Asia legal tech: Order in court

Legal tech investment is quietly booming from a small base, with the under-digitalized nature of law firms presenting both an opening and an inhibitor. First-mover ecosystems are self-organizing quickly

Taiger, a Singaporean start-up that uses artificial intelligence (AI) technology to streamline business processes, has been fielding requests from several local legal organizations about how to reduce the drains on their human capital. The challenge appears to be right up Taiger's alley, but this is no plug-and-play job.

Legal tech has emerged in recent years as an amalgamation of financial technology, cybersecurity, and business process automation. It faces some unique headwinds around cultural uptake, intellectual property, conflicts of interest, and the fact that much of the demand coming from lawyers requires bespoke products. These include a range of case management platforms, smart contracts, chatbots for legal advice, digital signature systems, and marketplaces for connecting lawyers with clients.

Reapplying existing tools in these applications is not an option. Product development must be undertaken on a client-by-client basis, with direct input from lawyers. The problem with this approach is that it pulls from the very resources it recognizes as under pressure: time and manpower. To make it work, Taiger took a $25 million Series B round earlier this month from a group including SGInnovate, a unit of Singapore's Infocomm Media Development Authority.

"We see contract auditing, document updating and document search as the most immediately areas of interest," says Joshua Kwah, a managing director at Taiger, noting the legal industry has been slow to adopt technologies like AI. "The inertia does impact tech providers as to how much groundwork in exploration and education we might need to undertake. To overcome that, we take a calibrated and collaborative approach, maximizing resources to clients who have a vision of where they want to go."

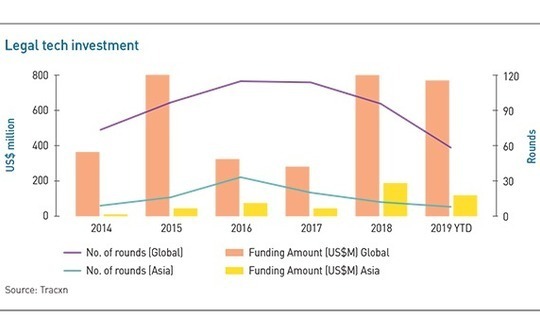

There is evidence that more start-ups, investors, and law firms are starting to take this plunge. Legal tech investment, excluding debt, grants and post-IPO rounds, grew 184% globally during 2018 to $794 million, according to Tracxn. It had reached $764 million by July of this year. Asian investment has been similarly meteoric on a reduced scale. Legal tech deals in the region hit $187 million in 2018 – a year-on-year increase of 318% – and $118 million in the first seven months of 2019.

The most active investors globally include Eight Roads Ventures, K1 Investment Management, 500 Startups, and Nextlaw Ventures, a US-based specialist in the segment. They have contributed to the emergence of nine unicorns to date, including Onit, LexisNexis, and LegalZoom, all based in the US. Asian standouts include BestSign, a Chinese digital signature specialist, and PatSnap, a Singaporean company that helps tech clients navigate the legalese of patent registration. They have raised $70 million and $50 million, respectively.

Strategic support

Singapore is the regional leader, with the government announcing a dedicated fund in May and backing initiatives such as the Future Law Innovation Program (FLIP), which brings together Infocomm and the Singapore Academy of Law's investment unit SAL Ventures. Late last year, FLIP went on to help law firm Clifford Chance launch its own incubator called Create+65.

FLIP currently has about 60 members, about a third of which are tech start-ups. The rest are in-house corporate legal departments and law firms, such as Linklaters, Dentons, and PwC Legal. Most of the opportunity here is at the smaller end of the spectrum, however, with about 80% of Singapore's law firms said to have five practitioners or less.

"With most of the smaller law firms, the way they onboard clients, manage contracts and communicate can be mapped out. We can tailor an affordable and meaningful program for them that can be scaled to multiple organizations," explains Noemie Alintissar-Mooney, a manager at FLIP. "The larger firms are trickier because they all have very different needs. It's about understanding inside and out who they are and what they're trying to achieve, more one on one."

Start-ups targeting smaller law firms are advised to begin with consultation work to analyze workflows, conscious that many bottlenecks may not require a tech solution. Where tech implementation is needed, a period of lawyer-technician cooperation is essential to establishing a product-market fit that is both usefully case-specific or potentially scalable. Taiger appears to be on this route.

At larger firms, the specially designed services required tend to have less scaling flexibility across a portfolio of clients. For example, some have looked to blend data processing efficiency with crisis management protocols to seamlessly manage client communications and security breaches. Others want systems for sharing in-house knowledge more efficiently while protecting intellectual property from competing law firms.

There are few rules of thumb for investors backing start-ups that want to scale their services across multiple law firms, especially since the demand side of the equation is so poorly understood. Accelerators like FLIP typically require a target market – such as data search automation for case briefings or precedent clauses – to be worth about $100 million globally. But it is widely acknowledged that these numbers are easily fudged.

As a result, most tech developers focused exclusively on the legal industry have not sufficiently fine-tuned their products or growth plans as yet, and most lawyers are still trying to articulate their needs. This limbo is further complicated by a basket of ethics issues that will probably play out differently in various regulatory environments.

Hand in glove

Many questions are expected to arise from the use of AI to advise on legal decisions or to generate legal advice. Who gives counsel authority in these situations and how to define the consequences of any legal mishandling are among the gray areas. Meanwhile, there is a nagging potential for conflicts of interest when lawyers who take sides on legal matters are allowed to advise on the creation of supposedly impartial arbitration infrastructure.

Taiger's Kwah says these issues require legal tech developers to work closely with in-market government authorities as a way of confirming boundaries and aligning tools such as AI systems to those boundaries. Australia's LawTech Hub, a collaboration between YBF Ventures and law firm Lander & Rogers, has followed this philosophy by engaging Philippa Ryan, the country's head of regulations for blockchain, as an independent board member.

Melbourne-based LawTech is less than six months old, but it is already expanding into Sydney, targeting fairly mature start-ups that have been through accelerators before. In addition to ecosystem creation, the program makes a priority of bridging the cultural gap between law firms and technologists. A big part of this effort is finding champions within law firms – typically junior lawyers with a taste for tech – who can be persuaded into deep engagement, including attending law tech events.

The idea is to bring the experiences of that tech development exposure back to the various departments at the law firm. This is a key point for investors because while the niche B2B nature of legal tech suggests a smaller market than otherwise similar B2C plays in areas like fintech, the lack of two-way commitment between tech developers and users is actually keeping adoption rates in check.

Start-ups have historically offered undifferentiated document assembly or practice management tools without proper consultation or processing of feedback with clients. Likewise, lawyers working in a partnership model have had little incentive to think long-term about modernizing their firms. Software is deployed and training sessions are run, but the necessary mind-shift is never inspired.

"They [lawyers] are happy to say it would be great and that it's really going to assist their practice, but then when you do a pilot and give them access to the technology, three months pass and they haven't logged in," says Michelle Grossman, head of innovation and transformation at Lander & Rogers. "I've found in my discussions across the board that in some of the bigger top-tier firms, where they have more widespread implementation, that has been a struggle for them."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.