Frontier markets: Late to the boom

Cambodia, Laos and Myanmar are among the last frontier markets in Asia but well positioned to benefit from accelerating interest in the ASEAN region. Private equity success will require a nimble approach

Emerging Markets Investment Advisers (EMIA) may be the only fund manager in the world that describes Cambodia as the most mature, financially savvy market in its mandate. But in the end, this unique brand of specialization could prove the key to survival in Asia's underexplored frontier territories.

EMIA touts the country as ahead of the curve in terms of investment regulations, with an uncommonly shrewd consumer market and dozens of popularly accessible credit institutions driving some $3 billion in small loans annually. The firm – which also focuses on neighboring Myanmar and Laos – has demonstrated its confidence in this backdrop by supporting a Cambodian expansion of iCare Benefits, a Singapore-based company that provides employers with worker benefit programs.

"Cambodia benefits from a particularly sophisticated microfinance sector, but we see all three of our markets as a natural trading and expansion block within ASEAN," says Joshua Morris, EMIA's CEO. "That's an attraction to us because we invest in financial services to support economic inclusion and leverage that block's growing middle class, increasing disposable income and aspirational demand for products and services."

This outlook is familiar among investors across emerging Southeast Asia, but the details of the iCare deal say much about how the vision can be practically pursued in the region's most inaccessible fringe. Most importantly, the company provides a novel workaround to the typical risk factor of loans turning sour due to credit schemes that fail to appreciate the hardships of low-income workers. No fees are charged, but revenues are generated through commercial transactions that have more manageable terms.

In some respects, balancing the risk-reward equation in such situations can be seen as akin to betting on bleeding-edge technology in advanced economies: innovation is the differentiator but necessity is still the mother of meaningful invention. As more private equity seeks opportunity in Southeast Asia's frontier markets, investors will need to remember that tailored approaches will be essential to both fundraising and turnaround success.

Busy in the backwaters

The iCare investment was made via EMIA's Cambodia-Laos-Myanmar Development Fund (CLMDF), which launched last year and recently closed at $65 million with an aim to commit up to $7.5 million in 10-14 companies. It expands on the firm's prior vehicle, a $20 million fund launched in 2010 that made eight investments restricted to Cambodia and Laos.

The growth highlights rising private equity ambitions in the region, recently exemplified by the International Finance Corporation (IFC) proposed $60 million investment in a Cambodia-Myanmar expansion by Hong Kong's IDS Medical Systems. One emerging pattern is cross-border expansion into the frontiers, a theme that bodes well for the investors seeking new opportunities in Southeast Asia's macro development story.

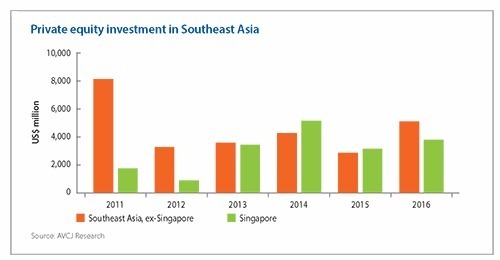

According to AVCJ Research, private equity interest in Southeast Asia ex-Singapore across the past five years has essentially mirrored that in the region's de-facto capital. However, markets outside of Singapore began to demonstrate greater relative momentum in 2016, with total investment spiking 80% on the year to about $5.1 billion versus a 20% lift in the city-state to $3.8 billion.

"We are seeing many more established PE firms investing in formerly off-limits Southeast Asian frontier markets such as Cambodia and Myanmar," says Andrew Thompson, head of Asia Pacific private equity for KPMG. "While such markets are still considered a little risky or offering lesser deal opportunity for some investors, we have seen in these markets some surprisingly large and less contested transactions. They appear to offer both high-growth and realistic pricing albeit with usual risks of investing in developing markets."

Many Asian frontiers such as Mongolia and Papua New Guinea struggle with a high dependency on commodities, which in turn subjects consumer purchasing power to wild cyclical swings. Although still largely agricultural, continental Southeast Asia benefits from comparatively diversified capital inflows and a certain consistency of investor optimism across areas of varying economic progress.

There is no agreement in the investment industry as to what constitutes "frontier status" – for example Morgan Stanley still relegates Southeast Asian success stories such as the Philippines and Vietnam to its frontier markets index. However, the inconsistency of this regional outlook is often interpreted as a reflection of the indistinct nature of its constituent economies and the notion that they are growing together with blurred economic borders.

"Companies in Vietnam will get to a level where they are open to more due diligence, transparency, shareholder governance irrespective of whether private equity comes in as a minority investor or as the owner," Pete Vo, managing director at CVC Capital Partners, told the AVCJ Vietnam Forum earlier this year. "This market, along with Cambodia and Myanmar, are the last remaining drivers of future growth in Southeast Asia and in Asia in general."

Some more tightly focused GPs share this perspective. Delta Capital Myanmar, for example, sees its core mandate as more closely aligned with the larger markets of Vietnam and Thailand than the Cambodia-Laos frontier. It expects to close its second Myanmar fund within the year at around $100 million, doubling the size of its first vehicle in 2014.

The momentum has been built, however, on a consumer-focused strategy that continues to face logistical challenges now mostly eclipsed by the region's more developed markets. Although infrastructure investment under China's One Belt One Road (OBOR) initiative is expected help even the score in the longer term, Myanmar's scope for business scaling is said to remain more than a decade behind ASEAN's leaders.

"You can get good volume if you've got an affordable product, but it's very hard to get margin at the moment because of the costs around infrastructure," says Nick Powell, managing partner at Delta. "If the price of power, warehousing and cold storage come down with new infrastructure investment in five years' time, it will be very beneficial to the consumer sector."

A tough sell

When Delta raised its first fund, Myanmar had yet to realize its historic transition to democracy. Nevertheless, fundraising for a successor vehicle has proven more difficult to achieve as the hard realities of redefining a nation come into focus. Myanmar Opportunities Fund II backers include global corporations, family offices and individuals outside the country.

Despite the expected inflows from Chinese investment banks under OBOR, the limited scope of the LP universe in Southeast Asian frontier markets is expected to continue. This is due in part to the unreliable scheduling behind state-backed infrastructure projects and the fact that many jurisdictions still lack pension funds and insurance companies – or don't allow the ones that exist to invest in private equity.

High net worth individuals, family offices and development finance institutions (DFI) will therefore continue to dominate the market in the foreseeable future. EMIA's CLMDF, for example is backed exclusively by DFIs, including Norway's Norfund, Swiss Investment Fund for Emerging Markets, Germany's DEG, Dutch Good Growth Fund and FMO of the Netherlands, Belgium-based BIO, Austria's OeEB, and IFC.

"Markets like Cambodia, Myanmar and Laos will benefit from the knock-on effects that OBOR brings, but the PE firms that get funded there will continue to rely very heavily on the DFI community for a while," says Ralph Keitel, principal investment officer in the PE and investment funds department at IFC. "In frontier markets, which lie at the heart of what DFIs do, almost all PE groups are emerging managers given how nascent those markets are. Nobody is yet raising a Fund VI or VII, so the quality of the management team and their understanding of local markets, is always the first decision point."

Across frontier markets, the key practical issues for LPs are usually associated with rule of law around contracts and predictability in the regulatory process. This includes concerns that regulatory agencies may not be properly staffed or trained, aggravating bureaucracies in which authoritative sign-offs are continually passed along until they reach the highest level of government.

"The approvals process needs to be less painful, with one place to go where you can be confident that you'll get approval as long as you fulfill all the requirements," says Daniel Wiedmer, unit head for the Greater Mekong region at Asian Development Bank (ADB). "I think that unpredictability is holding back a lot of investments."

Until these immediate concerns are legislated away, frontier ecosystems will continue to struggle to provide mainstream LPs with a proof-of-concept or a sufficiently comforting level of confidence that exit markets exist. For global platforms that are not set up for such risk, frontier markets are therefore expected to remain a waiting game.

Adams Street Partners, for example, is monitoring the early movers to see how initial bets work out. Although the fund-of-funds requires markets to produce a high-quality investment return event before making a dedicated approach, its strategy hints at the broader investment industry's sense of expectation by allowing regional funds to allocate 10-15% of their capital to frontiers on an opportunistic basis.

"Over the last 2-3 years, some of the regional funds have warmed us and many other commercial LPs to the idea of entering these frontier markets," says Sunil Mishra, a partner with Adams Street. "When the first commercial GPs with broad mandates begin to allocate capital there, at least it verifies that many of the governance and reporting standards are now being met."

Opportunities explained

Meanwhile, the education process for distantly observing LPs is being improvised at ground level by participating investors. The hard work here derives from a lack of overall business experience and understanding about the PE model as well as thin networks of deal-sourcing intermediaries. This environment places increased importance on building teams with advisory or consultancy experience.

Although commonly actionable in the private equity thesis, these efforts take on additional gravity in frontier markets, where impact-style investment houses often expect proactive cross-pollinations between GPs, LPs and various asset classes. Brummer & Partners, a Swedish hedge fund that began making PE investments in Asian frontiers including Bangladesh as early as 2008, advises deepening the pool of potential deals through flexibility in ticket sizes and openness to minority stakes.

"Decent risk-adjusted returns are increasingly hard to come by for investors globally, and we believe that our strategy of providing equity to high quality companies in growing markets with strong fundamentals is a style of investment that resonates with both seasoned emerging market investors and with family offices, many of whom are business owners themselves," says Anders Stendebakken, managing director at Brummer.

In the frontier markets of Southeast Asia, a relative lack of entrenched conglomerates has opened up this opportunity set by leaving a number of key sectors fragmented. In Laos, a lack of manufacturing has been balanced with a push in heavier industries such as agricultural processing and energy.

Annual GDP growth rates have fluctuated between 7-8% for the past 10 years, betraying a lower base starting point but also underlining government-backed momentum to re-brand the country's land-locked status as "land-linked." IFC has invested some $60 million in the country since 1998, while regional players such as Dragon Capital have experienced early traction with companies such as hydro power producer EDL-Gen, which listed on the Laos Securities Exchange in 2011.

"One of the major strengths in Laos is the power sector because it really has the potential to drive the development of manufacturing and grow export revenues," says Joseph Hoess, a director at Dragon Capital responsible for frontier market investments. "Laos is open to investment in the sector, and there are a number of hydro projects backed by private investors that are basically being built to export power to Vietnam, Thailand and Cambodia."

Laos is generally perceived as being outstripped by Cambodia in recent years, however, with the latter leveraging its local financial services industry to achieve the region's fastest poverty reduction milestones. Private equity firms including VinaCapital, Leopard Capital, SBI Holdings, which opened an office in the country in 2010, have all taken an interest.

"The legal framework for investment in Cambodia is excellent and very pro-business, so we expect it to be our primary market for the next several years," says EMIA's Morris. "But Myanmar will likely become the dominant frontier. Whether that happens in two years or eight years is hard to say because a lot of reform is still required before it really starts to pick up steam."

ADB claims to be Cambodia's largest multilateral development partner and has approved about $3 billion in lending, grants and technical assistance for the country since 1966. Echoing EMIA's outlook, it predicts the country will be the second-fastest growing market in Southeast Asia this year and next – behind only Myanmar. "If you're in a worldwide multinational, smaller markets like Cambodia and Laos are a good-to-have, but Myanmar is different," says ADB's Wiedmer. "In the long term, every multinational will have to confront the Myanmar question and think about its strategy there."

A Myanmar miracle?

Although hobbled by four decades of isolationist military rule, Myanmar is tipped to eventually overtake its neighboring frontier economies by virtue of its sheer size. With a population of about 55 million people, more than double Cambodia and Laos combined, the country offers more immediately accessible opportunities for players in both the traditional consumer sector and fast-scaling technology areas.

Perhaps the most noticeable success story of late has been the country's telecom tower space, which is said to have succeeded in putting 80% of the population online. Recent private sector investment in the space includes Innovation Network Corporation of Japan and Malaysia's Khazanah Nasional committing $600 million in regional tower company Edotco. Meanwhile, PE-backed Apollo Towers Myanmar has tapped a $250 million loan from the US government's Overseas Private Investment Corporation.

Lingering reservations for the country have mostly revolved around sluggishness by the new government in clarifying foreign investment rules. Since the country's dramatic power transition in 2015, the government has prioritized a peace process for long-smoldering ethnic frictions and growth in the agricultural sector.

A revision to the Companies Act, which is hoped to open up the financial services sector, was promised in June, but the timeline has been pushed back to year-end. The Yangon Stock Exchange officially opened in December 2015, but liquidity has been subdued.

"The new stock exchange is not foreigner-friendly at present. Foreigners cannot buy listed company shares – so where's the exit going to come from?" says Genevieve Heng, director and co-founder of Myanmar-focused private equity firm Anthem Asia. "We're seeing M&A activity in small consumer businesses, so for us, trade sales will probably be the most viable exit opportunity."

Unsurprisingly, with little IPO and M&A activity to verify turnaround capacity to date, exit options remain the biggest concern among GPs and LPs alike. But while private equity may prove to be the ideal mechanism for balancing this risk with the upside of the frontier markets' high growth rates, stakeholders are reminded that one size does not fit all. In frontier markets, PE's value-add component is indeed essential, but the focus on creativity will have to extend to deal structures and debt schemes.

"You have to adapt the private equity model in many of these markets, and you need a manger who understands that," says IFC's Keitel. "You could have three people who have 20 years of PE experience in North America, but it's completely different in places like Cambodia and Laos. You may have to do quasi-equity or self-liquidating instruments to lend a bit more certainty to how you get your money back."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.