Financial institutions and fintech: Bouncing checks

Southeast Asia’s traditional banks have begun to take a strong interest in the financial technology environment, but their early-stage involvement in the ecosystem is still tentative

For its latest funding round Singapore-based InstaRem roped in powerful friends. Along with GSR Ventures, the money transfer service also brought on board SBI-FMO Emerging Asia Financial Sector Fund. The fund's sponsors, Japan's SBI Group and Netherlands-based development bank FMO, allowed InstaRem to partner with financial institutions and profit from their years of experience.

InstaRem's banking sponsors are far from alone – observers of the financial technology industry have noted a growing eagerness among traditional players to sponsor innovative companies in the space. InstaRem co-founder and CEO Prajit Nanu sees these players as a welcome addition that can provide start-ups with the resources and connections they need to fulfill their visions. More importantly, they seem intent to follow through on that promise.

"Anything a start-up can do, they have the resources to do themselves. But banks are really leading the charge in terms of working with intermediaries – smaller start-ups like us," says Nanu. "In Asia we're seeing some great examples: development banks have set up their own incubators, their own investment funds, and so on. It's slow, but it's not lip service; you see actual partnerships in this market."

Southeast Asia has been a particularly fertile ground for such efforts, with prominent banks in Singapore, Thailand, and Indonesia taking steps to support the fintech innovation ecosystem. Their strategies vary, but what they have in common is a focus on providing innovative start-ups with the benefit of their expertise.

Banks' efforts are not altruistic,. of course - the institutions have their own goals for these initiatives, and due to the early stage of their development it is not clear whether those objectives will be met. Financial institutions have the power to decide the shape of Southeast Asia's fintech community, but their involvement will almost certainly further complicate an already intricate ecosystem.

Appetite for disruption

The promise of technology in the financial services sector is much the same as in other areas. However, financial services is particularly attractive due to the dominance of traditional banks with strict requirements for providing products such as loans and credit, a frequent lack of branches in low-income areas, and few options for services such as money transfers. Companies that offer an alternative to these giants, embracing the niches they do not fully occupy, have an undeniable appeal.

"These are areas where historically the area is either ripe for disruption, like payments, or it is an area that is underbanked in the first place, meaning that banks have not paid attention to that segment because it's not profitable for them in one way or another," says Tek Yew Chia, head of KPMG's financial services advisory practice in Singapore. "A lot of fintech companies see an opportunity to get into those areas."

Despite these factors, the disruptive impact of technology has so far been lighter in financial services than in areas such as e-commerce or transportation. One barrier to entry for start-ups is the amount of capital required, both for the financial activities themselves and to keep the company's infrastructure running smoothly – after all, customers are unlikely to trust their financial futures to a service provider that cannot keep its own lights on.

Regulatory restrictions around the sector, typically strict, also put experienced parties at an advantage over newcomers. This is particularly true in Southeast Asia, a politically fragmented market in which financial services players hoping to expand their businesses must adapt to widely varying modes of oversight.

However, in recent years both the financial and regulatory burden have been eased somewhat. Banks watching these trends have become understandably concerned about the possibility of competition.

"I think banks see the potential threat from start-ups, and because they want to respond smartly to that they decide to work with start-ups rather than wait to be out-disrupted," says Douglas Abrams, managing director at seed investor Expara Thailand. Expara, which invested in one of the region's earliest fintech start-ups, payment services provider 2C2P, is managing the SME Private Equity Trust Fund II, a fintech-focused vehicle launched earlier this year by Thailand's Government Savings Bank.

"What's especially challenging for banks is that fintech start-ups tend to focus on the more profitable products in financial services, so banks don't want to see that business eroded, leaving them only with low-margin traditional banking products," Abrams adds.

The lifting of these barriers has enabled start-ups to take on a much wider range of financial challenges. Mobile payment firms have taken off with the rise in smart phones, while other start-ups are targeting the more lucrative corporate market where much less investment in marketing is required. For example, InstaRem, which started as a service to send remittances from overseas workers home, also appeals to small businesses for the speed and low cost of its services.

Reluctant participants

What keeps banks from taking on these opportunities is not lack of appetite or resources. The problem is the institutional structures that prevent a large player from moving as quickly as a start-up and cultural misgivings around taking too many risks.

"What we've seen is that banks are keen to embrace these areas, but they don't necessarily know what the right solution is or what the right model is," says Damian Adams, a partner at law firm Simmons & Simmons, who specializes in fintech. "While it's not fair to say banks aren't innovative, they're less inclined to be in the business of entrepreneurial innovation, which requires that you fail at least a few times before you make a success of it."

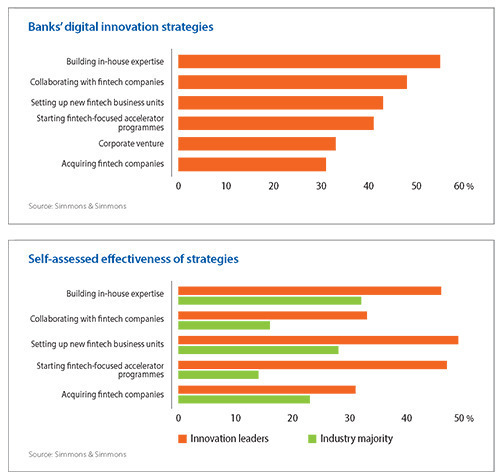

When Simmons & Simmons surveyed 200 global banks and asset management firms for a report on financial services earlier this year, they found a wide range of approaches to improving digital innovation capabilities. Asked how they had tackled the issue in the last three years, nearly half of respondents reported they had collaborated or partnered with a fintech firm – the second-most highly chosen option.

Setting up fintech and innovation-focused accelerator or incubator programs was also a popular choice, with just over two in five having taken this step. However, corporate venture investments and acquiring fintech companies proved much less appealing, with only 33% and 31% respectively indicating they had done so.

But the survey also revealed that confidence in these approaches was not strong. Among institutions considered by Simmons & Simmons to be innovation leaders – those describing their digital innovation as ahead of rivals – none of the strategies identified had a majority describing them as effective. Setting up an internal fintech business unit had a 49% following, while setting up fintech accelerators followed at 47%.

Among the rest of the respondents confidence was even lower. For the leading option, investing in in-house expertise, less than a third indicated they saw their actions in the past three years as successful. Fintech accelerators scored the lowest with only 14%. The responses would seem to indicate that financial institutions remain pessimistic about the start-up ecosystem.

Partnership with experienced industry players could be one way to overcome this restraint. At FinLab, a Singapore-based fintech incubator set up as a joint venture between SGInnovate – the VC arm of the government's Infocomm Media Development Authority – and Universal Overseas Bank (UOB), the VC partner handles investments while the bank mainly provides mentorship and guidance to investees.

"They want to be able to have the proper product market fit and the solutions that they feel are able to help them further their business objectives," says Felix Tan, managing director of FinLab. "So with the heads of UOB's businesses involved as our mentors, they will be able to identify the right companies and guide them in terms of their product market fit to make sure that the bank is able to use these products when they are ready."

Hong Kong-based VC investor Nest takes a similar role in InnoHub, an accelerator launched earlier this year by Thailand's Bangkok Bank aimed at supporting fintech development in the country. As co-manager, Nest identifies candidates for investment in a joint committee with the bank and commits capital to selected start-ups, with possible additional investments from the bank's venture arm. Once again, though, the institution's main focus is on mentorship rather than equity risk.

"We have Bangkok Bank senior executives engaged with start-ups, giving them direction on how their technology could be applied in the Thai market," says Niamh Given, director of programs at Nest. "Also because in Southeast Asia the markets are very diverse, Bangkok Bank is also supporting the start-ups with localization."

Vested interests

However, even when financial institutions are not active investors themselves, their tastes still have a considerable effect on the market.

In the case of FinLab, the incubator's partnership with UOB restricts the start-ups in which it can invest. The bank is looking for companies that will strengthen its own business, with an eye to acquiring investees down the line, and so the investment team naturally leans toward companies that fit this need rather than business models such as mobile wallets that have limited appeal to such clients.

"That space is extremely crowded, and also our focus is more on the B2B opportunity than B2C. We want the bank to be their first clients, so the whole idea is to have them serve the bank," says FinLab's Tan. "How UOB positions them and their product offering is entirely up to them."

This is not to say that an incubator's corporate backers have absolute veto rights. For FinLab, one partner is ultimately backed by the government, and SGInnovate is clear that its responsibility is to Singapore's wider financial services ecosystem, not UOB's corporate interests. Even in non-government ventures, financial institutions still need the input of their VC partners to help judge the risk of a particular start-up.

It is too early to judge the role of traditional banks in the fintech environment – market observers caution that this year's wave of accelerators and incubators have yet to graduate any start-ups, much less result in the hoped-for acquisitions. Nevertheless, many feel the institutions have already made their presence known. KPMG's Chia, looking at regional banks that have recently marketed new technology solutions to customers, suspects that many of these ventures were born from quiet collaboration with start-ups.

"It's not usually publicly visible, but a lot of the innovations we see are outcomes of banks working with some of the fintech companies," says Chia. "I think the key thing is whether enough time has passed to actually see how successful adoption has been – does it bring the start-up more revenue and investment, does the bank make a better profit, and does it solve a pain point for the customer? There are multiple dimensions."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.