Asia fund administration: Odd jobs

COVID-19 is the latest in a growing list of drivers causing private equity firms to outsource various operations. The trend is implacable but inherently flexible

Third-party service providers to the private equity industry that quietly hoped the flexible staffing and work-from-home arrangements of COVID-19 would translate into a spike in business are tempering their expectations. But although the pandemic didn't inspire GPs to rush into new outsourcing models as part of crisis management, it may have set the stage for more measured transformations.

Private equity firms increasingly shifted toward distributed work environments as travel restrictions and quarantine orders closed offices for months on end. Eventually, this led to the re-examination of internal operations, with a desire to optimize – and potentially rebalance – external and in-house resources. But for many GPs, the rethink has been delayed by an initial optimism that things would go back to normal quickly. At first, they did the bare minimum to support remote work and plan for protracted disruption.

This has been compounded by a general wariness to implement operational changes in a climate of uncertainty. In many ways, keeping costs down was the mantra of 2020, but the long-term budgeting advantages of outsourcing backend operations weren't enough to convince firms en masse to invest in shaking things up. Furthermore, performing due diligence on new vendors – or even new technologies offered by existing relationships – becomes more difficult with a distributed workforce.

Rich Itri, a senior vice president at Eze Castle Integration, a tech-focused consultancy for fund managers, still believes, however, that pandemic-driven changes to workplace and staffing norms will push GPs toward outsourcing in the year to come. After addressing portfolio issues and making select investments in 2020, the industry is now primed to chase deals again, with greater impetus to improve operational efficiency and flexibility expected to drive uptake of third-party services.

"As the new normal sinks in and the 2020 profits are realized, I believe many firms will acknowledge areas they have neglected and think more strategically about their long-term operations. PE firms can find significant long-term savings via an outsourced model as well as scale in areas where they need to be more innovative, particularly around data management, reporting, and analytics," Itri says. "As firms increase investment and strive to be more competitive, they will need to create some extensibility across their operations via outsourcing."

Preexisting trends

Service providers are quick to point out that this is all just extra tailwind for a trend already in motion. The most commonly cited drivers for more backend outsourcing among private equity firms include rising or unpredictable costs around office real estate, human resources, and increasingly technical or specialized number-crunching teams. In-demand specialization also translates into greater turnover risk, especially in the form of a GP losing an essential fund accountant.

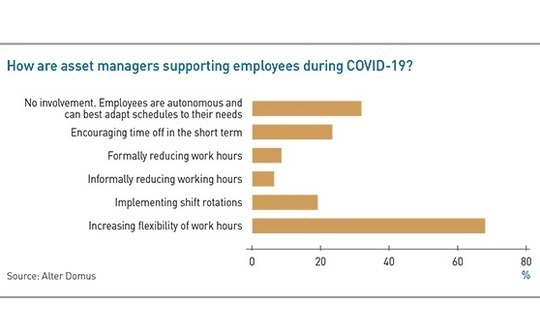

"I think the COVID-19 situation is probably going to kickstart an increase in outsourcing over the course of 2021 and going forward," says Alexander Traub, regional executive for Asia Pacific at fund administrator Alter Domus. "As people settle into this COVID-19 way of working, they're now starting to do something about a lot of the shocks that they had in March and April last year. And they're starting to think, ‘If we're going to do all this remote working anyway, why don't we outsource more?'"

At the same time, the maturation of the industry in Asia will only drive the outsourcing trend. With more managers in the region raising multiple vintages, there is a compounding effect on their accounting, auditing, and tax reporting duties. The administration of legacy funds, still going on in the background after full deployment, is driving a talent shortage in fund-specific bookkeeping expertise.

"There are still a lot of managers that are doing the monitoring and data recording of performance metrics of portfolio companies on Excel spreadsheets in their offices. But they're getting more and more data and demands for data, and the analysis is getting complex," Traub adds. "That's why for alternatives, the next wave of outsourcing in Asia is going to be that middle office. It hasn't taken off as yet, but as these managers raise Fund III and Fund IV, they're now across potentially multiple segments and certainly many positions and have significantly more to manage."

From the managers' perspective, however, the middle office remains a gray area, where the flexibility and control advantages of in-house will be continuously reweighed against the efficiency and financial logic of outsourcing procedural workstreams.

Investment decision making is often described as the cutoff point, where operations must remain in-house, although creeping adoption of hedge fund-style quantitative analysis suggests otherwise. Firms will strike a balance based on their specific circumstances, especially the scope of their internal resources. This will remain the case even as the evolution of the office results in GPs' resources becoming increasingly distributed.

"It's hard to completely rely on an outsourced approach with a lot of inputs that are generated for the substantive part of fund administration by frontline investment professionals, even if your team is working from home," says Hamilton Tang, a managing director at CDIB Capital, whose 200-strong staff is split 50-50 between investment professionals and backend support.

"Nowadays, there are many virtual interfaces to communicate and update in real-time, so you don't have to lose that depth of insight and nimbleness associated with being closer to the action. The middle office functions are so close to the front line, they necessarily involve a mix of external and internal resources – and I don't see that changing."

Burden of compliance

One driver of outsourcing expected to accelerate across the industry regardless of fund size or strategy is the growing question of regulatory and compliance requirements as pressure piles on funds domiciled in low and no-tax jurisdictions to increase transparency with third-party oversight. In Asia, even large firms that might otherwise handle regulatory work in-house have been obliged to outsource these functions. This is because many global GPs expanding their presence in Asia must deal with new, unfamiliar jurisdictions, often with a skeleton team.

Raymond Page, a Singapore-based managing director at Tricor IAG, says this has been the biggest driver of outsourcing in recent years. He observes that many banks in the region are now asking for intermediary certificates that due diligence is adequately completed due to recent anti-money laundering (AML) compliance problems.

As a result, Tricor IAG has been busy completing statements detailing what the fund administrator does and to what standard, what regulatory oversight it is under, and how it performs AML checks. Recently, much of the firm's bandwidth has been devoted to supplying AML certificates to banks to assist new managers in establishing fund accounts.

"With most of our new clients, the biggest questions now are about handling AML [anti-money laundering] and KYC [know your customer]: Are you regulated? What checks do you do? How often do you review? Have you ever been fined? Do you provide CRS [common reporting standard] and FATCA [Foreign Account Tax Compliance Act] investor services?" Page says.

"Those due diligence points are at the top of their list due to regulatory risk to their licenses and reputations. It's investment risk having a poor investment – that can happen. But if the manager has a regulatory breach and is sanctioned in any way, the negative fallout can impact appetite when raising the next fund."

This is difficult work to justify doing in-house because it's a specialized domain that varies from market to market, the rules and procedure requirements within each market change regularly, and the stakes can be as high as jail time. Many GPs, including large international firms, going to fund administrators in this area are embracing outsourcing for the first time. These relationships are expected to lead to manager queries about what else is on offer and consequently a lift in the outsourcing of standard backend functions as well.

Best in class

Both COVID-19 and the gradual maturation of Asian private equity are contributing to this trend by encouraging the creation of small, first-time funds that are often prone to outsource as much of their non-investment work as possible. Spinouts are being fueled by the growing acceptance and success of the asset class, as well as short-term economic pressures slowing down investment among relatively conservative institutions, which inspires some personnel to strike out on their own.

Much of this theme is supported by the notion that fund managers want to concentrate on what they do best – fundraising and investment – without getting bogged down in administration work. But yet another driver for an increase in outsourcing may be found in a rejection of this assumption. As reporting, data usage, compliance standards, and strategies become more complex, the role of backend support functions in informing frontline fund management activity is becoming increasingly intrinsic.

"The idea of just wanting to focus on investing and fundraising probably doesn't make sense in today's market. Now, you really need to provide a top-notch support function in order to have a good investment function," says Bonnie Lo, a partner at NewQuest Capital Partners, which has outsourced more as it has gotten larger due to industry-wide talent shortages in specialized back-office areas. NewQuest's 44-strong staff includes 25 investment professionals and 19 back office and middle office professionals.

"Private equity firms are getting more complex and multi-strategy, more like financial institutions and multi-asset managers," Lo adds. "Keeping up to speed with market regulations and LP demands should be a focus of the GP's leadership. Whether to outsource it or not is a firm's decision, but it's not enough now to say, ‘We just invest, and this other stuff is less important.'"

This effect might be most notable in the growing presence of data analytics tools in investment processes, the usage of which often has to be outsourced to specialist technicians such as MSCI and Burgiss. Last year, these two fund manager service providers entered a strategic tie-up that is said to have access to datasets covering $9 trillion of committed capital in private asset classes, or 90% of the global total. They expect overall allocations to private assets to triple within 10 years.

Activity of this kind could have significant implications for fundraising. LPs are already recognized for being noticeably more comfortable in fundraising processes when the GP's crucial metrics are confirmed by a familiar third-party service provider. As use of data-sharing and data-driven decision-making tools comes to the fore, GPs that deploy the new technology will be all the more attractive to LPs and better positioned to realize their scaling ambitions.

"We could probably do more in terms of continuing to upgrade our IT infrastructure," says one mid-sized manager. "We have an internal team that works with external consultants from time to time. But I do wonder if we might be better placed doing more with an external firm that is experienced with the private equity industry and at the cutting edge, seeing what others in the market are doing, and advising us on what platforms we should be adopting."

The blurring of the lines between frontline and back-office activity may be an even more pronounced trend in ESG, which is increasingly positioned as a firm-defining philosophy rather than a bolted-on diligence cost. This is an area where operations related to ethics and mission statements meant to demonstrate the DNA of a firm are often delegated to third parties. As such, ESG – even more than investing and fundraising – may be the last frontier of practical and responsible outsourcing.

"Firms need to have their ESG policies in place and ensure that they are thoughtfully conceived, practiced, monitored, and measured," says CDIB's Tang. "We can get external firms to advise on that, but ultimately, that's about the conduct and mindset of the investment professionals and how we address ESG issues upfront, which is not something that can be outsourced."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.