Asia consumer: Sale of the century

The traditionally slow-changing retail sector received an unexpected incentive to smarten up quickly this year. When the dust settles, shopping will never be the same again

COVID-19 has had a dramatic but inconsistent impact on retail in terms of the immediate shopping slowdown and the speed of the recovery.

Global demand for apparel, fashion and luxury is said to have slumped to 20-40% of pre-pandemic projections depending on geography and segment, while grocers have reported spikes as high as 20%, and e-commerce channels have regularly tracked revenue hikes of 5x. Consumer sentiment has proven equally patchy but also the clearest expression the sector's general uncertainty, with McKinsey & Company estimating last month that 80% of US consumers still feel unsafe about out-of-home activities.

Asia has come to the fore as a global leader in both retail digitization and controlling the virus, but the situation within the region remains as checkered as the global picture. One of the biggest shockwaves on this front came last month when Robinsons, Singapore's 162-year-old department store mainstay, closed its last two brick-and-mortar outlets, citing a long unfolding e-commerce threat exacerbated by COVID-19.

This points to the pandemic's most meaningful – and universal – impact on retail as a modernization accelerator, both in business culture and customer behavior. A typical pattern for any given market's e-commerce penetration in the overall retail space has been 20% pre-pandemic, 35% during the peak of the local lockdown, and 25% after lockdowns were eased. The consensus is that online targets expected to be reached in 2-3 years have come in six months. At the same time, consumers are more comfortable with the range of things they're willing to buy online.

Swifter uptake

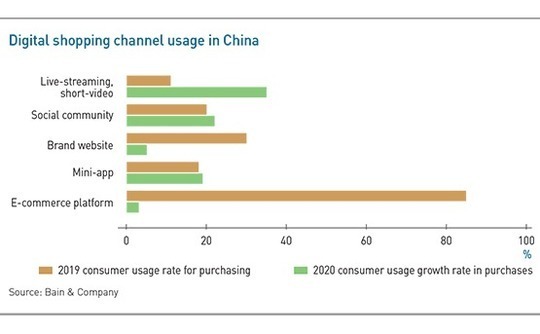

On the store side, the heightened urgency to blend offline and online business models this year has resulted in an already complex mix of data-driven omnichannel and smart phone-driven strategies starting to take a significantly bigger slice of the retail pie. Bain finds that only 11% of Chinese consumers made purchases using livestreaming and short-video channels in 2019, but that figure is set to grow by 35% in 2020.

"There's a big fragmentation in the path to purchase because things like mobile shopping, social commerce, horizontal marketplaces, digital payments, and short-form video mean that eyeballs are not going to retailers first," says Kanaiya Parekh, a Hong Kong-based partner at Bain focused on retail and store operations. "In Asia Pacific, 80% of retail sales will be conducted online or through mobile devices by 2023. In India and China next year, there will be a 33% and 37% increase, respectively, in the number of hours spent on mobile."

Investors looking for upside in these changes can rely on COVID-19 taking things to the next level in the near term across multiple geographies, but the rate of evolution will not be as uniform. China is the acknowledged leader in digital application uptake among retail businesses and leapfrogging consumer behavior. Most developing markets around the region, including India and Southeast Asia, are seen as roughly 5-7 years behind. Mature jurisdictions, including Korea, Japan, and Australia will evolve more slowly but from a higher base in terms of existing technology infrastructure.

There will be many common pitfalls. For example, much of the received wisdom about brick-and-mortar survival versus e-commerce revolves around adding complementary goods and lifestyle services to the traditional offering. Hong Kong music shop operator HMV Asia put a lot of eggs in this basket in 2016 under the guidance of AID Partners, including a cafe, restaurant, live performance venue, and a range of non-music lifestyle products. The store folded within two years.

"It's not simply a matter of creating a virtual storefront, a webpage, an app, or social selling. You've got to treat it like a virtual store, but it's still a store like any other. You must be able to fulfill products through that store and get them to customers," Darby says. "Omnichannel means omnichannel operations, not just omnichannel selling. As soon as you fail to keep your promise to the customer, you're going to lose that customer, and it's really hard to get them back again. Spend time on retention, not acquisition."

Brand awareness

Asian investors will be considering these factors in the context of rapidly shifting social backdrops, most importantly the aging of populations in developed markets and increasing affluence in developing markets. For many retailers, this will ultimately translate into a greater need to target new or unfamiliar demographics by bridging the online and offline worlds with new brands and embracing an in-house cultural change.

"It's advisable for companies to spin off another brand when targeting another demographic rather than use the same brand because it has a lot of baggage," says Arnold Wee, a partner at Singapore-based Firefish Branding. "You need to get some new blood into the brand too. If you use the same people, you won't get a transformation."

In most of developing Asia, the emergence of new local retail brands capable of challenging international incumbents is a phenomenon tied to the rise of the internet, which has done much to level the playing field in terms of brand awareness. At the same time, the e-commerce-driven decline of the department store format is increasing the relative footfall for branded boutiques. This is another trend that could experience a step-change connected to the COVID-19-driven acceleration in digitization, especially as it makes its way into more rural areas.

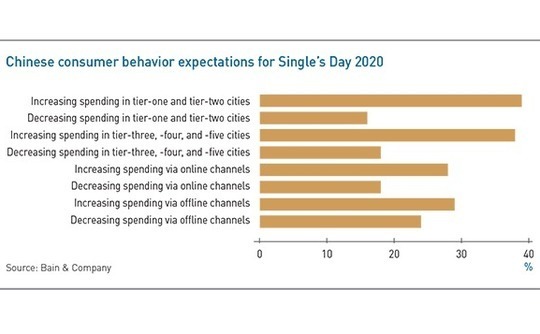

"The penetration within tier-one and tier-two is reaching its ceiling, it's not 100%, but it's close. But if you look at tier-three and four, penetration in those markets Is less than half. Last year's growth was all coming out of tier-three and four," Bain's Parekh says, adding that retail technology leaders like China's Alibaba Group and Pinduoduo have been among the most aggressive in making the pivot.

"It's not far-fetched to say you'll have a scenario in which retailers have more data scientists than buyers in the organization because the ones that can mine those data in the most effective way will be the ones that win. They'll be the new czars of retail going forward."

The idea that retail czars will dominate the sector through their ubiquitous and indispensable service ecosystems is well established, with China's Alibaba, JD.com and Pinduoduo (the latter two are both aligned with Tencent Holdings) apparently setting the standard for what's to come. Strong international brands such as fashion retailer Zara are accustomed to standing on their own in new markets, but in China, they could never compete without cozying up to the giants. Zara markets itself online in the country through a partnership with Alibaba's Tmall.

This aspect of the post-pandemic paradigm helps drive home the importance of digital and online operations upgrades as game-changers for every link in the retail value chain, from branding, product positioning, and customer engagement, to transaction services, back-office management, and logistics.

The newest czar on the scene is India's Reliance Industries. Its subsidiaries include Reliance Retail, a brick-and-mortar player building up a comprehensive digital and physical supply chain, and Jio Platforms, which is doing the same on the demand side, in part by leveraging its position as India's leading mobile carrier. Both companies have raised billions of dollars this year from the likes of KKR, Silver Lake, TPG Capital, and General Atlantic.

"I would argue that digitization of the retail supply chain may be even more important than digitization of the customer end because it's more difficult to engage with the different parties across the value chain, and it takes a longer time," says Eric Zhang, head of China at General Atlantic, also an investor in Alibaba. "On the customer side, it's all about how effectively you can sell the product, but digitizing the supply chain changes the whole ecosystem, including sellers, wholesalers, suppliers, packaging companies, and delivery companies. It fundamentally disrupts the industry."

Data dump

Some of General Atlantic's most recent investment activity helps illustrate how this game of ecosystems and retail supply chains can be played at various ends of the market. Earlier this year the private equity firm led a $300 million round for Chinese fresh fruit and vegetable delivery provider Dingdong Maicai at a valuation of around $2 billion.

The company – which buys directly from farmers and resells to end-users with a 30-minute delivery service – was riding a COVID-19 high fueled by public concerns around food safety at traditional wet markets. Revenue shot up 600% in February and is expected to chart 150% growth during the third quarter.

Dingdong brings together several themes of the day, including new demographic targeting; the start-up notes that Chinese millennials are starting to cook more but looking for new grocery shopping experiences. Perhaps most importantly, though, its end-to-end service is a massive collector of customer data in a traditionally brick-and-mortar space where meaningful behavioral and transactional insights are basically impossible to accumulate at meaningful scale.

This changes everything. For business lines such as grocery, which can struggle to maintain optimal inventory levels, the advantages of better understanding customer demand are manifest. In other retail categories with increasingly blurred online and offline components, the physical check-out will become the digital check-in. Even shoppers who do not make a purchase will provide useful data. Asia, and China in particular, will trial many of the innovations first.

"You're going to see retailers, even physical stores, completely revolutionize the way they approach the customer and how they run products in the next 3-5 years," Zhang adds. "They will change the store design, the layout on the shelf, and you'll see that in a big way in all the major retail formats in China. It started with cosmetics because that's where the highest margin products are, but eventually, it will move into different verticals."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.