Gulf gambit: Asia GPs court Middle East LPs

As the Middle East becomes a focal point for private equity fundraising globally, Asia-based managers hope that macro trends work in their favour. Being the right size and the right strategic fit also helps

Jade Invest, in its original incarnation as a China-focused fund-of-funds, signed up Kuwait Investment Authority (KIA) as an anchor LP in 2006. The firm was in the right place at the right time. As a goodwill gesture following a visit by the emir of Kuwait to China, KIA was instructed to create a vehicle dedicated to promoting investment and trade relations between the two countries.

"They wanted to learn about China by investing in it, and we were part of that," said Ludvig Nilsson, founder and managing partner of Jade Invest, which now pursues a mid-market direct investment strategy. "We were alone in selling China in the Middle East at the time."

The firm went on to develop a network of Middle East LPs – mostly family offices – that account for "a relatively large and important chunk of [its] capital." There was nothing fortuitous about it. One of Jade Invest's co-founders was Jonas Lindblad, an Arabic speaker and former resident of the Gulf region. Lindblad, who has since stepped back from the firm, returned there to build relationships.

With private equity firms the world over focusing their fundraising efforts on the Middle East like never before, the Jade Invest story serves as a reminder of what countless industry participants attest: securing LP commitments from this region requires patience, persistence, and a willingness to accommodate the strategic agendas of an increasingly sophisticated group of investors.

By all accounts, Chinese GPs are descending on the Middle East in droves as they look for ways to make up some of the shortfall created by traditional sources of capital – North America and to some extent Europe – pausing or scaling back commitments for geopolitical reasons. Those expecting to leave with a replenished LP base on the back of a couple of meetings might be disappointed.

"The geopolitical risk of China is seen as much lower in the Middle East than in Western markets, but I think the region is being falsely branded as a Klondike for fund managers," said Nilsson.

"It's an opaque society where you may struggle to find the right people to talk to; and if you do find them, they take a long-term approach. They might invest USD 2m as a try-out and go bigger next time. The relationships we have now are with groups we've known for over a decade."

Wall of capital

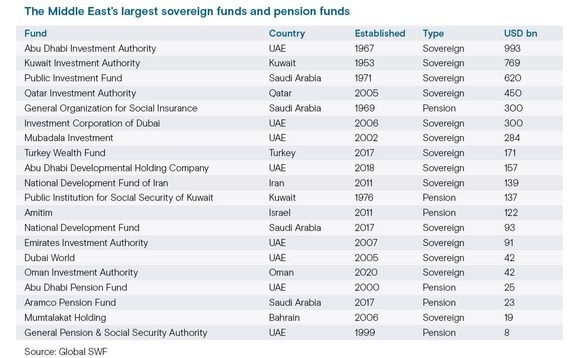

That the Middle East represents a sizeable fundraising opportunity is without question. Global SWF, a data platform that tracks sovereign wealth funds and public pension funds, estimates that 24 Middle Eastern groups are responsible for approximately USD 5trn of the USD 33trn held by the 200 largest investors worldwide. This is less than half the North American total but more than the EU.

Five Middle East representatives feature in the top 20, ranging from fourth-placed Abu Dhabi Investment Authority (ADIA) with USD 993bn in assets to Saudi Arabia's General Organization for Social Insurance (GOSI), which sits 20th with USD 300bn. KIA, Saudi Arabia's Public Investment Fund (PIF), and Qatar Investment Authority (QIA) are sandwiched in between.

Family offices are proliferating at such speed that industry participants are reluctant to estimate how many are in operation. One placement agent claims to cover approximately 60 investors region-wide, including the larger family offices regarded as being regular allocators to private equity.

Global SWF notes in its 2023 annual report that Middle East funds are now recognised as smart, flexible, and mature, while others point to an ability to take long-term views that can withstand inflationary concerns and even oil price volatility. Yet Ahsan Khan, a London-based vice president at placement agent Asante Capital, believes the evolution of the last 10 years is often underplayed.

"The initial objective was to diversify the wealth outside of the region and into more long-term strategic investments. That still holds true, but it has evolved from being a state-level objective to filtering down to family offices and corporations," he said. "And we must appreciate there is a high, and increasing, level of investor sophistication."

A typical marketing trip for a large-cap fund might begin in Abu Dhabi, taking in ADIA, Abu Dhabi Investment Council (ADIC), Mubadala Investment, Abu Dhabi Developmental Holding Company (ADQ), and Chimera Investments. ADIC merged with Mubadala in 2019 but multiple sources say the private equity teams still operate separately. A merger of ADQ's funds unit and Chimera is pending.

Abu Dhabi has two pension funds – Abu Dhabi Pension Fund and General Pension & Social Security Authority (GPSSA) – and the Emirates Investment Authority. There is also a long list of family offices, but not as long as in Dubai. The latter has Investment Corporation of Dubai as well.

"A lot of single-family and multi-family offices are setting up in the DIFC [Dubai International Financial Centre] or One Central," said Simon Kinzett, a senior director for investor relations at Permira.

"These aren't just families from the GCC [Gulf Cooperation Council countries], but from all over the world who are attracted by the locality, the ease of doing business, the tax environment. You could fill four or five days just doing meetings with family offices in Dubai."

Saudi Arabia has emerged as a prime target on the back of economic reforms and a push to develop more of an international profile. In addition to PIF, Riyadh is home to GOSI investment arm Hassana Investment, Sanabil Investments, and a cluster of banks and family offices. More family offices are found in Jeddah and Eastern Province. Saudi Aramco's pension fund is also in Eastern Province.

The largest players in Kuwait are KIA, Public Institution for Social Security of Kuwait (PIFSS), and Kuwait Fund for Arab Economic Development, while QIA and Oman Investment Authority (OIA) are preeminent in Qatar and Oman, and Bahrain has Mumtalakat Holding. A scattering of family offices and mid-size financial institutions make up the numbers. Israel may also come into contention.

"There's a lot of capital out there, a lot of new institutional investors are growing rapidly," said Mounir Guen, founder and CEO of placement agent MVision. "But it's very regulated, the larger gatekeepers have a strong presence in the region, and programmes are tilted towards larger funds – in terms of fund commitments and co-investment – and towards the US."

Issues of scale

StepStone Group, Hamilton Lane, and Cambridge Associates are generally acknowledged as the most active gatekeepers in the region, yet several sources observe these relationships are shifting from discretionary to advisory mandates. This is happening lockstep with the expansion of internal investment teams, increased appetite for direct deals, and rising ticket sizes.

Most of the larger sovereigns and public pensions would struggle to accommodate an equity cheque of less than USD 100m or a fund with a corpus below USD 2bn. For many, the starting point is now USD 200m-USD 300m, with the likes of ADIA capable of making individual commitments of USD 1bn-plus and underwriting co-investments in the USD 2bn range.

An investment professional with a global GP noted that ADIA had put more than USD 5bn to work with his firm over the past 18 months, across different funds and co-investments, but this paled in comparison to the USD 6bn allocated to Ardian's latest secondaries vintage.

Co-investment is often viewed through the lens of co-underwriting. In widely contested auctions, large LPs might be fed opportunities directly by investment banks, conduct their own due diligence work, and then choose a GP as a partner. Mubadala, for example, is said to favour managers with a sector or geographic focus as a means of augmenting its own sourcing capabilities.

On a recent trip to Saudi Arabia, Paul Aversano, head of the global transaction advisory group at Alvarez & Marsal, was peppered with questions about digital transformation, environment, social, and governance advisory, interim management, and CFO services. "If you are going to be a direct investor, you need the skills to operate businesses. They are building value creation teams," he said.

In Asia, there is some compromise on fund size and cheque size. Beyond the pan-regional players, ADIA backed sub-USD 3bn funds raised by China GPs such as DCP Capital and FountainVest Partners.

Other GPs find success through careful targeting: some large LPs – Sanabil is flagged in this context – will make smaller investments; others are keen on certain investment themes; and still more have multiple pools of capital that can be tapped. ADIA made a seed commitment to CBC Group's healthcare credit strategy through its special situations unit, said a source close to the situation.

"There might be someone at the top, but unless you are putting a huge amount to work, decision-making is often devolved. You might get money from the parent and the subsidiary, or one might do it and the other might not. They have their own return targets, so it's not unknown for them to compete," said a second placement agent. "Certain groups are not as tied up as one might expect."

However, these breakthroughs happen at the margins. The case for more capital flowing from the Middle East to Asia touches on the latter's long-term growth prospects, investors looking to hedge their bets between the US and China amid geopolitical tensions, and China's bridge-building efforts in recent years. Yet this doesn't necessarily translate into a wave of fund commitments.

"When you have 20-30 plans that speak for a lot of the aggregate capital, they aren't each going to write cheques for 50 managers in Asia or even 20 for most programmes. The Middle East is not a magic solution for every Asian GP," said Tom Swain, a director in Credit Suisse's private funds group.

Same bed, same dreams?

Two China-focused GPs that signed up Middle East LPs several years ago told AVCJ that they seldom travel to the region, noting that their investors are reasonably frequent visitors to Asia. One has been to the Middle East twice and the other has been once – to convince an LP to reduce its ticket size.

Several others looking to rebuild LP bases for sub-USD 1bn funds are flying to Abu Dhabi and Dubai on a quarterly or bi-monthly basis. Running into peers in hotels and the lobbies of office buildings has become a matter of habit, although they note that plenty of Chinese entrepreneurs, executives from industrial groups, and government officials are also doing meetings with local investors.

"Our traditional LPs have either delayed commitments or they are too afraid to bring them up for recommendation, so we are talking to investors who are still optimistic about China – Chinese money abroad, Asian money, and the Middle East," said a third manager who raised 20% of his last fund out of the Middle East and is actively courting sovereigns, corporate entities, and family offices.

"These are not typical institutional LPs, so you aren't doing a presentation, opening a data room, having them run due diligence, negotiating terms, and then in three months you have an LP. There is a lot more work now – we must be very strategic in our approach."

Strategic relationships are often mentioned in discussions with and about Middle East LPs. It is often regarded as code for greater co-investment opportunities, but the notion has broader political applications that play out at the family office level as well.

Bahrain-headquartered Investcorp has USD 52bn in assets under management, of which 23% comes from GCC investors, chiefly large family offices. They participate in committed programmes or on a deal-by-deal basis. Having primarily focused on Western markets, Investcorp entered Asia in 2018 and has since deployed over USD 1bn in the region. Investor demand usually has a strategic angle.

"When I have meetings with investors in the Gulf, the first part focuses on IRR, risk profile, how much money they can expect to make," said Hazem Ben-Gacem, co-CEO of Investcorp.

"The second part is always, ‘What else?' They might have a business that does A, B, and C, and they want to do a trip to Asia because they are curious. I see our investments as a prequel to a stronger trade momentum between the Middle East and Asia."

Moving one step further, Ben-Gacem offers a snapshot of a region in transition: the GCC has moved from being purely a source of energy in the 1950s through the 1970s to serving as a source of capital from the 1980s to the present; in the next phase, the GCC will be a source of business and services – potentially for all markets within a three-hour flight radius – and Asia can be a value-added partner.

This dovetails with accounts from Chinese GPs of Middle East LPs looking for collaborators who contribute to their local economies. The starting point in conversations might be whether a VC firm can offer access to talent and technologies. The third manager draws parallels with China's approach to foreign investment in the 1990s and 2000s when localisation was the price for market access.

"Strategic partnerships are not limited to just co-investment deal flow. Today, it's often more about finding a partner that can help strategic industries for the region, by setting up networks, R&D centres or structured knowledge-sharing," said Asante's Khan. "When the conversation becomes about that kind of partnership, a fund investment makes sense."

Going local

The meeting of minds covers many areas, from big data and cloud computing to new energy and mobility to climate-tech and food-tech. Even managers that find an optimal strategic fit may struggle to get traction. Competition for capital is intense – including from more established Western GPs – and they are invariably dealing with an unpredictable family office segment that refuses to rush.

"While smaller funds need to target family offices, it's still possible to raise a significant amount of money by collecting USD 20m and USD 50m cheques," said Kinzett of Permira. "However, they reward groups that have been coming for a long period of time, through the ups and downs, rather than those who go there in their hour of need."

MSA Capital may have gone further than any Chinese GP in this respect. Much like Lindblad at Jade Invest, Ben Harburg, a managing partner at MSA, spent part of his earlier career as a consultant in the region. He leveraged his local knowledge in support of MSA's fundraising efforts, said three sources familiar with the situation. Harburg did not respond to AVCJ's inquiry.

The firm started helping Chinese portfolio companies expand into other emerging markets, as well as making China-related investments in those markets, through its second fund. In 2019, MSA established an emerging markets technology-focused joint venture with some investors in Bahrain.

"MSA didn't write this playbook, but they were among the first China managers to pursue it. One of the best ways to get money from these geographies is you do something with groups locally, helping them invest or bring business to their markets, and then you expand that into a fund relationship for something you are doing outside of the region," one of the sources explained.

The joint venture ultimately evolved into a dedicated fund, known as MSA Novo, that invests across ex-China emerging markets globally. MSA opened several offices in the Middle East and formed local teams. The MSA Novo website references offices in Riyadh, Abu Dhabi, and Singapore.

Few Chinese – or Asian – managers are expected to establish a formal presence in the Middle East, but more frequent in-person engagement as part of market-specific investor relations efforts is viewed as inevitable. The question is whether they have the staying power.

"I know of people who go to the Middle East regularly, meet different groups, get USD 2m here and there, which might become USD 10m, and gradually build a book of investors," said Guen of MVision. "The money is there, if that's how you want to do it, but it's tough."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.