VC documentation: Standardizing small print

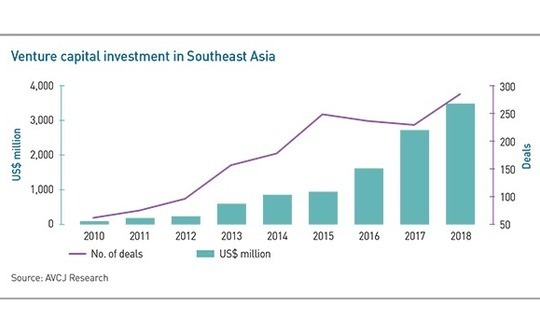

The rapid growth of venture capital in Southeast Asia has fostered the emergence of varied working practices. Singapore’s model investment agreements are intended to help bring order to chaos

Once a venture capital firm has completed its due diligence on a Southeast Asia target and hammered out the commercial terms of a deal, it can take about a month to negotiate legal terms and then close a Series A round. Kuan Hsu, a co-founder and general partner at KK Fund, would like to see the time allocated for this phase cut by half. Following the introduction of model investment agreements in Singapore, he may get his wish.

"With a standard set of documents, you can say, ‘These are the five things I want to change,' then everyone focuses on those things and you're done," Hsu observes. "It is a way of reducing friction in the ecosystem and accelerating development because start-ups can concentrate on building what they are building rather than spend time figuring out terms. You can pay lawyers to do that for you, but most start-ups don't have that kind of money."

The Venture Capital Investment Model Agreements (VIMA) were launched last October and have already formed the baseline for some deals, with lawyers adding modifications where appropriate. They include short form and long form term sheets, subscription and shareholders' agreements, a convertible agreement regarding equity (CARE) typically used at the seed stage, a non-disclosure agreement (NDA), and a venture capital lexicon.

The initiative was led by a working group comprising the Singapore Academy of Law, the Singapore Venture Capital & Private Equity Association (SVCA), Temasek Holdings, and three law firms, Allen & Gledhill, Clifford Chance, and Wong Partnership. A year-long process saw several rounds of drafts drawn up and shared with a variety of stakeholders, including additional law firms and the VC investment community, in order to get wider buy-in.

While the goal was to solidify Singapore's position as a venture capital hub – start-ups from across Southeast Asia choose to domicile in the city-state ahead of their institutional funding rounds – there was also a desire to bring order to a disordered system. Untwisting the threads of documentation that may originate from the US, China, or any number of online sources, was robbing the transaction process of its efficiency.

"When we came into the Southeast Asian market [in 2014] there was a diversity of knowledge and practice in the companies we reviewed as well as in their seed documents and in some of the documents our peers were doing at Series A and beyond. That came from the very ad hoc way the ecosystem developed," says Shane Chesson, a managing partner at Openspace Ventures.

Lost in translation

Problems usually stem from a lack of familiarity with institutional norms on the part of founders. Speed, simplicity and minimizing cost are the priorities for seed funding, which could lead to them settling on whatever model agreement is closest to hand. Rather than a term sheet and an investment agreement, each running to 20 pages, a start-up may have a single two-page document.

Founders might also be misled by similarly inexperienced friends and family investors who often populate early rounds. "There are sometimes terms that are not founder friendly and the founders won't even know," says KK Fund's Hsu. "For instance, they might need investors to okay certain actions, which isn't helpful to the start-up or to subsequent investors."

Resolving these issues means understanding what has happened in the past and its implications for the future. Raising new money is difficult without knowing how much equity would be given away and the flexibility around that. If there is little clarity or consistency in the rights of different shareholders, it can result in a messy capitalization table – which outlines percentage ownership, equity dilution, and the value of equity in each round – and a protracted clean-up process.

Nicholas Soh, a senior associate at Allen & Gledhill, recalls being held up by an anti-dilution provision in an agreement that bore little resemblance to any market norm. "There are several variants – broad base weighted average, narrow base weighted average, and full ratchet – and I wasn't sure what this one was supposed to be, it was more a mathematical formula than anything else," he says. "It took a lot of time trying to understand what they meant to happen when the provision kicks in."

The working group faced two key challenges during the drafting process. First, the documents are not intended to dictate market practice, but provide a starting point for a more streamlined negotiation process. Therefore, drafting notes and embedded explanations abound. For example, a note preceding the NDA observes that, while many VCs don't enter into such agreements, they can be relevant when dealing with a strategic investor.

Second, a balance was required between education and simplicity. The embedded explanations are intended to facilitate customization – they ask users to consider whether a term is relevant to their situation, and if not, advise that it be excluded. "We recognized the users of the documents would vary from first-time entrepreneurs to VC investors. We tried to bridge the gap between the two groups in relation to terminology and knowledge by providing guidance where possible," adds Satbir Walia, a partner at Clifford Chance.

She adds several differences between the Singapore model and those found in the US are based on a desire to minimize complication. The National Venture Capital Association (NVCA) includes a voting agreement and a right of first refusal and co-sale agreement; VIMA combines these into a single document. Meanwhile, registration rights aren't mentioned because it was decided that details around transitioning to public ownership are best left to later rounds.

A similar dynamic lies behind the inclusion of long form and short form term sheets in VIMA. Some investors preferred a short form approach because they said most founders are familiar with the process and don't want to get bogged down by the detail. Others endorsed a long form model because it serves as an educational tool: if a founder develops an understanding of the nuances at an early stage, it is easier to address complications further down the line.

"For a lot of early-stage deals, few terms are negotiated because founders want to keep it simple," observes Fong Jek Gan, a managing partner at Jubilee Capital Management. "If you put an elaborate template out there it could put more pressure on companies. If it's the first time they have encountered investment agreements, they might find it too complex to comprehend."

Encouraging adoption

There are markets in which handshake agreements are still common at the seed stage. VIMA is very much about providing the tools so that start-ups can graduate to institutional funding – raising larger sums of money that can translate into greater business scale – as seamlessly as possible.

It might be argued that the level of a market's maturity can be gauged by the number of documents released, each one addressing a more complex issue. The NVCA, for instance, has 18 available on its website, among them a life science confidential disclosure agreement and sample human resources policies for addressing harassment and discrimination. For Singapore, the more immediate goal is encouraging the use of VIMA across some diverse geographies.

The documents apply only to companies incorporated in Singapore, but the founders who use them might be running businesses in Indonesia, Vietnam or the Philippines, each of which has its own legal practices. Jubilee's Gan suggests more could be done within the investor and service provider communities to share information and best practices in different markets, so there is a stronger grasp of the intellectual journey a start-up makes when it comes to Singapore for funding.

On the VC side, the obstacles to adoption sit at opposite ends of the spectrum: inertia, whereby investors refuse to shift from templates they have developed internally; or excessive customization, to the point that documents no longer resemble the models on which they are based, and more time is spent trying to find common ground. However, Openspace's Chesson believes there is broad enough recognition of the advantages VIMA can bring.

"Starting off on a consistent basis takes away a lot of the legwork. It not only brings down legal costs, but also allows us to focus on other areas of due diligence and make better investment decisions," he says. "One by one, we are knocking down some of the things Southeast Asia has never had, whether it's growth investors, venture debt, outsourced service providers, or this."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.