4Q analysis: Riding the wave

Chinese companies return in strength to US bourses as investors leverage public market highs; Australia a bright spot as Asia fundraising slows; 2017 sets new record for PE investment on back of big buyouts, tech deals

1) Exits: IPOs on the up

The last golden age for Chinese IPOs in the US was in 2014 when 14 PE and VC-backed companies completed listings, led by Alibaba Group and JD.com. Much has changed since then, with domestic offerings and trade sales (Alibaba and JD.com are among the buyers) now established as viable options for investors. Nevertheless, 12 companies still listed on NASDAQ or the New York Stock Exchange (NYSE) last year – the most since 2014 – and seven of those offerings came in the final quarter.

Private equity-backed IPOs have been steady rather than spectacular in 2017, increasing over the course of the year to reach $12.6 billion in the last three months, according to AVCJ Research. But the contribution to that total from companies listing in the US is the highest in three years with $2.58 billion raised through eight offerings. (The non-China entry is Sea, a Singapore-headquartered mobile internet and gaming platform that raised $884 million on the NYSE.)

Of the Chinese contingent, education and financial technology are the dominant themes: Rise Education and Four Seasons Education – which offer after-school tutoring – were joined by Qudian, LexinFintech Holdings, PPDai, and Jianpu Technology. The first three of these four fintech players occupy the micro-lending space, helping meet the short-term financing needs of young consumers who tend to be underserved by banks. They use big data technology to make rapid credit assessments and match loans with funding sources such as high net worth individuals and institutional partners.

China – as usual – led the way in terms of private equity-backed IPOs, with 54 offerings generating $8.53 billion in proceeds, but strong public markets globally saw several other jurisdictions put in encouraging performances. Japan's 17 IPOs represented the highest quarterly total in three years, while India's seven were the joint most in seven years. India has delivered 37 offerings in 2016 and 2017, more than the previous five years combined. Seven of the 17 from 2017 took place in the final quarter, led by SBI Life Insurance, which raised $1.28 billion.

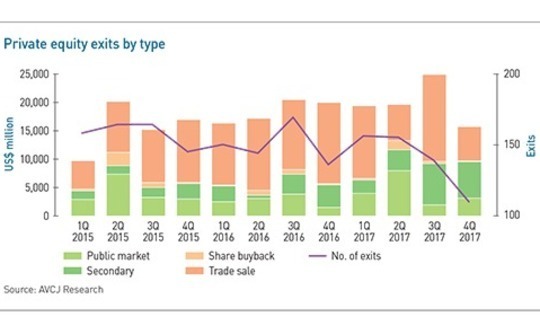

For the year in full, PE portfolio companies raised $39.8 billion through 395 IPOs. The dollar amount is not spectacular – it trails 2014 and 2015 – but the number of offerings represents an all-time high. A new record was also set for overall private equity exits in 2017, with proceeds reaching $79.2 billion, surpassing the previous year's $73.7 billion.

This came despite a relatively disappointing year for trade sales, which came to $40.2 billion, failing to match the 2016 high point of $49.8 billion. The decline in activity was counterbalanced by an uptick in public market sales – understandable given the performance of listed equities – and secondary sales. They reached $16.9 billion and $19.6 billion, respectively, with the latter total being the highest ever recorded.

Other breakthrough transactions from the quarter involved the region's least-developed markets. Vincom Retail completed far and away Vietnam's largest IPO, raising VND16.1 trillion ($709 million) and securing a partial exit for Warburg Pincus. Meanwhile, on the trade sale side, TPG Capital sold its majority stake in whisky producer Myanmar Distillery as Thai Beverage paid $735 million – to multiple investors – for a 75% interest.

2) Fundraising: Seasonal slowdown?

The final three months of 2017 will perhaps be best remembered for what didn't happen in terms of Asia private equity fundraising. Affinity Equity Partners was expected to close its fifth pan-regional vehicle at $6 billion before year-end, but the announcement came in the first few days of 2018. The filing for Orchid Asia's seventh fund, confirming a final close of $1.3 billion, also came in early January. Both vehicles were oversubscribed – the targets were $5 billion and $900 million, respectively – so the delays likely reflect the heavier administrative burden that has become part and parcel of fundraising.

Without these final closes, Asia-wide private equity fundraising came to a somewhat disappointing $13.1 billion in the final quarter of 2017. This is the lowest three-month total in four years, but it is drawn from provisional data compiled by AVCJ Research, which means the figure could be revised upwards as other fundraising activity comes to light.

For 2017 as a whole, Asia-focused private equity funds have attracted $97.9 billion in commitments. This compares to more than $100 billion in each of the three previous years, but it is still the fourth-highest total on record as capital has flooded into the asset class. If anything, 2017 will be remembered for KKR closing the largest-ever pan-regional vehicle at $9.3 billion – underlining how the market is becoming bifurcated – and a handful of enormous renminbi-denominated funds as Chinese governments at central and provincial level try to achieve policy objectives through private sector structures.

However, the bifurcation effect is apparent, with The Carlyle Group achieving a first close of more than $4.5 billion on its fifth Asia buyout fund. Having set an initial target of $5 billion, Carlyle is said to have agreed a hard cap of $6.5 billion, which would represent a 66% increase on the $3.9 billion it raised for Fund IV. Affinity's vehicle is 57% larger than its predecessor, while KKR saw a step up of 55%. The pace of fundraising is also faster than in the previous cycle – a result of increased demand as well as certain LPs writing larger checks for a smaller number of managers.

Australia, Japan, and Singapore were the only major investment destinations to see a quarter-on-quarter jump in fundraising activity. The most profound increase came in Australia, a notoriously lumpy market. Led by Quadrant Private Equity, Anchorage Capital Partners, and Allegro Funds, five managers achieved partial or final closes with combined proceeds of $1.69 billion, more than the previous three quarters combined.

Quadrant once again confirmed its status as a fundraising machine, taking approximately one month to reach a final close of A$1.15 billion ($863 million) on its ninth vehicle. The firm also appears to be deploying capital with increasing rapidity: approximately 16 months elapsed between the final closes on Funds VIII and IX, compared to 30 months for the previous cycle and three years for the cycle before that. What Quadrant isn't doing – at least not to the same extent as the pan-regional GPs – is substantially hiking the fund size with each vintage.

Meanwhile, the successful fundraises by Anchorage and Allegro could be seen to reflect investor interest in Australian special situations opportunities. Anchorage took three months to close its third vehicle on target at A$350 million, while Allegro achieved a first close on its second fund of A$250 million – the target size for the entire vehicle – within seven weeks. The GP eventually finished with A$290 million in commitments plus A$92 million for a sidecar vehicle.

3) Investment: Breaking records

Surpassing $50 billion in each of the first three quarters of 2017, Asia private equity investment reeled in the previous record total of $147.8 billion, set a year earlier, before the end of September. Although the final three months were not as impressive, with $39.2 billion in announced transactions, it was still enough to take the annual total past $200 billion for the first time.

The year has been characterized by big buyouts – many of them privatizations – and ever larger growth-stage investments for technology companies. There have been 37 deals of $1 billion or more, compared to 19 in 2016 and 25 in 2015, and they account for two-thirds of total capital deployed across the region. These themes were present in October-December as well, just not quite on the same scale as in previous quarters.

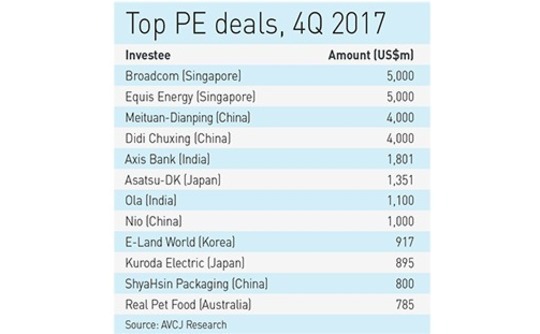

Each of the region's major investment destinations saw a fall in activity on the previous three months except for Southeast Asia. This was due to two $5 billion deals with a Singapore flavor: Global Infrastructure Partners' purchase of a renewable energy portfolio (incorporated in Singapore but with assets across the region) from Equis Funds Group and Silver Lake's support of a proposed takeover of Qualcomm by Broadcom (formerly Avago Technologies).

Elsewhere, two Chinese companies shared $8 billion of the $17 billion committed to growth deals, underlining the greater selectivity by investors in segments that have dominant players. Ride-hailing player Didi Chuxing raised $4 billion from investors such as SoftBank Group and Mubadala Investment at a valuation of $56 billion (eight months after SoftBank contributed $5 billion out of a $5.5 billion round), while online-to-offline services platform Meituan-Dianping received a $4 billion round led by Tencent Holdings at a valuation of $30 billion.

Four of those five are corporate carve-outs, but activity in the final quarter of 2017 suggests there is more to the market than sales of non-core assets. Tender offers by Bain Capital Private Equity for advertising agency Asatsu-DK (ADK) and by MBK Partners for electronic components manufacturer Kuroda Electric did not proceed with a unity of purpose between management and leading shareholders that has been present in other such deals.

Bain acquired ADK despite the initial opposition of major shareholder WPP Group, while MBK's purchase of Kuroda came against the backdrop of tensions involving activist investors that felt the company wasn't delivering optimal returns. Clearly, the drive for better governance and performance among Japan's corporate kingpins – and the role management teams want to play in achieving this – will force as well as encourage major shareholders into deals.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.