VC and age: No industry for old men

The trendy, shape-shifting world of venture capital is broadly seen as a young person’s game, although hard evidence to this effect remains in scarce supply

In an era when the most influential VC investors and technical experts often prefer sweatshirts and jeans to blazers and ties, it is unsurprising that a counterintuitive age bias has crept into the industry. Indeed, the instinct to follow youthful guides in a fast-changing landscape of lifestyle trends may be best crystalized by the observation that casual dress has become a strange kind of reverse power play in negotiations. The t-shirt is confidence; the suit is a sales pitch.

The thinking here is not altogether illogical. Young people adapt more readily to change, are more tolerant to risk, and don't always recognize that what they're doing is supposed to be impossible. There remains serious wariness about a lack of experience with market cycles, but the prevailing sense is that the creation of the next Facebook or WhatsApp will be another young, grassroots phenomenon rather than a conglomerate or government-driven affair. Furthermore, it will be a young, likeminded investor who sniffs out the breakthrough.

Investors are more convinced of these ideas in the US than they are in Asia, at both the GP and LP level. Standout examples include two Boston-based VCs, Dorm Room Fund and Rough Draft Ventures. Both are student-focused and student-run, as well as financially anchored by esteemed VCs in the form of First Round Capital and General Catalyst, respectively. Their IRRs are a reference point for the risk-reward equation of betting on college-age GPs and entrepreneurs locally.

That dataset doesn't exist yet in Asia. And numbers are only half the problem – Asian VCs face a tougher cultural fight. The reverse power play of the dressed-down millennial has less oomph in the region's more traditional circles. Even VCs in their 40s and 50s – the first generation of Asian investors to be widely educated in the West – have brought home little in the way of Silicon Valley-style risk-taking.

"In Asia, and most specifically in Chinese culture, there is this unsaid rule that the elders know more," says Norman Chang, a co-founder of Rookie Fund, a Taiwan-based investor in the same vein as Dorm Room Fund. "That's deep rooted very early in life in a way it's hard to transform, even when you go overseas for college. So we're not just trying to empower the young generation by investing in them, we're trying to collect enough data to show the VC world that the younger generation in Asia is ready."

Age concern

Rookie Fund, which spun out of 500 Startups' Taiwan-based team in 2015, has no shortage of connections in the world of institutional LPs. However, Chang estimates that, to date, less than 2% of them have warmed up to the youth-targeting-youth thesis. The GP's most prominent backers include 500 Startups' US-based founder Dave McClure and Charles Huang, the Taiwanese creator of the Guitar Hero videogame.

Rookie Fund has enjoyed a more subversive success, however, with the development of an expansive network of unpaid mentors, many of whom are established investors themselves. Ostensibly, these professionals are giving back to the ecosystem in an almost philanthropic way. But the more practical suspicion is that they have identified a unique channel of deal flow and ideas that taps into youth trends under the cultural radar of older investors.

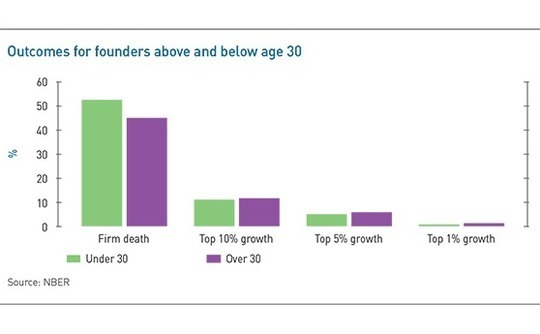

Still, it will take some time before most investors make a direct connection between youthful insights into consumer behavior trends and financial returns, especially given the available data. Research by the National Bureau of Economic Research in the US, for example, indicates that while entrepreneurs younger than 30 and older than 30 are mostly comparable in overall performance, divergences emerge where it matters most.

At the LP level, there is also the notion that age concerns have less to do with GPs understanding young entrepreneurs and more to do with longevity and energy. Compared to private equity, VC is significantly more sensitive to age, with LPs looking for managers who have enough stamina and career runway to tackle multiple 10-year funds while sitting on various company boards in disparate geographies.

Burnout under this pressure can happen as early as one's 50s, which causes many LPs to start raising succession questions with managers as young as 40. David York, a managing director at Top Tier Capital Partners, a VC-focused fund-of-funds based in the US, sees the optimal age for managers as being broadly in the 30s.

"VC is a contact sport from the standpoint that you've got to hustle and react quickly. It takes an enormous amount of energy to be successful and that tends to lend itself to younger people who haven't made a financial fortune," York says. "There has to be some model about apprenticeship, and that's not easy because probably 50% of the people who move up through the ranks don't work out. There's a fair amount of churn."

Changing zeitgeist

This is not to say that LPs can ignore the age issues that come with a growing generation gap between GPs and entrepreneurs. The accelerating pace of technological innovation and lifestyle change that colors almost every VC mission statement is creating ever wider cultural rifts and more nuanced risks around clinging to legacy mindsets, perhaps especially in developing economies.

Siddarth Pai, a founding partner at India's 3one4 Capital, sees distinct trends in young fund managers breaking away from larger VCs, as well as LPs viewing these investors as a way of getting much-needed exposure to disruption. Pai, who is 27, helped raise INR4 billion ($57 million) for his firm's latest seed fund last December from the likes of Japan's Sojitz Corporation and the Emory University endowment in the US.

"We have to divorce expertise and experience from age. Doing one year's work for 20 years doesn't give you 20 years' experience – it gives you one year's experience extended over 20 years," he says. "What was in vogue with start-ups even 10 years ago is no longer relevant. The tech framework, their approach to market, and the way they actually create code don't match up to what people who were part of the industry 10-15 years ago would do."

Much of the philosophy here is based on the idea that investors must be industry insiders to understand the relevant pain points and means of disruption. As a result, many entrepreneurs are now said to be actively seeking younger managers, and in Asia, the shift is strongly reinforced by social factors.

The relative sparsity of track records among young managers and founders in Asia is a hurdle compounded by elevated intergenerational skepticism about professionalism and reliability. To a significant degree, start-ups have attributed this effect to fewer students in the region taking out college loans or financing classes through part-time work versus their peers in other geographies. When university-age founders are entirely supported by their parents, it impacts the dynamics of a face-to-face with a seasoned VC.

"If you pitch to a slightly older investor, there's a little bit of a mental block. Entrepreneurs regress to when they were in school talking to authority figures, saying ‘yes sir, sorry sir, yes ma'am, sorry ma'am,'" Pai adds. "In India there are some investors that insist you call them ‘sir' and you follow this didactic pattern. That puts the entrepreneur off their game."

There is a hard truth is these observations: The relationship between young investors and young entrepreneurs will always be facilitated by a more natural and immediate sense of trust. Older VCs fielding questions about when they're too old to invest in youth-oriented categories are quick to point out the timeless, cross-generational virtues of open-mindedness and a passion for entrepreneurialism. But they can only forgo the intangible advantages of a peer-to-peer connection to a point.

There is no shortage of anecdotes about lifestyle unicorns that were initially rejected by the top brass at VC firms before younger staffers convinced their bosses to take a leap of faith. Communication is a strong theme here, with US messaging app Snapchat and Chinese news aggregation and short video platform ByteDance Technology among the most commonly cited examples. Branding these plays is also a challenge considered best met by youth leadership since decisions around style and persuasion can be too intuition-based to rely on feedback from formal surveying.

Play time

Perhaps the most youth-centric and fast-changing market of them all is videogames. This is a sprawling opportunity set that spans mobile apps, e-sports, and emerging technologies such as virtual reality (VR). Gamification is also a distinct trend across the communication and entertainment spheres, having penetrated social media and the film industry through interactive cross-content models.

China-based Ince Capital Partners, which spun out from Qiming Venture Partners last October, has raised $352 million from an LP base including university endowments and private equity firms for a consumer internet mandate with a specific interest in gaming. Steven Hu, a founding partner at Ince who previously served as CEO of a leading Chinese game publisher, is regarded as an authority on the local mobile gaming market.

Hu, who is in his 40s, says most of the revenue in this space comes from hard-to-predict homeruns, which are fueled by devoted gamers rather than casual players. He keeps his ear to the ground by playing new games with his daughters and understanding their preferences but admits that aligning industry-level technology readiness in emerging areas like VR with spikes in consumer appetite for any given product is not an exact science.

"The biggest problem for VCs investing in games is not age, but timing," he explains. "Timing is hard because when a game becomes a hit, they don't need your money anymore. In other sectors with social networks, the first-movers tend to become the biggest, but in gaming, the followers can win the market. You have to choose the right team at the right time, and we cannot forecast what kinds of games will be popular."

The Ince story suggests that much of industry believes specialist expertise and consistent market participation is enough to keep a VC in the loop as youth-driven categories evolve over the years. As one industry participant puts it: "Older VCs have been buying trends their whole lives, so they're always looking around the corner for the next big thing because that's what gets them up in the morning. It's more of a mindset than an age thing."

Nevertheless, the idea that generational culture gaps widen with the acceleration of technology's influence on lifestyle suggests that tracking behavioral trends may no longer be sufficiently savvy. Investors may have to embrace markets with more of a peer-level intimacy that is about knowing who the consumers are, not just what they want.

To illustrate this point, Rookie Fund's Chang, who describes himself as a millennial, says that even his generation suffers from a cultural disconnect with the younger adults his firm backs. He notes that well understood lifestyle verticals are getting sub-segmented by generation Z into unfamiliar categories that are problem-solving for unfamiliar preferences and anxieties.

One of Rookie Fund's seven portfolio companies to date is Rooit, a Taiwanese chat room operator focused on anonymity and game-style functionality. The company is said to cater to an entire demographic that doesn't feel comfortable making friends in person and without the use of technology as an intermediary.

"Dating has transformed into friendship, and making friends has become a segment," says Chang. "It can sound ridiculous and I have asked generation Z people, ‘honestly, is this really about finding blind dates,' but they say it's really just their way of making friends. That doesn't resonate with my life, but it's quite exciting. It makes me think about lifestyles and how people interact, and it makes me question what's happening."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.