Indonesia tech IPOs: Fringe benefits

The Indonesia Stock Exchange has seen the first IPOs of domestic tech start-ups in Kioson and M Cash. The appeal of these listings may lie chiefly on the non-financial side

The IPO of online-to-offline (O2O) e-commerce kiosk operator Kioson last October was a long-awaited milestone for the Indonesia Stock Exchange (IDX). As the first-ever public listing of a local technology start-up, it was widely perceived to have paved the way for other entrepreneurs to tap the public markets.

By some accounts, the publicity value of the IPO overshadowed its initial financial returns: Kioson sold 150 million shares, or a 23% stake, in the offering for IDR300 apiece, raising just IDR45 billion ($3.4 million). However, the stock has appreciated considerably in the months since – currently it is trading around IDR2,880, nearly 10 times the offer price – which CEO Jasin Halim sees as a validation of the company's strategy.

"Our timing was very good. There had been a lot of investments in start-ups, such as Tokopedia and Go-Jek, and the publicity was just phenomenal," says Halim. "We were very lucky at that time to have decided to go this IPO route, which created a huge opportunity for publicity, in turn helping to bring up the price level."

The Kioson listing had little direct impact on Indonesia's institutional investor community, since the company had no VC backers that could have made an exit in the offering. Nevertheless, it has prompted a debate about the potential uses of an IPO in Indonesia, and the degree to which a public listing could provide an alternate avenue for start-ups to raise capital.

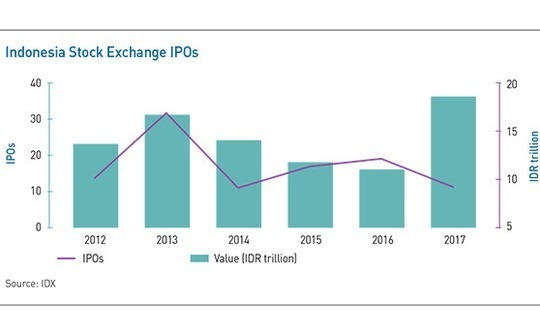

Kioson's offering contributed to a rebound year of sorts for IDX, which had seen public listings decline each year between 2013 and 2016. The 36 IPOs in 2017 not only ended this slump but also surpassed the six-year high-water mark of 31 listings set in 2013.

Still, while the number of companies going public rose, the capital raised through their offerings did not follow suit. Instead the collective value of the country's IPOs fell from IDR12.1 trillion in 2016 to IDR9.2 trillion in 2017. This figure was still above 2014's total of IDR9.1 trillion, the lowest point in the last six years, but significantly below 2013's high of IDR16.8 trillion.

The result indicates that, like Kioson, many of the companies that went public last year did so through relatively small offerings. This outcome could repeat as regulators' attempts to attract IPOs by small and medium-sized enterprises like M Cash, a similar O2O e-commerce operator that raised IDR300 billion in its November float, meet retail investors likely to provide limited returns.

"The IDX has actually been quite proactive – they do start-up initiatives, invest in resources to assist start-ups and get information out there so people are aware there are listing options," says Dea Surjadi, head of business development for Indonesia at Golden Gate Ventures. "But the Indonesia market also has very low liquidity. There's not a lot of cash circling the stock market, and only a limited percentage of the population actually buys stocks."

Profit motive

Compounding the issue of liquidity is the conservatism of local investors, who are widely perceived as preferring to invest in profitable companies rather than start-ups that are still burning cash. This leaves international investors, but most GPs counsel their companies that a valuation of at least $300 million is needed to attract capital from these players on the public market, which limits the number of start-ups for whom this is a realistic option.

Efforts are underway to make Indonesia a more attractive listing location for tech start-ups, with the regulators aiming for a leading role. David Rimbo, a managing partner at Ernst & Young who has advised the Financial Services Authority (OJK) and IDX on an E-Commerce Roadmap, notes that these bodies are experienced at tailoring listing requirements to suit industries with unusual needs.

"When the coal mining industry was really picking up five to 10 years ago, IDX relaxed some of the requirements, allowing coal mines that were still in the exploration stage to list on the exchange," says Rimbo. "So we approached them on that basis, to get them to consider whether such accommodation was possible for the benefit of the e-commerce ecosystem."

Market participants describe the regulators as open to the possibility of establishing a market aimed at tech companies, like Singapore's Catalist board, that would make it easier for start-ups to list. IDX has also begun to publicize more widely the tax benefits for founders, in hopes of encouraging larger companies to pursue a local listing instead of going to a foreign exchange.

However, the two tech listings so far were done under existing regulations. Kioson's experience in particular tests some of the conventional wisdom around Indonesian IPOs, especially assumptions about profitability requirements. The company had reached out to IDX and OJK to determine the requirements for an IPO, and was told that it was actually possible to go public before reaching profitability by listing on the development board.

Unlike the main board, which requires a company to demonstrate an operating profit for the previous financial year, the development board only requires that a company show it can make a profit by the end of the second financial year following the IPO. Kioson reached this target through the planned acquisition of Narindo, one of its partners that had already reached profitability.

"When you go to any investor, you need to show when you're going to be profitable," says Kioson's Halim. "We wanted to make sure that the horizon we showed them was very short so that if another start-up goes to them in the future, needing a longer horizon, they will have a successful model."

The development board also features more relaxed requirements with regard to hard assets, calling for a minimum of IDR5 billion as opposed to the main board's IDR100 billion. In addition, a company can list after 12 months of operation, rather than the standard three years.

But while the development board does provide an easier path to listing, the drawback of it and of a potential tech-centered board is that they could be perceived by investors as inherently riskier, making the challenge of liquidity even greater. With this in mind, market participants say start-ups must be prepared to see limited financial returns from their IPOs.

Listing perks

In these cases, the side benefits of a listing may take center stage. For example, there is a clear publicity opportunity for a company when it goes public, particularly if there are unique factors about the company or the offering. In the case of Kioson, being the first e-commerce start-up to list creates an obvious draw.

In addition, an IPO can serve as a substitute for a VC round, allowing entrepreneurs to raise capital and still maintain their independence from the documentation and control factors that a VC investor might demand. Founders might also see a listing as a more reliable way to determine the value of their companies.

"When you talk to a VC or PE investor, the valuation can vary from one to another, depending on who you talk to," says Halim. "So another reason for putting the company in public hands is that it gives you more of a marketplace approach on your valuation."

However, investors caution that entrepreneurs should not overlook the risks of treating an IPO as replacement for a VC round. Taking a company public too soon can leave it exposed to market stresses for which it is not ready, and deny it the assistance that an investor can provide in meeting its growth plans.

"If you go out too early, you're not getting any insight from your public market investors," says Shane Chesson, a founding partner at NSI Ventures. "But if you take a good VC's money, the VC is there alongside you and they provide a lot of input. We have experts to help you go into multiple markets and in-house tech, marketing, and HR that can all assist you to grow your business."

Whether more start-ups will follow the lead of Kioson and M Cash remains to be seen. While going public is technically feasible for such companies and both Kioson and M Cash have performed well since their offerings, their chances of success in the long term are unproven. Other entrepreneurs may therefore consider traditional VC investments as a smarter bet outside of special situations.

On the investor side, many see these smaller IPOs as warm-ups for the listings of Indonesian tech unicorns such as ride-hailing app Go-Jek, which has indicated it plans to go public by next year, and e-commerce platform Tokopedia. While these start-ups are likely to focus on financial returns in their offerings, since they do not need the publicity boost, existing examples of successful domestic tech IPOs can only help.

"There's a huge appetite for IPOs for tech companies among Indonesian investors, and we do expect a more robust IPO market," says Donald Wihardja, a partner at Convergence Ventures. "The size remains to be seen, but the IPOs of Kioson and M Cash are a proof of concept that Indonesian companies are IPO-able and a sign of the maturity of the market."

SIDEBAR: PE exits – Holding pattern

For the Indonesia Stock Exchange (IDX), 2017 was a welcome relief, as 36 companies went public after a steady decline over the previous four years. But the development went little-remarked by the private equity community, as only one of the listing companies was PE-backed.

This listing of MAP Boga Adierkasa (MBA), the Indonesian franchisee for several Western food brands backed by General Atlantic, was a muted affair. The company issued 22.2 million shares, amounting to a 1% stake, at IDR1,680 apiece, and raised IDR37.3 billion ($2.7 million).

"They floated a very minimal stake to the public, and the rest is held by the original shareholder and General Atlantic," says Larry Sutikno, CEO of boutique investment bank Avantgarde. "I think they are just listing the company, and then when they see the right value maybe they will exit."

The dearth of IPOs in 2017 was characteristic of Indonesia, where PE investors have rarely found listings a useful avenue for exits. Over the last 10 years, AVCJ Research's records show only a handful of PE-backed IPOs in the country.

Public offerings remain unattractive to PE for a number of reasons: for one, IDX is known as a relatively illiquid exchange where raising significant amounts of capital at a time is unlikely. For another, founders are often unwilling to part with many shares due to fears of losing control.

"Even after they go IPO they still want to keep a significant stake in the company, which restricts the size of the public float," says Devin Wirawan, head of investment at Saratoga Capital. "That creates an additional challenge for private equity: not only is the company not big enough, but the liquidity is also very slight."

This is not to say that exiting through an IPO is not worthwhile; a number of investors have successfully sold portfolio companies after listings or re-listings. Notably, CVC Capital Partners raised over $600 million in an offering of cable TV provider Link Net in 2014, following a technical IPO a few months earlier. Saratoga took telecom tower business Tower Bersama public in 2010, raising IDR428 billion. However, trade sales remain the dominant exit route for GPs overall.

While Indonesia's VC investors look to the country's financial regulators to create new incentives for their investee companies to go public, the PE community sees little need for improvement in this regard. If the environment for IPOs is to improve, the market liquidity and reluctance of founders to part with their stakes are the bigger obstacle to overcome.

"The regulatory pipeline has never been our concern," says Saratoga's Wirawan. "The government really wants companies to go public, for transparency and other reasons. The biggest issue has always been the size of the public float after the IPO, and traction from institutional shareholders."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.