Southeast Asia VC: Partner propositions

Strategic investors, particularly from China, are playing a growing role in Southeast Asia’s technology scene. Venture capital investors in the region hope their portfolio companies can benefit from the rising tide

The story of Alibaba Group's perspective on Southeast Asia can be charted through two major investments. Its acquisition of a majority stake in Rocket Internet-backed e-commerce platform Lazada for about $1 billion in April 2016 marked the first phase, when the Chinese internet giant hoped to expand into the region by assuming control of a local counterpart.

By August 2017, Alibaba's evolving understanding of Southeast Asia had led it to decide that market-specific investments could deliver as much value as partnering with a single region-wide player. Its purchase of a minority stake in Indonesian online marketplace Tokopedia, in a funding round worth $1.1 billion, reflected this shift in thinking.

"We had become successful in a very large market, and in 2016, Lazada was a well-run platform that was market-leading in many countries," Kenny Ho, head of investment for Southeast Asia and India at Alibaba, told the AVCJ Singapore Forum in July. "But over the course of the last two years we've entered a stage where different markets are starting to grow at very different rates, and that's when you need a more customized approach from an investment point of view."

Alibaba is just one of several strategic players tracking Southeast Asia's technology scene, and their growing presence in the market is a welcome development for venture capitalists, who see these new participants as avenues for corporate partnerships, growth capital, and exits. However, the arrival of external competition may also put the squeeze on local players. Investors must help portfolio companies leverage their market expertise to profit from strategic giants rather than being swept aside by them.

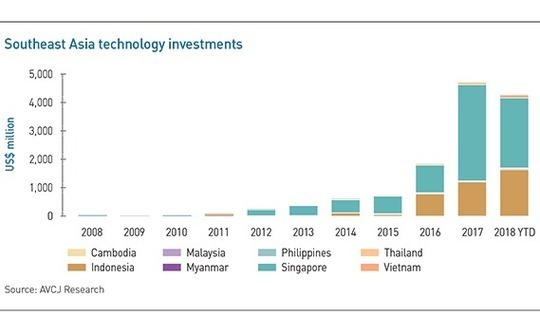

Investment activity among Southeast Asia's technology start-ups has grown rapidly in recent years: AVCJ Research shows that total commitments increased from less than $1 billion in 2015 to nearly $2 billion the following year, and then to $4.7 billion last year. That record is unlikely to stand for long, with $4.2 billion in investments recorded in 2018 to date. Singapore and Indonesia have seen by far the biggest share of this growth, though investments in Malaysia and Thailand have risen steadily as well.

"I used to joke that when we talked about Southeast Asia venture capital a few years ago at the AVCJ Forum, we'd typically be put in a room about the same size as the speakers' lounge – that would be the number of people who would show interest," says Shane Chesson, founder of Openspace Ventures. "So it's fantastic that people are starting to appreciate the Southeast Asia opportunity."

Strategic investors have played a major part in this investment expansion, participating in last year's two biggest deals – the Alibaba-led funding round for Tokopedia and a $2.5 billion commitment to Singapore-based ride-hailing app Grab in which Didi Chuxing and Hyundai took part. They were also present in this year's $2.5 billion round for Grab, led by Toyota, and the $1.5 billion investment in Indonesian ride-hailing and delivery platform Go-Jek. The latter included contributions from Google as well as three Chinese companies – Tencent Holdings, JD.com, and Meituan-Dianping.

Chinese incursion

The Chinese presence in most of these rounds speaks to the compelling opportunity that Southeast Asia is seen to represent for the country's tech giants. The region's population of nearly 600 million rivals that of India and China itself, but its level of technological development and internet penetration, on average, lags those two countries. Moreover, Southeast Asia is easier to reach than other growing technology markets like Africa and Latin America.

But Chinese strategic players have long been aware of the challenges that could trip up an unwary investor. Alibaba's Ho describes the process of planning the company's Southeast Asia strategy prior to 2016 as one of "soul-searching," as management tried to determine how its position as a leader in China's e-commerce market could strengthen its hand as it entered a new region.

"China is a huge, homogeneous market – it's over a billion people, with a very similar culture and a single language. And in terms of government regulations, things are consistent across the board," he says. "That's one of the key reasons why you see huge platforms like ourselves, Tencent, and other sizable internet companies, that are very successful in terms of scaling their business through a more or less homogeneous product offering."

"My wife was at Uber in Southeast Asia before it got sold to Grab, so she got to see internally how Uber, as an international company, failed to localize its services," says Donald Wihardja, a partner at Convergence Ventures. "It saw itself as a transportation company first, and its management either couldn't see the local battle, where Grab and Go-Jek excel, or were not allowed to localize it enough to compete."

Vishal Harnal, a partner at 500 Startups based in Singapore, compares the development of online economies to Maslow's hierarchy of needs. In almost all regions the internet start-ups that meet basic needs – including buying and selling goods, property, in-country transportation, and employment – tend to be locally-operated, by players that often prove hard for global competitors to dislodge. This is because these teams usually have an inherent advantage in market knowledge and a head start in building local networks.

"I think that the biggest shift that's happened in Southeast Asia is that the first layer has been built, and all of the businesses rising now are building on the sophistication of the platforms that have already been created," he says.

The bigger picture

By contrast, when local teams try to address higher-level needs – such as communication, entertainment, and international travel – they tend to lose ground to foreign rivals, because building a social media platform, social networking app, or online video player requires no local knowledge or networks. For this reason, Youtube and Facebook dominate their categories in most Southeast Asian countries despite being developed overseas.

In some ways this dynamic has eroded the fragmentation of Southeast Asia – observers say the region's urban centers are increasingly homogeneous, particularly among younger, tech-savvy consumers who access the internet for the same purposes through largely identical devices.

"A 26-year-old living in Jakarta, a 25-year-old in Bangkok, and a 24-year-old in Ho Chi Minh City are no different from each other in terms of consumer behavior," says Amit Anand, founding partner at Jungle Ventures. "They're living under the same social media platforms, using the same search engines, and their aspirational offline brands are all the same – they all prefer Zara and Starbucks over anything else."

As a result, a cycle has formed in the start-up community, where VCs are reluctant to back entrepreneurs addressing segments that are seen to be solved by foreign competitors, such as chat and media, and encourage founders to turn their efforts to areas where their overseas peers will operate at a disadvantage.

The growth of strategic investors as a force in the region will help to amplify this advice, as start-up founders look to the examples of Grab, Go-Jek, Tokopedia, and Lazada as models for their companies. By positioning themselves properly, they can tempt strategic players as partners, growth investors, and even, eventually, buyers of the businesses.

VCs are also excited by the penetration of strategic investors in Southeast Asia, both for the assistance they can provide portfolio companies on the business side and for their potential as an exit avenue. Alibaba's purchase of Lazada, which saw Rocket Internet, AB Kinnevik, and Tesco sell their stakes, is one example of a strategic player providing an exit to private investors.

There are caveats to the Lazada case, however: the company was said to be nearly bankrupt at the time of the acquisition, which undoubtedly depressed the price and could have made the purchase more attractive to Alibaba. When it comes to larger companies like Grab or Go-Jek, their size makes them unlikely takeover targets; their investors will most likely exit through IPOs.

Trade sales are still possible for smaller tech companies, and VC investors might also exit their shares to strategic investors that provide growth capital. But the most common benefit that foreign tech firms can provide to portfolio companies will probably be in recruiting these businesses as local partners to help build out their operations in Southeast Asia. Investors therefore see their role as helping start-ups position themselves as attractive collaborators.

In most ways, the value-add techniques involved are standard items in the VC toolbox, such as helping grow the senior-level executive suite and augment technology talent. Companies in Southeast Asia's emerging markets usually find Singapore to be a great resource, since the city-state has a large number of professionals who are based nearby and also accustomed to working to a global standard.

"When you're looking to hire somebody who has 10 years of experience in managing data analytics, 15 years of experience in managing a regional team, domain expertise, or management expertise, Singapore has that professional base," says Jungle's Anand. "They've been working in large industries, and now they're open to working in start-ups."

Perfect partners?

There is more debate around how an investor should choose future companies to back. With international technology players already devoting much larger resources to "global problems" like search engines and social networking, most GPs want to make sure their investees are focused on the local areas where they can make the greatest impact.

However, investors should also be wary of perceiving a local focus on the part of an entrepreneur who may lack the drive to tackle bigger problems. While founders need to be realistic about the issues they face and their ability to handle them, they also must be willing to take the initiative to achieve the all-important scale that can lead to greater collaboration opportunities.

"As we were raising our first fund, there was a rash of businesses that sold for less than $50 million in the region," says Openspace's Chesson. "That raised a classic question: is the entrepreneur's mentality just to bail out early? You don't want to back an entrepreneur who'll be happy walking away with single-digit millions – you want someone who has the vision to go very large."

To represent the ideal entrepreneur, Chesson points to Nadiem Makarim of Go-Jek, which Openspace (then called NSI Ventures) has backed since its Series A round in 2014. The firm credits Makarim's passion for pushing the company beyond its success in the motorcycle taxi industry and attempting to build a platform to solve a wide range of daily needs.

Ho agrees that companies that can provide insights into local markets are attractive investment targets for Alibaba as it seeks to penetrate Southeast Asia. However, he also considers vision and initiative as essential to a successful partnership. The most valuable collaborations will be those in which Alibaba's partners have as much to contribute as the Chinese company itself does.

"I don't entirely agree that you should leave the global issues to the global players," says Ho. "The way I look at it is, Alibaba has gone down a certain path in the past, so why don't we work together and try to jointly solve consumers' problems in a way that is mutually beneficial. And we feel confident that we'll be able to share the experience of our development in China with other entrepreneurs in the region."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.