Japan PE fundraising: Upsizing

Japanese private equity firms are looking to raise larger funds, based on what is described as a blossoming investment opportunity. Do they risk biting off more than they can chew?

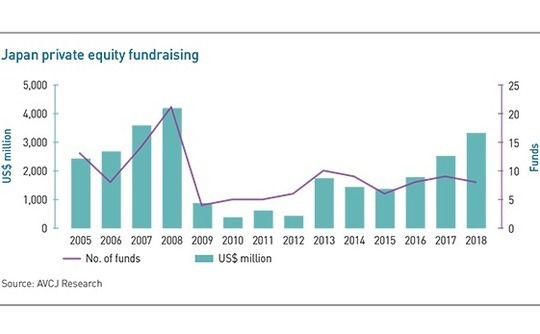

Japanese private equity has been here before. Between 2004 and 2007, investors plowed more than $30 billion into buyouts, roughly three times the aggregate for the previous four years and twice the amount that would be deployed in the four years that followed. It wasn't just global managers writing large checks. This was the era of Tokyo Star Bank and Covalent Materials, landmark deals that saw local GPs step up in size – only to step back when the market turned. In the bitter aftermath, it was uncertain whether some of these franchises would survive.

These recollections give context to the concerns now being expressed as several managers look to raise substantially larger funds than in previous vintages. "History always repeats itself and people forget about the pain," says Megumi Kiyozuka, a managing director with CLSA Capital Partners, which raised $400 million for its last fund in 2017. "I have been in private equity long enough that I remember the pain, and that's why I have no plans to increase our fund size significantly."

Though the refrain might be familiar, others argue that the market is singing a different tune. The two main sources of private equity deal flow, corporate carve-outs and founder-succession situations, have been turbo-charged in recent years by a combination of regulatory pressure, changing financial realities, age, and a growing appreciation of what financial investors can offer. Bigger ticket opportunities are available in both segments, which warrants larger funds.

Several industry participants add that the lessons of the previous cycle have been learned, resulting in strategies that are underpinned by greater discipline. Nevertheless, at a time when capital appears to be flowing more freely into Japanese private equity – from foreign and domestic investors – than at any time in the past decade, managers must separate temptations around how much they can raise from cold assessments of what can be efficiently deployed.

"This next fund cycle is probably when the judgment of each GP really kicks in," says Tatsuo Kawasaki, a partner at Unison Capital, one of the participants in the Covalent deal in 2006. "I don't know if it is smart to revisit what we did two or three funds ago. Our focus has become a lot more about fixing up medium-sized businesses and presenting them to strategic buyers. We are mindful of where most of the liquidity is in the M&A market, and it's not in the $1-2 billion space."

Bigger targets

A few GPs are now setting their sights on this segment. Last year, Japan Industrial Partners (JIP) closed its fifth fund on JPY148.5 billion ($1.37 billion), including JPY46.2 billion for a co-investment vehicle. In the previous vintage, the firm raised JPY67.4 billion. Polaris Capital is also looking to surpass $1 billion. The firm is seeking approximately JPY120 billion for Fund V, up from JPY75 billion last time around. Briefings regarding a JPY150 billion target are said to reflect the potential inclusion of a sidecar vehicle.

The Carlyle Group has traditionally operated in a higher tier, closing its third Japan fund at JPY119.5 billion in 2015. The firm is now looking to scale up to JPY217 billion, according to industry sources. This would represent a return to form for the manager, which raised JPY215 billion for Fund II in 2006, only to pare back the corpus JPY165.6 billion in response to weaker-than-expected deal flow.

Advantage Partners raised JPY215 billion for its fourth fund the same year, a more than fourfold increase on the previous vintage. It took years to repair the damage wrought by Tokyo Star Bank. A JPY20 billion bridge fund was raised in the interim before the manager closed a full-size fifth vehicle of JPY60 billion in 2016. Unison also went into repair mode, a third fund of JPY140 billion in 2008 followed by a fourth of JPY70 billion in 2015.

Speaking to AVCJ last year, Hironobu Wakabayashi, a managing director at carve-out specialist JIP, was unequivocal on the reasons for the fund size increase: they are seeing a greater number of larger deals. Whereas in the past corporates were often wary of JIP's proposals, "now they are somewhat more inclined to listen." The number of transactions available per year has risen from mid-single digits to low teens in recent years.

For its part, Carlyle expects to continue pursuing a mixture of succession and carve-out transactions. The three announced in 2019 were all succession, but Kazuhiro Yamada, head of the firm's Japan buyout team, notes that average deal sizes are rising across the market within the $100-300 million equity check space. "Over the next five years, the market is really going to emerge," he says. "The spin-outs may take time, and deal flow will still be lumpy, but we are in active discussions with conglomerates over large opportunities."

It is difficult to capture the scope of the carve-out universe. AVCJ Research's records show an uptick from 2016 when approximately two dozen of these deals helped the number of buyouts in Japan surpass 80 for the first time. There were only 30 carve-outs across the three previous years. Since then, the share has hovered around 25% – it hit 20% once between 2013 and 2015, even as overall deal flow has abated. The more challenging aspect is pinpointing changes in average transaction size.

Kazushige Kobayashi, a managing director with Capital Dynamics, estimates Japan sees around 100 buyouts a year and more than 70% are succession situations. The market quickly thins out above the $50 million equity check mark, with around 20 deals a year, of which no more than 10 exceed $100 million. Nevertheless, he claims that the industry pipeline is increasingly populated by carve-outs, and not just as the top end. Mid-market deals are also on the rise.

Mid-cap movements

This is one of the reasons why several smaller Japanese managers are looking to increase their fund sizes as well. J-Star, for example, is said to have set a target of JPY42.5 billion for its fourth vehicle, compared to JPY32.5 billion last time, while Aspirant Group wants to double the JPY27.2 billion it raised in 2016. Both are tracking corporate divestments. For J-Star, it represents the extension of a strategy previously dominated by succession, although more of those deals are expected too.

"We will do more carve-outs, and the ticket sizes will be larger," says Greg Hara, CEO of J-Star. He declined to comment on fundraising specifically. "These deals start at the large end of the market because the impact on the balance sheet is greater. I remember going to see a very large publicly traded Japanese corporation more than ten years ago, and the planning guy suggested we buy ten subsidiaries at once because he didn't want to deal with several single-digit million-dollar deals. It didn't happen, but the message was clear."

Hara believes divestments are filtering through to the mid-cap space in part because Japan's labor shortage is weighing heavily on smaller companies as well as the assorted governance and competitive pressures faced by their larger peers. Workforces are shrinking so businesses must manage bigger balance sheets per capita or employee. One of the easiest ways to address this problem is selling off non-core divisions.

The obvious due diligence question for LPs is whether the strategy makes sense. Joji Takeuchi, head of private asset investments at Asset Management One, gives two reasons why taking a fund into $1 billion territory shouldn't necessarily be dismissed out of hand. First, there has been space in the upper middle market ever since the principal investment arms of Japan's banks vacated it after the global financial crisis. Macro conditions are stable enough and PE deal flow strong enough to justify a return. Second, managers are more thoughtful about fundraising than 10 years ago.

Beyond that, judgments are made on a case-by-case basis. "Whenever there is a big increase in fund size, I really need to understand what the GPs are thinking. Are they raising more money purely because they can, or do they have genuine conviction that they can deploy it well, and if so, how?" Takeuchi says.

Some institutional investors still claim to be unsure of the current dynamics in Japan. Asked to explain a reluctance to make commitments in the middle market, one international LP observes that managers are either paying over the odds for assets as they try to step up in fund size or deploying too slowly. Others admit to passing on GPs seeking to raise twice as much money as last time because they were unconvinced that the shift in strategy would translate into better returns.

Tadasu Matsuo, head of alternative investment at Japan Post Insurance, acknowledges that more buyout opportunities are available, but stresses the importance of having the right execution capabilities. "For GPs that haven't done carve-outs before and expand into this space without relevant skills and experience, there could be a problem," he says. "If they still focus on succession and do a few carve-outs – so there isn't a big hike in fund size – we're more comfortable with that."

Execution issues

The two deal types present different challenges in terms of sourcing and negotiation. Whereas succession transactions hinge on convincing a founder to cede control of a business to which he has strong emotional ties, carve-outs tend to be a three-way conversation involving a seller interested in getting a good price and a stable transition, an existing management team that may need incentivizing to stay on, and the private equity buyer.

This extends to the post-investment period as well. Augmenting existing systems and personnel is needed in most succession situations; carve-outs require a wholesale replacement of functions previously covered by the corporate parent. A newly independent company must establish its own centralized administrative structures from IT and finance to logistics and human resources. A rebrand might also be on the to-do list once rights to the parent's trademarks expire.

The Longreach Group's acquisition of precision drilling business Hitachi Via Mechanics in 2013 was a classic middle-market play. But Mark Chiba, the PE firm's group chairman and partner, notes that it "could have been an $800 million deal" based on the level of sector expertise and operational impact required. "We went to fab-lite manufacturing, built a new factory, moved away from unprofitable customers, focused on higher end products and changed CEO a couple of times," he says.

Chiba also observes that the cross-border elements of working on a sophisticated industrial business – such as managing facilities and supplier relationships in China and Southeast Asia, understanding how Korean competitors approach a sector, and navigating geopolitical trade tensions – might be beyond some smaller domestic GPs. Even with Japanese consumer companies, growth strategies may depend on expansion capabilities within broader Asia.

Assuming the average equity check for a succession deal is $20 million and a manager wants to a portfolio of no more than 15 companies, the upper limit on fund size would be $300 million. Moving beyond that means writing larger checks, which almost certainly involves targeting carve-outs. This is not necessarily a problem; moving from $300 million to $500 million equates to dipping a toe in the carve-out space. But when a fund hits $1 billion, that's approaching full immersion.

Larger checks typically mean higher entry valuations. The EBITDA multiple for a carve-out is usually mid to low teens, industry participants say, although they note that it varies by sector and circumstance. Succession deals tend to command single-digit multiples. The combination of uncertainty over deal supply, working with larger, less wieldy businesses, and needing to extract more value or use more leverage to deliver the desired return is a turn-off for some GPs.

"Everybody talks about a tsunami of activity coming from carve-outs, but it hasn't happened as envisioned. Though more carve-outs will come over the next five years, with business succession there is the expectation of a fourfold increase in deal volume during the same period," says Jun Tsusaka, managing partner of NSSK, which is investing a JPY60 billion fund and primarily targets succession. "Until there is a sustainable market, we are generally cautious about raising too much money in the hope of doing larger deals, which require a different modus operandi and have different levels of complexity."

Shifting sands

However, the gravitational shift is unmistakable - and some see it as desirable. Five years ago, the industry split easily into two camps: local managers chasing small to mid-cap transactions; and pan-regional and global players snapping up mega deals interspersed with more modest investments if they wanted to make their presence felt. Increasing segmentation within the local GP community could be interpreted as a sign of the market's maturity. Managers see scope for differentiation, and they are pursuing it.

Unison, for example, has adopted a platform model, recruiting two teams to pursue roll-up acquisitions in different segments of the healthcare sector. Business development and value creation initiatives fall within the purview of those executives, who are answerable to the fund like any other portfolio company management team and receive resources from it. The idea is that they operate – and are perceived – as industry insiders rather than financial investors.

"It is easier for corporate sellers to come and talk to us because we don't look and smell like financial guys, which means we have a much better view of where the opportunities might be," says Unison's Kawasaki. "Will there be more mid-market carve-outs? If you are relying on advisors to bring you deals, there's no telling how it will work out. But if you go out there and approach companies, insider to insider, you see things differently."

Some of these approaches may flounder, but probably not due to a lack of opportunities. The more substantial risk is that local managers try to evolve too quickly, moving aggressively into areas where they previously haven't operated and writing larger checks than they've ever written before. These GPs might be making investments made possible by structural – perhaps inexorable – changes in the market, but a lack of discipline would still leave them susceptible to cyclical forces.

According to Tsuyoshi Imai, a partner with Ropes & Gray, a host of domestic private equity firms are now bidding on $200 million assets, something that would have been unheard of a couple of years ago. Yet he sees room for improvement in their negotiating stances, particularly in areas such as financing, where there is far less pushback on downside protection terms compared to global firms.

"There will come a time when there is a slowdown, or a dip, and a lot of the smaller funds get beaten up," Imai says, before adding that work has never been busier – more activity in the mid to upper tiers of the market, with larger succession deals as well as carve-outs on the table – and there's no end in sight. "It's going to be busy for at least the next five years," he asserts.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.