past two years alone, Singapore's GIC and Norway's Norfund acquired stakes in Yoma Bank, one of the largest local lenders, while Japan's Daiwa Securities Group set up a $30 million PE fund for the country. This coincided with the incorporation of the Myanmar Private Equity & Venture Capital Association (MPE&VCA).

Ecosystem members have been reticent to comment on the situation on the ground. In general, investors are not making new financial commitments, but they are supporting portfolio companies in whatever way they can, even if that means helping people leave the country. For the most part, silence is about reputational integrity. Publicizing any progress could be interpreted as implicit support for the military regime, a toxic concept in the international investment industry.

"We're trying to ensure the industry does not lose ground as a result of the current economic and political challenges. We are preserving the infrastructure, the connections, and the knowledge in the local private equity scene, so that when the situation stabilizes, we do not have to go back where we were five years ago," says Josephine Price, inaugural chair of the MPE&VCA and co-founder of local private equity firm Anthem Asia.

"It is clearly the wrong time to promote Myanmar in terms of expansion. But we can promote responsible investment, responsible value-add, crisis management, reputation risk management, cash management, and things like best-practice valuations in a difficult environment."

Anthem is among the most substantial locally based GPs along with Ascent Capital and Delta Capital. Anthem closed a $35 million fund in 2019, while Ascent closed its debut with $88 million last year. This coincided with Delta launching its third fund with a target of $100 million, which would top the $70 million raised in its prior vintage.

The most realistically foreseeable means of survival for these firms would be fund life extension agreements with LPs. All three are years away from the end of their harvesting periods, when LPs would be most receptive to any such request, leaving much in limbo. Some investors have demonstrated a commitment to the country, which might be cause for optimism. CDC Group, a UK DFI that has backed both Anthem and Delta, made two appointments to build out its Yangon office in October last year.

Perhaps the biggest actor involved is TPG Capital, which offers two contrasting illustrations of why timing is everything. Its first investment in the country, Myanmar Distillery, was flipped quickly; TPG bought a 50% stake for an undisclosed sum – estimated at $100-200 million – in 2015 and exited two years later when Singapore-listed Thai Beverage acquired a majority interest in the business for at least $735 million. The second, telecom operator Apollo Towers, is seen as a write-off.

"They're going, ‘Why the hell did we invest in a country like that? Now we're wrapped up in sanctions and who knows what,'" says one industry participant with deal experience in Myanmar. "It's occupying plenty of their time at mission control, and that's exactly why global investors will be avoiding Myanmar. For them, the upside isn't worth the risk."

Even dedicated in-country operators appear to have adopted a similar attitude. Following global outrage over the Rohingya refugee crisis in 2019, Myanmar Investments, which historically positioned itself as a patient long-term player, decided not to pursue further deals and liquidate its last two assets. These include minority stakes in Apollo Towers and microfinance provider Myanmar Finance International. So, did the investors who pressed on amid the rising gloom make a mistake?

"Maybe GPs in Myanmar were overoptimistic, overestimated how long they could stay in the country, or perhaps were made to wrongly believe the government had fundamentally changed. But hindsight is easy," says Claudia Zeisberger, co-director of INSEAD's global private equity initiative, who has been based in Asia for 26 years.

"I like to believe that they made the decision to be the gutsy ones and work in frontier markets with open eyes. That's the mindset that built Asia. I went to more going away parties than I'd ever been to in 1998 during the Asian financial crisis, but what if everyone had written off Asia back then? Where would we be today?"

Who's buying?

Part of the challenge for investors in Myanmar is basic supply and demand. If sentiment turns south and it's time to get out, a buyer must be found who wants to get in. But in some ways, the logic here might be the strongest argument for positivity about the outlook for local GPs. Global players that dipped their toes in Myanmar and now need to leave could become a source of significant deal flow for scrappier operators willing to pick up the pieces.

There is also the idea that Myanmar's long-touted fundamentals can and will carry some business models through the doldrums. The population of 54 million remains a sturdy market for consumer essentials, even in a depressed economy. This may be especially true given that the vast majority of people live in rural areas, representing the lowest per capita GDP in Southeast Asia and therefore a unique zero-to-one marketing opportunity.

"In general, when the market is crashing and everything is at its darkest, you need to buy, not sell. If you have a long-term horizon, you can pick up great assets at rock-bottom prices, with a little bit luck and patience, it pays off very well," says Thomas Hugger, CEO of Asia Frontier Capital, a shareholder in Myanmar Investments that also operates funds targeting Iraq and Uzbekistan.

"I'm pretty sure that will happen in Myanmar too where many investors have to sell for ESG [environmental, social, and governance] and sanctions reasons. But the buyers will be private companies and individuals, not institutions and public companies, except if they're from countries with fewer ESG compliance issues such as China."

The trend toward stricter ESG compliance in private equity has complicated attempts to forecast the fate of the asset class in Myanmar in at least two ways. Its most immediate effect would be as a potential deal driver whereby global investors seeking to minimize reputational damage pursue divestments that prioritize speed over price optimization. AVCJ has found no such activity to date, but much remains to be played out.

Japanese beer giant Kirin became the highest-profile example for this idea in the days after the coup, when it announced it was terminating a joint venture with Myanma Economic Holdings Public Company, a military-affiliated entity. Importantly, Kirin has not indicated that it intends to exit the market.

Socially unviable

At the same time, a subtler influence of the ESG phenomenon could dampen activity in the longer term. The difficulty of making ESG-compliant investments in Myanmar may eventually dissuade GPs with significantly institutionalized LP bases from targeting the country. This applies to impact-oriented LPs mandated to invest in frontier markets as well, because they are often among the most proactive on ESG.

"We're starting to see a disconnect between LPs with strict ESG goals and the reality of investors on the ground. That's going to increasingly squeeze the private equity industry in frontier markets like Myanmar, especially among the brand-name platforms," explains Andrew Thompson, KPMG's head of private equity for Asia.

"The small GPs will still have an appetite and may actually be quite motivated in Myanmar if they can take something off one of the global players for cheap. But that kind of activity will depend on how institutional and sensitive their LPs are – even DFIs comfortable with frontier markets are subject to the ESG megatrend."

Anthem, Ascent, and Delta have all received significant backing from DFIs. There is no debate that these GPs will be unable to tap government-connected LPs for new fund commitments in the foreseeable future. It remains to be seen whether they can make capital calls to support existing portfolio companies. A lot rests on the provisions in limited partnership agreements (LPAs), and in what circumstances LPs can withhold capital or move to wind down funds. Each one is to some extent unique, but in Myanmar, there will be at least one common deal-breaker among DFIs.

"We have to be able to prove that there's no connection with the military, and different DFIs will have different rules about it," explains one investor in the country. "Some DFIs will say it's an absolute no-go if the government is involved in management or ownership in any way. Some might say 5% is okay."

There are a few key factors that further complicate this due diligence burden. First, some businesses need to transact with the current regime where there is a supply chain monopoly that cannot be avoided. Second, it can be difficult to verify relationships because so much data is sourced from disinformation-prone sources such as social media and sharing reliable data could breach confidentiality agreements. Third, the lack of surname usage in Burmese culture can make tracking individuals nearly impossible.

"Development financial institutions, including European DFIs, are very familiar with emerging markets and some are keen to enter or expand their operations in Myanmar," Alexandra Vanderschelden, a director at Delta, told AVCJ in mid-2018 as outcry over the Rohingya crackdown mounted. "However, with DFIs being government-sponsored entities in most cases, the events in Rakhine State impacted their ability to make initial or new commitments to Myanmar."

GPs sticking it out in Myanmar will therefore have to ensure they have LPs with the necessary patience to stay the course until the recoverable parts of their portfolios can be managed. INSEAD's Zeisberger observes that in a situation such as Myanmar, these kinds of investors are more likely to be close to home than far away.

Still, even local and regional LPs that are less sensitive to reputational risk and are willing to think long-term about frontier markets have little reason to be attracted to Myanmar. Even in mid-2018, when sentiment on the country was arguably peaking, the International Crisis Group estimated the government had been underperforming in its peace process and economic development, despite benchmarks being revised to more realistic levels.

"The years between the election in 2016 and COVID-19 were okay, but they failed to live up to a lot of expectations. If those were really good years, investors might have had an easier time shrugging off the coup to get back to the growth. But they weren't rewarded for taking that early risk," says Field Pickering, head of venture and impact at Singapore's Vulpes Investment and managing partner of its Seed Myanmar Ventures business.

"Now it's quite clear that the possibility of a coup is always there but without any added potential reward. I don't think any investor's portfolio in Myanmar is going to come out in any form of health. Everyone's going to get decimated, and it will be a long time before they come back."

Tech trauma

Vulpes' strategy with Seed Myanmar was to get a foothold in the country in the early days of its economic opening as a way of positioning the firm for better opportunities down the track. It started investing in 2015 and built up a portfolio of eight companies, managing the risk by writing small checks. The standout investment, Nexlabs, raised about $1 million in total across several rounds.

Nexlabs was a local leader in online marketing but has contracted its staff by 60% due to disruptions in internet services. Myanmar has banned Facebook, the go-to outlet for social media advertising and most search engine activity. Twitter is also banned. In their place, a so-called whitelist of approved online services has been drawn up, leaving tech entrepreneurs nonplussed.

It's a crushing development for a start-up scene that was already sinking. Omidyar Network, a philanthropic investor launched by eBay founder Pierre Omidyar, helps illustrate the decline with its Phandeeyar program in Yangon. The incubator, which launched in 2015, ran two cohorts a year in its early days and had to turn some hopefuls away. By 2019, it struggled get a single slate of companies together. That was pre-coup and pre-pandemic.

Now the state of emergency gripping the country has snuffed out most of whatever entrepreneurship remained. This development is exacerbated by the fact that it is the younger, tech-savvy generations that have been most violently at odds with the military. AVCJ was given several accounts of start-up employees getting arrested and founders escaping to run their companies remotely in different cities around Southeast Asia.

"The angel investment scene in Myanmar was just getting started, but at this point, it's not even nascent – it doesn't exist," says one Burmese founder, who fled the country.

"Start-ups in Myanmar don't raise money from local high net worth individuals because those investors typically don't put money into tech. They might do some more brick-and-mortar business investing now, so there may be a lot of restaurants opening up or something like that. But we're not going to see local money going into the digital ecosystem."

Everyone investing and building businesses in Myanmar was conscious of the risk factors, but it might be argued that those in the start-up ecosystem had more reason than most to be blindsided. Despite an underperforming tech scene, Myanmar was one of Southeast Asia's relative internet success stories with 80% coverage, ubiquitous urban smart phone usage, and some of the cheapest, fastest internet in the region. Political and economic instability was part of the calculus – but a shutdown of the internet was not.

"You don't know if it's going to be a coup, SARS, an election, a tsunami, an earthquake, or a pandemic. You don't know what's going to hit you, but you know you're going to get hit," KPMG's Thompson says. "That's the law and nature of frontier markets. Sometimes you get a period of stability, and investors start to forget. Myanmar has certainly looked like it was on a pretty good trajectory, but events like this remind you that the laws don't change."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.