Southeast Asia PE outlook: Debatable boom

PE and VC players remain focused on Southeast Asia’s long-term growth trajectory despite gathering macro storm clouds. Valuations remain a bone of contention

Henry Kravis, co-founder of KKR, has been on the lookout for black swans for a few years, but macro vigilance does not appear to have suppressed his appetite for Asia, and perhaps especially Southeast Asia. The confidence is underpinned by the relative sturdiness of the factors in play: although a global economic deceleration may be inevitable, deeper narratives around rising regional wealth remain even more reliable.

"The longer that the dispute with China and the US goes on, I think you are going to see more opportunities," Kravis said in Malaysia earlier this month, flagging one of the more precarious political variables in a potential downturn. The comment came within days of his firm's first investment in the Philippines and shortly after its third investment in Indonesia's food space.

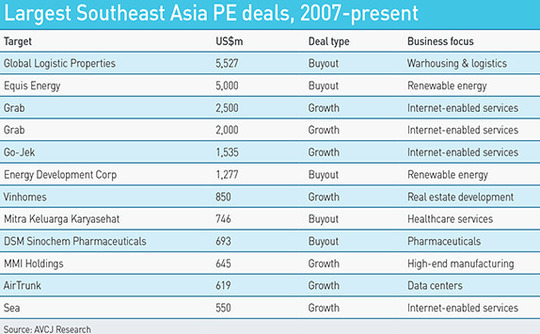

KKR also re-upped in Southeast Asian ride-hailing and delivery start-up Go-Jek this year, participating in a Series E round at a valuation of more than $5 billion. The deal has been held up by some as a sign that valuations have gone too far. In this view, investors that have recently done well in more saturated and developed jurisdictions have gone on to look for new areas to deploy, causing capital to build up in uncharted markets with few means of valuing companies on hard substance.

It should come as no surprise that as the most fragmented geography in its hemisphere, Southeast Asia is voicing mixed reactions on the subject. Still, at least one consensus has emerged. The macro rhythms that have colored the region's popularity as an investment destination and the more immediate issues such as trade policies and commodity price movements do not necessarily impact the intrinsic value of the businesses in question. Likewise, recalibrating investor expectations after a period of surging sentiment is no call for alarm.

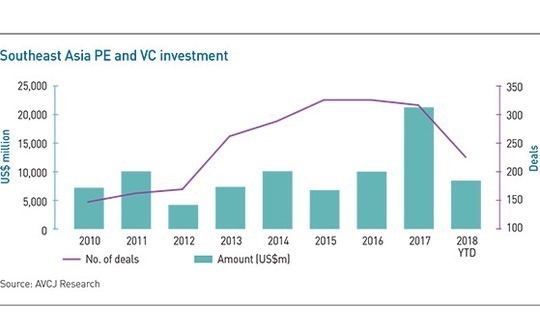

According to AVCJ Research, combined PE and VC investment in the region has fallen sharply during 2018, with $8.4 billion committed year to date versus $21.1 billion for 2017 as a whole. The drop-off, however, brings industry participation in the region's growth story back to its original trajectory. Investment in Southeast Asia has hit the $7-10 billion range in nearly each one of the past 10 years, even in the wake of the global financial crisis.

"GPs see this macro uncertainty as an opportunity because the momentum is actually quite strong," says Luke Pais, an M&A partner at EY based in Singapore. "In the last nine months, we've completed 18 transactions, which is much higher than what we did last year, and there's still a few months to go. In Southeast Asia, there are always some countries that are down and some that are going very well. The successful GPs are the ones that can move with that flow."

Southeast Asia has historically weathered macro events with surprisingly quick recoveries, including the Asian financial crisis of 1998. There is some expectation that this resilience could play out again with any new slowdown at the global level, in part due to improved ratios for foreign exchange reserves versus debt. Debt distress related to currency depreciation is still a significant risk in the region but related aggravators such as credit bubbles and wage inflation are seen as less pressing factors than they are in China.

Indeed, Kravis' prediction echoes widespread expectations that Chinese labor, intellectual property protection and trade tension woes will translate into a boon for Southeast Asia in the medium term. This outlook was dramatically punctuated earlier this month when UK appliances maker Dyson confirmed it would establish its GBP2.5 billion ($3.2 billion) electric vehicle factory in Singapore.

"If manufacturing production moves from China to Southeast Asia, that would spur industrial production, consumption, spending, employment, technology development and transfer, and we will see strong economic growth," says Gabriel Ho, a managing director at Dymon Asia Private Equity. "But downside risks would be the contagion effects in the event of a global recession."

The concern is that Southeast Asia has remained resilient to currency depreciation and debt risks in recent years because it has benefited from rising levels of Chinese consumption. If a macro event curbs that consumption, it could have a disproportionately negative impact the region's more indebted countries, such as Malaysia.

"As the US dollar strengthens, we might see some pressure on ASEAN currencies, and that's where US dollar-denominated investments in private equity, and even public equity, could be hit," one Southeast Asia-focused manager adds. "That could result in an even greater inability to repay debt and the region could lose the demand side of the economic outgrowth."

This situation offers a reminder that even as Southeast Asia's economic diversification helps pare back a historical dependency on commodities, currency volatility and a heavy reliance of foreign investment remain persistent themes. US-China trade tensions may well create openings for the region that didn't exist during past slowdowns, but subsequently elevated levels of global supply chain interconnectedness imply a possible contagion effect.

"While many Southeast Asia countries are economically stronger versus during the financial crisis in 1998, these tensions will cause a wait-and-see behavior for investments into the region, also with risk concerns from volatility in oil prices and US [monetary policy] tightening," says Shirley Crystal Chua, founder and group CEO at Golden Equator, a Singapore-based group that invests across private equity and venture capital.

To some extent, these forces have put downward pressure on valuations. Entrepreneurs with an eye on macro malaise are seen as more open to transacting with financial and strategic sponsors as a means of sharing some of the risk. "There is a bit more willingness to accept something that may not be their highest number," as one industry participant puts it.

Valuation pressure

Meanwhile, valuations continue to climb across the deal spectrum, with VCs anecdotally referencing accelerator graduates seeking to raise $10 million pre-money rounds, and mid-market players tracking consumer sector deals in recent years at EBITDA multiples in a range of 25-30x.

These multiples are said to have tapered down to the mid-teens in the past year, however. Manufacturing is roundly highlighted as an approachable space, with single-digit EBITDA multiples, typically cited as 5x and not currently moving up. Healthcare, by contrast, is deemed perennially, if justifiably, expensive, requiring investors interested in gaining exposure to seek creative inroads around services and technology.

Amit Anand, a managing partner at Jungle Ventures, does not peg valuation growth on capital flooding the market; in fact, he sees Southeast Asia as the least competitive market in Asia. He argues instead that nationalistic agendas by the likes of China, the US, and even India, are redefining the region as a "safe haven" for groups looking for growth in the digital economy.

"In a world where technology, talent and capital gets commoditized over time, proprietary data or exclusive networks are the only true barriers to entry," Anand says. "For businesses that have built such data or strategic alliance stacks in underserved markets like Southeast Asia, there is no limit in terms of growth or valuations that investors are willing to pay."

Global investors are bearing out this observation, especially corporate heavyweights such as Alibaba Group, Samsung, and Tencent Holdings, which have begun to exert an intense gravity on a number of financial and consumer segments. Corporate investment has also mushroomed in the form of in-house VCs, more than 60 of which are said to have set up shop in the region in the past two years alone.

More competition has been introduced through increased direct investment activity by global sovereigns, the emergence of private debt funds, rising alternatives allocations from regional families, and an uptick in PE-to-PE sales. As a result, faith in the region's long-term growth story is often spiked with a hard brand of near-term realism.

"Overall returns in Southeast Asia have been quite disappointing for private equity if you look at the aggregate returns, and there's a lot of liquidity in the system that has caused valuations to creep up beyond a reasonable level," says Brahmal Vasudevan, CEO of Creador. "Consequently, I think we're going to see that as these emerging market issues unravel over the next 6-9 months, a lot of mediocre companies that have been trading at elevated multiples are going to get hurt."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.