Portfolio: Quadria Capital & Indonesia's Soho Global Health

Quadria Capital has brought the clarity and energy that venerable Indonesian pharmaceutical firm Soho Global Health needs as it addresses pent-up demand in Southeast Asia’s healthcare market

Soho Global Health was a success story by any measure. After 70 years in operation, the company had become a leader in Indonesia's pharmaceutical space, marketing a range of herbal and synthetic treatments both licensed and developed in-house. Even more importantly, its distribution network had facilitated partnerships with global pharmaceutical giants keen to bring their products into the country.

But in 2015, Tan Eng Liang, Soho's president-commissioner and son of its founder, feared this success was creating a culture of complacency within the company and its controlling family. Tan knew the pharmaceutical industry was changing and that Soho would need to change with it or risk losing its edge. He saw a new outside investor as the best way to shake the entrenched management out of their routines and chart a new course.

Tan found his partner in Quadria Capital, which at the time was on the verge of closing its first independently-raised fund and looking for investees in Southeast Asia's healthcare sector. For the GP, Soho represented a rare opportunity: an established, market-leading company that was also open to an outside voice.

"We had a local owner who was pretty much making his own decisions, and many of the directors and staff at the time would just listen to him and implement what he wanted. What Quadria brought to the table was to push discipline in the organization," says Rogelio La O, CEO of Soho. "If it were not for Quadria we wouldn't have had the impetus or justification to make any changes."

As an investor, Quadria has aimed to reshape Soho's underlying business and put in place the systems and tools for the company to grow to the next level. Management have proved to be enthusiastic collaborators. The GP and the company see mutual respect and alignment as crucial to their continued partnership.

Trusted counsel

Quadria began to develop its relationship with Soho several years before the investment, when Tan was introduced to Abrar Mir, the private equity firm's co-founder, who advised on an acquisition that Soho was negotiating. The two admired each other's candor, and Tan began to seek Mir's input on acquisitions and hiring decisions that he was considering.

Tan was looking for advice because the business he had inherited from his father, though larger than any domestic competitor, was also limited in some key ways. Soho seemed like an unassailable institution, but its president worried that its traditional business practices left it vulnerable to market disruptions.

Most importantly, Soho, like almost all Indonesian pharmaceutical companies, relied on its third-party distribution arm, Parit Padang Global (PPG), to drive revenue far more than its in-house manufacturing operations. PPG distributed both Soho's products and those of many of its global pharmaceutical peers, accounting for up to 90% of overall revenue in the years prior to Quadria's investment.

Tan's frustration arose from the fact that profit margins for the distribution business had been shrinking for years, which made it difficult to raise funds for growing the network and investing in other parts of the business. Moreover, he feared a competitor willing to undercut Soho on margins could easily steal PPG's customers.

At his meetings with Mir, Tan found himself bouncing ideas off the former investment banker more and more, and eventually Mir brought in Quadria co-founder Dr. Amit Varma to provide further counsel. Talking over the prospects of the business, the three eventually decided that the most promising direction was to invest in Soho's drug-making arm. This would allow the company to build its own consumer brands in a vertical that offered higher margins than traditional logistics and distribution.

Quadria agreed to take a significant minority stake in the company for an undisclosed amount, giving Mir a board seat from which he could provide crucial support to Tan's restructuring efforts. The investment also allowed the GP to bring the weight of its team's collective healthcare experience to bear.

"Once we agreed manufacturing was going to be the pivot, he needed help in understanding this segment, how to build a factory, and more importantly how to get US FDA [Food & Drug Administration] approval," says Varma. "That's where the Quadria team came into play. All of us had worked in this environment, we understood FDA regulation and the global market, and we started to build a business case together."

The healthcare thesis

Mir and Varma had formed Quadria in 2008, targeting healthcare opportunities in South and Southeast Asia. Varma had been a practicing physician for 10 years in the US before returning home to India in 1999 to set up practice there, while Mir had served as head of Citigroup's European and emerging markets healthcare investment banking division before joining Religare Capital Markets in Singapore. He met Varma when helping to build out the firm's healthcare portfolio.

Quadria saw healthcare as a promising segment for private investors in India and Southeast Asia, due to the rising levels of "lifestyle diseases" in the region such as diabetes, heart and kidney conditions, and cancer.

Unlike infectious diseases, which dominated Varma's practice when he first returned to India, these illnesses require long-term assistance from multiple caregivers. However, the region's healthcare systems largely still focused on treating infections, and public-sector investment that could help adapt to the new requirements has been slow to materialize.

"One of the key things that Indonesia or other countries with large populations need, is good quality local companies that are not just dependent on selling their drugs into the US or Western Europe, but catering to the local market," says Varma. "One of our key beliefs is that the business case viability is dependent on how much you sell locally, or within Southeast Asia."

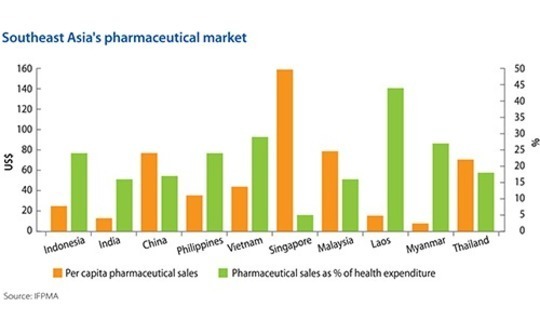

Indonesia's pharmaceutical market in particular seemed poised to take off. According to the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), the country's per capita spending on pharmaceuticals last year was among the lowest in the region at $23.30, ahead of only Myanmar, Laos, and India. By contrast, pharmaceutical sales as a share of total healthcare expenditure were around the regional median, suggesting that Soho's prescription drugs and wellness products would find a receptive domestic audience if healthcare spending in general rose.

Building a pipeline

With this deep market in mind, Quadria pushed Soho to restructure its business with a greater emphasis on manufacturing, aiming to grow the share of revenue represented by pharmaceuticals from 10% to 50% by the time the GP exited. The rebalancing would give the company a second base of revenue to fall back on in the event of disruption to its distribution operations.

Soho's products, which include both over-the-counter medications and prescription drugs, have shown strong performance in the domestic market. Its flagship treatment, the immunomodulator Imboost, recorded a 33% average market share in Indonesia last year, with its closest competitor taking 18%. The company's four children's multivitamin products had a combined market share of 36%, more than the next two largest companies combined.

In its line of herbal wellness treatments, Soho has drawn on Indonesian customs, adapting traditional medicines such as jamu – a blend of Indonesian turmeric and ginger – for its Curcuma products. With Quadria's help, the company is currently working to deepen its understanding of these folk remedies in hopes of incorporating them into new, scientifically advanced products.

"What we're trying to do is to put a lift to that jamu tradition by bringing some clinical research behind it," says La O. "In the case of Indonesian turmeric, for example, we're hoping to use epigenetic studies to show that it is effective, so that we can grow from marketing those products in Indonesia to selling them globally."

Quadria has also helped Soho to enhance its local distribution business, notably through more stringent compliance standards. For instance, the firm put a stop to the practice of incentivizing doctors to prescribe Soho's products, a common issue with Indonesian pharmaceutical distributors. The change was intended to reassure patients that prescriptions are based on medical insight rather than on personal enrichment.

Soho has also signed in-licensing agreements with offshore pharmaceutical firms contacted through Quadria's global network. The GP has set up 14 such arrangements with powerful industry figures such as Gilead Sciences, which granted Soho distribution rights to its hepatitis C medication in Indonesia.

Along with these operational improvements, Quadria played an active role in reshaping Soho's internal organization, which at the time of its investment was large and unwieldy, with multiple redundant layers of management. This bloat extended all the way to the top, where the GP decided to ease out several veteran directors who were being paid far in excess of their value.

"The bulk of our compensation was actually being paid to a few directors who had been with the company for 10 or 15 years," says La O. "By transitioning them out, we've been able to bring down our cost base, and at the same time we've been able to replace them with more competent leaders from the industry."

The rest of the organization provided plenty of additional fodder for cuts. By La O's estimate at least 2,500 employees have been let go since Quadria invested, reducing headcount by about half. The result is a leaner organization with a younger talent base, recruited from global pharmaceutical and healthcare players with fresh ideas to further improve the company.

Future upside

Soho is now planning its next stage of development. Along with further expansion in Indonesia, where the company still sees plenty of room for growth, Soho believes there is considerable opportunity in other Southeast Asian markets, where many of the same market pressures apply, such as growing incidence of lifestyle diseases and low levels of public healthcare investment.

The company is also in the initial stages of planning an expansion into distribution of medical devices, where Quadria's global connections are expected to play a major role in helping it find clients looking for a partner to help them enter Indonesia. Some of these ventures may not fully come to pass until after the private equity firm exits its investment. The initial commitment was made with a three to five-year horizon, and it currently sees 2020 as the most likely time for a liquidity event.

The growth demonstrated during Quadria's holding period, along with the company's organizational streamlining and willingness to take initiative, can create several avenues for the firm to dispose of its stake. Several industry players have already approached Soho with an eye to acquiring a stake and forming a strategic alliance, and Quadria could exit to one of these.

An IPO is also a strong possibility, since there are currently few high-quality listed healthcare companies in Southeast Asia. Quadria expects investor appetite to be robust if Soho continues its current growth trajectory. The company is already well-known in the market and confidence in the business will likely increase on the back of the internal improvements and transparency guidelines implemented by the GP.

"Soho ticks all the boxes – it is a market leader with substantial size, and is in a promising market segment," says Varma. "And once a company has had private equity money for a couple of years, that's seen as assurance that the corporate governance and compliance standards are of the highest quality. In Asia, it is not that difficult to list companies once you reach a certain threshold, and there can still be upside after the listing."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.