India healthcare: The growth infusion

Indian hospitals are increasingly attractive for private equity investors. GPs can thrive in the space with a well-defined growth strategy that takes local market requirements into account

Many private equity investors have worked in India's hospital space over the years, but True North may have a better claim to veteran status than any of them. The firm has held interests in several players, from CARE Hospitals, one of its earliest investments, to Kerala Institute of Medical Sciences (KIMS), in which it invested last year, and has built a track record of value creation in its portfolio companies.

Few GPs initially shared its appetite for the hospital industry, but in recent years True North has seen an increasing number of its peers start to get involved, drawn by strong evidence of opportunities for value creation and a string of productive exits. Operators in the hospital space have responded just as eagerly, providing a wide range of investment opportunities for PE investors to take advantage of.

"As more players go through the cycle, the industry's also getting more mature," says Satish Chander, a partner at True North. "That makes it easier for the next set of private equity investors to jump in and see that here is an industry which understands private equity, which understands systems and processes, and that has gone through some amount of clean-up on the corporate governance side."

PE attitudes toward Indian hospitals are also evolving, and not only in their appetite for investments. GPs are developing a wider range of value-add approaches, including traditional consolidation plays as well as more nuanced strategies based on adapting to the specific circumstances faced by the variety of operators in the hospital space. Exits have evolved as well, with a full spectrum of divestment opportunities now available for investors.

Significant challenges still remain for the growth of India's hospital industry, but investors that can tailor their approaches to suit individual circumstances should have no problem achieving profitable results.

"The healthcare landscape continues to deliver, particularly when consolidation happens," says Sanjeev Krishan, India private equity leader with PwC. "The challenge for private equity is in identifying the opportunity and the right time to invest, because hospital investments typically follow a period of growth, then plateau, then more growth."

Unmet needs

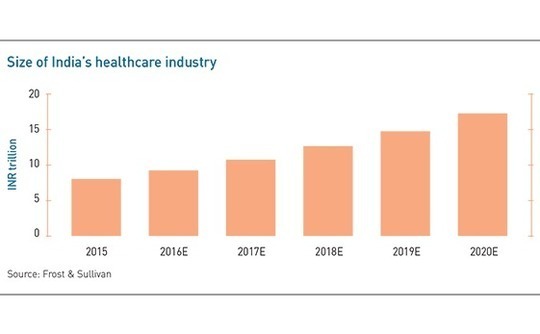

India's hospitals are at the center of a growing supply and demand gap. The country's healthcare sector was worth INR8 trillion ($116 billion) in 2015 and Frost & Sullivan expects it to more than double in value by 2020. By far the majority of this value is in healthcare delivery – i.e. hospitals – which accounted for 68% of overall sector revenue in 2016, with pharmaceuticals, the next-largest segment, on just 13%, and devices at 9%.

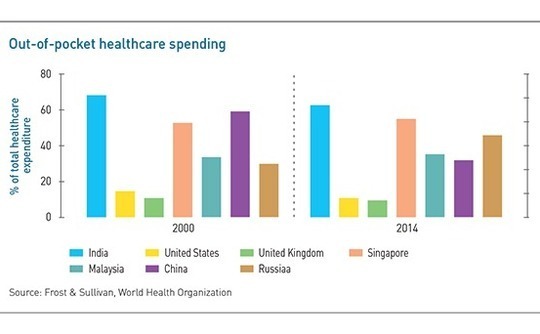

Private sector hospital operators have historically been crucial to this system. Spending by India's government on healthcare has consistently been lower than in other countries, representing 1.4% of GDP in 2014 compared to 8.3% in the United States, 3.1% in China and 2.1% in Singapore. As a result, 62.4% of overall Indian healthcare expenditure in 2014 was met out of pocket, the highest of all countries studied by Frost & Sullivan.

But even as Indian consumers continue to spend on private healthcare, the system has not kept pace with their needs. The country had only seven hospital beds per 10,000 people in 2011, just one-fifth of the level recommended by the World Health Organization. Demand for hospital services is only expected to rise, due to the growing incomes and aspirations of the middle class.

The fragmented nature of the private hospital system has played a large role in PE investment theses, with industry consolidation emerging as a theme in most deals. For larger chains, buying up smaller competitors to form a regional or even national network with the backing of private capital is appealing. Meanwhile, investors see clear parallels between the hospital industry and other fragmented parts of India's economy where PE players have been able to add value through efficiencies of scale.

"We've always thought that consolidation is long overdue here, though it could have been much faster if insurance penetration was higher," says True North's Chander. "But there are various other themes, in terms of medical equipment, training in clinical protocols, and dealing with suppliers, where there are plenty of benefits from consolidation."

However, in recent years some industry professionals have begun to question how far the consolidation thesis can be taken. While private capital has helped fuel expansion by a number of Indian hospital operators, no chain has managed to break through onto the national stage. With the country's hospital space still geographically fragmented, investors are wondering if new strategies would provide a more practical approach to the realities of the industry.

"It's not been easy for healthcare chains to grow pan-India, and many chains have struggled to expand beyond their core regions," says Vikram Hosangady, head of India private equity at KPMG. "Apollo Hospitals, Fortis Healthcare, and Manipal Hospitals have all done very well in their areas of focus. But to become pan-India and do well in every region still remains a challenge."

The economic divide between India's urban regions and its less developed areas is a major factor in preventing the achievement of scale. Successful hospital chains tend to be located in the country's tier-one cities, where the dense population provides large numbers of patients with a wide range of ailments. By contrast, a large multi-specialty facility would be hard pressed to find a sustainable patient population in a tier-two or tier-three city.

Cultural divisions also pose a hurdle for larger operators looking to expand into less developed regions, as healthcare in these areas tends to be provided through practices run by trusted local doctors. Whatever a newly established hospital may offer in terms of advanced medical technology and variety of treatments, it means nothing if it cannot convince local residents to give it the same level of trust.

"India is a very diverse country with regard to economic development among the various states, along with the distribution of individuals who can pay for healthcare either on their own or through insurance," says Hari Buggana, managing director at healthcare-focused GP Invascent Capital. "The country needs multiple ways of delivering healthcare to patients."

Single specialty

For Invascent, as with other PE firms, expansion remains a priority in its hospital investments. But rather than committing capital to help large multi-specialty operators acquire their rivals, the firm invests in smaller single-specialty hospital chains that can meet specific healthcare needs in their home regions and surrounding areas with a view to supporting organic growth and operational improvement.

Investments made under this strategy include oncology hospital chain Healthcare Global (HCG) and eye care provider Dr. Agarwal's Health Care, both of which have since been exited. Invascent still holds positions in the likes of Sunshine Hospitals, a South India-headquartered chain with facilities focused on orthopedics, cardiology, neurology and critical care.

Invascent is not the only GP to recognize the potential of the single-specialty hospital chains. True North has invested in maternity and child care chain Cloudnine Hospitals, while both HCG and Dr. Agarwal's have received additional PE investment since Invascent exited. But industry participants see these operators as just the tip of the iceberg. A plethora of hospital chains are emerging across India focused on providing local populations with treatments for specific ailments.

Demographic shifts are the main driver for this growing class of operators. The over-60 share of India's population is expected to reach 12.5% by 2026, up from 9.2% in 2016, and these aging citizens will need treatment for a range of illnesses including diabetes, heart disease, and cancer. In addition, improving infant mortality rates will lead to increased business for facilities specializing in mother and child care.

This last trend was the basis for True North's investment in Cloudnine. The GP concluded that since Indian mothers are increasingly giving birth later in life, they will require specialized attention to deal with possible complications. Cloudnine will have staff dedicated to addressing any difficulties that a mother and newborn child might encounter, along with more specialized equipment and facilities that may be harder to find at generalist hospitals.

"If it's a simple enough case, why should she be in a multi-specialty setup along with all the other ailments that those hospitals have to deal with?" says Chander. "If we can create a more vibrant environment, that will attract patients, and as long as the patients are generating traffic, it should be easy to attract the doctors."

Single-specialty facilities offer investors other benefits beyond appeal to patients. Purchasing and maintaining medical equipment tends to be less expensive, since the hospital does not need to support a wide range of treatment areas. Facilities are typically smaller, meaning the cost of land is lower, and recruiting talented doctors is easier as well, since working in a specialty hospital means they will not get lost in a departmental shuffle and may have more options for promotion.

But there are downsides too. By definition, these hospitals have very limited resources to handle issues outside their core focus; if complications arise in patients' treatment, they must be transferred to other facilities. Expanding into new regions is also risky because a hospital expanding into a new market has no other strengths to fall back on should demand for its specialty not develop as expected.

Furthermore, the smaller size of these hospitals can also be a barrier to private equity investment, since the proposed funding round may fall below a GP's minimum check size or outside its risk profile. True North has often been obliged to reject proposals from smaller specialty hospitals for these reasons.

Industry participants say there are still plenty of investment opportunities in larger hospital operators. The key is to find companies that can put an investor's money to work in ways that address the market's needs beyond the traditional focus on consolidation.

"Building hospitals is capital intensive, and this can create opportunities for investment firms, both in public and private markets, to support hospital groups that are expanding to fill the gap in infrastructure," says Sandeep Naik, a managing director and head of India and Asia Pacific at General Atlantic, which recently acquired a significant minority stake in Krishna Institute of Medical Sciences.

Private investors can provide assistance in a variety of ways, from backing physical improvements in existing infrastructure to implementing new systems and practices. Advent International's investment in CARE Hospitals is an example of all three. The GP acquired CARE in 2012 and proceeded to build stronger systems and a management team around the founders, while simultaneously introducing a program to add beds in the best existing hospitals.

Advent did add new hospitals as well – by the time it sold CARE to The Abraaj Group in 2016 the company had grown from 11 facilities to 16 – but growth for its own sake was not the focus of the investment. The GP saw its objective as delivering financial and management support that the company needed to see its expansion through to the conclusion.

Removing obstacles

The industry still poses difficulties for investors, particularly with regard to government. While the direct participation by India's government in the healthcare sector is limited, it still exerts powerful influence over operators in the form of regulatory oversight. For instance, a price cap on stents implemented last year depressed profits considerably for private hospitals, where cardiovascular procedures typically account for a large amount of revenue.

Actions such as these pose considerable risk for private hospitals, since their operating costs rank very low on the government's list of priorities. They cannot be avoided, but they can be predicted to some extent, and investors will need to take the possibility of further interventions into account.

"While the sector needs continued oversight to ensure quality of service and fair treatment of employees, the profitability and return on capital metrics of healthcare companies, which were already not very high, have been adversely impacted, which in turn restricts their ability to invest for growth," says Daniel Mintz, founding managing director at Olympus Capital Asia. "We expect investors to continue to focus on this sector, but also to watch for changes in the regulatory framework that can impact performance."

Roadblocks of this nature pose a relatively low risk in investors' minds, however, because the growth in healthcare demand should allow skilled managers to overcome most obstacles. As long as the GP has the right partner, they should be able to continue adding value together.

Investors are similarly assured about the prospect for exits from hospital assets thanks to a track record of successful liquidity events across both public and private markets. Public exits include last year's IPO of Aster DM Healthcare, a portfolio company of True North and Olympus, and the 2016 listing of IFC-backed healthcare conglomerate Max India, operator of hospital chain Max Healthcare.

Secondary sales are also an option, as with Invascent's exits of HCG and Dr. Aggarwal's to Temasek Holdings and ADV Partners, respectively (Temasek later made a partial exit in HCG's 2016 IPO), and Advent's sale of CARE to Abraaj. The recent acquisition of Fortis' hospital business by Malaysia-based IHH Healthcare, following a bidding process that involved several domestic rivals including companies backed by TPG and KKR, demonstrates that trade sales are also available for assets that show growth potential.

"It's never difficult for us to exit, since there are many financial sponsors as well as strategic players that are interested in the space," says Invascent's Buggana. "Especially for a buyer with longer-term expectations, these are de-risked assets that have already demonstrated good scaling ability."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.