Asia fintech: Follow the leader

China has set a compelling example for establishing a diversified and deeply penetrated digital banking industry in a developing economy. India and Southeast Asia are taking notes

The anecdotes coming out of China's new cashless society are astonishing glimpses of the world to come: hieroglyphic QR codes are literally becoming the virtual versions of a beggar's tin cup and a street busker's open guitar case. However, this leadership in financial futurism was probably destined to weather a game-changing regulatory backlash.

Earlier this year, the Chinese government began a staged crackdown on the fintech development sandbox that it has fostered and defended from foreign competitors since the turn of the century. With the notable exception of a ban on digital token sales, most of the new rules focus on leveling the playing field in banking services, especially peer-to-peer (P2P) payments.

Alibaba Group's Alipay and Tencent Holdings-owned WeChat Pay are said to have a combined 95% domestic market share in this space, transferring almost $3 trillion a year and often settling bilaterally with banks. The rules, which include a requirement to funnel P2P payments through a centralized clearinghouse, are a clear move to dilute this duopoly and thereby strengthen the position of traditional banks.

Some of the most interesting fallout so far has included an apparent pivot by Alipay parent Ant Financial from a focus on directly managed banking services toward technology support for partnering financial institutions. Payments and tech supply accounted for 54% and 34% of revenue, respectively, in 2017. As a result of regulatory pressure, that ratio will reportedly be reversed to 28% and 65% this year.

Investors in Asia's less advanced but rapidly developing fintech ecosystems will be following several themes. On the table are issues around the interplay of government and commercial spheres as well as the migration of modernized services into legacy banking infrastructure. In the case of India and Southeast Asia, China's massive influence will direct local ecosystem creation as an industry-wide trend unfolds whereby cooperative technology partnerships take precedence over disrupt-and-replace agendas.

"In terms of mobile payments, they're the world leader, and they're doing a lot of innovative things," says Nicholas Borst, a vice president and director of China research at Seafarer Capital Partners, noting traction by WeChat in setting up systems that allow Chinese tourists to use its payment channels in overseas markets such as the US. "If anyone is going to succeed in exporting their technology in this sector, it will be China."

Building blocks

China's fintech story to date has demonstrated that once the basic infrastructure is in place for simple payments services, start-ups are able to begin expanding laterally into other banking services, including lending, insurance and wealth management. In a developing economy, where credit cards and desktop banking are being leapfrogged over, the efficiency gains are revolutionary, and the early-movers quickly become systemically important.

By this process, the services that were de-bundled from the traditional banking industry will be re-bundled into diversified, technology-enabled entities. The most successful players are expected to focus on plugging these services into novel, contextual banking customer experiences. This concept entails situation-specific offerings around micro-insurance, micro-lending, and transaction payments. For example, a personal line of credit could be offered instantly upon the purchase of a big-ticket item, either online or in a physical store.

Meanwhile, the B2C business models that define nascent fintech ecosystems will give way to more B2B strategies. In part, this is because data-reliant services around credit and lending require heavyweight partners. The move toward more cooperative and infrastructural B2B plays will also alleviate perennial concerns around scaling a B2C-style fintech business, which include difficulties in distribution and regulations, as well as capital intensive customer acquisition hurdles.

James Lloyd, Asia Pacific fintech leader at EY notes that attracting tech-savvy millennials through viral marketing, targeted offers and an improved customer experience might be reasonably straightforward. But acquiring and retaining a significant share of mass-market customers can prove much more challenging.

"Getting the average person in the street to change their longstanding behavior is extremely difficult. Many fintechs have already found that, after capturing early adopters, they need to move further into traditional customer acquisition – whether advertising on TV or the sides of buses," Lloyd says. "This is often where digital enters the real world, and it's expensive. Successful challengers need to be smart – availing of non-traditional partners and distribution channels."

According to UK fintech specialist Finch Capital, the transition toward a more corporate-connected digital banking industry is already happening in the most advanced markets. VC fintech investment in the US is now said to be channeled 60% toward collaborative business models and only 40% toward competitive ones. The shift is expected to be more pronounced in Asia's developing markets since lower levels of public financial literacy are likely to check the proliferation of B2C models.

Traditional banks, with their natural advantages in distribution, legal compliance and underwriting have to be part of the cooperation equation. Even before Beijing ramped up the regulatory pressure this year, Ant Financial struggled to put together deposits and was beginning to pursue synergies with major lenders. Given regional tendencies around strict government oversight and fintech-applicable service gaps for small companies and unbanked people, this trend will likely echo across developing Asia.

"When fintech really started disrupting traditional banking, banks were a little bit scared that they were going to become irrelevant or turn into utilities that just provide custodial accounts and not much other value," says Zennon Kapron, founder of research firm Kapronasia. "But in the past years, a very antagonistic relationship has become more symbiotic. I think that's a pivot that we'll continue to see especially in China, but potentially in India and Southeast Asia as well."

Imitating China?

Industry players in India and Southeast Asia see their markets as ripe for Chinese-style fintech ecosystem development. This view is supported by the rise of corporate data giants, especially in e-commerce and ride-hailing, as well as rapid advances in smart phone affordability and internet penetration. Relative to China, a substantial amount of infrastructural groundwork needs to be laid, but as fintech philosophies migrate toward B2B plays, logistical deficiencies are being increasingly interpreted as an entry.

The most concrete reason China will be a key factor in the development of Indian and Southeast Asian fintech is strategic support. Alibaba and Tencent have poured billions of dollars into both regions' internet services players, including India's Paytm, Flipkart, Ola and Bigbasket, as well as Southeast Asia's Lazada, Tokopedia, Grab and Go-Jek. In Southeast Asia, China is seen as having a commanding influence, while India has proven something of a battleground with incoming US strategics such as Amazon and Walmart.

The overwhelming differentiator for India, however, has been a concerted government push to improve the access and scope of fintech-ready datasets. This has been achieved through various tax number and voter identity registries, rules that formalize previously untraceable commercial transactions, and financial digitization initiatives such as a recent banknote demonetization. All this has driven cooperation between fintechs and legacy banks but also resulted in the country's reputation as a restrictive regulatory environment.

"The banking regulations in India make it difficult for someone to create a completely parallel structure like Ant Financial has been able to do in China where they could access deposits directly," says Michael Fernandes, a partner at LeapFrog Investments. "In India, even if a company like Paytm tries to replicate that model, the regulations ensure that the cash will come from the traditional banking sector and the old establishment will have some level of protection."

The fact that e-wallets like Paytm can't access and keep cash on deposit has contributed to a shift in Indian fintech momentum from telecom-enabled payments to unsecured consumer lending. Leaders in this space, including LeapFrog-backed NeoGrowth Credit and American Express-backed IndiaLends, also aim to leverage a cultural transformation in the traditionally savings-oriented economy. Compared to their parents' generation, India's digital natives are freewheeling spenders and comfortable with credit.

"India is very strict when it comes to giving banking licenses, so the banks don't see the fintechs as competition, and that's a big difference between India and China," says Gaurav Chopra, founder of IndiaLends. "In my view, that's helping the fintech sector here because we get the regulatory compliance and credibility of the bank instead of just starting off by ourselves. But it's also the reason we're probably not going to see standalone branchless banks in India like we've seen in the UK."

Customized solutions

Online-only banking is one area where Southeast Asia may have outpaced India. Timo, a branchless Vietnamese bank in strategic partnership with local private equity firm VinaCapital, offers a case in point by helping re-bundle many of the industry's recently digitized services under one virtual roof. This quasi-greenfield concept involves Timo setting up a paperless interface for VPBank while the traditional lender handles all the licensing and cash-based back-end duties.

"We take what's existing at the bank, look at a consumer's lifestyle and fit the banking product into what the consumer is already doing," says Cameron Warden, CEO at Timo. "It's almost a software start-up approach that's got a real customer focus on usability. We need to ask why banks are doing things the way they're doing them, and if there's anything we can remove legally, we'll do it. But I wouldn't expect digital banking to really challenge traditional banking in the short run."

Timo plans to take this model to the Philippines and Thailand, where progressive incumbent technology and financial sectors are considered ripe for similar modernizations. Thailand in particular has demonstrated amenability to digital lending with the likes of Kasikorn Bank, Bangkok Bank, Government Savings Bank and Siam Commercial Bank all operating in-house fintech investment programs. DBS Bank has echoed this sentiment in India and Indonesia with its mobile-centric DigiBank service.

"Banks have traditionally operated as pipeline companies, working directly with customers. Increasingly, banks will need to make the shift to platform companies and learn to work through partners," says Leonardo Koesmanto, head of digital banking for DBS Bank Indonesia. "In that regard, DBS Bank Group is open to expanding its ecosystem partnerships and in making investments either in fintechs or other companies that allow it to embed itself in the lives of customers."

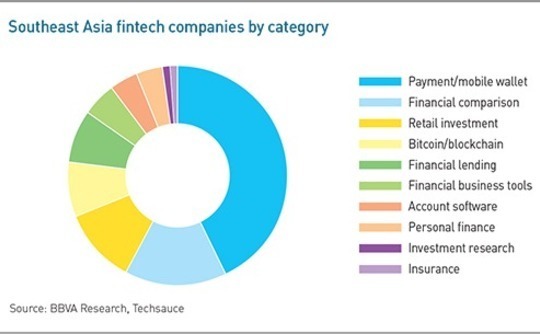

DBS backed up this ideology in May by participating in an $85 million Series C round for Singaporean e-commerce company Carousell with a view to diversifying the business model through new financial products and payment services. Southeast Asia's fintech industry, however, remains heavily weighted toward single-service start-ups, with 43% of players in the payments and wallet space, 15% in financial comparison, 11% in retail investment, and marginal showings in important banking areas like lending and insurance.

As a result, the regional ecosystem is characterized by a shapeless P2P services landscape with no clear leaders. In Singapore, the fragmentation has arguably slowed innovation and the commercial development of the payments segment as the majority of consumers default to existing point-of-sale options such as tap-and-go plastic transactions.

This effect harks back to the traditional challenges around B2C customer adoption where users are naturally prone to stick with less optimal yet well understood products, especially in developed markets like Singapore where only negligible efficiencies are gained. But even in Southeast Asia's less tech-savvy markets, the vacuum in fintech leadership has aggravated cultural issues around product familiarity and a lack of brand loyalty.

"In China, Ant Financial and WeChat are the first and only app you've used because they came with your first smart phone, so they captured that first-touch experience in the ecosystem," explains Markus Gnirck, a co-founder and director of Tryb Group. "In Southeast Asia, you don't have that trust, and customers are exposed to a wider variety of services. They go to whatever's cheaper, so I think it will be a challenge for any pure-play B2C model that comes up."

The collaborative approach

Tryb, which invests exclusively in Southeast Asian fintech, is navigating this environment with focus on B2B business models in more advanced areas, including lending, credit, and contract management. Its latest deal came courtesy of First Circle, a Philippines-based lending platform operator focused on small to medium-sized enterprises (SMEs). The company provides supply chain and trade financing services to businesses with no prior credit history that contend with development headwinds related to operating in pre-internet economic ecosystems.

"Many other lenders are doing peer-to-peer, but First Circle's CEO and co-founder Patrick Lynch is going down another road as a lending strategy – you can call it peer-to-institution," says Gnirck. "He has built up some very solid credit scoring risk scoring technology that leverages regional e-commerce ecosystems and partners with various business associations to bring SMEs into the financial cycle where they can actually get access to loans. You can start with a P2P model in this sector, but I don't think it's going to work in the long run because you have to be able to tap into global capital markets."

As with China, Southeast Asian fintech appears set to graduate from a consumer-facing, payments-dominated space to a corporate and bank-connected profile. More evidence came earlier this month when Filipino telecom giant PLDT partnered with KKR and Tencent in a $175 million deal aimed building out a multi-platform business encompassing enterprise services, lending, and e-commerce rewards. The investors are expected to expand the commitment to $225 million by the end of the year.

"When fintechs entered this space 3-4 years ago, they were always looked at as the disruptors or the ones who would be eating your lunch," Lito Villanueva, a managing director at PLDT told delegates at the AVCJ Philippines Forum, noting that 65-70% of the local fintech companies are foreign owned. "Now, we're seeing there are synergies and collaborations among all of these stakeholders because at the end of the day, we are not eating the pie, we're enlarging the pie."

The most commonly cited candidates to play the role of Alibaba and Tencent in Southeast Asia, however, are the ride-hailing leaders. Grab and Go-Jek have started to move into financial services both on the driver side, where they're operating insurance and credit, and on the consumer side, where they've begun to facilitate micro-credit options. In recent months GrabPay received an e-money license in the Philippines and Go-Pay partnered with state-owned Bank Negara Indonesia to offer micro-loans to SMEs.

"If you are building a fintech company to go directly to consumers, it is essential to build a brand, create trust and transparency and, at the end of the day, provide a better user experience," says Hans de Back, a partner at Finch Capital. "That requires significant capital and solid distribution channels, which are available to fintechs in China through collaboration with tech giants as well as financial institutions. We are observing a similar trend in Southeast Asia, as both local and Chinese tech companies like Grab, Go-Jek, Tokopedia and Alibaba, begin to work with payment, lending and insurance fintechs."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.