Vietnam: Entrepreneurial instincts

Vietnam’s private sector is rich in opportunity and many people have ambitions of building the next Mobile World. But engagement between entrepreneurs and private equity doesn’t always run smooth

For the first time, Nguyen Duc Tai was stumped. Asked what he might do differently if given the chance to helm Mobile World's journey to the peak of Vietnamese retail once again, Tai observed that he seldom revisited the past because there is so much to do in the present. After a few moments of thought, he told the AVCJ Vietnam Forum: "I'm sorry I cannot answer the question."

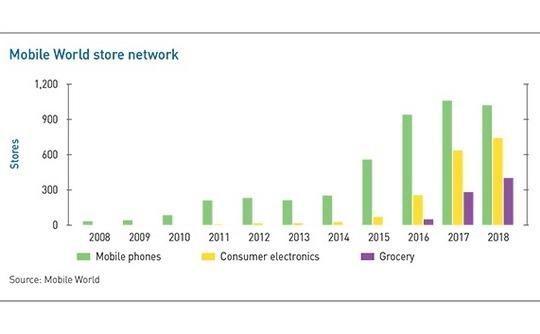

Mobile World is one of the country's biggest private sector success stories. Launched in 2004 by Tai and four co-founders, who together contributed $100,000 in start-up capital, the company is now the leading mobile phone and consumer electronics retailer with 2,300 stores and revenue of VND86.5 billion ($3.7 billion) in 2018. More than 500 of those outlets are supermarkets as Mobile World looks to apply its modern retail strategy to the grocery segment. The company listed in 2014

It is a story that others are understandably trying to replicate. "We are so excited by the type of entrepreneurs we are investing in today. It has evolved so much from our first fund in 2002," says Chad Ovel, a partner at Mekong Capital, which backed Mobile World in 2007 when it had seven stores. "Entrepreneurs today are much younger, well-traveled, almost all are fluent in English and extremely well studied. And they are very growth ambitious, setting outrageous targets."

The opportunity for private equity is significant, but so too are the risks in a private sector that is barely 25 years old. While there is scope for modernization and consolidation everywhere, from pharmacies to pawn shops, success is contingent on establishing strong partnerships. Distrust between investor and investee – which limits the capacity for value creation – and companies that can't scale because they fail to augment management are still relatively common occurrences.

"The traditional problem we have seen in Vietnam is a lack of understanding about what a reasonable structure might look like. Investors that would happily pay 10%, have no rights at all and sit in the corner still exist, but they are rare these days," says Andrew Thompson, head of private equity for Asia Pacific at KPMG. "PE is about creating value by turning good companies into great companies. You can't get that if the deal proposed is ‘We just want your money, now go away.'"

The expectations game

Until he was approached by Mekong, Tai had never heard of the concept of private equity, but he quickly recognized what might be achieved with the additional capital. It took Mobile World 12 months to accumulate enough money from its first store to bankroll the launch of a second. A third followed six months after that. With Mekong's support, the store count reached 209 by 2011.

Over time, Tai began to appreciate that his financial investor was about more than finance. Improvements were made in areas such as reporting systems and human resources management, while external advisors shared best practices of retail in overseas markets. "Honesty and openness are very important when working with private equity," he says. "If you are not open with them, how can they contribute value?"

"We have been fortunate to have a long relationship with Masan [KKR backed the Vietnamese conglomerate's consumer unit in 2011 and its livestock unit in 2017, while also investing in the parent group] and can demonstrate some of those things. But there aren't many data points in the country just yet, particularly at scale. We are trying to overcome that."

Failures to appreciate the full scope of a PE offering also factor into pricing considerations. There is a tendency among founder-entrepreneurs to use heady valuations from other transactions as a reference point and demand something similar, with little regard to the bona fides of the buyer.

"I have seen people haggling excessively over entry valuations and ending up with partners that are not going to add as much value as other investors," Thompson says. "There is a difference between a sovereign wealth fund investment that will be passive in nature and someone who is going to mobilize best-in-class global resources to drive a business forward."

Mobile World's five-strong founding team – and the absence of a patriarchal, family-led governance structure – was always viewed positively by investors. Nevertheless, the company experienced growing pains. In 2012, for example, stores were opening at a faster pace than the supporting infrastructure. Investors previously told AVCJ that inventory selection and management were the root cause of the problem and it took the best part of a year to bring costs back under control.

Tai identifies customer service as another area in which Mobile World struggled to maintain high standards as its footprint continued to grow. They slowed expansion while figuring out a solution. The result was a recalibrated management and incentive system, whereby customer service quality became the key consideration when deciding whether someone deserved a promotion.

People problems

However, an arguably more fundamental leadership challenge came much earlier. Tai validated locations for the first 40 stores personally but realized that these duties would have to be delegated for Mobile World to achieve scale. "When I talk to other businessmen it's all about trust," he says. "They worry that an employee will move to a competitor and take the knowledge with them. If you keep all the knowledge to yourself you will remain a family business, you cannot grow fast."

Mekong's Ovel believes this is the biggest obstacle facing Vietnam's entrepreneurs once they receive capital and embark on ambitious expansion strategies. "The question is how we can help those entrepreneurs and founders keep the wheels on the bus. It comes down to how good they are at building their management team," he says. "This is an area we spend a lot of time on. We have an in-house team of four people called our talent and culture team that helps our companies recruit."

Given the high correlation between private equity returns and the quality of a portfolio company's management team, difficult conversations about personnel can ultimately be worth it. There is often a reluctance around bringing in talent on high salaries – perhaps higher than those awarded to the incumbent management – recruiting people who have no connections to the founding family, and relying on non-Vietnamese executives, even if English is already widely used among management.

Agreeing to such changes means overcoming fears about losing control. A founder's response is instructive because during the onward journey a unified sense of purpose – and with it a clear statement of identity – is incredibly important. "Unless the founder and management are laser-focused in maintaining the consistency of their corporate culture, what naturally happens when there is a high level of recruitment is the culture gets diluted and it becomes messy," says Ovel. "We support them in defining what behaviors they expect from their team to fulfil long-term goals."

Tai decided to establish Mobile World after a shopping trip with his wife ended in frustration because none of the salespeople were able to listen to his needs and recommend which mobile phone he should buy. A trip to Mongkok in Hong Kong underlined the potential of unleashing modern retail in Vietnam.

But there is a stark difference between coming up with an idea and putting it into practice. Tai's advice to those who want to create the next big brand is to learn their trade. He served as head of strategic development for one of Vietnam's mobile operators before starting his own business and then held a range of different positions – across finance and accounting, marketing and sales, and logistics – as Mobile World was built from the ground up. The experience was invaluable.

"It's hard to find a company in Vietnam that has two shops and thinks about the behind-the-scenes controls. Some of our competitors have 100 stores but they still rely on Excel and email," he notes. "I tell people to go and find a good company where they can learn, not just get a good salary. After five years they can think about setting up something for themselves. Otherwise, I don't think they will be successful."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.