Southeast Asia buyouts: Flexibility first

Southeast Asia has yet to deliver a consistent stream of large-cap buyout deals. Private equity investors must be creative, flexible and patient in trying to crack the market

Affinity Equity Partners completed its first deal in Thailand in 2000, buying a majority stake in National Semiconductor Electronics at a valuation of around $100 million. It was the largest PE transaction ever seen in the country. The GP had to wait nearly 20 years for its second investment, with a $200 million commitment to a local hospital chain closing earlier this year.

Thailand is an extreme case in Southeast Asia – it received less than one tenth of the PE capital deployed in each of Indonesia and Malaysia over the past decade – but the challenges faced by large-cap managers are fairly typical for the region. Ownership of assets is concentrated among a relatively small cluster of family groups, deal sourcing is a protracted process and large transactions are few and far between.

"Our view has always been that if you are trying to count the number of deals a year where you can write a check for $300 million and get control – which is what a lot of our peers appear to be looking for – you only need one hand, perhaps two," says Jeffrey Perlman, a managing director and head of Southeast Asia at Warburg Pincus. "Those deals will be intermediated, highly competitive, and trade for rich multiples."

Private equity investment in the region is steadily increasing. Average annual deployment for 2015-2018 came to $12.9 billion, up from $7.9 billion and $9.7 billion for the preceding two four-year periods. More private equity deals are happening – exclude early-stage transactions and the average for 2015-2018 is 150 deals per year compared to 123 in 2011-2014 – and across a wider variety of markets. Regional flights out of Singapore are increasingly populated by PE executives on the buyout trail.

However, deal flow remains notoriously lumpy. A record $21.4 billion was deployed in 2017, but two transactions accounted for about half of that: the Hillhouse Capital and Hopu Investment-backed privatization of warehouse operator GLP, which has a bigger footprint in China than Southeast Asia; and Global Infrastructure Partners' purchase of a renewables portfolio from Equis Funds Group, a deal of unusual size for its type in Asia.

These are the two largest out of only about a dozen $1 billion-plus transactions in Southeast Asia over the past five-and-a-half years. Half of these are not classified as buyouts, with the rise of growth-stage rounds for internet-oriented businesses such as Go-Jek, Grab and Tokopedia an increasingly prevalent trend.

Going large

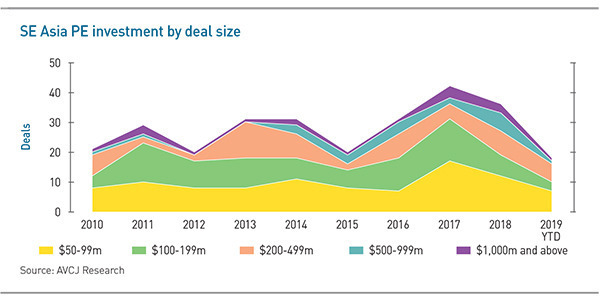

There were four deals of $1 billion and above in 2017 and three in 2018, but only one so far this year, according to AVCJ Research. More discernable increases in activity are apparent further down the size spectrum. Between 2015 and 2018, 15 transactions of $500-999 million were announced, a threefold increase on the preceding four years. The number of deals in the $100-499 million range held steady at approximately 60 in each of the two periods. Nine more have emerged so far in 2019.

"For me, a large-cap buyout would be an enterprise valuation in excess of $500 million, and those are rare. GLP and the Equis portfolio were the headline deals signed in 2017 and closed last year. I can't think of any private equity buyouts of that magnitude since then," says Lee Taylor, a partner at law firm King & Spalding. "But in the $100-500 million space, there are more deals than ever before."

About eight years ago, global and pan-regional firms were busy measuring for office space in Singapore as they laid the ground for an expected surge in Southeast Asia large-cap deal flow. "Everyone was hoping to do more, but they've been proved wrong," says one regional buyout fund manager. "Some have started doing much smaller deals, which suggest they can't find anything to do, or they are just going after those cash-burning internet companies."

Even when a large-cap deal is available, investors are likely to face stiff strategic competition, especially for consumer-related assets. Columbia Pacific Management's portfolio of hospitals in Southeast Asia – predominantly Malaysia – and India is currently on the block with a $2 billion price tag. Three bidders have reportedly been shortlisted, of which two are local conglomerates, although TPG Capital is said to be working in tandem with one of them.

For financial sponsors battling strategic players for assets in markets that do not have top-notch creditor laws, there are limits on how far they can push the envelope on financing. KKR was able to secure institutional financing out of the US for its $1.1 billion acquisition of Goodpack in 2014, but the pallet provider has a multinational client base. Deals in Malaysia and Thailand tend to be financed by local banks that have ties with competing local corporates.

"In markets like Indonesia and Malaysia, you cannot perfect security, so you fall into the unsecured regime and that's typically where high yield kicks in as a back-up. The interest coupon on high yield tends to be a few hundred percentage points higher, depending on the circumstances," says Lyndon Hsu, global head, leveraged & structured solutions at Standard Chartered.

Hsu compares the willingness of global PE firms to come down the size spectrum in India and the dynamic emerging in Southeast Asia. KKR, for example, put $366 million to work in 2018 with Singaporean luxury group V3 a year after paying just $74 million for a minority stake in Indonesian bakery Nippon Indosari Corpindo.

CDH Investments, a Chinese GP that looks at cross-border investments with relevance to its home market, is among those that have compromised on deal size. The firm wants to write equity checks of at least $100 million, but in Southeast Asia the historical range has been $25-75 million. "This is a function of the opportunity set rather than our appetite," says Thomas Lanyi, a managing director with the firm.

While more markets have become viable targets for private equity, Lanyi claims the speed of this opening up has, if anything, been slightly disappointing. Myanmar has flattered to deceive, the Philippines is a challenge for anyone who is not an insider, and Indonesia was until recently known for high valuations and "quasi-mezzanine structures" that – from CDH's point of view – involved taking equity risk for debt-like returns.

"A lot of the deal flow has been suboptimal or of low quality," Lanyi adds. "By the time a deal gets to institutional private equity it has already been chewed over by the family conglomerates."

Vietnam is the exception to this rule, in part because the nature of corporate ownership differs from other markets. The average deal size has tripled in the past decade and investors see increasing opportunities to deploy more than $50 million, and in some cases $100 million, per transaction. Private equity investment in the country between 2015 and 2018 was $4.6 billion, a 75% increase on the preceding four years.

Beyond control

Most of the capital deployed by Warburg Pincus in Southeast Asia has gone into Vietnam. The firm recently closed its second regional companion fund, which invests alongside its global flagship vehicle, at $4.25 billion, up from $2 billion in the previous vintage. That earlier fund was designated a China vehicle with a side pocket for Southeast Asia. Now, though, the two territories share top billing. Warburg Pincus has gained traction through its flexibility.

"We look for scalable business opportunities, whether they are platforms or existing businesses that will be users of capital, and we employ a line of equity or staged investment structure whereby we can still put meaningful dollars to work," says Perlman. "We end up writing similar size checks to our peers, but we think in a more de-risked fashion. Phasing in capital is good from a risk management perspective and an IRR perspective. It is also helpful if local currencies are depreciating."

The firm has made investments across real estate, logistics and infrastructure in Vietnam and Indonesia, but Warburg Pincus has also backed technology start-ups through conventional growth-style structures. Minority investments were central to the firm's strategy when entering China and India, and Southeast Asia is following the same path, although the capital-intensive nature of the platform deals can result in Warburg Pincus gradually moving from a minority to a majority position.

The private equity opportunity set in Southeast Asia will almost certainly continue to expand as the region's economies mature. Buyouts may also gain traction as founder-entrepreneurs become more comfortable selling to financials sponsors and positive experiences from the current crop of deals filter through local networks. As for the family groups that dominate certain countries, GPs must find ways to work with them. CVC Capital Partners has already achieved this in Indonesia.

As such, deal sourcing is likely to remain protracted, even if it ultimately culminates in an auction process. "I was working on a deal in Southeast Asia where the winning bidder had been courting the company and management team for about seven years," says Taylor of King & Spalding. "That's how these guys get their deals. They originate them well in advance."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.