Portfolio: Navis Capital Partners and Hanoi French Hospital

Navis Capital Partners has taken a boutique private hospital to a new level of competence and professionalism just in time for the biggest healthcare emergency in living memory

Over the course of three years, Navis Capital Partners has more than doubled the potential capacity of Hanoi French Hospital (HFH) with the construction of a seven-story building for around $30 million, the implementation of a new in-house IT system, and the restructuring of senior management. Then things started getting challenging.

Major construction and technical upgrades were completed around mid-2019 and quickly put to the test with the onset of the coronavirus outbreak and the host of operational complications it brings. What's more, the entire project was somewhat uncharted territory for Navis. The private equity firm acquired 100% of HFH in mid-2016 for an undisclosed sum in what was described as a first-mover investment in a Hanoi private hospital.

HFH is Navis' first and only Hanoi-area asset and its debut investment in a general hospital. The GP claims significant experience in construction projects of lower complexity across the region, including logistics and manufacturing facilities. But a fully equipped hospital that needs to live up to international standards entails an almost incomparable level of detail. This bar was raised even higher by the unfamiliar marketing requirements of the target segment.

"When I started looking at this deal several years ago, I knew what everyone knew: Medical's a growing space and there's a supply-demand mismatch. But what I found out as we dug in is how many unsuccessful hospitals there are, not just in Vietnam but around the region," says David Ireland, a senior partner at Navis. "It's not easy to advertise a hospital in the same way you would another product. It's a lot of word of mouth. That reputation is one of the huge values of this business."

Building out

Established in 1996, HFH is the oldest international private healthcare facility in Hanoi and specializes in pediatrics, obstetrics, and gynecology. All the hospital's construction permits were in place at the time of acquisition. At that point, the business employed about 50 full-time doctors and 20 rotational doctors to cover a capacity of 70 beds. A plan to expand to 170 beds has been paused at about 130 beds due to indirect effects of COVID-19.

The new building, which connects to the old building and wraps around it in an L shape, now hosts all HFH's beds, operating rooms, and outpatient clinics. It is expected to grow beyond 170 beds once the old building has been sufficiently remodeled to take over outpatient activities. Work on the old building that was halted due to COVID-19 is expected to resume without significant delay, with the workers back on site as of last week.

"If you're not careful with hospitals, you run a process that's steady-state momentum. Navis has been successful in bringing a project management approach to that, pointing at things that need to change, understanding what the current situation is, and being strong about determining what the future state needs to be," says Jef Peeters, CEO of HFH. "Normally, building hospitals takes forever, and there's always a reason to change and postpone something. That's just not happening here."

Peeters has 15 years of experience helping European hospitals with transition issues, including crisis management and post-merger integrations. He was brought in earlier this year, allowing the former CEO, a doctor, to concentrate on medical outcomes and managing the team of doctors. This was part of a general effort to professionalize staffing and overall operations by improving business expertise without losing medical aptitude.

Critically, Peeters also offers a substantial background in traditional consumer business building, having spent some 10 years as an Asia strategist for Coca-Cola in the 1990s. This is seen as an important ingredient in realizing the potential of Vietnam's hospital sector, which appears to be morphing into a dual public-private structure similar to the US or Australia. Filling premium beds has proven a niche but compelling opportunity set, especially as increasing affluence implies greater discretionary expenditure on healthcare.

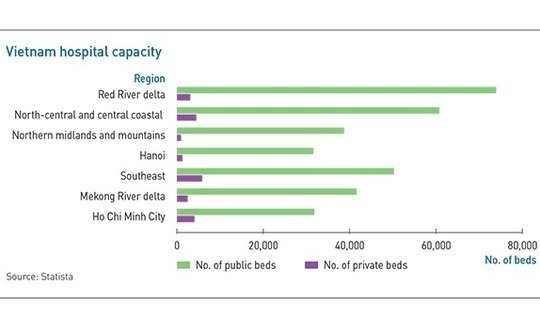

HFH also plans to exploit a geographic imbalance in this supply-demand equation. According to Statista, the ratio of private to public hospital beds is about 1-to-10 in southern Vietnam but only 1-to-20 in the country's north. As of 2018, metro Ho Chi Minh City and Hanoi each had about 32,000 public hospital beds, despite the latter having two million fewer inhabitants. Hanoi's private bed capacity, however, was 70% lower at 1,274 units.

Carving out market share here will be perhaps the least straightforward aspect of Navis' expansion effort, particularly as the profile of the target customer evolves and competition rises. Successful private clinics in the more cosmopolitan Ho Chi Min City have begun to penetrate deeper in Hanoi, including FV Hospital and Hoan My Hospital. To date, HFH's main local competitor is Vinmec International Hospital, although it lacks both HFH's longevity and its prestige location in Hanoi's traditional medical district.

"If you have the money, you can build a hospital and put in the most modern equipment, but really what makes a hospital work is the connection it has with its patients," Ireland observes. "That takes time and quality of doctors."

Middle-class maneuver

The key point about HFH as a value-add exercise is that it was not a business that needed fixing – it was merely no longer meeting its potential. In some ways, the challenge for Navis was to help the existing team understand that just because something isn't broken, it may still need to be "fixed." This required an inordinate amount of communication and manpower for an investment of this size.

The private equity firm deployed six investment professionals to HFH. Ireland is project leader while five others are variously tasked with overseeing upgrades in areas such as construction, design, and relevant third-party contracting, as well as HR issues, regulatory compliance, IT, financial reporting, and branding.

Navis team members flew in from around the region about twice a month to offer their assistance over the course of three years. This activity – which has temporarily stopped in recent weeks due to COVID-19 – is gradually slowing as project milestones have come to fruition.

"The insight of Navis has been to see the hospital for what it is, particularly the fact that it's always been a great hospital, but it was capacity-constrained in a growth market," says Peeters. "You have to look beyond the traditional clientele of a hospital to see that, and that's come with a step-by-step plan to actually make it work. You can point out an opportunity to make it bigger, but you need to do more than just throw cash at it."

One of the more incisive revamps has been in repositioning HFH as a hospital for the booming domestic middle class. Marketing was not a major necessity prior to the expansion. The 70-bed facility could easily maintain a full house as the de facto caregiver for Hanoi's expatriate community, tourists, and international business travellers. Now, the importance of wooing locals to fill empty beds has come into focus.

HFH's first attempts at expansion marketing took a well-worn approach among private hospitals, touting high quality standards and the expertise of international doctors. That wasn't hurting, but it didn't add value because it spoke primarily to an existing clientele through existing channels such as tour operators and traditional chambers of commerce.

"We weren't really present with the younger generation, and if you're thinking about maternity and pediatrics, diabetes, sports medicine, and those kinds of more future-oriented specialties, you have to tap into a different segment of the consumer base," says Peeters, adding that 88% of HFH patients are now Vietnamese.

Work on this point has included social media campaigning and development of a new website that showcases the best of the physical construction efforts while also highlighting products that cater to specific and immediate needs of a younger and more diversified consumer set. Vaccination for families is one of the more successful examples.

"People respond to that, you create value, and you create repeat business," Peeters adds. "It's really similar to consumer marketing in product-based businesses."

Efforts in this vein have been underpinned by an understanding of how to adapt to a fast-evolving landscape of increasingly digital-savvy consumers. Most recently, that includes analyzing what product offerings are going to be most in demand in post-COVID-19.

Fit for purpose

HFH expects a rapid and eager return to normal public usage of hospitals when the time is right, albeit with an increased emphasis on services related to breathing, lungs, and infections. That outlook will set the communication agenda for the next 2-3 months, combing an assessment of China's navigation of the crisis and an improved set of internal data courtesy of Navis' IT overhaul.

The incumbent IT system was more than a decade old, not scalable, and insufficiently robust to offer the level of information detail on costs and patient management that would be required of the enlarged operation. Installing new multilingual infrastructure -– Vietnamese, French, and English – presented several challenges. Most important of these was the fact that, in a hospital context, practically every employee in the building uses IT in some form.

Doctors and nurses, who were maintaining a perfectly successful and well-oiled machine prior to the investment, had to begin inputting data that they previously didn't have to address – and do so according to unfamiliar protocols. The mechanics of these processes are not particularly difficult, but Navis had to keep diplomatically emphasizing the utility of the exercise, even as it orchestrated a complex construction job on the building next door.

"We knew it was risky because it was going on at the same time we were building this whole new hospital, and we had to transfer everybody over. But we had to do it simultaneously, just because of time," Ireland says. "With any business, much less a hospital, there are always moments of pain with these things, but we persevered. It's just about keeping the momentum and preaching the importance of it."

HFH's newfound IT capacity could not have come at a better time. Social wariness around COVID-19 has seen a sharp drop in elective treatments that has in turn caused much of the business to go online. The most successful of these transitions has been in the monthly maternity workshops, which saw attendance per session jump from about 150 to 5,000 since going virtual two months ago.

It is worth noting that Vietnam is now seen by many as the regional leader in COVID-19 control, with only about 270 confirmed cases and no deaths at time of publication despite the containment challenges that come with a population around 100 million. HFH has had to follow strict rules, reporting three times daily to the Health Ministry and setting up an external perimeter that checks every incoming patient regardless of condition.

The experience has nonetheless been galvanizing for the HFH team and optimism is generally high. Obstetrics, which represents 25% of overall business, has naturally remained a stronghold. Hospital-wide, operational activity has never fallen below 50% of what would normally be expected. This week, the government suspension of a vaccination program was lifted, and the backlog is expected to be recouped in 3-4 weeks.

"We're very sensitive to people who are nervous about going back to the hospital, but it will take them a while," says Ireland, flagging more plans to turn crisis into opportunity. "We are now in the midst of launching quite a sophisticated telemedicine function where we will provide appointments and consultations with doctors. I want us to be the best at this. We're not scared to invest because we see this as something that's very important going forward."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.