Trans Pacific Partnership: A rising tide

When the US withdrew from the Trans Pacific Partnership, the remaining participants decided to go it alone. Hopes are high that the deal will result in improved business environments across Southeast Asia

The 2016 US presidential election produced few areas of bipartisan accord, but the Trans Pacific Partnership (TPP) managed to unite both the left and right in their revulsion for the free trade agreement. Both Republican Donald Trump and Democrat Hillary Clinton, along with her left-wing challenger Bernie Sanders, called for the deal to be reexamined, and when Trump withdrew the US from the TPP following his election the agreement seemed buried.

But the deal has proved more resilient than expected: the other 11 signatories came together in mid-2017 to negotiate a revised version of the accord, which has moved toward ratification with a speed that shocked many observers.

"I was very surprised that they were able to get this through in such a short period of time – I thought they would have to spend years and years renegotiating it, because a trade agreement is always a delicate balance between giving and taking, and obligations and rights," says Matthias Helble, a research economist at the Asian Development Bank Institute (ADBI) in Tokyo.

The revival of the TPP speaks to the confidence of participants in its ability to improve business conditions, particularly in emerging markets. Whether it can effect these improvements without the participation of the world's largest economy remains to be seen.

Playing politics

President Trump's withdrawal of the US from the TPP came as a bitter pill to the other partners, which had been negotiating the pact in one form or another since 2005. Indeed, the final text was agreed on before the election. All that remained was for enough of the signatories representing 85% of the participants' GDP to ratify the deal.

Losing the agreement so close to the finish line was bad enough, but what made the decision even more frustrating was the suspicion that the president was still operating on the level of politics rather than statesmanship. Trump had promised to end the TPP on the campaign trail and was determined to do it, regardless of the economic impact to the country.

"The problem is that if you look at Trump's criticism, he hasn't really been specific about anything," says Sanjay Mathur, chief economist for Southeast Asia and India at ANZ Bank. "He's said it's stacked against the US, but he hasn't quite proven it, and he's also said that it's a 5,000-page document and nobody can understand what's going on. To me, neither of these issues really have meat on them."

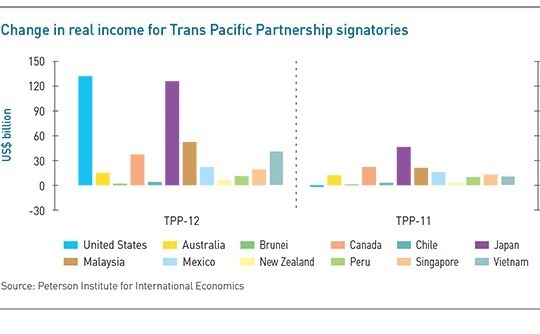

Contrary to the president's assertions, in fact, the US stood to gain the most from the TPP. An analysis by the Peterson Institute for International Economics in 2017 projected that while real income for all participants would be higher under the agreement than it would with no new trade deals at all, the US would gain $131 billion with the TPP in force. Only Japan came close to the same benefit at $125 billion.

Trump's objection to the length of the agreement is similarly misplaced in the view of economists, since the pact's benefits are in its comprehensiveness and attention to detail. TPP's provisions affect wide swathes of its member nations' economies, particularly emerging markets, which could eventually see every aspect of their business cultures overhauled.

The most immediate evidence of TPP's impact on Southeast Asia is in the field of tariffs. The agreement includes cuts to 90% of all tariffs among member countries upon its entry into force (EIF), and most tariffs will fall to zero within 10 years. New Zealand's wine industry, for example, was expected to see tariffs representing NZ$17 million ($12 million) per year from seven markets, including three in Asia, eliminated within 16 years under the original TPP.

"If you're in the wine space, this is going to open up new markets in Japan, in Vietnam, in Malaysia, where the tariffs might have been much higher before," says Steve Okun, ASEAN representative for EMPEA. "So long as you stay within the TPP you'll be much more advantaged than you would be in a non-TPP country, which right now would include the US or China."

Digital dividend

Harder to quantify than tariff reductions, but perhaps even more important, are the measures that the TPP introduces to reform the digital economy. The agreement is among the first plurilateral trade deals to specifically address the role of technology in trade and to prescribe concrete actions to put all participants on an even playing field.

Two of TPP's most important actions in this regard address the movement and storage of data across borders: signatory governments may not impede access to digital information or force companies to store data on its users in a particular country within that country's borders. While exceptions are allowed for public interest or national security, these rules represent a commitment to the principle that companies that do business with customer information must be allowed to operate without hindrance.

Also of note is the flexibility built into the TPP with regard to new industries, especially services, where every sector is by default open to any form of delivery, including digital, unless specifically noted otherwise. This is the reverse of how most trade deals operate, and it is expected to make the introduction of new business models much easier, particularly in Southeast Asia's patchwork of regulatory approaches.

"In any other agreement you would need to get all the countries together, and they would need to agree that that particular industry needs to be open and available for digital distribution. That can be really difficult," says Deborah Elms, executive director at the Asian Trade Centre in Singapore. "By contrast, under TPP any new service sector is automatically opened."

With the prospect of breaking down tariff barriers and a framework to grow the digital economy, among many other provisions in the TPP including cybersecurity and intellectual property rights, it should come as no surprise that the other participants didn't want to let the TPP go. Asia's developed economies have been intent on reviving the agreement, particularly Japan and New Zealand, which had already ratified the deal when Trump withdrew.

Despite the backing of these countries, along with Australia, which joined New Zealand to broach the subject in March 2017, renegotiating the agreement to reflect the US departure was expected to take significant time and effort. However, this has been largely avoided. Instead of starting from scratch with a new accord, the participants agreed to a deal that was more or less identical to the original TPP.

The only difference between the original and the new Comprehensive & Progressive Agreement for Trans-Pacific Partnership (CPTPP) is that the revised deal suspends 20 provisions pushed most strongly by the US, including intellectual property provisions related to pharmaceuticals. More than 90% of the document remained intact following the suspension; the only other change was to require ratification by six of the 11 participants.

Winners and losers

The renewed push was boosted by studies that showed a TPP-11 (so named for the 11 remaining participants) could still deliver economic benefits to partners, albeit more modest than the original, now called TPP-12. For instance, the same Peterson Institute study projected that by 2030 Japan's real income would be $46 billion above the baseline under TPP-11, as opposed to $125 billion under TPP-12.

Ironically, the only loser in the TPP-11 would be the US itself, which would go from a $131 billion gain over the baseline in the original deal to a $2 billion drop as an outsider. Such predictions have led to hopes that the US will rejoin the agreement. The suspension rather than outright removal of provisions is intended to make this easier, since once the US rejoins the deal can quickly be restored to its former state.

This seems unlikely, as despite indications earlier this year that Trump was reconsidering, there have been no concrete steps toward re-enrolling the US in the CPTPP. However, observers remain optimistic about the potential of the agreement for promoting a level playing field among members and non-members alike once it takes effect, which is expected by early next year once four more countries have ratified it.

These hopes are particularly bright in Southeast Asia, home to four of the CPTPP's members. The existence of a framework for fair treatment and transparent governance is expected to exert a powerful attraction to join the pact, and even to influence countries that choose to remain outside.

"If governments like Indonesia decide that TPP is not for them, I don't think that's catastrophic. They can still be outside the TPP, but what they cannot do is be difficult," says Elms of the Asian Trade Center. "Non-members cannot set up a challenging investment climate or opaque mechanisms in a world where TPP exists, because investors will say, ‘Why am I here when I could be in a TPP country?' So I think we will find that either more countries will join, or they will have to by default become more aligned with TPP."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.