Vietnam consumer: Trading up

Vietnam’s consumer economy is attracting a wider range of investors as deal sizes inflate and new openings emerge in a winding value chain. Private equity is positioned to exploit several vantage points

Sentiment for Vietnam has accelerated more rapidly than actual investment, but signs are accumulating that a tipping point may be on the horizon. This outlook is supported by a mix of recent private equity deals which together reveal a maturation process on several fronts.

Earlier this year, Warburg Pincus agreed to back Vietnam Technological & Commercial Joint Stock Bank (Techcombank) to the tune of $370 million. This followed closely on the GP setting up a $200 million logistics platform for the country alongside local industrial conglomerate Becamex IDC. Meanwhile, Creador made its first Vietnam investment by injecting about $44 million into Mobile World, a domestic frontrunner in telephony and household appliances.

A number of macro themes are prominent in this activity. Vietnam's nascent middle-class spending power is creating investment openings all along the consumer value chain, from downstream retail and services to upstream commercial support infrastructure. It is accompanied by higher expectations around quality and service for both essential staples and upmarket consumables.

This story has developed irrespective of macro cycles at the national and global level during the past decade, providing locally based private equity players with a relatively stable turnaround market. For PE, the opportunity has been tied to both the amenability of the consumer sector to traditional value-add playbooks and an absence of direct competition from legacy financial institutions, which are generally wary of providing growth capital to asset-light businesses.

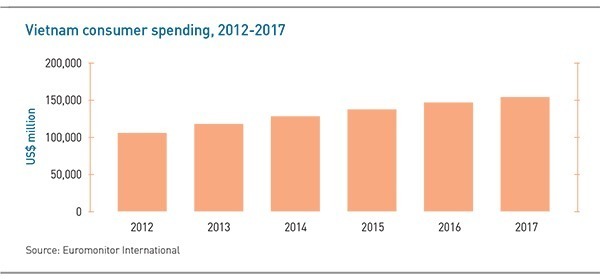

At the same time, Vietnam's post-war baby boom in the mid-1970s has aged into the so-called "golden" population structure, with two-thirds of the country contributing to the workforce. Nominal GDP growth has held around 6.5% in recent years as foreign direct investment and government infrastructure spending drives a mass migration from the provinces to the cities. Consumer expenditure increased at an annual average rate of 7.8% during the five years to 2017, according to Euromonitor International.

The growing presence of global and Southeast Asian GPs points to a more precise economic threshold, however. Vietnamese consumer companies have finally reached the size where their growth capital requirements are attracting large strategic investors and international private equity.

"We see actionable opportunities in the emerging champions in Vietnam," says Bert Kwan, a managing director at Southeast Asia-focused Northstar Group. "The leaders are becoming clearer in some of the more traditional consumer segments. In next generation segments where technology meets consumer, we are getting a sense of who will likely be in the cohort of champions based on the quality of management teams and the robustness of business models. It is in these areas where the right private equity partner providing the right amount of capital can make a particularly big difference."

In many instances, these emerging champions are already so large that the pre-IPO rounds they seek to raise are beyond the reach of local and sub-regional investors. But a parallel preponderance of mid-cap companies looking for growth options does imply an expanded opportunity set for everyone. Notably, Mekong Capital, which writes checks of $8-15 million, has exited several positions to larger GPs, from TPG Capital's acquisition of Vietnam Australia International School to Creador's investment in Mobile World through a PIPE deal.

New markets

Private equity inroads are further supported by the still-fragmented nature of the country's various consumer-related industries and the fact that modern trade practices remain a fledgling proposal across the value chain. This transitioning frontier profile means that as more money piles into the sector, investors must be open-minded not only in how they define the opportunity set but also in how they can penetrate changing markets.

PENM Partners' activities in Vietnam have tracked this evolution, including the rise of the local heavyweights. The Ho Chi Minh City and Copenhagen-based firm began operating in the country in 2006 with a smattering of investments in small food and personal care product companies, only a couple of which had managed to establish even marginally professional brands.

One of these was a chili sauce maker called Masan Foods, which has since transformed into Masan Consumer Holdings, a conglomerate with annual sales in excess of $2.5 billion that has reinvested the sector by backing the likes of Techcombank. On the back of this success, brand curating has solidified as the crux of PENM's consumer thesis. The strategy is based largely on the view that older generations distrustful of non-branded products are still making most of the household shopping decisions.

"Food safety is everything for the decision makers purchasing household items in Vietnam," says Hans Christian Jacobsen, a managing partner at PENM. "Buying branded processed foods is less of a priority, but for fresh produce – dairy, juices, fish, and meat – safety is a significant driver of preference choice. For now and for the next many years, that's going to be a very important parameter in the whole marketing of consumer products in Vietnam."

Investors generally agree that the local legwork of the past five years has set up an encouraging landscape for private equity entries. Vietnam consumers are now more educated about business models that traditionally appeal to the asset class and modern retail plays have become relatively ubiquitous, at least in the larger urban areas. This process has included a proliferation of chain grocery stores, specialty retailers, restaurants, coffee shops, and online marketplaces.

"We expect there to be a doubling in e-commerce by merchandise value this year from last year because people are getting more used to buying things online and payments are getting easier," says David Do, a managing director at VI Group, a local middle market-focused firm that has raised $400 million across three funds. "The big issue in Vietnam has been return rates. People tend to return things if they're not familiar with them – but we're seeing that lightening."

The rise of modern retail implies a corresponding development in infrastructural support. This theme is playing out globally as established companies look to streamline shelf space use and inventory processes through technology while also improving customer experience. In Vietnam, the whole process is more rudimentary but not incomparable.

Although growth in Vietnamese e-commerce is expected to drive investment in a number of support industries, especially around logistics and finance, most of the private equity opportunity is said to be in the professionalization of the brick-and-mortar players. Mekong, for example, sees the intense competition between international chains in Vietnam's grocery space as both a deterrent and an opening for PE participation.

"For the supermarkets to drive their frequency of visits, they need a fresh offering, and the only way to really pull that off is to have a sophisticated cold chain," explains Chad Ovel, a partner at Mekong. "We see this as a great way for us to invest in modern trade retail even though we couldn't find a direct window of opportunity in supermarkets and mini-groceries. It's also a diversified play because we're growing broadly with the market instead of just taking a single bet on one of the chain stores."

Mekong's cold chain investment, ABA Cooltrans, services several of Vietnam's top supermarket, convenience store, and restaurant outlets via a fleet of almost 300 outsourced trucks. Operating asset-light is a key part of the game plan. Indeed, historical rockiness in local real estate and financial markets has prompted Mekong to transition into an exclusively asset-light consumer approach.

There are a number of risks related to an asset heavy approach to consumer logistics in Vietnam. One is the fact that real estate prices are uncommonly high for a developing country due to the prohibitively widespread use of land for artisanal economic purposes and a cultural predilection for investing personal wealth into land.

This challenge is being partially answered by a rapid expansion in shopping mall infrastructure financed by the government, which is supporting private consumer investment opportunities on leased properties. Warburg Pincus has also invested in this space, having backed mall operator Vincom Retail in 2013 and securing a partial exit last year in the company's $700 million IPO.

Additional risks relate to the lack of local debt at fixed interest rates, which could result in long-term assets becoming economic drags on a company during inflationary periods. For heavy assets financed offshore, deflation of the local currency could create similar problems. However, VI Group views embracing the heavier end of the logistics spectrum as a more measured approach.

"Whenever you have hardware, you're going to have higher capex and slower growth, but if your locations are right, you've invested in the right equipment, and built warehouses to the right specs, it's a much more predictable cash flow business," says VI's Do. "That's why investors value medium and long-distance logistics companies based on profits, whereas last-mile delivery is valued on revenue growth."

VI's logistics investments include Gemadept, a port operator and cargo transport company, and Vinafco, a freight forwarding and supply chain specialist. Despite the pressures of the real estate and project financing environment, these types of plays do appear to reflect a persistent confidence in heavy infrastructure, with even traditionally real estate-wary investors tending to take up some exposure. Mekong's ABA, for example, has acquired a large cold storage warehouse.

Professionalizing supply chains for traditional retail outlets appears set to remain the most viable consumer support play for private equity as accelerating uptake of e-commerce distorts the market in the foreseeable future. There is a prevailing suspicion that the finer categories of last-mile logistics related to online shopping and personal deliveries could be monopolized by regional mobility technology players the likes of Grab – leaving little upside even for early-moving competitors.

"We looked at a lot logistics companies in Vietnam but we never made any investments because we haven't found the same level of quality that we could in other developing countries. A lot of distribution companies are poorly organized with a lot of leased equipment," says PENM's Jacobsen. "If they go down, you lose your money, and then they start a new business with the same staff in the same leased trucks. It's a risky business."

This perspective accounts for much of the attention at the more complex, downstream areas of Vietnam consumer, including healthcare, travel, and education. Healthcare has proven to be a difficult play so far due to the prevalence of public hospitals. Travel opportunities, meanwhile, are often either considered locked up by international players in online ticketing, or vulnerable to the exterior macro cycles that impact the disposable income of inbound tourists.

Education, however, has generated a number of interesting stories, with investors citing a strong cultural prioritization of children's welfare. In addition to TPG's purchase of Vietnam Australia International School, EQT Partners has invested English language specialist ILA Vietnam, and VI Group has backed Wellspring International Bilingual School as well as the American Academy of Vietnam.

Financial revolution

In the most strategically fundamental way, education is also attractive as a bet on family life. As Vietnam's golden baby boom population becomes more middle class, family-related spending patterns are expected to be colored by surges in mortgage financing, life insurance, and credit card uptake.

Warbug Pincus predicts outsized growth across the next 10 years in all three of these financial services categories and has invested the consumer-facing banking segment accordingly. Techcombank, which signed an exclusive 15-year insurance partnership last year with Manulife, is one of the first local operators in home loans and unsecured personal credit with products such as Dream Card.

"Private sector players, given how they can focus more on the customer and use capital more efficiently, will continue to take share from the state-owned banks," says Jeffrey Perlman, head of Southeast Asia at Warburg Pincus. "As that happens, public market investors will see similar return on equity that they've seen in markets like India. If you can generate 20%-plus growth and above 20% return on equity on a go-forward basis, the book value starts to compound, and you can end up with large financial institutions over time."

One of the breakout companies in this space is Timo, which claims to be country's first digital bank although it maintains a couple physical locations decked out like coffee shops. The appeal to millennials and the focus on technology are notable for recalling familiar private equity and venture capital investment themes, especially as young people move out of their parents' homes and start making their own consumption decisions.

However, these modernist trappings also belie a lingering conservatism that could make sector transformation and PE participation difficult. Vietnam's personal credit industry is still hindered by extensive security packets and a web of regulations that make it hard to open a new consumer finance boutique.

Risk may be greatest in payment technology segments, which are often seen as winner-take-all propositions. Other back-end fintech domains such as data processing and credit scoring systems could be comparatively prospective for PE, especially since establishment of a credit risk assessment industry is considered essential for taking Vietnamese commerce to the next level.

Playing the field

VinaCapital, a local investor that claims $1.8 billion in assets across multiple asset classes, has embraced the financial services space with a diversified mandate. In a strategy that highlights the uncertain nature of this end of the consumer sector, the firm has spread its bets across technology-based retail banking, traditional banks, and selected fintech segments.

"Online banking is a key area, but we may have seen too many of these e-wallets coming up and my gut feeling is that the banks – or MasterCard and Visa – are going to develop their own similar technology and dominate this space with their own prepaid credit cards," says Andy Ho, CIO at VinaCapital. "You really have to be careful about competition in this space because there's a lot of money chasing these start-ups, but frankly, there may not be enough room for multiple players."

This brand of cautious open-mindedness is a recurring philosophy among informed investors navigating the evolving consumer landscape in Vietnam. The inclusiveness can be daunting – it cuts across finance, logistics, e-commerce, manufacturing, product processing, and direct retail – but it can still be addressed with an overarching targeting methodology.

For example, instead of trying to find gaps in specific areas of the value chain, private equity investors could focus on easing the growing pains of Vietnam's new breed of corporate heavyweights. Many of these companies, such as local dairy giant Vinamilk, are ramping up efforts to operate at both upstream and downstream ends of their respective industries, but struggling to integrate these assets and run them in an efficient manner.

"When we talk to family businesses in Vietnam about their challenges going from raw materials to finished products, nine times out of 10 they say capital is the problem," says Nguyen Cong Ai, a partner at KPMG. "But even some of the large corporations don't have a management system with enough operational visibility to see things like the fluctuations in day-to-day output. There are a lot of things that are not on the capital side around technical knowhow and process improvement that need to be looked at too."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.