Temasek and CFOs: PE to the people

It has taken Temasek Holdings four secondary transactions over 12 years to create a product that allows retail investors to participate in its private equity portfolio. Will others follow suit?

Over the course of seven days in mid-June, more than 25,000 individuals in Singapore successfully applied for access to a portfolio of PE funds managed by the likes of The Blackstone Group, KKR, and TPG Capital. Nearly 11,000 of these retail investors committed between S$2,000-4,000 ($1,450-1,900) in what ranks as one of the most unusual and impactful attempts to democratize the asset class. There was even the option of subscribing via ATM.

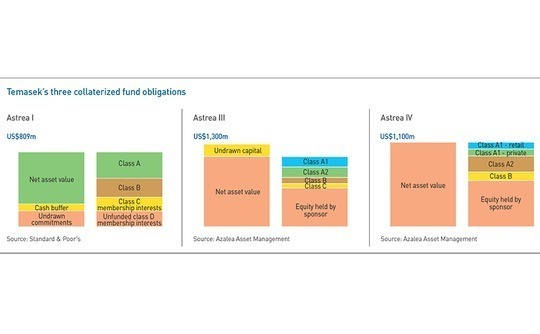

For Temasek Holdings, it represents the culmination of a 12-year journey. The Singapore government-owned investment fund has completed four secondary transactions in the Astrea series, including three collateralized fund obligations (CFOs) whereby investors subscribe to bonds backed by private equity vehicles. Of the $501 million raised in the most recent of these, S$121 million came through bonds sold to the general public.

This first-of-its-kind deal involved a rigorous investor education initiative and the employment – once again – of a structure that has largely fallen out of favor in the PE industry. Opinion is divided as to whether CFOs can be revived as a channel for retail participation in the asset class, but Temasek has certainly delivered on its ambition to do something different.

"It was always within our group's aspiration to deliver a new asset class in private equity to a larger public, particularly retail investors who find it difficult to access this asset class. There are easier ways to de-risk a structure than a CFO – a lot of people in the secondaries space use bank loans – but we wanted to put a product into the market," says Margaret Lui-Chan, CEO of Azalea Asset Management, the Temasek-owned group responsible for the two most recent iterations in the Astrea series.

The beginning

The first iteration, launched in 2006, came at a time when CFOs were in vogue. Banks were not as willing as they are now to lend against a portfolio of LP interests in funds, but institutional investors in the US and Europe were willing to put up the money. The issuers, typically financial institutions, found that AAA ratings were eminently achievable for senior tranches.

CFOs also offered flexibility in that they could deliver products throughout the capital structure based on the same underlying funds. "Securitizing a portfolio into different tranches where the return and the upside and downside are different opens up a broader investor universe. Bond investors and low yield investors like the limited downside when you securitize a portfolio and chop it up into tranches," says Lucian Wu, a managing director at HQ Capital.

Astrea I saw $809 million raised to buy 46 fund positions held on Temasek's balance sheet, with Capital Dynamics servicing the transaction. Class A and B rated notes accounted for $489 million of the corpus and the rest was "quasi-equity," of which $171 million could be called to cover unfunded commitments. Temasek contributed 49.5% of the quasi-equity, with third-party investors – reportedly AlpInvest Partners, Coller Capital and Goldman Sachs – putting in 50.5%.

The transaction had several features that remain part of the Astrea series in some form to this day, including a liquidity facility to ensure the structure continues to operate even if distributions from the funds temporarily dry up. Astrea IV, for example, can operate without cash for three years. The broad principles of portfolio construction are also largely unchanged.

The senior tranches for Astrea I were 40% overcollateralized, buyout funds were responsible for 94% of net asset value (NAV), and no more than 17.4% of the portfolio had exposure to a single vintage year. Astrea IV is 54.4% overcollateralized and backed by 36 funds with a seven-year weighted average age – so they are mostly fully deployed – and a NAV that is 86.1% buyouts. NAV peaks at 21.2% for a single vintage.

The bonds from the first iteration of the program were repaid at the end of the five-year tenor and the senior tranches were still rated AA and AAA despite the global financial crisis. Unfortunately, the crisis substantially eroded investor confidence in CFOs. When Astrea II launched in 2014, it was structured more like a traditional secondary, albeit with a few tweaks.

Ardian took the lead in pricing a portfolio of fund interests worth more than $1 billion, including unfunded commitments, according to sources familiar with the deal. Temasek remained the single largest shareholder in the 36-fund portfolio with a 38% stake, while much of the rest is said to have been covered by an Ardian fund. Four other groups – institutional investors from Singapore and overseas – came in as well.

"It was more like a traditional secondary transaction because the market conditions required it," says one investor who took part in the deal. "But a pure secondary transaction, where the investors take out the entire portfolio, would not have flown."

Getting rated

For Astrea III and IV, the portfolios were worth around $1.1 billion and Temasek retained a majority stake in each one, putting the transaction sizes at approximately $500 million. This alignment of interest – along with overcollateralization, diversification, fund maturity, and structural protection – was important in getting ratings agencies comfortable with an asset class unlike anything else in the structured finance universe.

"The real challenge is there is no scheduled cash flow, in terms of magnitude or timing," says Jesse Sable, a credit analyst at S&P Global Ratings. "Our whole framework is focused on a statistical analysis of public market volatility and of private equity returns. As we look at 100,000 simulated paths, what are the scenarios where there are going to be cash flow droughts that could potentially cause interest shortfalls or ultimate failure to pay principal?"

This analysis uses historical data that match characteristics of the target portfolio, primarily the types and ages of the funds, to create cash flow projections. For example, about 20% of Astrea IV comprises 2013 vintage buyout funds, so Fitch Ratings reviewed how five-year-old buyout funds performed over different economic cycles. It then examined how these scenarios corresponded to economic cycles over 10-year intervals to match the maturity of the bonds.

The key data points in the analysis are: how much capital the underlying funds called; how much capital was distributed; and what was the NAV appreciation or depreciation that was driving distributions. Fitch also tested the resilience of the CFO structure to different magnitudes of underperformance by the funds.

Problems emerge when the components of a CFO don't correspond to the datasets being used to assess them. In the case of Astrea III and IV, the level of exposure to growth equity and to Asia was unusually high. S&P ended up applying a 100% haircut to future distributions from the Asian funds in Astrea III, citing potential mismatches between Asian fund performance and the non-Asian fund performance on which its methodology was based.

For Astrea IV, the ratings agency performed its own statistical analysis and relied on some third-party analyses to investigate how Asian fund performance correlated to its existing datasets. As a result, it was able to give some credit to the Asian funds, but the haircut was still 45%.

"You have to understand their methodology and how their models work in order to construct the portfolio and make sure it's going to meet their requirements. As more of these get done the ratings agencies will become more comfortable with different methodologies, new ways to think about PE data and returns and more open to a broader set of underlying investment strategies and geographic regions," adds Stephen Sloan, managing director and head of the capital advisory group at Greenhill & Co.

As Azalea's exclusive financial advisor on Astrea IV, Greenhill was involved in negotiations with the ratings agencies over the structure and cashflow modeling of the CFOs. It also assisted on valuation and analytics as Azalea modified the portfolio. A number of the LP positions in funds were acquired on the secondary market specifically for inclusion in Astrea IV because they offered greater diversification in terms of vintage, strategy and performance.

Of the portfolio's NAV, 62.8% is in the US, 19.1% in Europe and 18.1% in Asia. Blackstone Capital Partners VI, PAG Asia I, and Silver Lake Partners IV are the three largest investments, together accounting for 22.6% of NAV. There are five Asia-focused funds among the 36: KKR Asian Fund II, Hahn & Company I, FountainVest China Growth Fund, Trustbridge Partners II, and PAG Asia I.

Tailormade transaction

This customization is reflected in other elements of the structure as well. Several industry participants describe Azalea's actions as testing out the market and reacquainting the investor community with CFOs. As such, several features that were commonplace of these transactions pre-global financial crisis are absent. For example, rather than taking a dynamic portfolio approach that allow the manager to trade in and out of the underlying funds, Astrea III and IV are both static structures. What investors see is what they get, and with substantial downside protection.

Measures intended to protect the bondholders include a reserve account – funded after interest payments are made on the class A and B bonds – that is intended to fully repay the principal of the class A bonds on maturity. There is also a trigger mechanism that redirects residual cash flow to the reserve account if the debt level exceeds 50% of the overall portfolio value.

Opting to set aside cash generated from a portfolio to target a certain call date, rather than directly amortizing down the notes, is common in structured finance, according to S&P's Sable. What makes Astrea unusual is the decision to hold on to cash for as long as five years.

"We designed the bond with local investors in mind," says Azalea's Chue. "Right now, they are most familiar with bonds that are repaid in a full lump sum at the end of the term, so we started with that. To do something with amortization and early redemption, we would probably have to wait until later iterations of the program as investors become more familiar with the product. For Astrea IV, the principle was to make it easy for investors to understand."

Moreover, the S$242 million in class A1 bonds – split equally between a public offer and a private placement – are denominated in Singapore dollars and have a fixed interest rate. There is a 1% interest rate step-up if redemption doesn't happen within five years and a 0.5% bonus payment on redemption subject to performance. In contrast, the senior tranches of Astrea I were floating rate and US dollar and euro-denominated, and the reserve account was only designed to cover capital calls.

Azalea went out of its way to ensure that investors actually understood the structure. A user-friendly website was created for Astrea IV, complete with explainer videos and documentation that broke down the transaction in layman's terms, providing hypothetical models as to when and how the bonds would be repaid. There was also a roadshow specifically targeted at retail investors. Each event featured a primer on private equity, an explanation of Astrea IV, and a question and answer session.

Azalea received nearly S$890 million in applications for the retail offer, with a handful of people seeking allocations above S$1 million. They were cut back to S$11,000 apiece as 65% of the bonds went to individuals who subscribed for S$30,000 or less. Everyone who applied for S$4,000 or less received their full allocation. Overall demand for the three classes of bonds came to $2.5 billion. The effort was considered a success and there are plans to repeat it.

"It has taken us 12 years to get where we are, and we will continue to develop the platform. It will be a regular program, probably every 18-24 months," says Azalea's Lui-Chan. "We want to offer similar products through an ABS [asset-backed security] structure because it gives us flexibility to tweak the terms, to offer different levels of risk in the capital structure to different investors."

While the size of these transactions is unlikely to change much – a portfolio of $1-1.5 billion is seen as large enough to justify the costs – a natural evolution in the product would be to allow retail investors to participate in the junior debt tranches. Managed in phases, it would bring investors ever closer to pure PE exposure as their familiarity with the asset class grows.

This raises the question as to whether bonds are the logical stopping point for the Astrea project. "One would imagine that if you had this overarching goal as a quasi-government institution to deliver private equity to the masses, then you would see them not only sharing in the benefits of exposure through a bond but also sharing the benefits of the leverage," says one Asia-focused GP. "On this basis, eventually there would be a tranche that comes out on the equity side."

Wider take-up?

As such, Temasek's objective to realize societal as well as financial benefits stands it apart from most others in the market. Asked if he thinks more groups are likely to consider CFOs, Jason Sambanju, founder of Singapore-based secondary investment firm Foundation Private Equity, is circumspect: It's worth considering, but there is already a lot of straightforward leverage available for LP portfolio purchases. A global secondaries investor takes a similar view, noting that his firm will continue to rely on vendor loans, deferred payments, and third-party leverage.

The bottom line is CFOs take a lot of work and require collaboration with multiple stakeholders. And if the societal objective is removed from consideration, perhaps the financial and administrative burdens don't stack up. Wu of HQ Capital observes that groups using leverage to buy secondaries might reconsider their options as interest rates rise, but he has seen little evidence of a CFO revival. Nevertheless, Azalea believes it can create a template to be used by other asset owners.

"It could be pension plans and sovereign wealth funds that want to rebalance their portfolios, or even traditional secondary investors that want an alternative to borrowing from banks," says Chue. "We do receive inbound inquiries and some of the questions relate to transaction features, such as the costs involved and whether they can include other asset classes like infrastructure and real estate."

The most obvious candidates are financial institutions that are required to move alternative assets off their balance sheets for regulatory reasons but want to retain a degree of exposure. Indeed, one of the few other CFOs in recent years saw an insurance company spin out a portfolio of private equity fund positions and then subscribe to bonds issued by the new vehicle.

For others, though, the implications of the Astrea transactions are wider ranging. Greenhill's Sloan believes they reflect a transition in global secondaries as investors respond to the stronger capital flows and rising sophistication by taking tools that have proved effective in other financial markets and applying them to private equity.

"You already see this in a lot of the GP restructuring transactions, portfolio financings and more interest in CFO structures where we expect others to consider this as an alternative liquidity option as the securitization and ratings process becomes more efficient over time," he says.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.