Southeast Asia manufacturing: Back in the game

Contract manufacturers are reconsidering their exposure to China in the light of trade tensions with the US. Southeast Asia stands to benefit, but companies will have to navigate an increasingly complicated landscape

To say that Foxconn dominates the contract electronics manufacturing industry would be too modest; in the eyes of many, it is the industry. If Apple took industrial design to new heights within the consumer products sphere, Foxconn has been instrumental in its commercial realization – at scale and at affordable price points. The Taiwanese group's 3.9 square-kilometer facility in Shenzhen is the location of final assembly for the majority of iPhones and iPads.

So when Foxconn announced earlier this year that it was building a new factory in Vietnam and expanding its India operation, the move took on a significance far beyond a normal international expansion. The company's decision is widely seen as a bid to spread its operations beyond China as a hedge against the ongoing trade tensions with the US, a view reinforced by fellow iPhone manufacturer Pegatron's move to open new factories in Vietnam, Indonesia, and India.

These developments have troubling implications for the Chinese economy, but one country's loss may turn out to be another's gain. For Southeast Asia in particular, investors are optimistic that the deepening struggle between the world's two largest economies will help the region recapture a share of the manufacturing market that it lost in the previous decades.

"Southeast Asia has been part of the global electronics supply chain for the longest time. It didn't steal IP [intellectual property] or try to establish global dominance," says Wai San Loke, founder and managing partner at Novo Tellus Capital Partners, which targets industrial and technology deals in the region. "Likewise, it's a trusted friend to China as well. It's never going to be as big as the US and China in importance, but it's been overlooked for far too long. From an investor's perspective there's a great opportunity."

Taking advantage of this opening will not be straightforward. Southeast Asia has a strong manufacturing base, with electronics accounting for over 25% of ASEAN's $1.3 trillion in exports in 2017. But the largest customers for electronics and other consumer goods have grown to expect a level of efficiency that will be difficult to establish in such a fragmented market. The region requires time to reestablish itself as a manufacturer of choice.

Electronics superpower

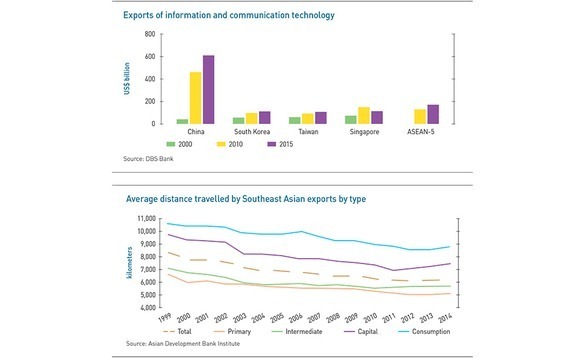

As Foxconn represents the contract electronics manufacturing industry in the West, so the industry itself has come to represent China's dominance in global manufacturing. The country's growth as an exporter of electronics has been explosive: a study last year by DBS Bank found that China's shipments of information and communications technology grew from $44 billion in 2000 – smaller than South Korea, Taiwan, and Singapore – to $608 billion by 2015.

The 2015 total was larger than all three of its historical rivals combined, plus Malaysia, Thailand, Indonesia, the Philippines, and Vietnam, collectively referred to as ASEAN-5, which DBS did not track in 2000. China also led in each of the subsectors: computers and peripheral equipment, communication equipment, consumer electronics, and electronic components.

However, even before recent tussles with the US, seeds for the exit of manufacturing contractors were being laid. For many observers it has been clear for the better part of a decade that change was inevitable.

"The structural trend of China becoming more nationalistic and the cost of land and labor going up didn't happen overnight," says Jovasky Pang, co-founder and CEO of Archipelago Capital Partners, which invests in niche industrial segments in Southeast Asia as well as consumer, healthcare and financial services. "In fact, Southeast Asia overtook China as Japan's main FDI destination in 2014, which was also the year China's labor force hit its peak."

The potential for Southeast Asian manufacturing was suggested in a 2016 study by the Asian Development Bank Institute (ADBI) that analyzed the distance travelled by exports of goods across Asia at various stages of production. By tracking primary and intermediate-stage goods – production inputs destined for further assembly – along with capital and consumption goods, intended for final markets, the study aimed to determine how the manufacturing sector had evolved in the region since 1999.

Unsurprisingly, the results show a gradual centralization of the production process in China, with the average distance travelled declining for Japan, South Korea, and Southeast Asia, but rising for China – from around 6,500 kilometers on average for all classes of goods in 1999 to more than 7,000 km in 2014. This indicates that manufacturers of end products for Western markets were relocating to China, while regional producers of inputs increasingly sent their goods to Chinese factories for final assembly.

For Southeast Asia, however, this decline started to reverse in 2011 as capital goods began traveling longer distances, with consumption goods following suit the next year. By 2014, the distances for both categories were still far below their earlier levels – around 16,000 km overall, compared to nearly 21,000 km for 1999. But the data suggest that global consumer goods businesses were discovering a renewed appreciation for the region's manufacturers.

The signs of a revival have continued as a result of uncertainty regarding China. It is predicted that as the China-US trade talks drag on the trend towards Southeast Asia will accelerate as multinationals seek to insulate themselves from becoming collateral damage to salvoes from both sides.

"People were already saying that low-end Chinese manufacturing, like textiles, would have to move to Vietnam, Bangladesh, and so on," says Derek Scissors, an economist at the American Enterprise Institute. "Now, with this additional uncertainty, it's going to move faster – you're going to see people who thought they had five to 10 more years of China being the most competitive area for production deciding that they may only have two."

Innate appeal

Evidence for this phenomenon has grown in recent months. Along with Foxconn and Pegatron, several other Taiwanese contract electronics manufacturers such as Compal and Wistron have announced plans this year to relocate part of their production from China to India or Southeast Asia. South Korean car maker Hyundai Motor Group also received approval in December to build an electric vehicle factory in Indonesia. All have cited the trade tensions as a motivation for reducing their reliance on China.

Southeast Asia is an attractive destination for several reasons. First, the region's population, while nowhere near the size of China's, is considerably younger on average, with a median age of 27. This means manufacturers can draw from a growing pool of laborers at their most productive age.

Second, Southeast Asia has long experience with contract manufacturing – its exports of capital and consumption goods traveled longer distances than any other region in Asia prior to the rise of China and covered a wide range of areas. Semiconductors in particular have been a bulwark in Southeast Asia – microchip manufacturers such as Intel and Motorola have had bases in the region for decades. A generation of skilled managers and engineers trained at these plants, many of whom currently work in China and could easily move back home.

"If I was a large multinational and I wanted to guarantee the Six Sigma standard of less than five defects per million, my global supply chain would need to understand that," says Novo Tellus' Loke. "That understanding has been ingrained in a lot of Southeast Asian managers since the 1980s."

Despite these advantages, rebuilding the region's manufacturing base will not be as simple as relocating factories back home. China's years of dominance have reshaped customer expectations around contract manufacturing, and most of the limitations that drew companies away from Southeast Asia in the first place have not been resolved.

For global consumer brands, the most obvious gain from centralizing production in China has been the low labor cost – for example, in a 2016 teardown, market research firm IHS Markit estimated that out of the $224.80 factory cost of an iPhone 7, only $5 comprised assembly labor, with the rest going to materials. The labor savings have allowed retailers like Wal-Mart to keep the prices of their products low, while contributing to massive profits for premium brands such as Apple.

This cost gap alone is not insurmountable for Southeast Asian countries, but it will be much more difficult to replicate the logistical networks that multinational firms have built up in China over the last 20 years to accelerate delivery of primary and intermediate materials for just-in-time manufacturing. Redirecting these networks from a single large complex like Foxconn's to any number of smaller factories across several countries will create burdens few in Southeast Asia are prepared to handle.

"No single country in Southeast Asia can have the integrated supply chain and the capacity for the volume that China produces," says Archipelago's Pang. "You are looking at a fundamental shift in the way these countries have to plan around industrial cities and cater to the industries they are trying to attract, and that takes time."

A complex future

Investors will also need to bear in mind that Southeast Asia is not the only destination for manufacturers relocating from China. As the only market with a population rivaling China's, India could put up a significant challenge despite its own historically fragmented logistics space. Mexico might also benefit from instability in the China-US relationship thanks to its proximity to the US and Europe.

Moreover, the next phase of contract manufacturing is expected to be more nuanced than the winner-take-all themes that have characterized previous stages. Loke describes the current China-dominated environment as Asia 3.0 – following 1.0, in which Japan led the way, and 2.0, where Southeast Asia took the baton. The future will likely see manufacturing split among several markets based on their strengths: textiles in Vietnam and Bangladesh and consumer electronics in Malaysia or Mexico, for example, with China retaining a reduced but still large share overall.

However, this fragmentation – when coupled with advances in technology and analytics that make it easier to coordinate shipments from multiple locations – also means that the global flow of production inputs will become ever more complicated. Success will depend on local manufacturers' ability to integrate themselves into the processes demanded by their customers.

"It's no longer enough to offer low labor costs and good logistics. What is far more needed now is that you can also offer IT connectivity and that you have skilled people who can manage a relatively complex procurement process," says Matthias Helble, a research economist at ADBI in Tokyo. "There are more and more limits for countries that are at the bottom to be able to join these supply chains."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.